RSP: Equal Weight Has Been Winning, It May Be Prudent To Stick With It

RSP has been beating the S&P 500 since my last review, which has reversed a trend that had been occurring for all of 2020.

Diversification should remain a focus for most investors, as large-cap ETFs are heavily concentrated in a few stocks. RSP helps correct this.

I would manage expectations going forward, with modest positive returns expected given how high markets have climbed. However, I see less downside risk with RSP because it is less concentrated.

Main Thesis and Background

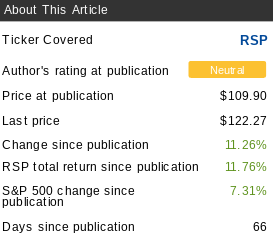

The purpose of this article is to evaluate the Invesco S&P 500 Equal Weight ETF (RSP) as an investment option at its current market price. I had covered, and recommended RSP, for the first time a few months ago. While I was generally cautious on equities, expecting only modest gains, I felt RSP was a smart option to help investors diversify their equity portfolios. The heavy concentration on broad market funds, such as the Vanguard S&P 500 ETF (VOO) and the Invesco QQQ ETF (QQQ), told me it was time to find ways to limit my exposure to the "Big 5". Those are the major tech names that are dominating the large-cap indexes. In hindsight, this was a timely call, as RSP has delivered strong gains, well above my own expectations. Importantly, the fund has beaten the S&P 500 by over 4% in the interim, as shown below:

Source: Seeking Alpha

Due to this positive move, I thought it was an opportune time to take another look at RSP to see if I should adjust my outlook. After review, I continue to see merit to owning this product, but I am reluctant to upgrade my outlook because I do not expect large gains in the short term. Rather, I would be happy to see small, single digit returns over the next quarter. Therefore, a neutral rating on this fund remains appropriate, and I will explain why below.

Big 5 Struggles Are Helping RSP Outperform

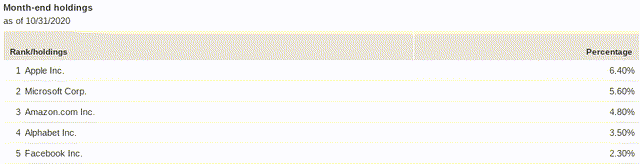

To begin, I want to take a look at the cause of RSP's recent outperformance. This will help readers better gauge if they expect it to continue, or not. Back in September, I noted I was concerned about rising equity valuations, and saw RSP as a reasonable alternative to take some risk off the table. While the fund still held a fairly high P/E ratio, the primary reason for my review was to discuss concentration risk in funds that track the S&P 500 by market cap, such as VOO. While concentrating a portfolio is not inherently "bad", it does expose investors to more risk due to the limited amount of diversity, so there is a trade-off. Throughout 2020, this risk was rewarded, as the "Big 5" in the market, Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), and Facebook (FB), had been driving gains. This was allowing funds like VOO to vastly outperform RSP, as those companies make up a substantial portion of VOO's portfolio, as shown below:

Source: Vanguard

While these percentages may not look high, we have to consider that VOO is tracking the S&P 500. Therefore, with a portfolio designed to track at least 500 companies, holding almost 23% of total assets in just five companies means the fund is very top-heavy. By contrast, none of those companies are even in RSP's top ten holdings, and RSP does not own more than .3% of any one individual stock, as shown below:

Source: Invesco

Again, this does not make RSP automatically superior, but it does present investors with a way to diversify and help their portfolio manage some of the concentration risk they are likely getting by holding popular, broad-based market funds.

With this in mind, we can begin to understand why RSP has been leading the S&P 500 recently. While the "Big 5" have been big winners throughout 2020, over the past two months, they had lagged significantly. In fact, while the other 495 stocks have registered a positive return since early September, the "Big 5" have actually declined by over 8%, collectively, as shown below:

Source: Charles Schwab

I have a few takeaways here. One, this chart highlights the inherent issue with investing in the S&P 500 through a market cap weighted fund. The fortunes are largely dependent on just a few big names. For investors who think those names are going to continue to lead the market, then there is not much of a problem. But for those, like myself, who are concerned about their general prospects and the level of concentration risk one is exposed to, then a fund like RSP would be a better fit.

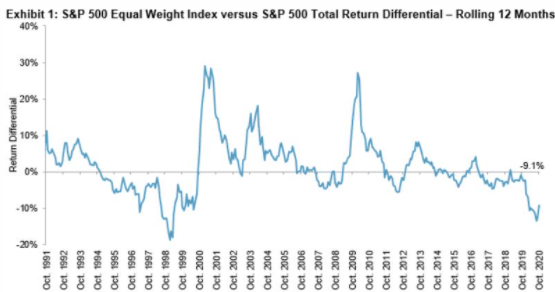

Two, the market's performance has begun to even out lately, as evidenced by the performance spread of the "other 495 stocks" compared against the "Big 5". Of course, investors may be inclined to see value in the big names now, since they have taken a bit of a breather. While there is some merit to this opinion, I would exercise some caution here for a key reason. The reason is, over the long term, the equal weight index actually tends to outperform the S&P 500. Yes, there is no denying the last year has been in the favor of the market-cap index, but history shows us that performance gap is a bit of an anomaly, as illustrated in the graph below:

Source: S&P Global

My takeaway here is that investors should recognize an equal weight index carries less inherent risk, and often produces stronger performance as a result. Concentration risk is very real right now, and while that has offered rewards throughout 2020, the recent setback for the "Big 5" has exposed the downside potential of this strategy. With RSP suddenly leading, and history on its side over the long term, there is strong support for this investment option.

