American Electric Power: This Pure-Play Electric Utility Is Nothing To Write Home To Mom About

With a potential wave of anti-natural gas sentiment, some investors may be looking for a pure electric regulated company.

Only 19% of AEP customers are in states rated Above Average/More Constructive for regulatory financial support while 31% of customers reside in states rated as Below Average/Less Constructive.

There are “better” utility opportunities available for investors to choose from and I am willing to walk past AEP at this time.

American Electric Power (AEP) is one of the few regulated all-electric utilities. With a potential wave of anti-natural gas sentiment, some investors may be looking for a pure electric regulated company. However, investors need to remain diligent in their overall research, and while AEP is a stalwart of the large-cap pure-play regulated electric utility crowd, its overall investor profile is average for the sector.

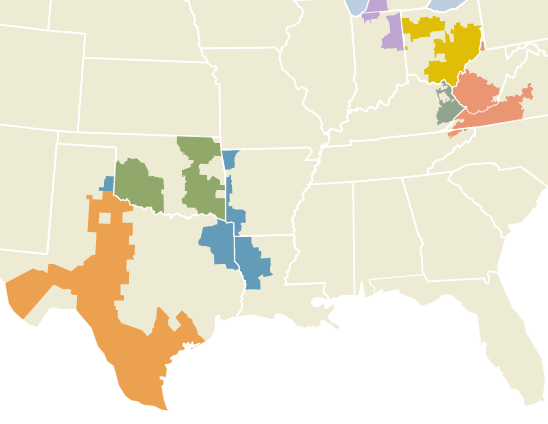

American Electric Power is a major electric utility across 11 states in the Midwest and eastern Southwest. The firm services ~5.2 million customers, putting it in the top tier of large utility companies. AEP is diversified and integrated, meaning it owns FERC-regulated high voltage transmission assets, electricity generating assets, and distribution assets. How these are combined depends on individual state PUC regulations. For example, in Texas and Ohio, AEP owns the distribution network as a separate regulated business than its power generating plants. In other states, AEP operates as an integrated provider of electricity, holding both generating and distribution assets as a single entity.

Within the supply chain of electricity, AEP website offers the following description of its business groupings:

Transmission: We own the nation's largest electricity transmission system — more than 40,000-miles — with more 765-kilovolt extra-high voltage transmission lines than all other U.S. transmission systems combined. It brings high-voltage power from generation operations to substations, where it's "stepped down" to be used by numerous distribution networks.

Power Generation: We are one of America's largest generators of electricity, owning or operating about 24,000 megawatts of generating capacity in the United States.

Regulated Service: We serve nearly 5.4 million customers in our regulated service territory, spanning more than 200,000 square miles in 11 states. Maintaining the nation’s largest electricity transmission system and more than 219,000 miles of distribution lines, we deliver safe, reliable power to customers in Arkansas, Indiana, Kentucky, Louisiana, Michigan, Ohio, Oklahoma, Tennessee, Texas, Virginia, and West Virginia.

Competitive Retail Electricity: AEP Energy is a certified competitive retail electricity and natural gas supply provider operating in 28 service territories in six states and Washington, D.C. AEP Energy supplies electricity and natural gas solutions for more than 400,000 residential customers and business customers."

In addition, AEP operates a wholesale energy marketing and supply company (AEP Energy Partners), a local consulting and distributed solar energy company (AEP OnSite Partners), and a developer and operator of large wind and solar generation projects (AEP Renewables).

Due to these structural differences, American Electric Power reports in five distinct operating segments. From AEP 3rd qtr 2020 earnings presentation, below are the five reporting segments along with YTD earnings per share and YTD revenue for each as of 9/30/20:

Vertically Integrated Utilities: $1.90 YTD EPS, $6.75 billion YTD revenues

Transmission & Distribution Utilities: $0.84 YTD EPS, $3.31 billion YTD revenues

AEP Transmission Holdco: $0.75 YTD EPS, $0.88 billion YTD revenues

Generation and Marketing: $0.31 YTD EPS, $1.23 billion YTD revenues

Corporate and Other: $(0.24) YTD EPS.

Total: $3.56 YTD EPS, $12.19 billion YTD revenues

American Electric Power generates about 75% of its revenue and earnings via state-regulated integrated utilities and state-regulated distribution utilities. While FERC-regulated transmission assets provide 21% of YTD earnings and offer better operating profit margins, potential shareholders are best off to initially focus on the individual state-regulated businesses. Below is their service map, also from the presentation.

