Kite Realty Is Emerging As A Premier Shopping Center REIT

KRG reported 92% rent collection - outpacing the industry.

KRG maintains a conservatively leveraged balance sheet with ample liquidity.

Shares don’t trade as cheaply as some peers, but the disconnect is justified on account of KRG’s quicker recovery.

I rate shares a buy with over 30% total return upside.

Kite Realty Group (KRG) has stunned Wall Street with results that easily pace the shopping center REIT sector. Third-quarter rent collection of 92% made KRG look more like a net-lease REIT than a shopping center REIT. Even accounting for the negative financial impact from COVID-19, KRG maintains a conservatively leveraged balance sheet. I rate shares a buy.

Flying Like A Kite

Among all the companies that I cover in the shopping center REIT universe, KRG’s third-quarter results appeared to be the strongest. KRG improved upon the 80% of rent collected in the second quarter with a 92% rent collection rate in the third quarter:

One potential contributor to the strong rent collection was the high 92% economic occupancy rate and the fact that 97% of the portfolio was open and operating (95% seems to be the average for peers).

The strong rent collection led KRG to report same-store net operating income (‘SS NOI’) declines of only 6.9%, with FFO declining by 23% to $0.30 per share. Shopping center REIT peers reported double-digit SS NOI declines across the board - KRG’s results set the high bar. KRG recorded $3.6 billion of reserve for uncollectible rent, approximately 6% of billed rents.

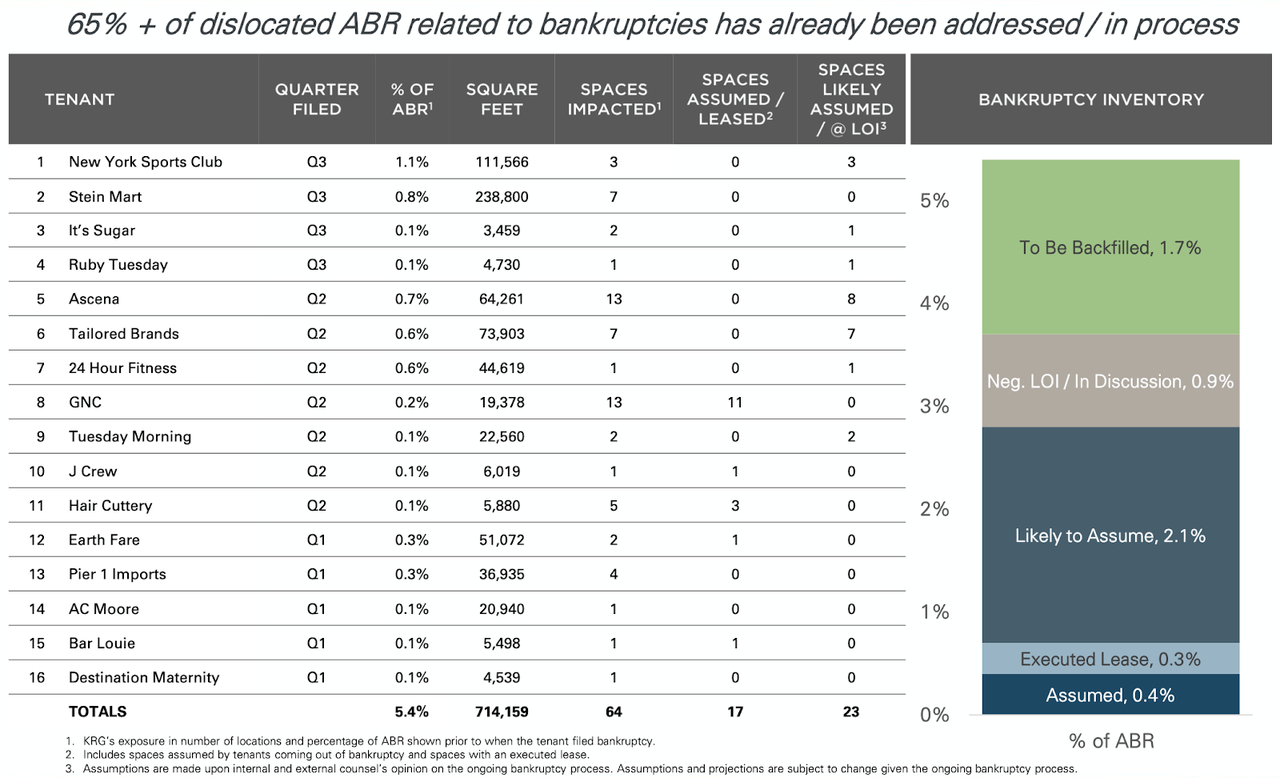

KRG has been quick to address COVID bankruptcies, having already addressed 65% of dislocated average base rent related to bankruptcies:

Finally, KRG generated surprisingly healthy leasing spreads of 2.3% on new leases and 7.6% on renewal leases. If you had asked me in April which shopping center REIT would recover fastest from the pandemic, KRG would not have been my first choice, but it has performed strongly this year and I expect Wall Street to take notice.

