TAL Education Group: Muddy Waters Makes It Easier To Enroll Students

Tomorrow Advancing Life, otherwise know as (TAL) is China’s latest venture aimed at bettering tuition.

Its figures remain staggering, quasi perfectly constructed.

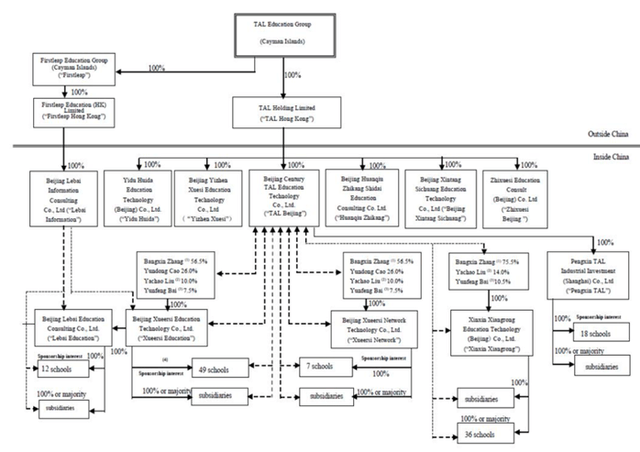

But TAL is premised on expansion at all cost and its makeup is a spider’s web of variable interest entities.

In a country not celebrated for informational transparency, this enterprise seems too good to be true.

It may well just be.

A heart touching narrative

When Bangzhin Zhang devised an idea of progressing access to tuition following his own debacles as a student, he dreamed big. An overly ambitious out-performer with a hunger for bettering Chinese society and satisfying an enduring societal burden, that of excellent tuition - he formed the company which ultimately would become known as (TAL) - Tomorrow Advancing Life. Eagerly premised on making tomorrow better, his organization grew - according to Tom as he prefers to be known - from a small tuition outfit to a $3B educational behemoth catering to the learning needs of the 105 million elementary school students in China. The market was unlimited as was the ambition.

Source: TAL Investor Presentation

But deep down, TAL has not been without controversy. An organization which is a mishmash of variable interest entities, franchises and organizations working in unison under the TAL umbrella, accusations have previously been widespread regarding fraud, earnings management, and deception. The firm has already been the object of a report by Muddy Waters and has likewise been at the center of a fraud investigation. The committee formed internally to investigate these matters found little in evidence to substantiate the claims.

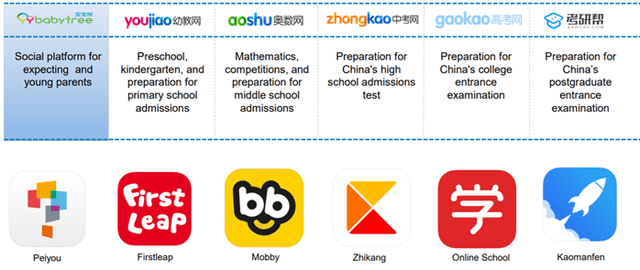

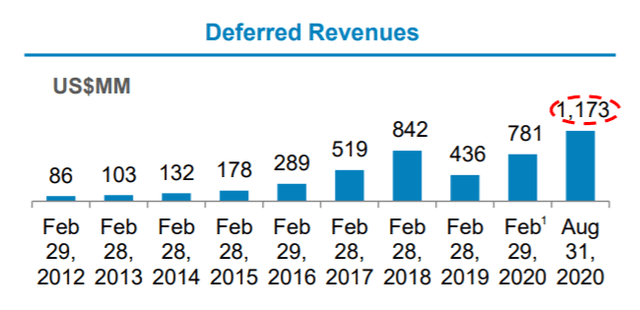

Source: TAL Investor Presentation

The firm's numbers are exceptional - a service business with low overheads, mammoth revenue growth rates (40% over 10 years, 47.5% over 5 years), net margins which were well into double digits, and a total addressable market in the hundreds of millions. Sales have gone from $37.4M in 2009 to $3.273B by 2020 - expanding 88 times over 11 years, roughly 50% per year consistently. 50% gross margins, a treasure chest of cash and marketable securities. What is not to like regarding such an immensely successful organization?

Source: SEC Filings

Organization

TAL is structured as a plethora of variable interest entities, partaking in a range of inter-company transfers to optimize capital flows in the group. The arrangement provides flexibility but comes with reduced transparency, the opportunity to exaggerate revenues by cross selling, and an intermingling of interests often obfuscating real data. While controls regarding VIEs have been decidedly enhanced since the Enron scandal came about, they continue to be opaque. And for an entity which does not fully recognize US GAAP, this must raise auditing eyebrows. Not surprisingly, sales and marketing expenses have progressed exponentially like revenues - from $53M in 2015 to $484M in 2019 - 9-fold in just 4 years. A critical observation with the firm is that growth is founded on buying sales through mounting spend in marketing efforts.

