Surburban Propane Offers A Defensive 7%+ Yield, But Potentially Warmer Winter And Debt Paydown Weigh

SPH offers an attractive yield of 7.3% after a recent distribution cut.

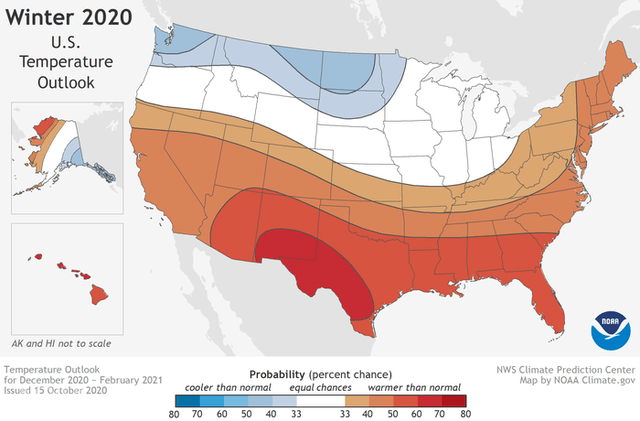

However, forecasts suggest the 2020/21 winter may be relatively warm especially in the southern and eastern U.S. where SPH has substantial operations.

In addition, management is targeting material debt reduction which may cap any distribution increase for several years.

Suburban Propane (NYSE:SPH) is an attractively valued, high-yielding utility distributing propane. After the dividend cut in 2020, it now offers a well-protected dividend and potentially enticing yield of 7.3% at the time of writing. I last wrote about the company in March around the market lows, and the stock is +50% since then. The distribution has been cut, as expected, but like many stocks, the valuation in Q1 was too pessimistic.

However, investors are likely, on current projections, to see a warmer winter for fiscal 2021 so that, as a key profitability driver, may limit the stock performance. For those looking for a defensive yield, SPH remains a reasonable option but without obvious positive catalysts, there may be better value elsewhere.

2020/2021 Temperature Trends - Negative To Neutral

A key issue for SPH as a supplier of heating are temperature trends. As you would expect, colder weather causes people to require more propane. This matters primarily during the winter period. The current forecast for winter 2020-21, as of mid-October, suggests relatively warmer weather in the south (compared to history) and cooler or more normal in the north. That outcome may not be dissimilar to this past year where SPH saw average temperatures 10% warmer than normal and still delivered $1 per share of net income. As management stated on their Q4 call.

All average temperatures across our service territories for fiscal 2020 were 10% warmer than normal and 4% warmer than the prior year.

Source: US Department Of Commerce

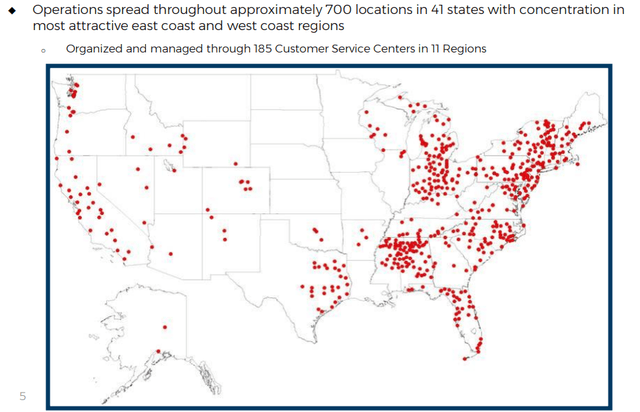

The challenge is then mapping these broad trends to SPH's coverage area (as below). There is risk to the forecast of course, but SPH does appear poised for another relatively warm winter, with little exposure to cooler than average temperatures and clear exposure to expected warmer regions.

source: SPH Investor Presentation (2019)

Distribution Yield, Leverage and Coverage

SPH recently halved its distribution to make room for debt paydown. The distribution is currently $0.30/quarter for $1.20/year. That compares with $1 per share of net income in fiscal 2020. However, the business is relatively capital-light. For fiscal years 2016-2020, EBITDA has ranged from $220M to $279M with a high in 2018 and low in 2016. 2020 was $252M. Taking these high and low recent outcomes we can examine the capital structure and allocation:

| Outcome | 2016 (warmer winter) | 2018 (cooler winter) |

| EBITDA | $220M | $279M |

| Interest expense (2020 actual) | $75M | $75M |

| Capex (2020 actual) | $32M | $32M |

| Tax | Negligible | Negligible |

| Available for distribution/deleverage | $113M | $172M |

| Target distribution at $0.3/quarter | $75M | $75M |

| Distribution coverage | 1.5x | 2.3x |

That all looks reasonable, if not conservative. However, the business is targeting 3.5x-4x leverage vs. 4.6x currently. What does that mean for unit holders?

As of June 2020 (the most recently SEC filed balance sheet), the company had $1,225M of debt. Assuming they hit their 4x leverage target in a warm winter and 3.5x during a colder winter, this suggests debt paydown should be $250M-$350M to achieve management's leverage target. That assumes no major change in operating performance when compared to recent history. After the distribution cut, free cash flow for debt paydown should be between $38M and $97M using the weather scenarios of 2016 and 2018 above. This suggests that it will take management 3-7 years to reach its leverage goal. That's less appealing to investors, especially given management's enthusiasm for bolt-on acquisitions, which have supported the operational performance.

Covid Impact Fairly Minimal

As a utility, SPH is seeing less impact from Covid-19. People still require heating. The data which will likely move the stock over the coming months concerns temperature outcomes, not Covid cases. However, there is a mix shift from industrial/commercial to residential as management detailed on the Q4 call. In fact, SPH did post relatively strong second half numbers as Covid hit, so I suspect that the mix shift is positive to margin because they are able to achieve slightly better economics with residential than commercial customers.

We expect to continue to see some softness in commercial and industrial demand until we see a real turnaround in the economy, but much of that softness is expected to be matched with higher residential demand, particularly if we get weather.

Conclusion

SPH can be an attractive investment going into a cooler winter. We may not see that in winter 2020/21. Also management's focus on debt paydown implies that $0.30/quarter is the new normal for distributions for the medium term.

If we assume that a 7% yield is fair for a stable, but largely ex-growth business, we have a fair value for SPH of around $17/unit, so close to the current price. SPH appears to be a reasonable hold, but there may be better opportunities elsewhere if the 2020-21 winter proves relatively warm and deleverage takes several years as expected.

The main risk to this thesis may be on the positive side. Currently, global yields on government debt are at extremely low levels. If that causes investors to accept lower yields on investments such as SPH as bond substitutes, then the stock could re-rate accordingly. For example, at a 5% expected yield, SPH could trade at $24/share. On the negative side, of course, a string of warmer than average winters could push out deleveraging efforts longer than planned. Also, the trends of the 2020-21 winter temperature should be monitored against the forecast above.

Disclosure: I am/we are long SPH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not intended as investment advice. Author's stock positions may be updated without notice. No warranty is given on the accuracy of the information in this write-up or that it will be updated. Investing involves risk of permanent capital loss.