2U: Growth Outlook Justifies The Price Tag

2U posted a strong top and bottom-line performance, continuing to benefit from COVID-19-led shifts in education trends.

With 2U turning (adjusted) EBITDA positive in F3Q and margin expansion guided in FQ4, FCF breakeven appears to be within reach.

The undergraduate opportunity adds significantly to the addressable market.

2U shares may not be cheap, but I believe the growth outlook justifies the price tag.

Based on my DCF, I believe the fair value for 2U shares stands at c. $41.

With EdTech increasingly emerging as an exciting new growth area, 2U (TWOU) is in a prime position to benefit as the leading player in the "University Services" segment. As a result of COVID-19, 2U's market opportunity has likely expanded, on the back of the increasing adoption of online graduate degree programs and alternative credentials, along with the longer-term opportunity in the undergraduate space. Valuations remain pricey at current levels, but on the back of continued online learning growth, along with the underlying margin expansion potential, I think there remains an upside in the shares.

Graduate Degree and Alternative Credentials Underpin Top-Line Strength

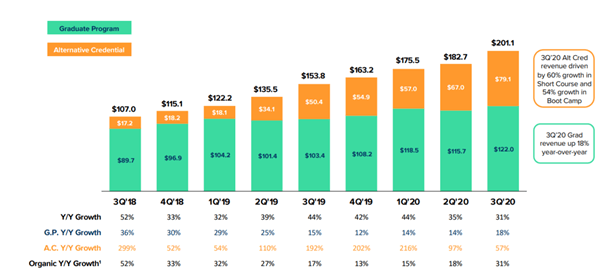

For FQ3, the company delivered an impressive 31% Y/Y organic growth as demand continued to strengthen across degree programs, short courses, and boot camps. The fact that growth continues to accelerate highlights the increasingly favorable backdrop 2U currently operates across both graduate programs (+18% Y/Y) and alternative credentials (+57% Y/Y).

Source: 2U FQ3 Presentation Slides

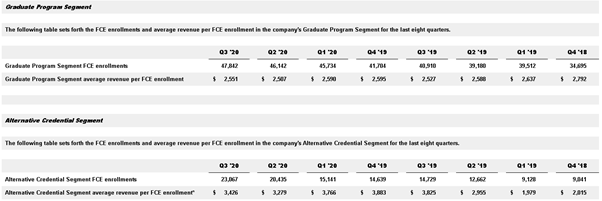

Graduate program full course equivalent (FCE) enrollment growth of 16.9% Y/Y was a slightly disappointing step down from the 17.8% Y/Y growth in 2Q, while graduate revenue per FCE improved to 0.9% Y/Y growth from a 3.1% Y/Y decline in 2Q due to a greater mix of higher tuition programs. In the alternative credentials segment, revenue increased 56.7% Y/Y, driven by increased demand for short courses. Similarly, alternative credentials FCE enrollment increased 56.6% Y/Y, with alternative credentials revenue per FCE declines also improving to 10.4% Y/Y.

Source: 2U FQ3 News Release

With the demand tailwind in the alternative credentials segment mainly coming from an increasing need to upskill and reskill via distance learning to improve career prospects amid COVID-19, I see plenty of room for growth ahead. Meanwhile, the graduate degree side has seen relatively slower growth but provides investors with greater visibility and resilience, considering the average program length of c. 2.5 years.

Signs of Improvement in the Bottom-Line

Encouragingly, 2U has also turned adj. EBITDA positive, with margins of 1.8% for the quarter, well ahead of Street expectations. The outperformance was largely due to a more measured cadence of program launches by 2U for the quarter, along with ongoing improvements in its operational efficiency on the marketing and technology fronts.

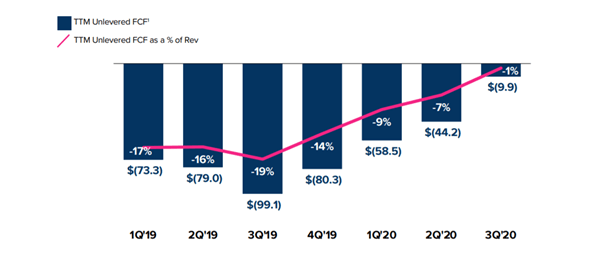

Cash burn has also improved considerably, with unlevered trailing-twelve-month FCF up sequentially for the fourth consecutive quarter to -$10 million - the lowest outflow as a % of revenue thus far.

