VEU: Tide Shifting In Favor Of International Stocks

The combination of dollar weakness, much more attractive valuations, and expectations of a recovery in revenues should see international stocks recover relative to the U.S.

Positive announcements on the vaccine front have provided the trigger for recent international equity outperformance.

The VEU tracks the FTSE All World Ex-U.S. and represents a low-cost option for investors looking to diversify out of U.S. stocks into other developed markets.

Over the past few months we have been positioning for a turnaround in the performance of international stocks relative to the U.S., owing to a combination of dollar weakness, an extreme valuation divergence, and expectations of a recovery in revenues. Positive news on the vaccine front has allowed the Vanguard FTSE All-World ex-U.S. ETF (VEU) to outperform and we expect more to come.

VEU: A Diversified Alternative To The U.S.

The VEU tracks the FTSE All World Ex-U.S. and represents a low-cost option for investors looking to diversify out of U.S. stocks into other developed markets. The index is highly diversified both geographically and by sector, with Financials, the largest sector, making up just 17% of market capitalization and Japan, the largest country weight, also making up 17% of the index.

International equities not only trade relatively depressed on most fundamental metrics, this is occurring at a time when the fundamentals themselves are relatively depressed in the first place. This is a follow-up article to one we posted in early August (see 'Weak Dollar A Precursor To U.S. Equity Reversal'). Since then we have started to see a reversal take place and we expect more to come over the coming months.

Dollar Weakness Should Be A Tailwind For International Stocks

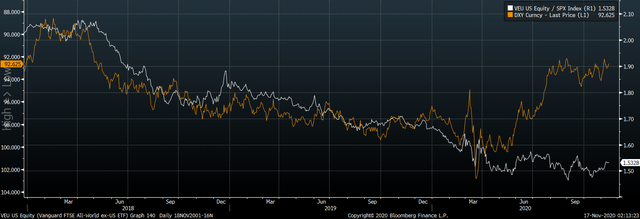

Strength in international currencies has typically been associated with outperformance in international stocks relative to the U.S. As the chart below shows, despite the ongoing weakness in the DXY, the VEU is yet to materially outperform. The strong historical correlation makes intuitive sense as both the DXY and stocks are driven by expectations of relative growth rates between the U.S. and the rest of the world to some degree. After having been bearish on the U.S. dollar since April, its decline likely has further to go. Even if we do not see any further dollar declines, we should expect the weakness we have already seen to translate into VEU outperformance going forward.

Ratio Of International Stocks To U.S. Stocks Vs. DXY (Inverted)

Source: Bloomberg

Reliable Valuation Metrics Suggest VEU Is Relatively Cheap

Depending on the valuation metrics used, the VEU ranges from around 30% more expensive than the SPX (using the price-to-earnings ratio) to almost 50% cheaper (using the price-to-sales ratio). We believe the price-to-sales ratio is likely to prove a far better gauge of long-term valuations than earnings, given the extent to which international equity earnings have been hit by the Covid pandemic. This follows from the tendency for profit margins to mean revert over the long term. The current profit margin of the VEU is just 3.5% compared to 9.5% for the SPX as declines in revenues have fully wiped out earnings for a large number of sectors and countries. Such extreme divergences in profit margins are unlikely to remain in place over the long term.

International Revenue Growth Should Outperform

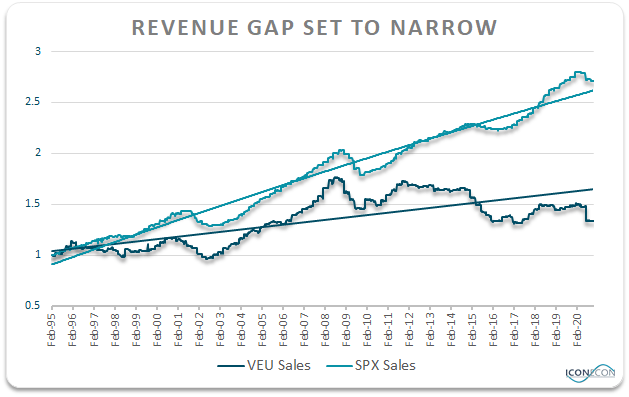

The trailing price-to-sales ratio may even underestimate the extent to which international stocks are undervalued relative to the U.S. as international sales themselves have been much harder hit over the past year and should recover more rapidly as the global economy recovers. The following chart shows revenue per share for the VEU and SPX rebased to 1 in 1995. While structural underperformance of international revenues may very well remain intact over the long term, the extreme moves relative to trend suggest strong cyclical outperformance in international revenues.

Revenue Per Share

Source: Bloomberg

Paying Too Much For Glamour Stocks

Over recent months of talking up international stocks as an alternative to the U.S. we have noticed that many market participants dismiss the idea of international equity outperformance on the basis that U.S. companies are simply better. While this may well be the case, history shows that it does not matter much. History has shown that when retail investors chase household names and glamour stocks as they have done over recent months, it is often a sign that these stocks have already performed so well that future underperformance is likely. We noted in September in 'FTSE Vs. NDX: Huge Value/Growth Reversal Ahead' that Apple (NASDAQ:AAPL) was valued at more than the entire FTSE 100 companies despite revenues being just one eighth of the size. We have already seen an 18% decline since then and we expect the reversal to gather steam.

Disclosure: I am/we are long VEU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Over the past few months we have been positioning for a turnaround in the performance of international stocks relative to the U.S., owing to a combination of dollar weakness, extreme valuation divergence, and expectations of a recovery in revenues.