Source: Company website

As sector investors know, utilities live and “die” based on the actions of the gatekeepers to their profitability – the state utility regulators. It has been difficult in the past for retail investors to ascertain if the regulators were more “business friendly” in some states than others. Comparing the regulatory impact on utilities in Virginia and Indiana versus Texas is quite a difficult feat for most investors. However, the credit folks at S&P Global Intelligence thought individual state regulatory environments were important enough of a factor on utility profitability, and hence credit profile, that they devised a rating system decades ago. While it has mutated in its presentation several times and is now occasionally published by their consulting group Regulatory Research Associates, RRA, utility investors should not underestimate the long-term importance of the RRA ratings. Known as the State Commission Rankings, RRA lists states by three major categories: 1 More Constructive / Above Average; 2 Average; 3 Less Constructive / Below Average. Within each category, RRA further groups the states into three: 1 (highest) ,2 (average), and 3 (lowest) within each category. As there are no 1-1 states and no 3-3 states, investors should focus on those states rates More Constructive or on high side of Average, or states rated 1-2, 1-3, and 2-1. More information can be found in my commentary of June 2020 titled: Utilities: Regulatory Environment, COVID-19, And Taxes - Location Matters.

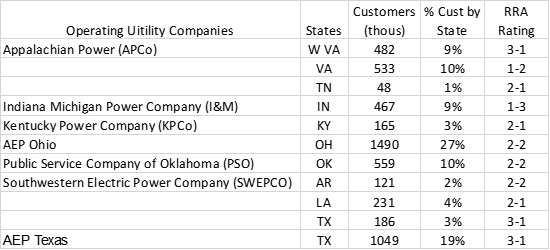

The following table outlines each operating company, the states they serve, the number of customers in the state (thousands), the percentage of total companywide customers by state, and the RRA rating for Regulatory Environment.

Source: Investor Presentation, GMI

A worthwhile utility investment goal could be to have the majority of each utility’s exposure in states with higher RRA regulatory ratings, or Above Average (1-2, 1-3) and highest Average (2-1), with little to no business in states rated as Below Average (3-1, 3-2). However, AEP has twice as many customers in states with Average (2-2, 2-3) or Below Average (3-1) as it does in Above Average (1-2, 1-3, 2-1). Only 19% of customers are in the Above Average (1-2, 1-3) category while 31% of customers reside in states listed as Below Average for regulatory support.

Reliance on regulatory financial support for utilities will become more critical over the next few years. The residual effects of the pandemic, added to the aggressive mandate for incorporating renewable energy and the need to offset the potential reversal of the 2017 income tax reduction and ratepayer-related decreases, could exert added stress on utility profitability in less supportive states.

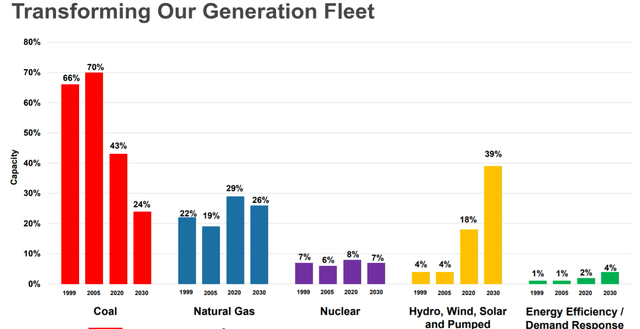

American Electric Power has been the beneficiary of lower fuel costs over an extended amount of time. The company has a large, and declining, fleet of coal powered generation plants in geographies ripe with coal assets and natural gas generating plants in areas where gas production is more local. However, this has positioned AEP with a large legacy of coal plants, with 43% of its 2020 generation still reliant on coal. Like most electric utilities, AEP is in the process of transitioning away from its coal-powered roots, replacing the coal capacity with hydro, wind, solar, and pumped water. The graphic below outlines the transition of AEP’s fuel composition, from the Nov 2020 EEI Financial conference.

