AVITA: COVID-19's Impact

AVITA's existing FDA-approved product is growing to become the standard of care in a $200 million market.

The COVID-19 pandemic has been particularly disruptive for AVITA.

AVITA's pivotal stage projects hold promise for significant future investor returns.

AVITA's financials are facing added challenges from the pandemic.

Pandemic-related delays may prove damaging to AVITA's overall prospects from a competitive viewpoint.

AVITA Therapeutics, Inc. (NASDAQ:RCEL) bills itself as a regenerative medicine company focused on skin applications. When I last discussed this name in "Hot Potential For AVITA Burn Regeneration Device", it was an Australian company available as an ADR listed over the counter in the US.

It has since (06/2020) redomiciled (p. 8-9) itself in the US where it is now listed on the NASDAQ under the RCEL ticker stated above. This article discusses how AVITA's potential is being subverted by the pandemic and the characteristics that make it a strong recovery play when the pandemic subsides.

AVITA garnered FDA approval for its lead product in September 2018, touted by its CEO as potentially standard of care with a $200 million market opportunity

AVITA's lead product is its RECELL System. This is an FDA-approved (09/2018) device that allows healthcare professionals to produce a suspension of Spray-On Skin Cells using a small sample of the patient's own skin. RECELL's premarket approval [PMA] authorizes its use in the treatment of acute thermal burns in patients eighteen years and older.

AVITA launched the RECELL system in the US in 01/2019. Despite approvals in Europe and Australia, AVITA has focused its sales efforts in the United States and plans to continue to do so for the immediate future (p. 18).

Beginning with its RECELL product system US sales for H1, 2019 of ~A$1.1 million, its subsequent quarterly US sales were:

- Q3 2019 ~A$2.2 million

- Q4 2019 ~A$2.9 million - commercial highlights:

- 41 of 134 U.S. burn centers have ordered RECELL

- 136 of 300 burn surgeons at 59 of the 134 U.S. burn centers have been trained and have performed a RECELL procedure

- RECELL has a 100% success rate for hospital purchasing approval (U.S. Value Analysis Committee or "VAC")

- Q1 2020 ~A$4.6 million - commercial achievements since approval:

- 56 of 132 U.S. burn centers have placed orders for the RECELL System

- Over 50% of U.S. burn surgeons and burn centers are trained on the RECELL System

- A$10.8 million in U.S. sales

- Q2 2020 ~A$4.7 million

- Q3 2020 ~A$5.8 million

- Q4 2020 ~US$3.8 million - commercial metrics:

- Estimated procedural volumes decreased by approximately 4% from the prior quarter.

New accounts added - 8

Cumulative accounts with Value Analysis Committee (VAC) approval - 77.

- Q1 2021 ~US$5.0 million - Commercial metrics:

- Procedural volumes were 496 in the first quarter of fiscal 2021, an increase of 27.2% over the prior quarter

- Added 9 new accounts in the first quarter of fiscal 2021 for a total of 86 accounts

The story above is a bit messy. It is complicated by several factors. AVITA reports on a fiscal year basis. Figures prior to its fiscal 2020 third quarter are reported in Australian dollars while those thereafter are in US dollars. During the bulk of this period, the Australian dollar traded between $0.68 and $0.74.

Nonetheless, CEO Perry anticipates good things for AVITA in this indication. During AVITA's Q1, 2021 earnings call, he noted:

With our recent experience, we are becoming increasingly confident that the RECELL System is rapidly evolving to become the standard-of-care within the inpatient [burns] setting, which we see as a $200 million market opportunity with little competitive headwinds. [bracketed word corrected from "burden" in transcript]

This $200 million seems doable, given AVITA's Q1, 2021 US quarterly sales of $5 million. RECELL is in its early post-approval stages. It has been doing the hard blocking and tackling work of introducing its new approach to burn treatment, training surgeons, getting burn center administrative approvals and the like. Lastly and importantly, as will be discussed below, the pandemic has impacted AVITA erratically but substantially.

The COVID-19 pandemic has been particularly disruptive for AVITA

It seems as if the majority of the names that I follow are struggling through this pandemic, and yet they've figured out ways that their technology can assist in combatting COVID-19; I think of such varied players as Abbott (NYSE:ABT), T2 (NASDAQ:TTOO), Novavax (NASDAQ:NVAX), Gilead (NASDAQ:GILD), Omeros (NASDAQ:OMER), RedHill (NASDAQ:RDHL), CytoDyn (OTCQB:CYDY), and Athersys (NASDAQ:ATHX).

