Digital transformation is considered by many to be the fourth industrial revolution. Cloud computing is the heart of the transformation.

CLOU is an excellent way of investing in a broad spectrum of cloud computing stocks. The risk is fairly evenly spread amongst the 35 stocks in the fund.

An investment in cloud computing stocks does have some risk, including a possible take-back of profits from this year's bull market when a vaccine is approved.

CLOU is a long-term investment based on the fourth industrial revolution, and I am giving it a buy rating.

(Source: shutterstock)

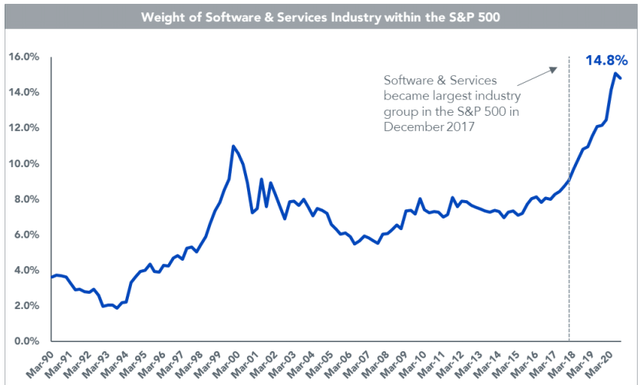

Software & Services is quickly becoming the dominant industry in our economy and, as of December 2017, has become the largest industry within the S&P 500, with 15% of the S&P 500 index by weight and $4.3 trillion in market capitalization. Central to the software industry's recent success is the emergence of cloud computing, which is at the heart of a movement called Digital Transformation, the topic of my marketplace service, and which some believe is the coming of the fourth industrial revolution.

(Source: WisdomTree)

In this article, I would like to cover how to take advantage of the revolution by investing broadly in cloud computing companies, without the worry of individual stock risk, by investing in the Global X Cloud Computing ETF (CLOU).

X-as-a-Service

Cloud computing has enabled a business model referred to as Software-as-a-Service ("SaaS"), which has propelled software companies into the stratosphere. Whereas in the past, software revenue was generated by sales of perpetual licenses, the new SaaS model enjoys significant advantages that include:

- low upfront onboarding cost for the customer

- steady recurring revenue stream

- higher level of customer retention due to switching costs

- higher customer lifetime value

- software deployment and update

SaaS companies tend to have better financial metrics than their non-cloud cousins, including margins, free cash flow, and revenue growth.

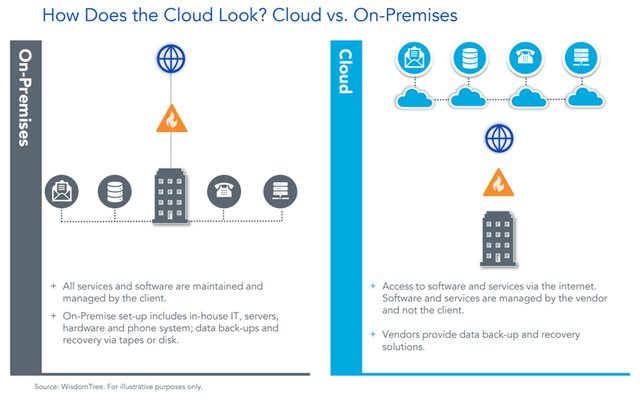

(Source: WisdomTree)

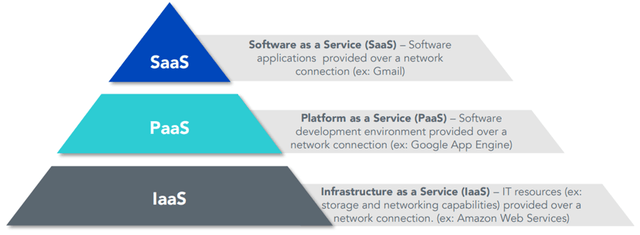

Another emerging business model is called Platform-as-a-Service ("PaaS") which extends SaaS to multiple-related software applications, providing opportunity for cross-selling and up-selling, which often lead to a high dollar-based net expansion rate.

A third area of business related to the cloud is the infrastructure that makes SaaS and PaaS happen. It is called Infrastructure-as-a-Service (IaaS). Companies such as Amazon.com (AMZN) and Microsoft (MSFT) provide IaaS via Amazon Web Services ("AWS") and Microsoft Azure.

