Cresco Labs: Overview Of U.S.-Based Cannabis Growth Monster

CRLBF is one of the “Big 4” cannabis operators capitalizing on the rapidly growing industry.

CRLBF has focused on wholesale distribution channels, in stark contrast with peers.

Revenues have been growing in the triple digits, though profits have remained elusive due to 280E taxes.

I rate shares a buy with 100% upside but with high uncertainty.

Cresco Labs (OTCQX:CRLBF) is one of the “Big 4” U.S. multi-state operators (‘MSOs’) in the cannabis industry. In comparison with peers, CRLBF has a heavier emphasis on the wholesale market, although its retail dispensary segment is also growing rapidly. The newly-elected Democratic administration may provide tailwinds if cannabis is decriminalized on the federal level. CRLBF’s balance sheet is in weaker shape than the rest of the Big 4, but future growth may enable the company to eventually reduce leverage. I rate shares a buy with tremendous upside but note the high uncertainty and potential risks.

New Cannabis Growth Monster

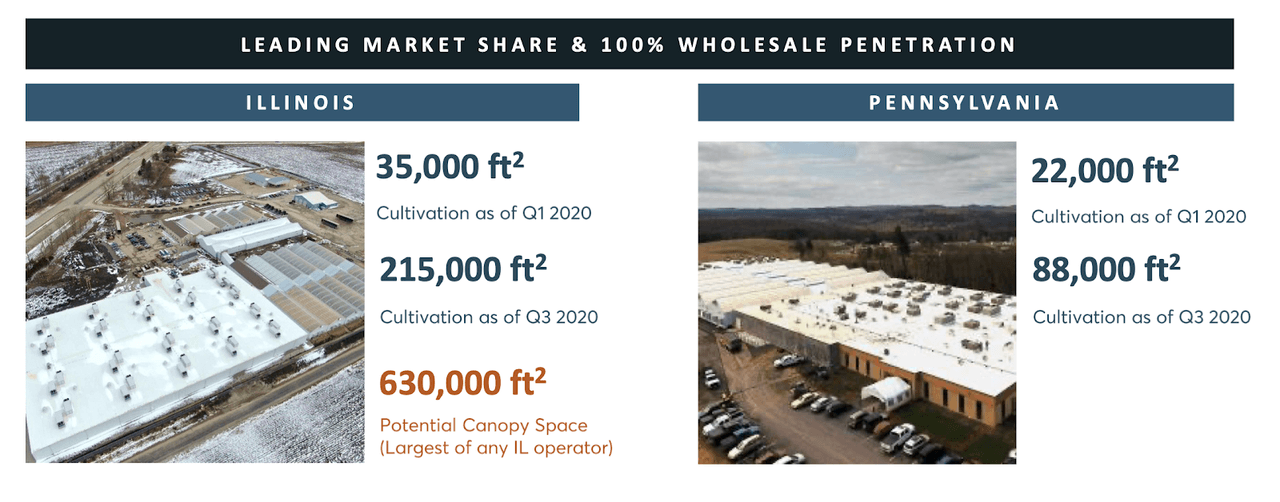

CRLBF has operations in 9 states, but its key core markets are in Illinois and Pennsylvania, where it has leading market share and 100% wholesale penetration:

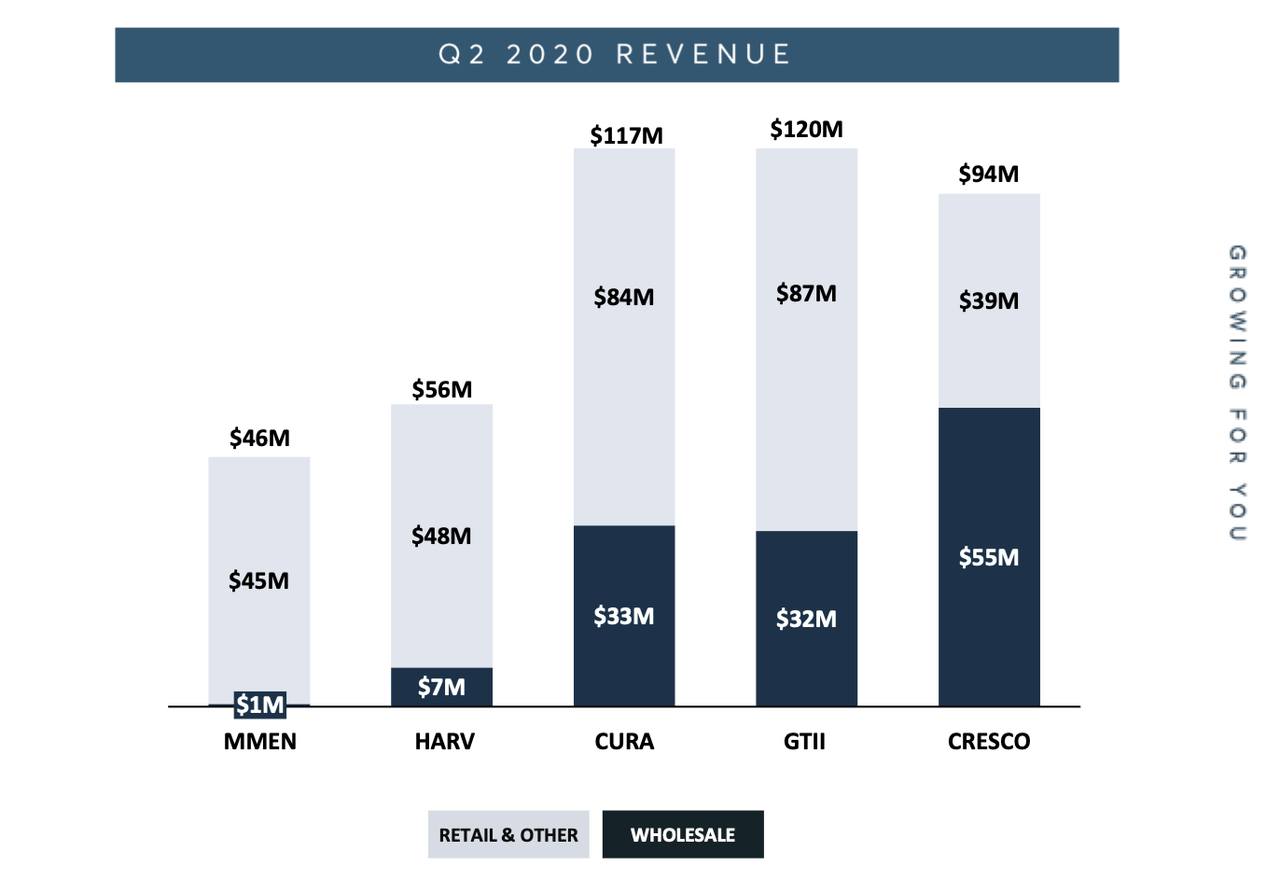

We can see below that unlike most U.S. based cannabis operators, CRLBF derives the bulk of its revenues from wholesale distribution channels:

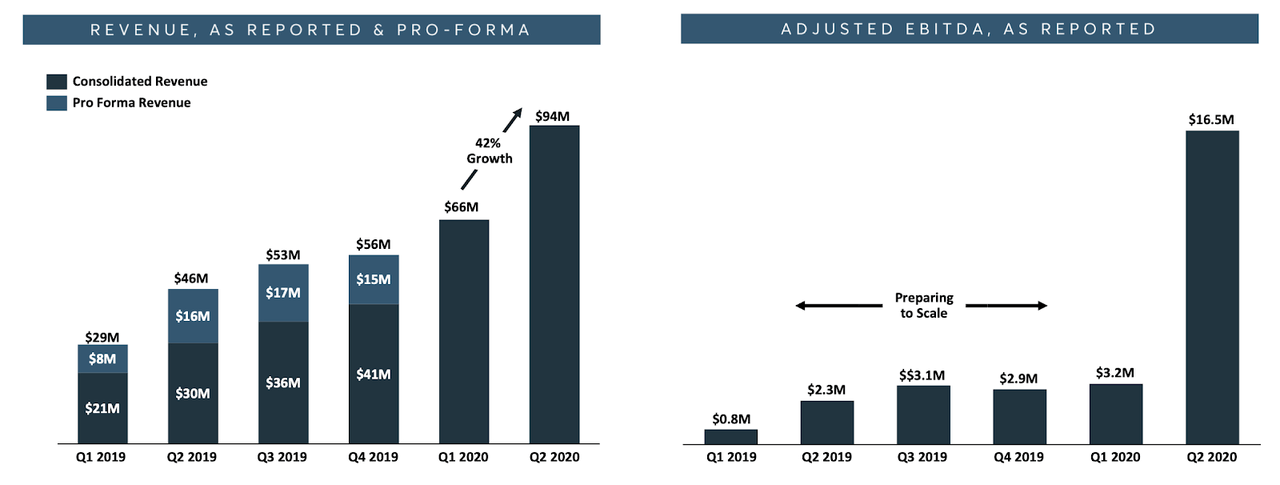

Even prior to the 2020 election, CRLBF was growing like a weed (pun intended). Second-quarter revenues grew 42% over the prior quarter or over 100% over the prior year.