AVITA is not such a company. At this point, the pandemic presents unalloyed challenges without any prospective countervailing opportunities. In AVITA's Third Quarter Fiscal 2020 Financial Results and Company Update for the quarter ended 3/31/20, CEO Perry was vigilant, concerned, and hopeful as the pandemic started to unfold. He noted:

We have seen consistent growth since the launch of the RECELL System and we have, so far, been somewhat insulated from the COVID-19 challenges to-date given the treatment of burns patients is generally not elective nor deferrable. While we didn't see any impact to the rate of burn incidence or RECELL System utilization during the quarter, it continues to be difficult to predict the breadth of potential impacts over the coming months due to the current COVID-19 macroenvironment. These considerations operate in addition to the overarching burn environment which is inherently "lumpy" and difficult to forecast.

He further noted that reduced societal activity was impacting the incidence of burns. Regardless of burn center access, his "best guess" anticipated that such curtailed activity could degrade procedures by up to 20%. His remarks during its Q1, 2021, earnings call were less sanguine.

During this call, he reviewed ebbs and flows throughout AVITA's business as the pandemic impacted its:

- procedural volumes,

- access to the hospital setting for business development,

- budgets, resources, and access for patient enrollment in studies,

- study patient follow-up disrupted by access issues and patient concerns,

- study progress impacted by participants contracting COVID-19,

- manufacturing operations.

AVITA's pipeline boasts three pivotal stage projects

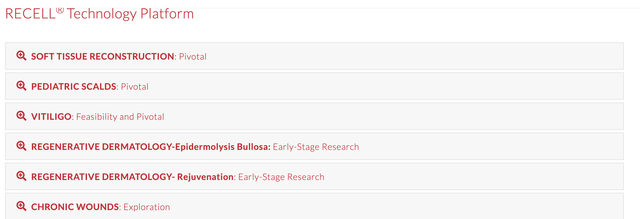

AVITA's strategy for amping its value for shareholders is all about leveraging its PMA with label expansion opportunities. Following receipt of its PMA, the FDA granted AVITA three Investigational Device Exemptions ("IDEs") studies which have enabled the company to initiate pivotal clinical investigational studies to seek expanded FDA (supplementary) PMAs of the RECELL System for each of soft tissue reconstruction, pediatric scalds, and vitiligo.

Enrollment of those clinical studies is ongoing, and, if successful, those studies would enable the company to commence commercializing the RECELL System in the United States in each of those indications. AVITA's website lists its pipeline as follows:

Its soft tissue reconstruction study is facing tough sledding, thanks to a variety of concerns, including but not limited to COVID-19. CEO Perry reviewed the situation as follows in its Q1, 2021, earnings call:

Our soft tissue reconstruction pivotal study has not ... been able to generate momentum with only two patients enrolled thus far. This study has witnessed periods of enrollment cessation due to COVID and a loss of patients to off label use of the RECELL System or simple screen failures due to patients being excluded due to contraction of COVID or other confounding, but unrelated medical conditions, such as cancer or mental health issues.

CEO Perry was more optimistic on the pediatric scalds study. During a late summer push, they were able to add eight patients to this trial, thanks partially to the addition of new sites. As I write on 11/15/20, I am concerned that the current massive COVID-19 resurgence bodes ill for ongoing efforts in both pediatric pivotal trials.

Thankfully, the vitiligo trial has somewhat different dynamics. Vitiligo is a chronic condition that persists in patients as opposed to one arising in an emergency. CEO Perry comments on its progress during AVITA's Q1, 2021 call are instructive as follows:

By contrast, many of the impediments that we see for enrollment in the intensive care setting are not evident or are more manageable within our vitiligo pivotal study. It has been a whirlwind start for our vitiligo study, beginning with the granting of our investigation of device exemption in early July, followed by quickly navigating through both investigational review board, or IRB, approval and site contracting to enroll our first patient in late September. As of today's date, we have enrolled eight vitiligo patients, with six of those patients being enrolled in the pivotal study in one site, and two patients enrolled in the single site vitiligo feasibility study at UMass.

He enthuses that patients, doctors, and prospective study sites are all showing strong interest in this study. He anticipates it as being AVITA's study that is likely to be the quickest to complete enrollment and the one most likely to be next in line for FDA approval. It will be interesting to see how this plays out.

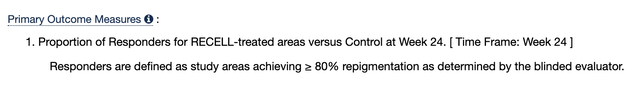

The primary outcome measure for AVITA's 84 participant vitiligo trial shown on clinicaltrials.gov is:

Its primary completion date is listed as September 2022. Should tailwinds accelerate its enrollment, one might anticipate a potential for an earlier completion. Perry has offered no target. AVITA bulls are likely to reach their own conclusions. Approval in vitiligo would open up a market he characterizes as including 4.5 million Americans constituting a market opportunity in excess of $750 million.