(Source: WisdomTree)

Investing in Cloud Computing

There are literally dozens of XaaS companies, and CLOU offers a convenient way of investing broadly in the industry without being exposed to the risks of individual companies. In fact, it currently holds 35 cloud computing stocks weighted by a capped market capitalization algorithm and rebalanced every 6 months. The top-ten CLOU holdings are listed in the table below. No constituent accounts for more than 4.4% of net assets and the weightings appear to be fairly evenly spread, at least for the top ten stocks.

| Top Ten CLOU Stocks | Weight (%) |

| Fastly, Inc. (FSLY) | 4.382 |

| Xero Ltd (XRO AU) | 4.285 |

| Paycom Software, Inc. (PAYC) | 4.274 |

| Anaplan, Inc. (PLAN) | 4.265 |

| Proofpoint, Inc. (PFPT) | 4.249 |

| Paylocity Holding Corporation (PCTY) | 4.138 |

| Akamai Technologies, Inc. (AKAM) | 4.131 |

| Workday, Inc. (WDAY) | 4.119 |

| Salesforce.com, Inc. (CRM) | 4.007 |

| Dropbox, Inc. (DBX) | 3.959 |

ETF Valuation - Top Ten Stocks

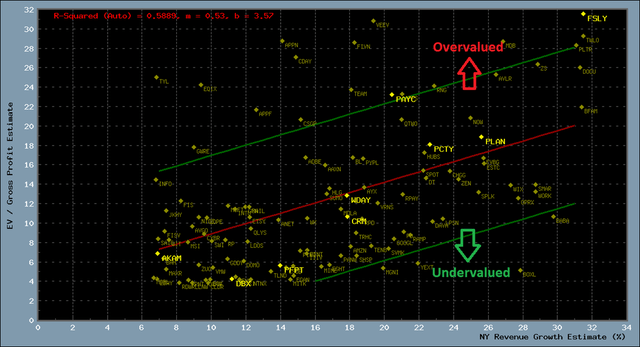

My followers will recognize my technique for valuing stocks. For those readers not familiar with my scatter plots, please refer to this recent article for more details.

Nine of the top ten stocks are highlighted on the scatter plot above. XRO is listed on a foreign exchange and is therefore omitted here.

The red line represents the best-fit line of fundamentals for the 200+ stocks in my digital transformation stock universe. The above plot suggests that two of the stocks are frothy, those being Paycom and Fastly. Paylocity, Anaplan, Workday, and Akamai are fairly valued, while Salesforce.com, Dropbox, and Proofpoint are undervalued.

From this data, and based on the assumption that the nine holdings are representative of the remainder of the ETF constituents, I believe that the ETF in general is not overly valued.

Investment Risks

CLOU has been a huge beneficiary of the pandemic, as businesses shifted to remote operations, and people in general have been at home avoiding the virus, making the internet the prime source of entertainment and activities. CLOU's price has more than doubling from approximately $12.50 to $26 in September.

(Source: Yahoo Finance/MS Paint)

But there is an old saying "what goes up must come down". With a COVID-19 vaccine expected to be approved in the coming months, it is likely that there will be some retracement of cloud stocks.

Also, the current market action for cloud computing stocks is somewhat reminiscent of the dot.com era, immediately prior to the crash starting in 2000. Technology stocks were performing well beyond what many analysts considered acceptable valuations. It wasn't long before the market turned into a disaster, and the same could happen here, although I believe that there is much more substance behind the internet companies than existed 20 years ago.

Summary and Conclusions

CLOU is a cloud computing ETF provided by Global X, consisting of approximately 35 stocks that are SaaS, PaaS, or IaaS based. The stock holdings are rebalanced every six months using a weighting algorithm based on market capitalization. At present, no stock constituent has a weight higher than 4.4% of net assets. Therefore, the risk is fairly well distributed amongst the portfolio of stocks. I consider the top nine (of ten) ETF stock constituents to be fairly valued by my custom valuation technique, except for two stocks: Paycom and Fastly. All in all, valuation looks reasonable.

I have two concerns regarding the investment in CLOU. The first concern relates to the general situation involving the pandemic and the likelihood of a vaccine coming in the not-too-distant future. CLOU has been a great beneficiary of the pandemic, with the ETF price skyrocketing. But with a vaccine on the horizon, it is quite possible that some of the advances made the past nine months will be given back. The second concern relates to the crash resulting from the dot.com era and the possibility of a repeat. While this is certainly a possibility, I believe it to be unlikely.

Despite the concerns, I believe that CLOU makes a good long-term investment. The fourth industrial revolution is unfolding before our eyes, and all investors should be taking advantage of this once-in-a-lifetime opportunity. I am giving CLOU a buy rating.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.