Source: TAL Investor Presentation

The Sales & Marketing Paradox

But beyond sales lies another issue, revenue recognition, deferment, and warranty. TAL collects tuition fees in advance, records them as deferred revenue and recognizes proportionately when the courses are delivered. For personalized premium services - students can withdraw at any time and refunds are afforded in accordance with certain terms and conditions. This creates a substantive revenue recognition issue:

- Revenue deferrals means that TAL can flexibly manage earnings, increasing or reducing the bank of course fees collected in advance to telegraph messages to investors. It makes those revenues streams opaquer.

- It is likely that refunds are used as one of the key sales pitches from the $484M sales and marketing effort - sign up now, if you don't like the tuition, you can cancel and have your money returned. Such a strategy would dope sales numbers and make revenue streams even more suspect.

- According to the firm, revenue increases have primarily been generated by small class enrollments and online learning - but the numbers just do not seem to jive. Of the 14M enrollments TAL boasted in 2019, 676 learning centers service these requirements. That makes for about 20,710 enrollments per learning center. Of course, you could argue that those 14M enrollments are predominantly online - but that only accounting for 13% of enterprise growth. TAL mentions "small classes" more than 30 times in its annual filings, but the mismatch between learning centers and enrollment numbers, presumably one enrollment per student, seems surreal.

- Learning centers have grown by 24% from 2017 to 2019. At the same time, enrollments went from 3 million to 14 million, growing by 400%. The "all the tuition is done online" argument holds poorly, particularly given the growth numbers, the traditional way of delivering after hours tuition and the intense online competition which would more adversely impact firm growth.

An Army of Teachers, Learning Centers and Students

TAL boasts 499 service centers, 676 learning centers and an army of 21,387 teaching staff (and rapidly growing). According to company documents, there are on average 14 students per class. There are 105 million elementary students in China, if one enrollment corresponded to one student, TAL would already cover about 13% of China's entire elementary schooling market. Gross revenues netted out by the number of students show a decline in average selling prices from $267 USD in 2017 to $183 USD in 2019. Nothing gives us an idea of the number of tuition hours charged but this could be indicative of noteworthy discounting to boost revenues - that too seems odd if the business already commands about 13% of the total addressable market.

The level of growth in both service and learning centers appears far behind that of enrollments, possibly signaling a continued increase in online learning. Learning centers from 2017-2019 grew at a rate of about 15% (1,492 m2 per centre which seems sizable) compared to enrollment growth of 156% over the same period. During the same period, net income was just as staggering, clocking in at $116M in 2017 and hitting $367M in 2019 - a compound growth rate of 177% - and this despite unit selling prices reducing by about 17% on a year on year basis.

Putting Numbers to the Magic

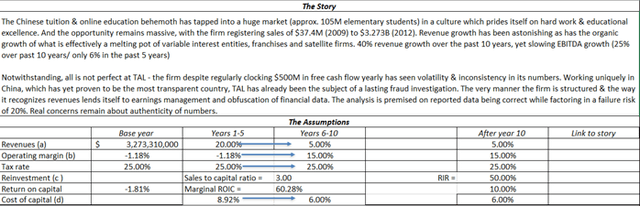

Having evaluated company filings, scrutinized the past 11 years of financial data via Gurufocus, I have constructed the following valuation.

The following assumptions are predicated:

- Use of a conservative forward revenue growth rate of 20% per year over next 5 years

- Convergence of growth rate moving from 20% towards 5% with a terminal growth rate of 5% in year 10

- Inclusion of operating leases, netted to their present values

- Inclusion of employee options outstanding

- An adjusted Beta of 0.541 and an equity risk premium of 5.89%

Corporate overview & key inputs

Source: Inputs filled in by author. Model by Aswath Damodaran

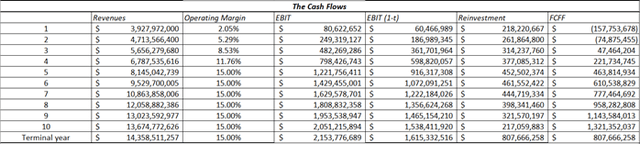

Discounted cash flows

Source: Inputs filled in by author. Model by Aswath Damodaran

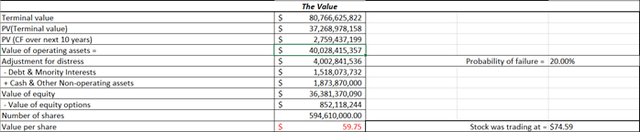

Valuation summary

Source: Inputs filled in by author. Model by Aswath Damodaran

The sensitivities of equity valuation signify meaningful changes in assumption create big differences in valuation. I have been quite conservative on revenue growth (+20% YOY) For investors curious to know, if you assumed 40% revenue growth year on year, value per share would be somewhere around $170. Company fair value is $59.75 in my model.