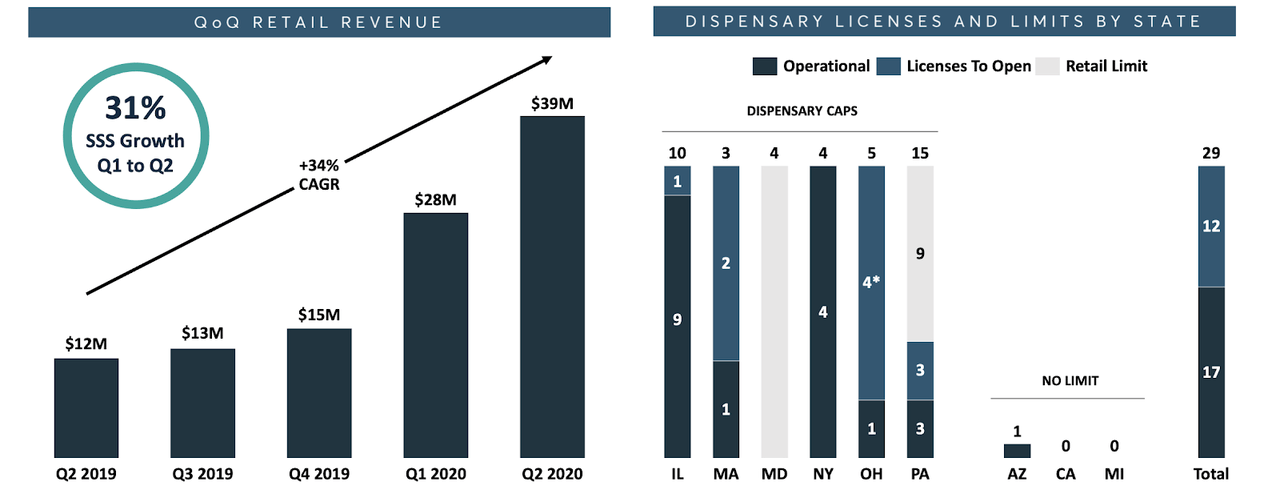

Investors could expect even more growth moving forward, as CRLBF is seeing strong comparable sales growth and the company still has 12 additional licenses to open new retail dispensaries:

Decriminalization Tailwinds?

Most names in the cannabis sector bounced when it became clear that Biden would be the next president of the United States. While Canadian names bounced the hardest, it is arguably the U.S. MSOs that may experience the greatest benefit. Consider CRLBF, which in spite of the torrid top-line growth, recorded a $4.7 million net income loss in the second quarter. If you’ve only followed cannabis names in Canada, then perhaps the losses are nothing to be surprised about. What you might not know is that due to the fact that cannabis is federally illegal, MSOs are unable to deduct normal operating expenses from taxable income. As a result, CRLBF recorded $13.3 million in income taxes in spite of earning only $8.6 million in taxable income. This phenomenon is known as the “280E tax.” If the Democratic administration can decriminalize cannabis, then the 280E tax might be eliminated, providing a dramatic boost to the bottom line.

Balance Sheet Remains Key Risk

While CRLBF has reported strong growth more or less in-line with MSO peers, its balance sheet is notably the weakest in the peer group. CRLBF had $71 million in cash versus $309 million in long-term liabilities. I typically prefer to see leverage-neutral or even preferably net cash on the balance sheet because U.S. cannabis companies have limited access to capital. CRLBF, for example, needed to take a $22 million loan at a 23.78% effective interest rate in order to finance its acquisition of Origin House. I am hopeful that CRLBF (and the rest of the Big 4) will choose to rely more on stock issuance rather than high-interest debt to finance future growth endeavors.

Valuation and Price Target

Based on the latest quarter, CRLBF generates an annual run-rate of $377 million in revenues. As of recent prices, shares trade at just 4.7 times sales. While that may seem expensive for a company that has yet to produce a profit, the company has a long growth runway and should be able to produce significantly higher profit margins from newly opened dispensaries in existing markets. It isn’t every day that you get to buy a stock at a low single-digit revenue multiple in a company growing its top-line in the triple digits. I suspect that the fact that CRLBF trades over-the-counter and not on the major US exchanges is the primary reason why shares trade so cheaply. My 12-month fair value estimate is $17, which corresponds to approximately 6 times forward revenues. CRLBF may be able to list on the US exchanges if cannabis is decriminalized federally, which may present even more upside.

Risks

There is no guarantee that cannabis will be decriminalized on the federal level in a quick timeframe, or at all. Further, decriminalization may not remove 280E taxes, or 280E taxes may simply be replaced by alternative taxes.

The cannabis industry remains very new and the regulatory environment is likely to change significantly over time. CRLBF is currently able to report strong profit margins due to the limited-license policies of many of the states it operates in. If these states were to change to an unlimited-license model, then CRLBF would face significantly more competition.

Management risk is significant in this sector. Experienced cannabis investors know all too well the dangers of investing alongside companies run by “growth at all cost” management teams, as predicted growth might not come quick enough to overcome high debt loads. While CRLBF’s balance sheet is not yet in the “red zone,” I would be wary if the net debt position continues to grow moving forward.

Conclusion

Courageous investors may be able to purchase shares of a rising cannabis powerhouse before shares are listed on the major exchanges. While CRLBF has a rather high debt load, the forward growth outlook may lead to significant free cash flow which may be used to reduce leverage. In spite of triple-digit top-line growth, shares trade at a low single-digit multiple of revenues. I rate shares a buy, but position sizes should be small at least until the company improves its balance sheet position.

Discover More High Conviction Ideas

Cannabis stocks are one of my top high conviction ideas. Subscribers to Best of Breed to get access to my top high conviction ideas and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, broad market coverage, and high conviction picks.

Elevate your investments with Best of Breed.

Become a Best of Breed Investor Today!

Disclosure: I am/we are long CRLBF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.