Profound Medical's TULSA-PRO: Potential For Remedial Breakthrough In Complex Segment

Profound Medical has unique differentiators via their TULSA-PRO procedure that provide a breakthrough in an otherwise complex treatment domain.

The company has faced headwinds from COVID-19 this year, but key collaborations with RadNet adds torque to the TULSA-PRO flywheel.

Shares have seen +105% upside in the single-year period to date, and the market is rewarding the company with every update to efficacy and safety outcomes.

The complete story may be under-reflected in market price, and with a modest quarter from a research perspective, there is further upside likely.

We see a fair value of ~$22.50 on today's trading.

Investment Thesis

We believe that the cumulative data for Profound Medical's (NASDAQ:PROF) hero procedure TULSA-PRO evidences its adoption and integration across a breadth of urinary and prostatic cancer divisions. There are key differentiators in PROF's clinical data that point to a potential remedial breakthrough in an otherwise complex treatment domain. We believe that TULSA-PRO can capture additional market share in benign prostatic hypertrophy ("BPH") and prostate cancer ("PC") markets, plus other prostatic diseases ("PD") related to these conditions. We believe this market segment remains underexploited, and PROF's technology has the potential to disrupt the current leaderboard in the space, where key collaborations are likely to increase the torque in the TULSA-PRO flywheel.

Data Source: Author's Bloomberg Terminal

Shareholders have realised +105% in upside over the single-year period to date, and whilst it is still early days for PROF, management remain committed to driving early adoption of the TULSA-PRO ("TP") procedure, boosting manufacturing capacity and players in the field over the recent periods. With a range of safety and efficacy data beginning to stockpile for the procedure, we believe that the company's US market strategy has a high probability of eventuating over the coming years, at least to some degree. Thus, we are bullish on the long-term outlook of the company, and below, we highlight some of the factors investors must consider into their own reasoning.

Catalysts For Long-Term Price Change

Management reported sound clinical data for TP, from the 3rd quarter. The data was quite modest in an absolute sense, but the evidence from the TACT pivotal trial shows the commercial potential of TP, as a minimally invasive procedure for ultrasound-based suspect tissue ablation. The pivotal trial was published in the Journal of the American Urological Society, and also showed a favourable risk/safety profile with minimal impact on quality of life, plus a low rate of residual PD. Again, on TP, the 3-year follow data from the phase 1 precision and safety study showed robust efficacy and safety data, with additional colour on functional outcomes and predictability of follow-ups, based on early imaging and PSA. Encouragingly, from years 1 to 3 in the study, there were no new serious adverse events recorded, and any mild events were ubiquitous with no change in urinary, bowel or sexual function. Management are confident based on this data that the results at the end of year 1 from ablative treatment in PC or PD seem to be a good indicator for 3-year results from the same.

Then, there was the data for the prospective TP study for the procedure in BPH patients. We saw encouraging results in urinary function improvements, alongside no adverse sexual or bowel function reactions. Additional positive data was seen on peak flow rates in urinary function, which showed an increase from 11.5mL to 26.8mL a second. Still early days for PROF here, but again, showing the breadth of potential application for TP in the wider PD/PC segment. Notwithstanding the complications of incontinence and urinary function following PC and PD treatment or surgery. We view high patient and clinician preference, should the data continue along this trajectory. PROF is now looking to enroll an additional 40 patients in the study's progression. Additionally, TP has been investigated in Finland, for severe urinary retention and intractable haematuria in patients suffering from advanced and symptomatic PC. The main outcome that seemed positive for the sample was improved catheterisation, as 70% of the sample were catheter-free after 1-year, and 100% were free of blood-urine after this period also. These signal incredible results in an otherwise complex treatment area.

Financials & Outlook

From the Q3 exit, PROF recognised revenues of ~$3 million, which was a substantial ~330% YoY increase on the top. Expenses did increase by $1.3 million, particularly on the back of R&D expenditure and technology upgrades, alongside staff compensation increases. The company realised a net loss of ~$8 million, compared to a loss of just over $6 million in Q3 the year prior. PROF is better positioned now to drive the US market strategy, which will dovetail via 3 main skews. Firstly, through urologist accounts who are specialising in more advanced and arguably superior treatment alternatives in PD and PC. Then, there is the collaboration with US radiology behemoth RadNet, alongside other independent imaging entities. We firmly believe that the RadNet collaboration is a key strategic manoeuvre for TP's US market entry. PROF has indicated that RadNet is still on track to treat their first patient, in spite of COVID-19-related delays.

