Quotient's Disruptive MosaiQ Platform And Its Upcoming Approval

Quotient's MosaiQ diagnostic platform is set to be approved in the US this year.

However, the stock does not seem to be drawing much investor attention.

Despite having a good product and a strong revenue stream, QTNT's stock looks a bit sluggish.

I posted an article on Quotient Limited (QTNT) and its MosaiQ platform in September last year. Since then, the company has come nearer to approval, which, per their latest earnings call, should happen before the end of 2020.

"Initial SBS 510(K) approval. As Franz mentioned earlier, we answered all the questions from the FDA and anticipate approval before the end of the calendar year. The approval will cover both the microarray and the MosaiQ instrument."

However, we wrote that article near the stock’s highest prices since then, and although I was optimistic about an upside from that price, the COVID-19 pandemic was certainly a dampener. By March, the stock was trading near $2, and although the company’s strong fundamentals have made it possible to boost the stock up near $6 today, we are still not near last year’s highs. Given we are just a couple months away from approval, and this is a somewhat undercovered stock, I doubt we will see a lot of upside.

However, that being said, the product is still a potential market disruptor. As I said in my previous article, other transfusion diagnostics companies have single products targeting one of three areas, Immunohematology (IH) (or blood grouping), serological disease screening (SDS) or molecular disease screening (MDS). MosaiQ does all three things together, giving in one single, compact uniform a platform that has a multi-utility function unavailable anywhere else.

About Quotient

Quotient Limited is a commercial-stage transfusion diagnostics company with operations based in Switzerland, Scotland, and Pennsylvania. As of 2018, the company had 72 CE marked and 63 FDA licensed reagents, which generate a steady revenue stream for QTNT. The latest development is due to the COVID-19 pandemic; QTNT has now added capabilities for microarray-based SARS-CoV-2 antibody test for use on the MosaiQ platform for COVID-19. The company was founded in 2007 and is headquartered in Eysins, Switzerland.

News/Catalyst

In its 11/2/2020 earnings call, the company said that MosaiQ will be approved by end-2020. In late September, the FDA gave an EUA or Emergency Use Authorization for MosaiQ COVID-19 Antibody Test, which detects “antibodies generated in humans in response to the SARS-CoV-2 virus using Quotient's proprietary MosaiQ blood testing microarray technology.” The antibody test was CE marked on May 1, 2020 and is now available in Europe and the US.

"Quotient believes customers find its COVID-19 antibody tests attractive because they are highly accurate and the MosaiQ system is efficient. The test is performed on Quotient's fully automated, high-throughput MosaiQ instrument. A single MosaiQ testing instrument can process up to 3,000 antibody tests per day. Independent studies continue to confirm that Quotient's MosaiQ COVID-19 antibody testing system is highly accurate and efficient. In the September issue of the Journal of Clinical Virology, the Medical Laboratory of the French Military and the French Military Biomedical Research Institute published an independent, external study evaluating the MosaiQ COVID-19 Antibody Microarray and MosaiQ system. It concluded that the clinical specificity of the test is 100%, and the sensitivity was over 98% in samples taken more than 14 days after the onset of COVID-19 symptoms. The evaluation also concluded that the MosaiQ system “enabled rapid throughput of samples, and the single-use microarray is of specific interest to manage high numbers of samples in a limited time with low levels of laboratory technician support.” Recent results from an independent, third-party study evaluation in Scotland also confirmed the high-performance attributes of the MosaiQ COVID-19 Antibody Microarray."

The company plans to sell the first ten MosaiQ devices for testing COVID-19 in the first 3 months of approval.

Platform, Market

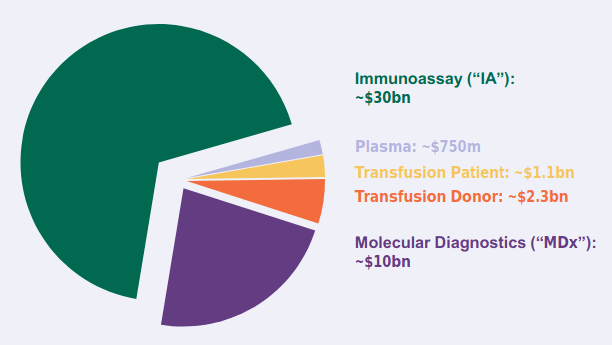

MosaiQ’s robust and flexible platform is poised to disrupt the ~$40 billion market in MDx and IA.

(Image source: company presentation)

Proprietary and Advanced Microarray Technology for Multimodal Diagnostic Testing

Financials

QTNT’s market capitalization is $589.74 million, and stock price $5.84 (-29.81% 1Y) at the time of writing. The stock’s 52-week range is $2.40 to $10.38.

Shares outstanding are 101.02 million of which institutions hold 56.22%, hedge funds hold 21.41%, the public holds 13.31%, PE/VC firms hold 7.25%, and insiders hold 1.81%.

3 Wall Street analysts are very bullish with an average rating of 5/5 and a price target of $12.67, revised down though from $13.50 of 8/31/2020.

There is a short interest with 5.06 million short shares to be covered in 6 days.

Cash balance was $162.74 million as of 9/30/2020 (1H-2021).

Anticipated operating expenses are $5 million to $6 million per month (as stated in 1H-2021 earnings call), so the cash runway could extend into fiscal 2022.

Debt as of 9/30/2020 (1H-2021):

“The company has an outstanding debt of $145 million, with the first reimbursement due in April 2021. We might explore options to restructure the debt or delay reimbursement until substantial cash is generated from the sale of MosaiQ.“

Revenue estimates for March 2021 and March 2022 are $41.91 million and $43.89 million, respectively. Revenue was $32.7 million in fiscal 2020 (year ends March), and was $41.6 million in the TTM, whereas revenue costs were $17.8 million and $19.2 million in fiscal 2020 and the TTM, respectively. Operating expenses were $93.5 million and $97.1 million in fiscal 2020 and the TTM, respectively.

Risks

The company had an accumulated deficit of $483.4 million as of March 31, 2020. Moreover, the FDA has said that it will “require MosaiQ to obtain approval of a biologics license application, or BLA, for the MosaiQ IH Microarrays and traditional 510(K) clearances for the instrument and the initial MosaiQ SDS Microarray, comprising two tests, CMV and syphilis... The MosaiQ SDS II Microarray, comprising additional tests, will be subject to BLA approval.”

Bottom line

QTNT has a market disruptive product, and there’s a near-term catalyst. However, the stock’s price still does not show rapid signs of improvement. True, it has recovered strongly from March, and anyone who bought it in March is richer by 200%. However, despite the great product, it remains to be seen if there is going to be further upside from now. This is a stock to watch closely before the catalyst, and maybe take a position if things look good.

About the author

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.