Source: EEI Financial Conference Nov 2020

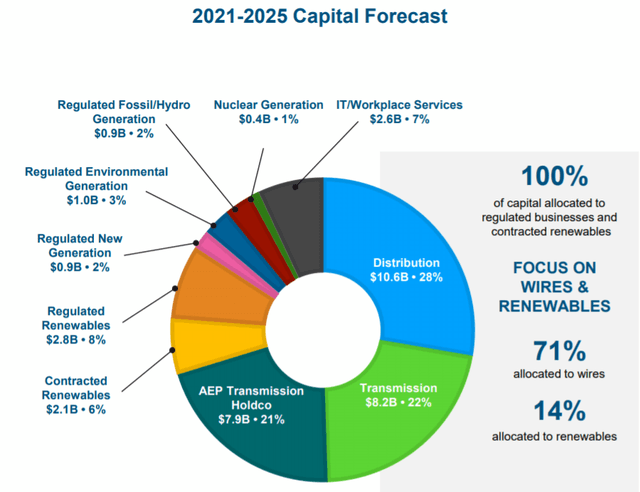

Like other utilities, AEP’s rate base growth is driven by a large capital expenditure budget over the next few years. Management outlines its investment plans to invest $38 billion over the next 4 years through a graphic available on its 2020 Factsheet presentation and offered below. The bulk of AEP’s investment is allocated to regulated businesses and renewables. AEP's capital plan includes $26.7 billion in transmission and distribution operations investments, with a focus on continuing to upgrade its electric grid infrastructure and implementing new technologies. In addition, AEP plans to invest $2.8 billion in regulated renewable generation and $2.1 billion in competitive, contracted renewable projects. It would be interesting to visualize a Vistra Energy (VST) type conversion of shuttered coal powered plants into solar and battery farms, utilizing the existing connections to the electric grid.

During the 3rd qtr. 2020 earnings press release, management outlined its 2021 operating earnings guidance of $4.51 to $4.71 per share, with midpoint of $4.61. Over time, management expects earnings per share to grow by 5% to 7% annually, slightly better than the sector average. The current dividend yield of 3.3% seems light compared to its peers, but its earnings growth will sustain constant dividend growth in the 4% to 5% range.

American Electric Power is on the fringes of an emerging political bribery scandal in Ohio. Recently, the Ohio legislature passed a financial support package for nuclear power plants in the state and AEP is one of several companies benefitting from the bill. However, it is alleged that a recently spun-off division of FirstEnergy (FE) which owns FE’s Ohio nuclear assets bribed the Ohio Speaker of the House to get the bill passed. While claiming no wrongdoing, AEP will nonetheless be subjected to negative repercussions and fallout from the scandal, especially as it relates to a potential shift in the support of the Ohio PUC towards the electric utilities under their jurisdiction. Currently sitting in the middle of Average for support by RRA, Ohio’s utility regulatory environment could slip into the Below Average category, and with 27% of its customers residing in Ohio, is worthy for shareholders to watch carefully.

In addition to its common stock, AEP offers a few Mandatory Convertible Collared Preferred shares: American Electric Power Company, 6.125% Equity Units Due 8/15/2023 (AEPPZ) and American Electric Power Co., 6.125% Equity Units Due 3/22/2024 (AEPPL). From quanumonline.com, the convertible terms are:

APPZ: The stock purchase settlement rate will be 0.5003 shares per unit if the then current market price is equal to or greater than $99.95 and 0.6003 shares per unit if the market price is equal to or less than $83.29.

APPL: The stock purchase settlement rate will be 0.5021 shares per unit if the then current market price is equal to or greater than $99.5818 and 0.6026 shares per unit if the market price is equal to or less than $82.98.

With the current common share price trading at $90, the conversion ratio falls between the collar prices of $99 and $83, and will be calculated by taking the common price and dividing it by the preferreds $50 par value.

In early fall 2019, I started building a portfolio of utility preferreds, and continued into the spring of this year. AEP’s convertible preferred was among those chosen in the convertible category. However, I sold out when the scandal news broke as I felt the investment risk exceeded my tolerance for this portion of my income portfolio. I owned the common back in the late 1990s mainly due to its higher margin transmission assets (which was a larger part of the overall business back then), the stock made a nice return over time, and I moved on after about 10 years.

I currently rate American Electric Power as Neutral based on its RRA ratings, its high exposure to coal power, and the uncertainty in the future regulatory environment caused by the Ohio scandal - regardless of AEP’s participation. From a stock valuation viewpoint, AEP is trading at an Enterprise Value/EBITDA ratio of 13.2x, which is a bit expensive considering recent utility acquisitions have been valued in the 12x to 15x range. I believe there are “better” utility opportunities available for investors to choose from and am willing to walk past AEP at this time.

Author’s Note: Please review the disclosures found on my profile page.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.