Balance Sheet Analysis

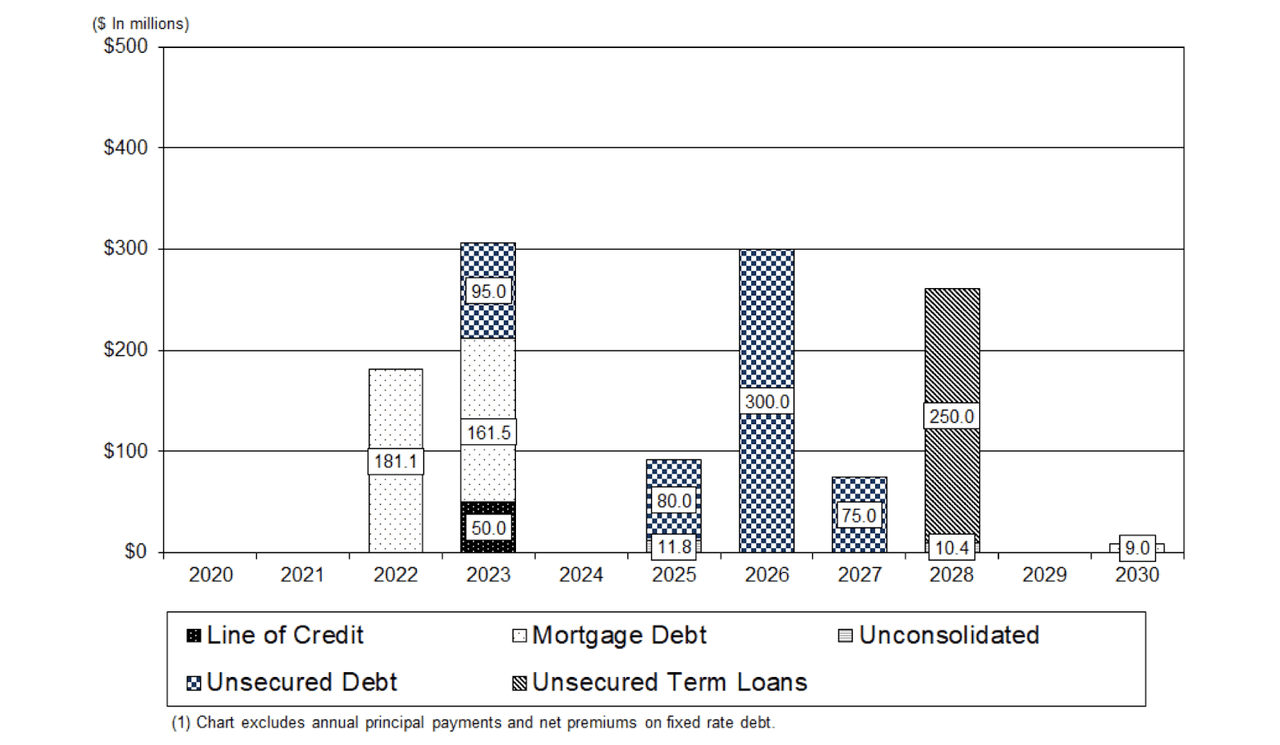

KRG maintains a solid balance sheet rated BBB- or equivalent by the credit rating issuers. KRG has no debt maturities until 2022 and maintains a strong liquidity profile of $577 million.

