Tesla Could Break Out on S&P 500 Inclusion - How to Trade It Now

Tesla (TSLA) - Get Report was up about 8% Tuesday on news that it will finally be included in the S&P 500.

Given its $420 billion market cap, it may surprise some investors that one of the biggest public companies in the country isn’t already included in the index.

After much anticipation though, the stock will finally be included on Dec. 21. We don’t know yet which company will be replaced, but we do know that Tesla will be added in two stages due to its size.

Up 8% on the day is enjoyable for investors, but it’s a bit disappointing for some as the stock opened higher by 12.75% and rallied 13.2% in the opening minutes.

The rally has shares of Tesla driving right into current resistance. If it can’t break out, resistance can hold steady and open up shares to a dip. On a continued move higher though, bulls will be looking for a much larger run.

Trading Tesla

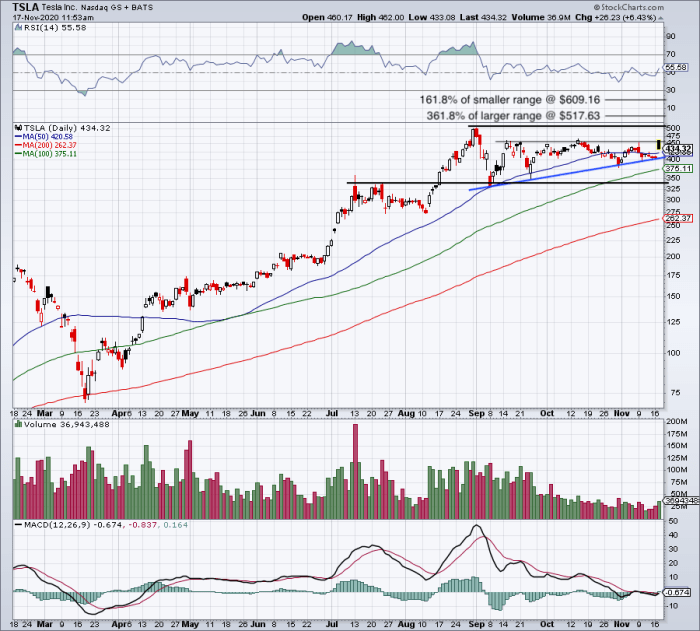

Tuesday's rally sent shares up to the $450 to $460 area, which has been resistance. That level cemented itself as a tough level to push through after the stock topped out in early September when Tesla split its stock.

Amid this recent consolidation, bears have been unable to crack Tesla. Although there have been some dips, none of them have been meaningful given the stock’s 615% rally from the March lows to the September high.

Each dip was met by buyers at uptrend support (blue line). Should the current rally fade from resistance, I want to see the 50-day moving average and this uptrend mark hold as support.

Below will put the 100-day moving average back on the table, along with last month’s low near $379.

But really, the big focus here is the $460 level. If Tesla stock can clear Tuesday’s high at $462 and the October high at $465.90, then it could be off to the races.

The October high is the stock’s highest high since topping out. Clearing it not only puts Tesla stock over resistance, but opens it up for a potential rotation back up to the all-time high at $502.49.

Should we get there, investors have to start thinking about potential extensions. If measured from the March low to the pre-coronavirus high, the 361.8% extension comes into play near $518, followed by the four-times range extension near $565.

When working with a smaller time frame - such as from the fourth-quarter low to the September high - the 138.2% and 161.8% extensions come into play near $568 and $609, respectively.