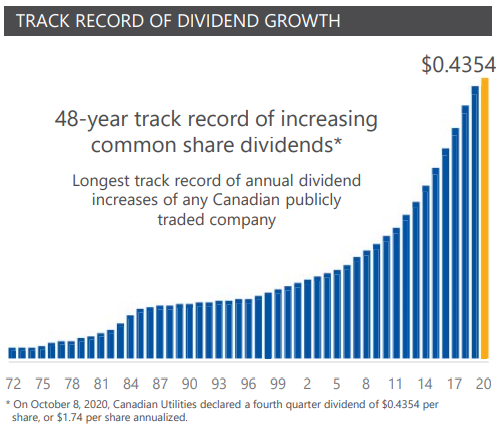

Canadian Utilities Has A 5.6% Yield And A 48 Year Dividend Growth Streak

5.6% Yield from strong regulated utility assets.

The longest dividend increase streak of any publicly traded Canadian company.

25% upside to my estimate of private market value.

Multiple potential upside catalysts including earnings from a new Puerto Rico JV.

Canadian Utilities (OTCPK:CDUAF)(TSX:CU) is a large utility based in Alberta, Canada. The firm has the longest continuous record of dividend growth of any company in Canada, with their streak approaching 50 years. The firm is almost entirely based on regulated utility businesses, which are the source of their stable cash flow growth. The company has an investment grade credit rating, and their debt is well termed out, with no significant maturity wall. The company trades with greater liquidity in Canada, and all figures in this article are in Canadian dollars unless otherwise specified.

Source: Q3 2020 MD&A

Operations

The company has multiple utility operations, mostly in the Province of Alberta. Alberta is Canada’s most free-enterprise province (many of the others have government run utilities) and historic returns on equity have been good. The company reports an average return on equity of over 10% for both the trailing three and ten year periods. That significant return on their capital is the biggest reason the company has been able to continually grow its dividend for decades.

Source: CU Investor Presentation

The company’s operations are diversified between electricity and gas, with their largest segment being electricity transmission in Alberta. That business (the transmission of electricity over long distances at high voltages) is a good one. They have continued to put new capital to work at high returns there. The Alberta electricity grid has needed significant investment as the province’s economy has grown.

Alberta’s economy is quite dependent on oil and gas, and has therefore been relatively stagnant for a number of years. However, there are significant changes to the generation mix in the province that are occurring, and that is likely to add demand for electricity transmission. Renewable generation (mostly wind) is getting added at a quick pace in the southern part of the province, and cogeneration plants dedicated to thermal oil production have been getting installed in the north. But the large legacy coal plants in the central part of the province have been either de-rating as they convert to natural gas or shutting down completely, and they will all be gone (for regulatory reasons) by 2030. That change in the location of the major generation in the province is likely to lead to profitable growth opportunities for their transmission business. They are part of a very profitable oligopoly in Alberta electricity transmission, along with Fortis (FTS) and Altalink, a subsidiary of Berkshire Hathaway (BRK.B)(BRK.A). As the generation mix in the province moves around, new transmission lines will be necessary to move the new power.

The company also has large businesses in the distribution of both electricity and natural gas in Alberta. These are likely to be slower growing, as the primary source of growth is new connections. The Alberta economy is in a slow growth phase, so I would expect their distribution business to be more likely to earn strong and stable returns than to grow quickly. They do have the ability to deploy capital into the gas business to replace aging pipelines, and that capital does increase their regulatory capital, and therefore their returns.

Finally, they have a natural gas transmission business in Alberta and an international gas distribution business. These are their smallest operations. The international gas distribution business is based in Australia, which is a stable country and offers regulated returns. That does provide some geographic diversification as well, but the bulk of the operations are still in Alberta.

Puerto Rico

The company has also recently won a contract to manage electricity operations in Puerto Rico. The joint venture operation (they own 50%) was selected to manage both the transmission and distribution functions on the island. This contract is fee-for-service at guaranteed rates, and will allow them to earn money without the input of capital, so it is an asset-light management type business. The contract is for 16 years, so it isn’t a permanent operation, but that is long enough that I suspect the market will include the returns from the contract in their earnings stream. Earnings growth without the input of capital is especially useful for dividend growth, because it doesn’t require the retention of capital from previous earnings. The joint venture will charge fees starting at $60 MM USD the first year, and rising to at least $105 MM (plus potential incentives) by the fifth year. Because the assets will only be managed by the joint venture and will still be owned by the public agency that owns them now, they will remain eligible for US Federal disaster relief funding in the even of future hurricane damages.

Other Operations

The company has a variety of other operations, but they aren’t a big part of the picture here. There is a small amount of electric generating assets in various places, most of which are on long term contracts. They sold the vast majority of their electricity assets (all coal and natural gas plants in Canada) in 2019. This reduces their greenhouse gas emissions dramatically, and also reduces their re-contracting risk. While power generating plants tend to become obsolete, transmission and distribution infrastructure tends to just continually be upgraded, so it is more of an evergreen asset. I think this sale has materially reduced their risks from a contract point of view, and it also makes them a potential ESG type investment, as their operations have very limited greenhouse gas emissions.

They also have a variety of other utility type operations, including some industrial water management plants, and storage operations for both natural gas and liquid hydrocarbons. These are long term infrastructure type assets, so they deserve a high multiple, but they are a relatively small portion of the firm.

Valuation

Because of its long history of growing its dividend, the company has often been valued based on that dividend. With a current share price of $31.32 CAD they have a yield of 5.57%. I think that is almost certainly too high for a business with a nearly half century history of dividend increases that also has reasonable forward-looking growth prospects. Canadian interest rates are very low (near zero) and so a growing 5.6% yield seems quite attractive.

Those low interest rates affect the company in two ways – the first is that their debt can almost certainly be refinanced at lower interest rates. The second is that the dividend yield the market is willing to accept to own the shares is likely to decline if interest rates remain at their current lows. Either of these factors could cause upside above and beyond the dividend yield for the shares.

From a private market point of view, I think the purchase of AltaLink by Berkshire Hathaway in 2014 is by far the best comparable. The seller was SNC Lavalin (OTCPK:SNCAF), and given issues that they had they were at least partially a distressed seller. Berkshire-Hathaway under Warren Buffett hasn’t been widely known to overpay for acquisitions, so I think considering those two factors it is likely the price of that transaction was somewhere between fair and low, and that deal went off at over 12X EBITDA.

I think the fact that interest rates have come down materially since then suggests that 12X EBITDA is probably conservative. In the trailing twelve-month ((TTM)) period, the firm has EBITDA of $1.695 billion CAD. At a 12X multiple, that would imply an enterprise value of $20.3 billion. Subtracting their debt and preferred shares at face value, and adding back cash provides an estimated fair value for the common equity of $10.7 billion, or $39.20 CAD per share. That is 25% in excess of the current $31.32 CAD share price.

Conclusion

While the private market value exceeds the current share price, I think the private market value isn’t likely to be realized through a takeover, as Canadian Utilities is controlled by Atco Ltd (OTC:ACLTF). So while I don’t think that premium is likely to be realized, I think its comforting to know that there is value here in excess of what the market is charging for the shares. The company pays a strong and growing dividend, and at 5.6% it’s an attractive security for generating income. There are a number of potential catalysts for increasing the value in the future, including new asset-lite operations in Puerto Rico and the potential to refinance their debt at lower interest rates.

Disclosure: I am/we are long CDUAF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Purchased on the TSX under symbol CU

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.