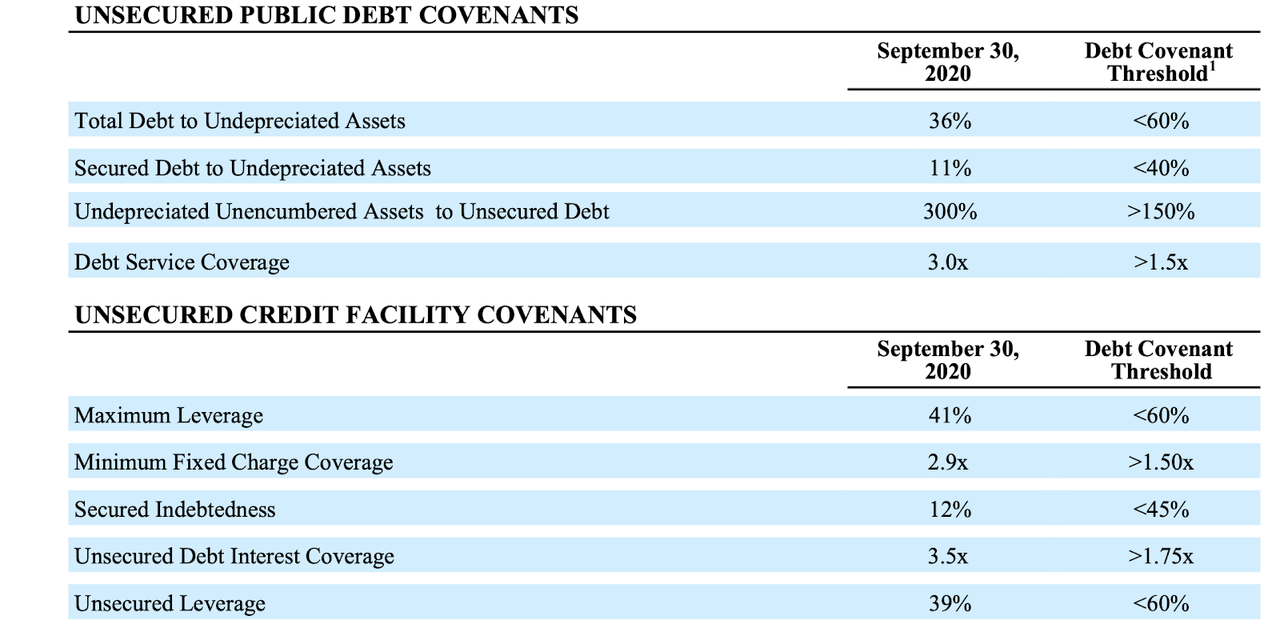

Based on the current quarter annualized, KRG has a debt to EBITDA ratio of 6.9 times. While that multiple is high compared to historic standards, it is reasonable considering the bloodbath that shopping center REITs have been subject to this year. Most critically, we can see below that KRG is in no danger of violating any of its unsecured debt covenants:

KRG’s strong balance sheet is a critical source of safety in the event that the pandemic worsens moving forward.

Valuation and Price Target

Based on the current quarter FFO of $0.30 per share, KRG trades at only 11.4 times FFO. KRG has slashed its quarterly dividend from $0.3175 previously to $0.052 as of the latest quarter. I expect the dividend to recover significantly by next year, in order to match taxable income. My 12-month fair value estimate is $18, representing 13.3 times FFO. While that price is essentially what it traded for prior to the pandemic, I note that KRG was trading at a deep-value multiple heading into 2020, in spite of having transformed its portfolio and right-sized its balance sheet over the past several years. KRG’s strong performance in 2020 further strengthens its case to trade closer with the top tier shopping center REIT peers moving forward.

Risks

There may be more bankruptcies on the horizon. While rent collection and operational levels have improved dramatically, there is no guarantee that there aren’t more bankruptcies to come. While KRG’s balance sheet is well-positioned to weather any storms, the stock price is unlikely to experience multiple expansion until results stabilize.

There is no guarantee that KRG can collect deferred rent. Investors should not consider deferred rent as paid until the cash is in the bank. Because KRG’s rent reserves are less than uncollected rent, KRG may need to report further write-offs in future quarters if past deferred rent proves uncollectible.

It is unclear if the country is close to a stable recovery from the pandemic. If the localities in which KRG operates decide that further lockdowns are needed, then KRG may once again experience difficulties collecting rent, reversing the progress made over the past several months. KRG should be considered an investment hinging on recovery from the pandemic.

Conclusion

KRG has surprisingly outpaced the pack with rent collection rates that of rival net-lease REITs. I expect the market to reward KRG with a higher multiple following the pandemic, one that better represents the progress KRG has made with regards to its portfolio transformation and reduction in balance sheet leverage. I rate shares a buy with over 30% total return upside.

Discover More High Conviction Ideas

Shopping center REITs are only one of my top high conviction ideas. Subscribers to Best of Breed to get access to my top high conviction ideas and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, broad market coverage, and high conviction picks.

Elevate your investments with Best of Breed.

Become a Best of Breed Investor Today!

Disclosure: I am/we are long KRG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.