Source: 2U FQ3 Presentation Slides

The cash balance is also now much stronger at c. $500 million (up from $213 million in FQ2) following the recent capital raise. While I would not additional capital raises ahead, 2U is well placed to capitalize on growth opportunities and realize favorable returns on its investments.

Fiscal 2020 Guidance Indicates Growth Opportunity Remains Intact

Looking ahead, management has reinstated guidance, with full-year revenue now moving ahead of Street expectations to $760-775 million (+34% Y/Y at the midpoint). While some might argue against the sustainability of current demand trends, I believe tailwinds will persist for the foreseeable future, as the pandemic drives shifts in career opportunities and increases the adoption of distance learning. Recent additions to its boot camp and short course offerings should also help sustain double-digit segment revenue growth. Furthermore, 2U's short course business allows the company to be nimble with its investments, in-line with changes in demand patterns.

While I do anticipate some deceleration beyond FQ3, I see it less as a function of demand-side challenges and more due to the need for 2U to balance growth with profitability. In FQ3, for instance, 2U opted to be more selective with its new program launches - a trend I expect to persist going forward. The current full-year guidance implies FQ4 top-line growth of 28% Y/Y (moderating from the 30.7% Y/Y growth in FQ3), with adj. EBITDA margins rising to c. 7%. With management also indicating EBITDA margins should remain positive going forward, I see FCF on track to turn positive by fiscal 2022.

Undergraduate Degree Adds to the Growth Potential

One of the key concerns around 2U remains its pace of new institutions added - 2U's total number of partners remains at 75+, paling in comparison to the number of universities in the US. However, I believe this reflects 2U's more measured approach to pursuing profitable growth rather than an indication of a slowing top-line ahead. It also highlights the massive addressable market (TAM) available to tap into.

Furthermore, the expansion into undergraduate offerings stands to widen the existing TAM - for instance, the company has deployed its online undergraduate degree offerings over the spring at Simmons University (in addition to online graduate degree programs). Additional commentary on the undergraduate degree endeavor also includes the announcement of additional London School of Economics and Political Science (LSE) degrees. I view the latest moves as a positive indication of undergraduate demand, with the much larger TAM afforded by undergraduate TAM likely to add to the future longer-term growth potential.

Growth Outlook Justifies the Price Tag

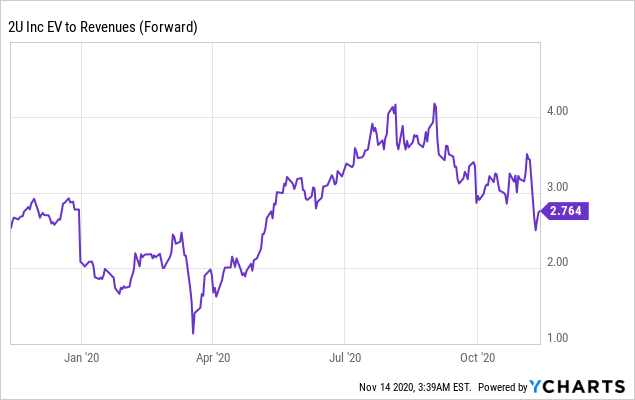

Overall, 2U remains a leading EdTech play on the higher education space and stands to benefit from the COVID-19-led shift toward online learning. With 2U already adj EBITDA positive and positioned to hit FCF break even in the near term, I think the upside potential remains intact. Admittedly, 2U is not cheap, but relative to the significant addressable market opportunity and continued bottom-line improvements, I remain positive on 2U shares.

Data by YCharts

Data by YCharts

My price target stands at $41 based on the following assumptions - a weighted average cost of capital (WACC) of 10.8% and a beta of 1.7 to reflect elevated near-term volatility in the shares. Meanwhile, the WACC reflects both a higher cost of equity (to account for execution risks) and the latest debt/equity mix. As the company will not generate material EBITDA or earnings through 2021 (by my estimates), I believe a DCF is the most appropriate way to value the shares.

Valuation | |

Sum of PV of unlevered FCF | 386,979 |

PV of residual value | 2,240,361 |

Equity value (net of debt level) | 2,826,056 |

Diluted shares outstanding | 69,128 |

Equity value per share | $41 |

Source: Company Data, Own Estimates

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.