On another subject, AVITA has not totally given up on markets outside the United States. In this regard, Perry notes:

...Together with our commercial partner COSMOTEC, we continue to focus on regulatory approval in Japan. I am pleased to confirm that we have completed the three required non-clinical benchtop studies in August as scheduled. Our efforts and interaction with COSMOTEC and the Japanese regulatory authority are ongoing. And we are hopeful of advancing our application for marketing approval of the RECELL System under Japan's Pharmaceuticals And Medical Devices Act, or PMDA.

AVITA's finances are typical for early stage commercial biotech companies, which is to say dilution is likely in the picture

AVITA's VP, Finance, Ekins, gave the readout of its financial performance for Q1, 2021. As noted above, it scored a strong $5.0 million in US sales of RECELL in a quarter during which it mounted a recovery from its earlier COVID-19 woes.

Not atypically for biotechs just feeling their way forward in commercializing their first FDA-approved product, these sales pale in comparison to its operating costs for the quarter which came in at $14.9 million. Ekins attributes AVITA's $6.6 million Q/Q increase as:

...driven primarily by increases in personnel costs, clinical study costs associate with our four clinical studies and the cost associated with establishing AVITA a U.S. public company, including completion of our redomiciliation, the first U.S. GAAP audit for the three-year period ended June, our first proxy statement and our first 10-Q.

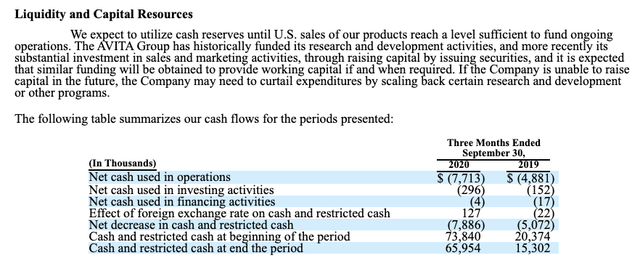

Operating losses for the September quarter were $10.2 million as compared to operating losses of $3.6 million the same period last year. Cash on the balance sheet was approximately $65.8 million as of September 30, 2020.

Subsequently, during Q&A, Ekins estimates that R&D should level out at between ~$3 and $4 million with G&A at the range of $4 million to $4.5 million. At these levels, it is likely that AVITA will be looking for additional funds at some uncertain point in the not too distant future.

Turning to the Liquidity and Capital Resources section of its 10-Q (p. 21) as excerpted below offers some color on the situation.

The question mark that it raises for me relates to its "substantial investment in sales and marketing activities" which Ekins seemed to have omitted from his estimates. Regardless, it should come as no surprise that a company like AVITA might open up a substantial secondary offering at any time. Certainly, AVITA's prospects support the likelihood that such efforts will be successful.

AVITA has an attractive therapy. However, delay always raises potential for competition

I would be remiss if I did not discuss potential competition for AVITA, competition which may take advantage of the headwinds AVITA is encountering from the pandemic. In this regard, AVITA has done an effective job of building a moat for itself with the blocking and tackling it has done with burn surgeons and centers.

In its latest 10-Q (p. 19), AVITA expresses satisfaction with its competitive situation when it notes:

Our compelling data from prospective, randomized, controlled clinical trials conducted at major United States burn centers, health economics modeling, and real-world use globally, demonstrate that the RECELL System is a significant advancement over the current standard of care for burn patients and offers benefits in clinical outcomes and cost savings.

Will this hold up as time marches on particularly during the current pandemic infused environment? In its Q2, 2020 earnings call, AVITA is also dismissive of competitive threats. I have not found contrary evidence. I welcome comments on this subject.

Conclusion

AVITA is a tempting target for those looking for a speculation in a newly commercializing biotech. If we treble its $200 million opportunity in its currently approved indication and take that as our marker, it seems reasonably valued with its current market cap of $0.465 billion. This seems particularly to be the case when one considers how the pandemic is currently presenting such an uncertain but troubling mien.

My decision to step back from this name for the time being is my homage to the power of the pandemic. Mindful of RECELL's potential in vitiligo and elsewhere and my expectation that the pandemic will pass, I am looking for an opportunity to buy AVITA on pullbacks.

Disclosure: I am/we are long ABT, TTOO, GILD, OMER, RDHL, CYDY, ATHX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may or sell shares in ABT, TTOO, GILD, OMER, RDHL, CYDY, and ATHX, over the next 72 hours.