Demand has already increased in cadence since the agreement began in January, and delivery of TP systems to their network should continue to roll out over the next few months. Delays were always expected, considering pandemic-related deferrals in key segments across the board, in all major medical outlets. However, this collaboration adds significant torque to the US flywheel and will likely include integration of the TP system into RadNet's entire 335 imaging centres across the US. RadNet also has the required "bolt-on" technology that will be required to run the TP, via ultrasound energy and 3T MR imaging capacity. Management have pulled guidance on the TP's shipping numbers, although had placed an aggressive figure of ~25 units to be sold over the course of 2020. However, as the pandemic will begin to settle, the headwinds there will blow over, and cadence in TP placements will likely continue to expand well into 2021 and beyond.

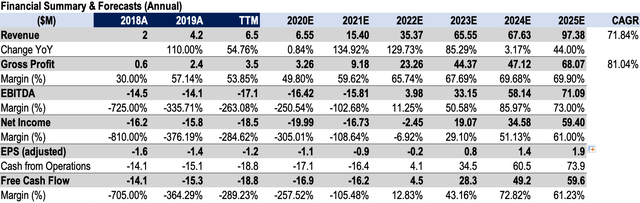

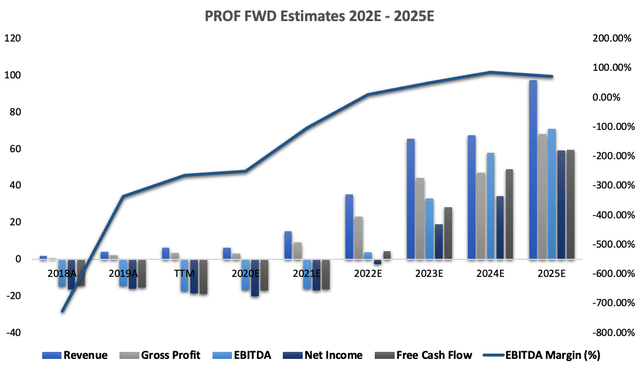

We see high sequential growth of CAGR ~72% in top-line earnings over the coming 5-year period, with peak sales volume of ~$98 million by 2025. Free cash will likely expand nicely over this period, especially as the cadence of TP placements increases via early adoption and the RadNet collaboration.

Data Source: PROF SEC Filings; Author's Calculations

Data Source: PROF SEC Filings; Author's Calculations

Non-Dilutive Capital Is Unlikely

Management claimed cash of ~$110 million at the end of September. However, the balance sheet shows a total of cash & equivalents of only ~$83 million. Back in January, they completed an equity raise of $40 million, alongside a $46 million equity raise back in July at $14.50. Proceeds for both raises were put immediately to use, in commercial manufacturing and additional commercialisation efforts for TP, to launch throughout the US and globally. Management are confident the runaway on the cash figure will continue for over 2 years, but they have said that in the past, and still completed 2 equity offerings this year. Working capital seems sufficient, but inventory-to-cash days remain at almost 2 years, exacerbated without the run rate in TP placements. Lenders are unlikely to engage in non-equity financing structures, especially considering the un-actioned US market strategy, alongside the lack of key clients outside of RadNet, who have delayed placements from the pandemic anyways.

Thus, further financing is likely to remain dilutive in nature, and equity offerings are likely once entering the US successfully in our view. We can see evidence of the capital structure at work, as common equity to assets is ~95%, whilst total debt to equity is only ~1.8x. Thus, equity holders have bared the finance risks for the company to date.

