TECL: Using 3x Super Leveraged Tech Focused ETF For Actionable Options Plays

The Direxion Technology Bull 3x Shares ETF is a stopgap high leverage trading tool.

Used in conjunction with the derivatives market, the security can produce consistent short-term profits.

US large cap technology makes up the lion’s share of the ETF's holdings.

Leveraged ETFs remain exceedingly risky – due caution is required.

The Direxion Technology Bull 3x Shares ETF (TECL) is Direxion’s packaged big technology play providing traders with tactical trading opportunities which utilize both ETF and derivatives markets to engineer profitable trades. Due to its highly leveraged nature and particular use of OTC derivatives, the ETF is not a suitable long-term investable asset.

Overview

Direxion’s lasting effort to afford investors and traders alike the possibility of gaining rapid exposure to movements in big technology stock prices has been around since 2008. Surprisingly, the market for highly leveraged big technology ETFs remains a tad muted despite the mammoth gains produced by US technology assets over the past decade. TECL is comprised of S&P 500 technology companies, including telecommunications, to provides some level of diversification. It depends heavily on returns generated by its key holdings, Apple Inc (AAPL), Microsoft (MSFT) and Alphabet (GOOG) (NASDAQ:GOOGL).

Source: Market Chameleon

The leveraged ETF presents a lot of similarities to the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares ETF (NYSEARCA:GUSH), at least in terms of structure, so I invite you to read my article on fading big pops in price action. Concerning TECL, the strategy remains comparably similar. In this instance, given technology's continual rise, positioning on flops is optimal here. I will detail this strategy further in the document.

The main comparable asset on the ETF market is the ProShares Ultra Technology ETF (NYSEARCA:ROM), and for analytical purposes, I have provided an overview below.

Source: Data compiled by author from ETF.com

TECL provides much larger trading volumes combined with substantial assets under management. The two funds, however, remain indistinguishably less popular than other ETFs given the 10+ years both funds have been in the market. They continue to be on the fringe of the global ETF offering with high expense ratios being priced in accordingly.

TECL is a premium proposal at 1.08% - its ProShare’s counterpart (ROM), despite being more economical, stays well within the higher echelons of ETF pricing. These are not cheaply priced funds, nor are they particularly sought after or widely traded. Both funds resort to the use of over the counter (OTC) derivatives markets to generate 3x leverage – this is a uniquely important trait as it exposes both funds to counterparty risk. In times of massive financial strain, OTC derivatives use places both ETFs in the basket of extremely risky assets, highly susceptible to market contagion. Trading volumes are marginal as are distributions, which reflect the nature of the assets both funds hold.

TECL vs. SPX price returns. Note positive & negative effects of leverage.

Source: TradingView

Breakdown

The Direxion Technology Bull 3x Shares ETF is deeply exposed to Apple Inc. and Microsoft, meaning its structure is possibly less balanced than its counterpart. Due to its 23% holding in Apple Inc., it also factors in a greater degree of country risk given the exposures the Cupertino firm has to China both in terms of customers and vendors. Due consideration of this is required before taking any position in the asset.

An overview of major holdings includes:

- Apple Inc. 23.74%

- Microsoft 20.29%

- Visa (NYSE:V) 4.30%

- Nvidia (NASDAQ:NVDA) 4.26%

- Mastercard (NYSE:MA) 3.81%

- Adobe (NASDAQ:ADBE) 3.00%

- PayPal (NASDAQ:PYPL) 2.95%

- Salesforce (NYSE:CRM) 2.92%

- Intel (NASDAQ:INTC) 2.81%

- Cisco (NASDAQ:CSCO) 2.13%

44% of fund returns are generated by Apple Inc. and Microsoft, underscoring appreciable concentration risk.