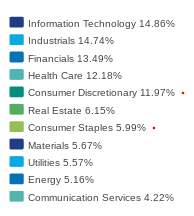

American Consumer Is The Bright Spot

I now want to shift to a discussion on the underlying holdings of RSP. First, I will take a look at the state of the U.S. consumer, as they are critical to the success of the economy as a whole, and also RSP. While the fund's sector weightings are led by Information Technology, Industrials, and Financials, the consumer sectors of Consumer Discretionary and Consumer Staples actually combine to represent almost one-fifth of total fund assets, as shown below:

Source: Invesco

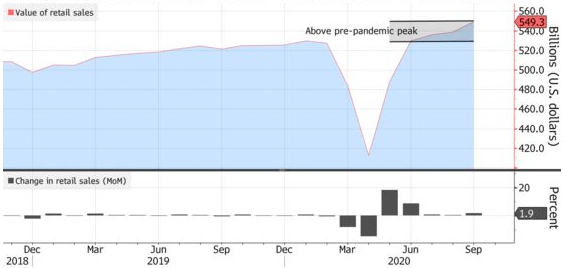

Therefore, it is important to consider how consumers have been faring of late. Intuitively, investors would probably surmise that spending is down due to the pandemic. Surprisingly, however, the U.S. consumer has actually been one of the biggest bright spots for the economy since the Q1 lows. With the economy still in partial lockdown mode, many consumers are indeed unwilling to spend on discretionary services and travel. However, this reluctance to spend on services, along with low interest rates stimulus measures, has freed up cash that can be used for other consumer goods. As a result, retail spending has actually been rising month over month since May, and total retail sales have surpassed their pre-pandemic peak, as seen below:

Source: Bloomberg

Clearly, consumer spending has helped to keep the economy on a reasonable footing, after falling off a cliff earlier in the year. As we now approach the all-important holiday shopping season, I expect spending will continue to rise for the next few months. This is bullish for the economy as a whole, and also for RSP, given its large consumer focus.

What's The Downside? A Lot Of Good News Is Priced In

Through this review, the connotation has been relatively positive, for both the market and for RSP in particular. However, I noted at the beginning of the piece that I have a neutral rating on equities right now. While I feel RSP is a good option, I see plenty of downside potential for the fund, and feel investors would be fortunate to make between 1-3% in total return through 2020. Therefore, I believe a neutral rating is more prudent, because I do not expect large gains going forward. Yes, I think RSP has a good chance of beating the S&P 500 as a whole, but that is more because I see more downside potential there, as opposed to a lot more upside potential for RSP.

Therefore, I feel bound to manage expectations a bit. The rationale behind this sentiment is simple - markets are at all-time highs, yet the economy still faces a host of problems. The COVID-19 pandemic continues to rage on, with escalating cases in both the U.S. and most of Europe. While positive vaccine news was an important development, for both the market and health concerns, we are still far away from actual mass distribution to most Americans. Therefore, while the vaccine is a welcome development, it won't be effective until it is in circulation and people are taking it.

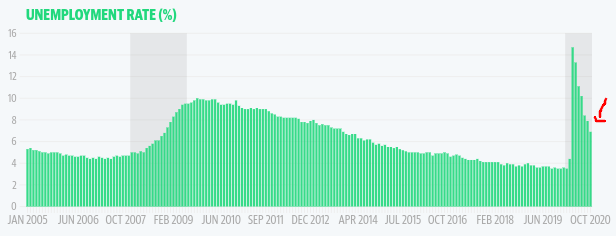

Further, stimulus measures have stalled in Congress, and we may not see more until next year when the next government is sworn in. The lack of stimulus could pressure both equity and debt markets, and also trickle down to stifle consumer spending, which has so far been quite robust. Finally, while metrics like consumer spending and stock prices have eclipsed pre-crisis levels, other important metrics have not. Chief among them is the unemployment rate, which is currently sitting just under 7%, according to the October jobs report, released in November, seen below:

Source: Yahoo Finance

The point here is that while equity markets, including funds like VOO and RSP, have been rallying consistently in the last few months, they continue to get more and more disconnected from reality. Corporate revenues and profits, while having recovered substantially, are still far off (on average) from where they were pre-crisis. The labor market, while improving, is similarly much worse than it was for most of the last decade. Yet, stocks sit at record levels, implying that a tremendous amount of positive expectations are baked into stock prices. This concerns me, and as a natural contrarian, I believe being prudent now is the right course of action. Thus, while I see merit to a fund like RSP, I have to caution that the fund has plenty of downside risk right now, as does the equity market as a whole. This reality balances out some of the bullish attributes for stocks, and supports my neutral view, in my opinion.

Bottom line

RSP has been beating the market, and I see a high likelihood that can continue. I see less downside risk going forward, and continue to view it as an attractive way to improve a retail investor's diversity in their portfolio. Despite this, I do see plenty of risks for equities as a whole, so I would caution investors against getting too aggressive with new positions here. Therefore, I am keeping RSP on my shopping list, but in small quantities, and I would suggest investors approach new positions cautiously at this time.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in RSP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long VOO, AMZN