RLJ Lodging Trust: Checking Out For Now

RLJ Lodging Trust's balance sheet should allow it to easily survive the pandemic.

Investors may have to wait until 3Q 2021 for a dividend increase, and it may still be lower than pre-pandemic levels.

Income investors should avoid the common stock. The preferred is still a good buy.

Reviewing My Earlier Calls

I last covered RLJ Lodging Trust (RLJ) common stock on March 8, 2020, about halfway through the COVID-19 market crash. At that time, I pointed out that RLJ had $900 million of cash on its balance sheet after completing a program of non-core hotel sales following the merger with FelCor Lodging Trust. With no debt due until 2022, RLJ's balance sheet was indeed prepared for tough times, as I stated in the title. The COVID-19 pandemic was tougher and longer-lasting than I anticipated at the time, and RLJ decided to cut its $0.33 quarterly dividend to $0.01 and borrow against its revolving credit facility in order to conserve cash.

While the Bullish call looked terrible at first, buy-and-hold investors are about breakeven since that article. Swing traders had plenty of opportunities to get in and out, with the stock bottoming below $5 within two weeks and then trading up to almost $15 over optimism around lower COVID-19 numbers in early June. The stock quickly went back to the $8 level as COVID-19 cases picked up in many Sunbelt states as the summer started. Finally, the stock has spiked again to $11 on good news about vaccines and treatments.

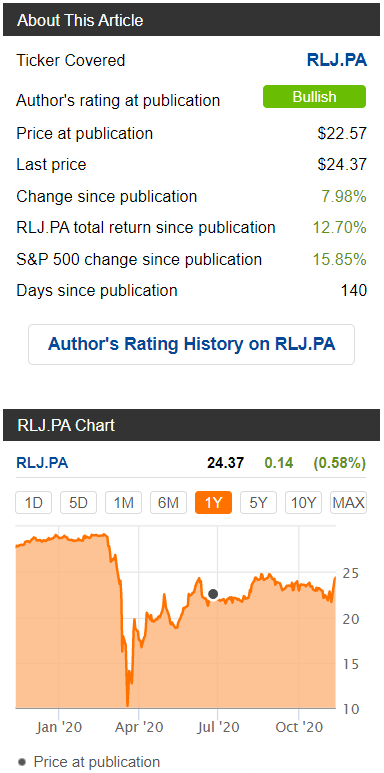

In the March article, I was also positive on the preferred stock, RLJ.PA. This is a non-callable, cumulative preferred stock that the company picked up in its merger with FelCor. This preferred is convertible but far out of the money. It is a small part of RLJ's capitalization with $328 million outstanding at par value. The dividends cost RLJ only $6.3 million per quarter. For comparison, the company's interest expenses are about $26 million per quarter. Current yield on the preferred is about 8%. As the preferred is now the highest cost of capital for RLJ after the common dividend cut, the company was planning to buy back some shares in the open market. These plans were put on hold when the pandemic hit.

Despite falling below $10 during the March COVID-19 crash, the preferreds recovered quickly to the mid-$20's by June when I reiterated my bullish call. The REIT had a cash burn of around $30 million per month at that time, which would be easily manageable given its cash balance. The preferreds have been a good investment since then with some capital gains and no change to the attractive dividend.

Fortress Balance Sheet But Slow Recovery

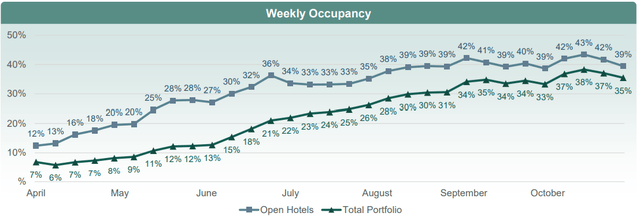

RLJ recently reported 3Q 2020 results. The REIT continues to recover from the worst of the COVID-19 lockdowns, but progress has been slow and RLJ remains unprofitable. 96 of its 103 hotels are now open, but occupancy is still only 37.1% in the open hotels, or 29.3% overall. Average Daily Rate was $119.26, resulting in a RevPAR of $34.92. For comparison, the year-ago metrics were ADR of $178.15 and occupancy of 81.1% for a RevPAR of $144.39. EBITDA was slightly positive at the open hotels but slightly negative overall, and adjusted FFO was -$0.32 per share.

RLJ estimates its cash burn rate at $25 million per month. That comprises (at the midpoint) $4.5 million of hotel operating losses, $7 million hotel fixed costs, $2 million of corporate overhead, and $11.5 million of interest and dividend payments. Assuming another two quarters at this rate before COVID-19 vaccinations and treatments allow enough travel to get to cash breakeven, RLJ would burn $150 million of cash. This poses no immediate problem for RLJ, as the company still has $1 billion in cash on the balance sheet, $200 million available to draw on the revolver, and no debt coming due until 2022. Nevertheless, there is a big difference between breaking even and being able to restore the dividend to its prior rate. That may take a couple of years, during which time income investors should look outside this industry for opportunities.

In the model below, I estimate the occupancy rates needed to achieve breakeven and higher levels of FFO. In the breakeven case, I start with the numbers management provided on the current level of cash burn of $25 million per month ($75 million per quarter). To achieve breakeven would require more like $80.8 million of incremental revenue due to the variable portion of hotel operating costs, which increases along with the number of rooms sold. In the breakeven case, RLJ would need occupancy of around 62% at current room rates, or around 50% at $150 ADR. (That room rate is about halfway between current rates and pre-pandemic rates.)