But the fundamental and singularly most important thing here is data integrity. I stay bearish on the long-term prospects of TAL. While it remains a tradable asset, the firm may be subject to more scandals regarding management of its revenues.

- The venture is structured as an assortment of variable interest entities - simplifying earnings management, inter-company selling, movement of assets & liabilities around different pockets of the organization. While providing flexibility, it furthermore weakens quality control.

- TAL is a relatively asset light service business - its learning and service centers are growing noticeably slower than its enrollments, possibly implying that future enrollments cannot be serviced to the same level of standing and quality or enrollments are not being presented correctly. In case of a liquidity event, there is not much collateral against which creditors can value a stake in the organization.

- Revenue structure simplifies earnings manipulation - tuition fees are collected in advance as deferred revenue and recognized proportionately as tuition is delivered. This combined with the fact that refunds can be returned to students increases the possibility of a large reversal due to revenue recognition errors and/ or a wave of refund requests. It is likely that 100% satisfied or your money back ploys are forced upon potential students as a way of pumping up the revenue bank.

- Sales & Marketing expenses engaged to keep this huge revenue snowball growing is substantial - $126M in 2017 climbing to $484M in 2019. Expenses are growing at a sizably stronger rate than sales. This combined with lowering average selling prices could imply that market share is being purchased rather than earned.

- Similar phenomena can be seen with the gargantuan group of teaching staff - salaries going from $244M to $553M over the same period. These costs are growing quicker than sales too.

- TAL has already been the subject to a corruption scandal - no tangible feedback was provided to market onlookers by the internal investigative team. Muddy Waters, the reputed short seller, correspondingly released a report in 2018.

- TAL currently faces an ongoing class action lawsuit for material misrepresentation. No outcome has eventuated, but this continues to be a risk.

- No research and development spend - despite touting itself as advancing tomorrow, little in terms of proprietary tuition-based technology has been developed. Few barriers to entry exist - teaching staff and market share could be theoretically purchased by new entrants.

- Modifications in designation of investments may be used to manage earnings - $131M in income was filtered through to the income statement in 2019 by changing investment designations from available for sale to available for trading. This has the effect of clouding earnings consistency and quality.

- The Amended Private Education Law promulgated by the Chinese government allows governments at or above the prefecture level to support private schools (such as TAL) by subscribing to their services, providing student loans or scholarships, and leasing or transferring unused state assets to the school. Changes in legislation may have the effect of making earnings quality increasingly opaque, including their source, authenticity, quality, and ability to be reproduced.

- Audit fees have materially increased - from $1.3M in 2018, they increased to $3.352M a year later. I cannot find anything justifying a 257% increase linked to an increase in expenses. Deloitte China, TAL's auditor has had more fraud blow-ups than any other auditor in China as per comments by Carson Block.

- The venture is wholly Chinese and solely operates in China - this implies different equity risk premiums, country risk, liquidity risk, etc. particularly in a political environment of Sino-American conflict. There is no requirement by Chinese enterprises to comply with US GAAP.

- TAL is holding $414M in goodwill as of 2019. Goodwill which is the premium paid over the fair value of acquired assets ultimately reverts to the mean when tested for impairment. This implies a long term correction in the value of assets.

Source: TAL Investor Presentation

TAL was premised on a dream of delivering better tuition and serving societal needs of a developing superpower. It has experienced monumental success and the numbers keep delighting investors. And it is that very narrative which leaves me on the sidelines; a Chinese firm raising US capital to chase growth at any cost in an environment when stocks only go up, provides for considerable risk the day gravity takes over. This is only augmented due to the cultural, political and economic gaps lying between corporate China and US capital markets.

While this asset is tradable, its faces intrinsic risk linked to integrity around the model and the presentation of the numbers. As per the Chinese proverb,

Muddy Waters Makes it easier to catch fish.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I hope you enjoyed my article and invite you to follow my profile for actionable insights in equities, derivatives, FX, commodities and fixed income trading.