Valuation

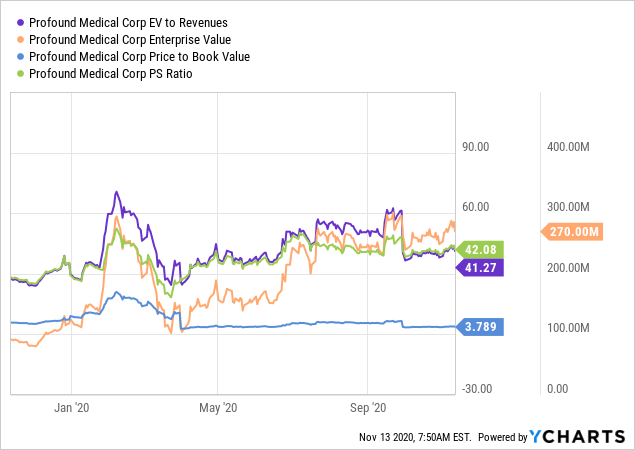

We're not game on estimating TP placements over the coming periods at this point. Management have provided little colour here from the Q3 earnings call and have only hinted at TP placements at 6 sites (well off the 25 forecasted earlier in the year). We don't feel its warranted to place emphasis on a DCF methodology without more certainty on the commercial potential and market size that PROF can capture in this segment. In other words, the quantitative aspect needs more beef to justify a valuation. Shares are trading at ~3.8x book value, and at almost 41x top-line earnings. Obviously, FCF yield is on the lower end at -7.4%, which will need to improve as more TP placements roll out. The company has a diluted market cap of $338 million, ~$83 million in cash on the balance sheet plus $1.7 million in debt. Therefore, we value PROF on an enterprise level at ~$257 million. There is around $13.45 in EV per share, on that basis, $4.33 in cash per share, plus $4.77 in book value per share. We could also say just over $0.20 in sales per share, but this is not meaningful. However, using a sum of the parts ("SOTP") methodology, we see a fair value of $22.55, ~25% upside on today's trading. Thus, we see the one-year expected return of around 15%-25%, considering a probability range of 60% to 100%. With negative earnings modelled from our analysis, we don't see a price target from multiples relevant at this stage.

Data by YCharts

Data by YCharts

Investors must realise that performing a limited range of valuation measures increases the standard error in the calculation potential. In other words, without a robust list of valuation that are largely correlated to each other, and to the underlying price, there is a greater chance that the valuation may be incorrect. This is why we prefer to perform a large valuation set in the first place. However, considering the challenges in forecasting and modelling DCF outcomes with PROF, plus the lack of profitability and uncertainty over the fair value of their assets, we must rely on the SOTP framework to give the most accurate measures at this point. This includes EV and other multiples, as well.

Further Considerations

On the charts, shares have trended in a wide ascending channel since the selloff in March. There has been a clear level of support defined, which has been tested 5 times over this period. Shares did break away in June, forming the upper resistance level; however, retraced gains back to the support level by September. Since then, standard deviation of price outcomes has been closely wrapped around the average return. Therefore, the strength and direction of the nearer-term trend seems validated at this point. We can see evidence of this pricing activity YTD on the charts below.

Data Source: Author's Bloomberg Terminal

Dissecting the charts further, we can see an ascending triangle setup forming, where the mouth of the ascending wedge is narrowing. The upward pressure from the support level is driving shares to the resistance line, and we believe that shares will crack resistance over the next month or so, should this trend continue. The flat upper trend line shown on the chart below indicates this resistance level, and we can see the effect of the upward pressure from support, clearly driving the return focus into the resistance bar. Therefore, considering these points, we firmly believe that the current investor sentiment is bullish, in line with our thesis. We believe longer-term investors would benefit from observing the below chart, to gain insight into entry in light of the upcoming inflection points that we foresee over the coming periods. We can see evidence of the market support on the chart below.

Data Source: Author's Bloomberg Terminal

Shares have a decent level of factor exposure to momentum and RSI ranges, as we can see on the chart below. Shares have held within healthy RSI ranges, albeit were we saw on autocorrelation with RSI > 70 and price retracements back in July. Similarly, momentum has been highly autocorrelated with share pricing outcomes, indicating this factor exposure. We believe that investors should keep a close eye on momentum and PROF shares, in particular, watching for any upticks in the momentum factor. Those holding PROF in portfolios, depending on the strategy, may tilt exposure to momentum for PROF, should this occur. We believe that investors would benefit from the upside in price outcomes based on this strategy, as we often do. Considering we hold a beta-neutral stance in our portfolio strategy, investors may want to hedge systematic risks and wider market exposure, by holding beta negative alternatives within the same asset class. We can see evidence of this factor exposure on the chart below.

Data Source: Author's Bloomberg Terminal

In Short

PROF is in the early stages of a growth that seems contingent on its US market entry landing successfully. We believe that there is commercial potential for the TULSA-PRO procedure, backed by a decent level of quality evidence in an otherwise complex domain in respect to patient outcomes. Men's health has received a high degree of attention over the years, with urologists and other specialists in the space, changing the paradigm heavily to focus on patient-centred outcomes. Considering the complex issues such as incontinence, peak urinary flow, haematuria, bowel function, sexual function, and a breadth of other complications with prostatic disease, then the TULSA-PRO system has a high potential to create a remedial breakthrough in this segment. COVID-19 has been a large headwind this year. However, the company has managed to maintain its ties to US radiology giant RadNet, who should increase the cadence of TULSA-PRO placements over the coming few years. In this vein, alongside the market strategy that will see placements dovetail across the US, we believe that the commercial potential is high, and that this will be reflected in PROF shares over the coming periods. Based on a SOTP methodology in valuation, which we believe is most appropriate at this stage, we see an upside of ~25% on today's trading. However, we prefer to perform a range of valuation measures, so investors must consider that one valuation method alone, increases the standard error potential within the entire scope of calculations. Nonetheless, we are bullish on the long-term outlook of the company, and foresee further upside over the coming periods. We look forward to providing additional coverage.

Disclosure: I am/we are long PROF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.