Ascendis Pharma: TransCon Platform Is A Major Value Driver

Ascendis has a PDUFA date of June 25, 2021 for its lead indication.

However, what makes this pre-market stage company so valuable is its TransCon platform.

In about 5 years, this may be a very profitable investment.

Ascendis Pharma (ASND) is a European biopharma concern with a market disruptive technology called TransCon that is able to convert any drug into a sustained or extended release molecule without increase in molecular size. That means it can take any currently approved drug and increase its efficiency without simultaneously increasing its adverse effects profile. The company has a proof of concept of the platform in its lead indication, pediatric growth hormone deficiency; here, SoC, or standard of care, is once-daily genotropin. The lead candidate of Ascendis Pharma has a once-weekly dosing regimen, but has proven to be equal or better in efficacy compared to once-daily genotropin in a phase 3 clinical trial. This means better adherence, cheaper treatment, and perhaps even a better safety profile.

TransCon Platform

Using the example of long-acting growth hormones, we see that normally, growth hormones are made longer-acting by increasing their molecular size. This increases their half-life, but also decreases their ability to penetrate tissue as well as decreases renal and receptor-mediated clearance. As I said in my earlier article, TransCon temporarily links an inert carrier to GH of standard size, which improves half-life. However, at the opportune moment, using physiological pH- and temperature-induced linker autohydrolysis, the unmodified 22 kDa GH is released into the target tissue, providing, in effect, the best of both worlds.

Coming to broader applications, this technology can effectively control the release rates of the drug by using suitable carrier geometry. Effective geometry can be used to reduce as required the receptor binding and clearance of the active molecule from the body. Suitable linkers with different half-lives can be chosen to control the half-life of the drug. This way, Ascendis can achieve administration frequencies from 24 hours to upto 6 months by choosing from a vast library of carriers and linkers for different therapeutic applications.

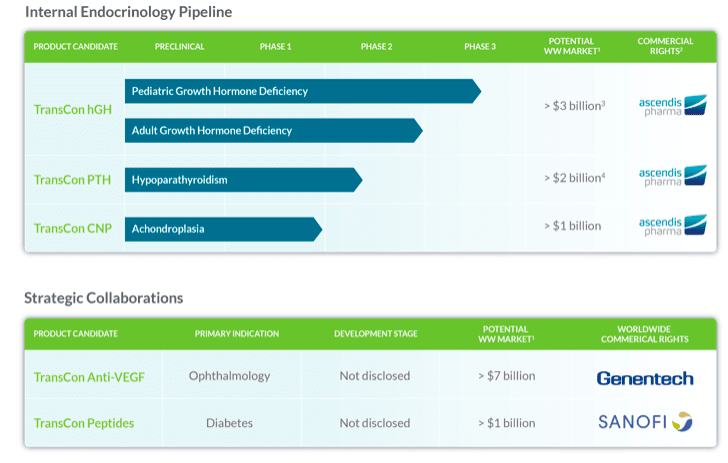

There are three major transcon products in clinical development: Transcon HGH (for growth hormone deficiency), Transcon PTH (for Hypoparathyroidism) and Transcon CNP (for Achondroplasia).

Market Potential of Lead Candidate

This too has been discussed before, so we will just do a recap. In my previous article, I said that the growth hormone market is a $3.5 billion market and it is growing at a 2.4% CAGR. That should make it around $4 billion by the time of launch of the drug. 90% of this is pediatric; that means a market of $3.6 billion. Just this September, Sogroya or somapacitan from Novo Nordisk (NVO) was approved. Somapacitan is the first once-weekly LAGH, and it is a 22 kDa molecule too, so it is a direct competition for TransCon hGH, which is also going to be approved two years later.

Now, one analysis will say that, based on the 40% non-adhering patients, the target market should be smaller. Though, this may not be true. “However, this is simplistic; even those who manage to give themselves the stringent daily dosage will find a long-acting dosage of similar efficacy beneficial, and given realistic prices, will shift.”

Rest of the Pipeline

However, TransCon hGH is the least of the platform. It is merely the proof of concept of the platform. The value of the platform is far greater than this first drug.

Here’s a chart showing the various target market potentials:

(Source: Company website)

“So we have another $3+ billion of market being targeted by its internal endocrinological pipeline, all of which are in clinical stages and should get a boost by the first approval probably late next year. TransCon PTH for hypoparathyroidism has Phase 2 top-line data due Q1 2020 - TransCon CNP for achondroplasia Phase 2 has been initiated. There is an oncology pipeline with first IND next year - oncology target molecules are IL-2 b/g, TLR 7/8 Agonist, and VEGF-TKI. Then we have another $8 billion market potential in partnered technology, with Roche in ophthalmology and Sanofi in diabetes. All this constitutes the value of the company’s scientific assets.”

Next Catalyst and Major Updates

Ascendis Pharma A/S is scheduled to host a Virtual Oncology R&D Day on Friday, November 20. The event will provide information on how the company is using its TransCon platform, along with its unique algorithms to therapies in oncology. This is just oncology, but any activity will help this undercovered European biopharma.

In April this year, TransCon PTH, a long-acting version of parathyroid hormone, showed strong data in a phase 2 trial, demonstrating “that TransCon PTH eliminated standard of care in 82 percent of subjects within four weeks. In the per protocol analysis (n=57), TransCon PTH eliminated standard of care (i.e. off active vitamin D and ≤ 500 mg per day of calcium supplements) in 100 percent of subjects in the highest dose arm (21 µg/day) and 82 percent of subjects across all dosage arms.”

The company submitted a BLA for TransCon hGH in June, and plans to submit for EU approval and Japanese trial later this year. The US BLA was accepted in September, with an action date of June 25, 2021.

Bottom Line

Some years ago, there were rumors that a consortium of Big Pharma from Europe, including Eli Lilly (LLY) and Novo Nordisk, tried to buy Ascendis Pharma for about a third of its current market cap. Luckily for the company, it refused to fall for this. Its platform is what adds value to the company despite having no drugs in the market, and the lead indication having strong competition from a Big Pharma drug that was just approved. Ascendis Pharma has a strong cash balance of over $1 billion, and if everything goes well, this company is going to become a major mid-sized biopharma in about, say, 5 years. This may be a good time to understand that.

About the author

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.