While Apple Inc. and Microsoft make up a large part of its competitor’s (ROM) holdings, it is noteworthy that Facebook (NASDAQ:FB) and Alphabet equally make up sizeable chunks in holdings. This helps explain differences in returns where digital payments assets (Mastercard & Visa) are highly prominent in TECL. Payments processors have been much more adversely affected by the COVID-19 pandemic than digital assets, illustrating differences in fund returns.

Trading Vehicles

While I maintain a relatively bullish outlook on large cap technology and digital assets, I equally believe Apple Inc. continues to be somewhat overvalued compared to its Silicon Valley peers. Here, you would need to decide your position on some of the underlying assets before trading.

Due to the risky nature of leveraged assets, my recommendation is to take tactical limited exposure trading positions married to holding some of the underlying assets. For example, I have a more bullish outlook on Facebook, so I would have tendency to hold Facebook stock, and trade TECL on the derivatives markets. To do so, as per any trading strategy, you need the alignment of several catalysts.

- Large increases in volatility allow you to use options to benefit from intrinsic qualities of short options whose value drop rapidly as volatility drops (volatility crush).

- Considerable drops in tech stock values for entry points – monitor changes in daily price action on the Nasdaq. On days which have strong action to the downside, use this as a catalyst to build in short-term positions

Source: Market Chameleon

Using the implied moves charting function on Market Chameleon, you can identify moves in the price of the ETF which could provide an opening for a bullish defined risk credit spread. Debit spreads can also be used, depending on how your brokerage remunerates cash balances on your account.

Given big technology’s propensity to moving to the upside in a constant enduring manner, I do not recommend you look at upside swings to fade a pop with a short position.

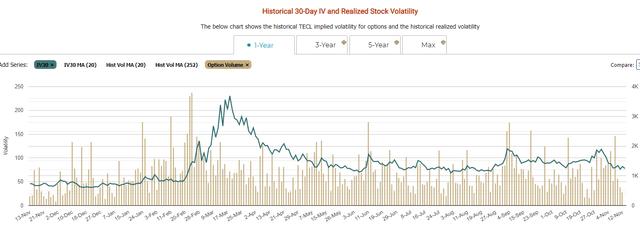

Historical 30-day Implied Volatility & Option Volumes

Source: Market Chameleon

Position characteristics

To use TECL as a short-term leveraged trading tool, you will need to define position characteristics. I have highlighted some key features below:

- Use defined risk: My recommendation would be to engineer a credit spread using puts on large drops in the ETF. For example, if the ETF dropped to $300, you could build a bull put credit spread by selling the $290 put and buy the $280 put 4 to 6 weeks out.

- Max gain of the credit spread would be the credit you take in. Max risk would be the differences between the upper and lower leg of the position.

- Avoid naked positions with leveraged ETFs to avoid catastrophic losses.

- Be privy of any dividend dates and the moneyness of your short position. Holding a short in the money option close to the payment of a dividend leaves you widely open to dividend risk.

Key Takeaways

TECL is Direxion’s big tech ETF play aimed at allowing you to have short-term exposure to leveraged price action in big technology securities such as Apple Inc. and Microsoft.

- To generate 3x leverage, the ETF resorts to the OTC derivatives market. This exposes you to significant counterparty risk. Therefore, while it remains an ideal short-term trading tool, it should not be a long-term portfolio holding.

- Option markets allow you to take risk defined positions (limited gains and limited losses) on movements of the ETF; this most likely remains its most practical use, albeit a short-term one.

- Comparably speaking, this is an expensive ETF with a relatively high expense ratio, likely to reflect the complexity of devising, engineering, and holding a basket of derivatives to give the mega-leveraged effect.

I remain relatively neutral on TECL as a long-term investable asset. While it can generate solid price returns, so can holding the underlying stocks. My preference would be to do appropriate due diligence on my favourite technology stocks, hold them for the long term and put TECL to its best use as a tactical trading tool.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: For additional ideas on using ETFs to build profitable options strategies, check out my article on GUSH. If you enjoyed my article, please follow my Seeking Alpha profile. Thanks!