To do better than breakeven, it is clear RLJ will need to raise room rates above current levels as occupancy rates greater than before the pandemic would be needed to hit the FFO targets shown at $120 ADR. To produce a quarterly FFO of $0.22/share, RevPAR of $99 would be needed. This represents 66% occupancy at $150 ADR. To get to $0.33/share FFO (the pre-pandemic dividend rate) RLJ would need about 75% occupancy at $150 ADR. As a check on my model, I estimated the occupancy needed to produce $0.46 FFO (the actual 3Q 2019 result) at pre-pandemic room rates of $180. You can see that the calculation shows that 70% occupancy is needed. This is below the actual 3Q 2019 occupancy of 81%, however, RLJ has cut some costs, which should be sustainable such as the Wyndham management agreement.

The big question for investors is whether RLJ can hit any of these targets. While COVID vaccines and treatment R&D readouts have been positive lately, President-elect Joe Biden has predicted a "dark winter" before vaccine distribution ramps up. Some rollback to RLJ's occupancy gains is possible and may already be happening.

(Source: RLJ 3Q 2020 Pro Forma Supplemental)

Nevertheless, Travel Weekly reports that one economist estimates that hotels can recover around 68% of 2019 levels by the end of 2021. Using RLJ's 2019 RevPAR around $147, that would amount to 2021 RevPAR of $100. That comes close to my $0.22 FFO/share case in the table above. This same economist said that hotel revenue would not hit 2019 levels until 1Q 2024.

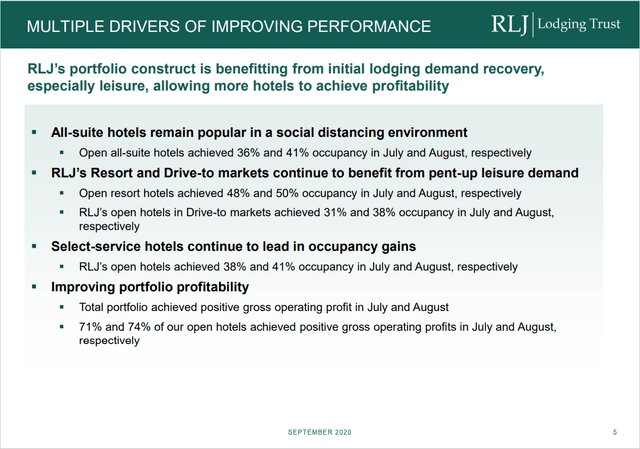

RLJ's portfolio has plusses as well as minuses compared to the industry average. The REIT has many all-suite hotels and locations in resort and drive-to markets. These have been popular with leisure travelers who have come back quicker than business travelers. However, RLJ also has many hotels in urban locations and in the Upscale classification which could continue to struggle until business travel picks up.

(Source: Investor Presentation, September 2020)

Based on the industry outlook, I think it is highly likely that RLJ keeps the common dividend at $0.01 until the second half of 2021. At that time, I would expect an increase to around $0.22/share, which would be 2/3rd of the pre-pandemic level. I think the dividend could stay at that rate for 2-3 years. While FFO coverage of 100% might be acceptable to start, given the company's strong balance sheet, I would expect it to want to get back closer to historical levels of 150% over time. RLJ does have debt due in 2022 and 2023 and may also want to put some cash toward open market preferred buybacks.

Valuation

Given the estimate of $0.22 FFO in the second half of 2021, some discount is in order compared to pre-pandemic levels. RLJ was trading at about $16 before the pandemic and paid a dividend of $1.32 per year for a yield of 8.25%. Applying a similar yield to my 2H 2021 FFO and dividend forecast of $0.88/year, I get a value of $10.67/share. Inverting that and assuming 100% FFO dividend coverage gets you a P/FFO of 12.1 times. This is well above pre-pandemic levels, and I would expect this ratio to come down in 2022-2023 as FFO grows and dividend coverage improves.

As for the preferred, it should be clear from my estimates above that I expect the dividend to continue. The cost of the dividend is included in the cash requirements in the tables above. RLJ's huge cash balance easily covers the dividend for now while the REIT is not profitable. It would even be enough to buy back all the preferred shares, if that were possible. The REIT only needs to get back to a RevPAR around $74 to begin paying the preferred dividend out of operating cash. I think this is feasible by 2Q 2021 with the vaccine rolling out and spring leisure travel picking up. Once the REIT sees this level of cash coming in, it may also try to buy back some preferreds in the market at or below $25. As many holders feel confident with the dividend and would be reluctant to sell, the buyback could be small and still put an effective floor under the preferred.

Conclusion

I was not pessimistic enough in March about how severely COVID-19 would impact RLJ and the hotel industry in general. Still, I was correct about RLJ's strong balance sheet and its ability to weather the storm. Although it looks like the company will make it through the pandemic, it could take a number of years until RLJ has the FFO to be able to pay the common dividend at pre-pandemic levels. I see the REIT currently fairly valued based on a dividend level of $0.22 per quarter in the second half of 2021. While a vaccine and treatments are highly likely to be available next spring, COVID-19-related setbacks over the winter could cause volatility in the share price. For that reason, I would avoid the common stock here. I recently sold my position in RLJ common to offset a capital gain elsewhere and to pursue dividend payers in other sectors. RLJ's preferred dividend remains safe, and I continue to hold it and consider it a buy at or below $25.

Disclosure: I am/we are long RLJ.PA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.