An Almost Insatiable Appetite Has Suddenly Developed For The Tiny 5.68 Million Share Float Of Glucose Health Inc.

The recent activity in the shares of Glucose Health, Inc. has been nothing short of remarkable. The buying has been relentless, despite an RSI reading which is showing signs of an overbought condition.

Momentum stocks are notorious for confounding investors who attempt to fight the upward trend.

We warned about the explosive nature of GLUC shares and how difficult it might be to time an exit and subsequent re-entry point.

Sometimes it is better to maintain one's perspective as a long-term investor and refrain from a trader mentality.

The last thing anyone should think about doing, with the Lilliputian public float, is putting on a short position.

Momentum stocks can make you a lot of money. They can also do serious damage to your portfolio if you attempt to fight the kind of momentum surge that we are witnessing right now in the shares of Glucose Health, Inc. (OTCPK:GLUC).

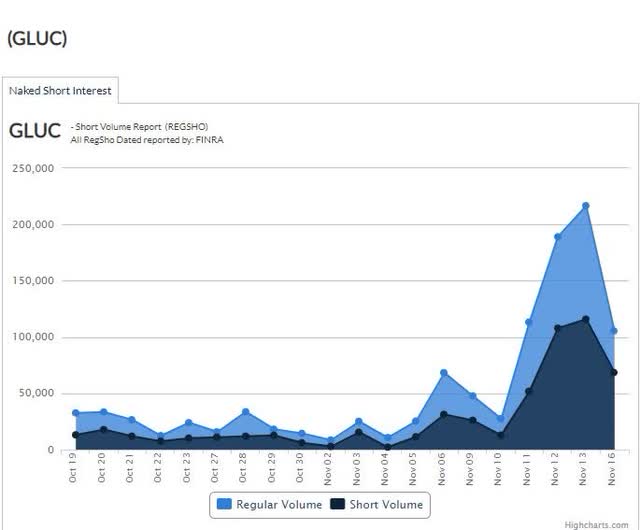

The old adage that "a picture is worth a thousand words" certainly applies to the recent activity that we have seen in GLUC shares over the past five trading days.

Source: Stockscores

Source: Stockscores

Source: Stockcharts

Source: Stockcharts

The closing two paragraphs from our last Seeking Alpha article dated November 12, 2020 stated:

The long-term trend for CELH and GLUC remains intact, although a short-term overbought condition for both stocks may lead to the pause that refreshes before marching onward and upward. Both stocks can be explosive, and investors must determine if they want to run the risk of missing the next move higher by attempting to time an exit and re-entry point.

With an RSI (Relative Strength Index) reading of 80.52, shares are considered to be overbought on a technical basis.

That said, looking at the chart above, one can see that back in the June/July timeframe of this year, the shares remained in overbought territory for quite some time and actually breached an RSI reading of 90.

So what is driving such buying activity?

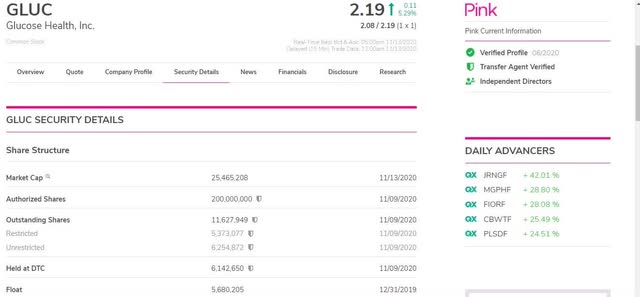

The simple answer is supply and demand, but another factor appears to be at work here, as well. That additional factor is the low level of tradeable shares in the public float.

With a mere 5.68 million shares available for trading among investors, it doesn't take much in the way of a seller strike to force buyers to pay up for whatever is available on the Ask.

Source: OTC Markets

Source: OTC Markets

If there are no shares readily available for purchase, typically the Market Makers will attempt to provide liquidity by selling shares naked-short, meaning that they do not borrow shares from an owner, but literally are naked, by the fact that the shares that they are selling to a buyer have never been loaned out.

In a "naked" short sale, the seller does not borrow or arrange to borrow the securities in time to make delivery to the buyer within the standard three-day settlement period.

Source: SEC. gov

We believe that what may have taken place today was a scramble by the Market Makers to cover their naked short positions before the share price went any higher and created huge losses on their book.

Source: OTC Short Report

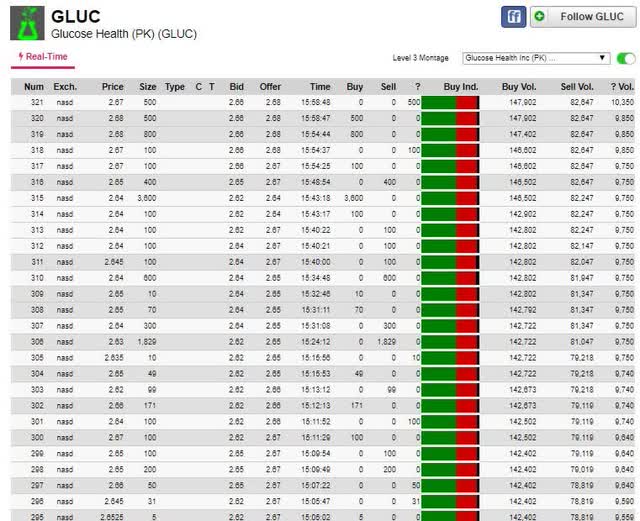

Right from the opening bell today, it appeared that someone was hell-bent on buying shares without regard to the cost. Within the first hour of trading, over 70,000 shares traded hands, and the price hit a high of $2.70 versus the prior day's closing price of $2.30.

In fact, the shares actually gapped higher; opening at $2.35, which also just happened to be the low for the day.

It is difficult to believe that this was simply normal retail activity. Usually, retail demand tends to be more measured and deliberate. Retail investors try to pick and choose their spots; looking to enter somewhere between the BBBO.

We have to assume that this could have been a buyer who was desperate to own shares with a sense of immediacy, perhaps to cover a share deficit in their account?

In any event, the buying persisted all day long and we saw a closing price of $2.67, up some 0.37 cents or 16.09%. Up volume outpaced down volume by almost 2-to-1.

Source: Investors Hub

Source: Investors Hub

The shares closed at a new all-time 52-week high, and at that closing price, it means that about 99% of longs are now showing a profit, at least on paper.

This is when you see investors give thought to following the trend even higher and averaging up their price while at the same time using a trailing stop-loss order.

Closing near the high of the day is usually a good sign, and we may see some additional carry-over buying tomorrow morning.

Either way, shares of Glucose Health, Inc. appear to be getting noticed with regularity these days. The shares are exhibiting signs of strong momentum, and we wouldn't be willing to fight what can only be categorized as a parabolic move higher.

Disclosure: I am/we are long GLUC. Business relationship disclosure: Under Section 17(b) of The Securities Act of 1933, the principals of Altitrade Partners are deemed to have received compensation, in the form of Rule 144 restricted stock, purchased at a discount in a private transaction with CEO Murray Fleming, on September 1, 2020. These shares were not issued by Glucose Health, Inc., and, therefore, did not result in dilution to existing shareholders. The net value of these shares, at the time of issuance, was approximately $375,000. Both parties have mutually agreed that this would be a "one-time only" arrangement. As a result, we do not expect to receive any other compensation, directly or indirectly, now or in the future, from Glucose Health, Inc. or any of its affiliates.

Additional disclosure: Disclaimer: We are not responsible for updating this article, or our opinion on any of the stock(s) that are mentioned in our articles. We are not in the business of giving investment advice and ask that readers refrain from asking us for it. Please do your own due diligence before investing. We are not responsible for any actions that you take based on the opinions that we express on Seeking Alpha.

Please remember that this article is a reflection of our current opinion on GLUC. It is based on information that is publicly available at the time we wrote the article. Additional public information may be available but was not brought to our attention at the time we authored the article. We provide sources and links to factual information that we include in our articles but take no responsibility for the accuracy of their content. An investor should consider that new information may become available regarding the company's business activities, financial condition or corporate governance. It is the responsibility of each investor to make sure that they stay abreast of any new developments which may arise, that could have an impact (negative or positive) on their investment.

We currently hold a beneficial interest of greater than 10% of the outstanding common shares of GLUC. We also own shares of preferred stock Series B, C, & D issued by the company as a part of the normal course of financing activities by the company. We are not considered to be an affiliate or control person of Glucose Health, Inc. and exercise no influence over decisions made by the company, its CEO, or the Board of Directors. An investor should carefully take this information into consideration when assessing the value of our opinions. We make every attempt to be objective in our articles, but there is always the potential for a conflict of interest to exist by virtue of our substantial equity ownership in the company.