Flagstar Bancorp: Low LTV Ratios Make This Bank And Mortgage Originator Interesting

Flagstar Bancorp is firing on all cylinders this year and the mortgage originator has sold more than 50% more loans than last year.

This boosted the EPS tremendously, but readers are cautioned to not take this for granted.

Upon studying the quality of the loan book, the low LTV ratios of both the residential and CRE mortgages are actually interesting.

Introduction

At first glance, I wasn’t too impressed with Flagstar Bancorp (FBC), as less than 15% of its loan book consists of residential loans. However, upon having a closer look, the low LTV ratio of the mortgage loans (including commercial real estate mortgages) and the lower than perceived risk on the ‘warehouse lending’ portfolio make the bank more interesting than I thought.

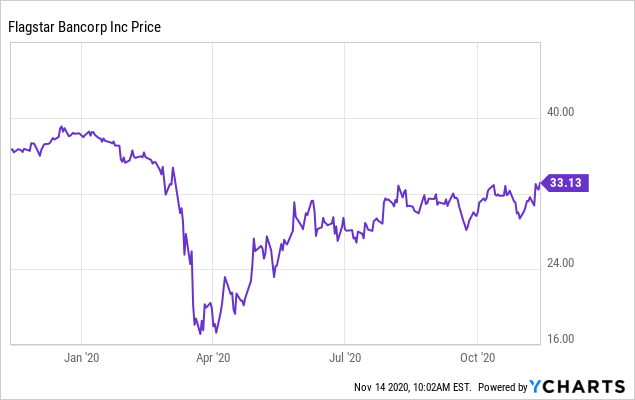

Data by YCharts

Data by YCharts

An expanded balance sheet results in increased net interest income

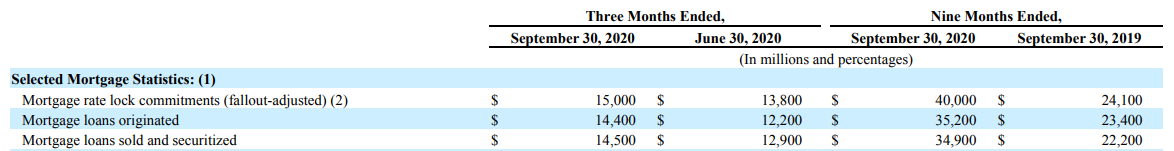

As the 6th largest mortgage originator in the country, Flagstar Bancorp generates a substantial portion of its annual income through the sale of loans. During the third quarter, the bank originated about $14.4B of loans and sold and securitized $14.5B of loans. In the first nine months of this year, the total of almost $35B in sold and securitized loans is roughly 50% higher than in the first nine months of last year.

Source: financial statements

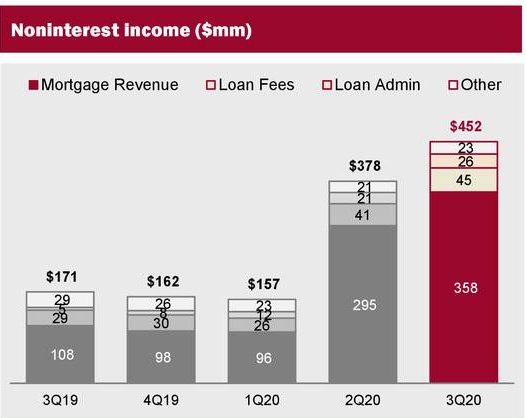

During the third quarter, Flagstar recorded a non-interest income of $358M (and a net gain of $346M) from the sale of loans due to a higher margin on the loan sales.

Source: company presentation

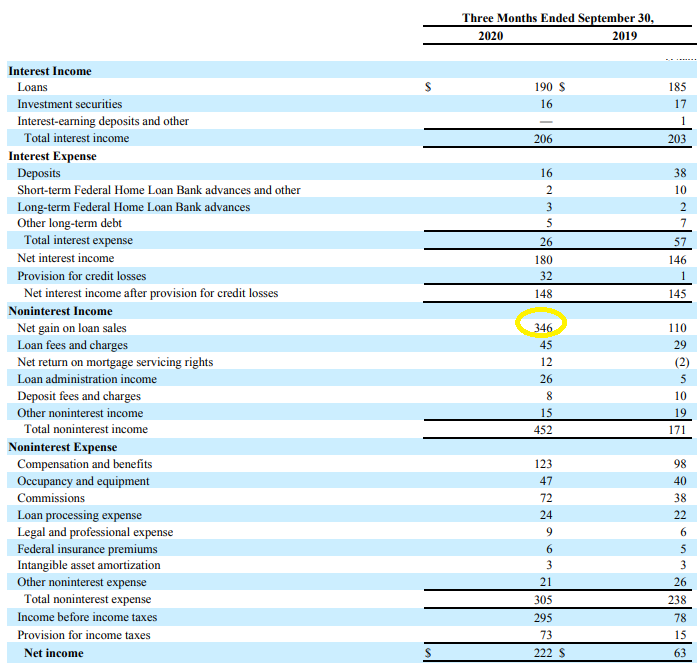

The importance of the loan sales is pretty clear upon reviewing the income statement of Flagstar. Although the bank saw its net interest income increase by more than 20% in the third quarter (to $180M, up from $146M in Q3 2019 thanks to a combination of a slightly higher interest income and a lower interest expense), the $180M in net interest income is being dwarfed by the $346M net gain on the sale of loans:

Source: SEC filings

The $222M net income results in an EPS of $3.90, but as you can imagine, we cannot reasonably expect the gains from loan sales to continue at the current elevated level. But as long as they do, Flagstar will continue to report outsized EPS results. And the strong net income in combination with a low dividend helps the tangible book value to increase tremendously. In just one year (from September 2019 to September 2020), the tangible book value per share increased from $28.57 to $35.60 thanks to the retained earnings and despite a 1% increase in the share count.

A closer look at the loan book

Flagstar Bancorp provides a breakdown of its assets which are nicely divided into subcategories with accompanying details on the interest income generated and the annualized yield. It also provides an average balance of the different positions in the loan book:

Source: SEC filings

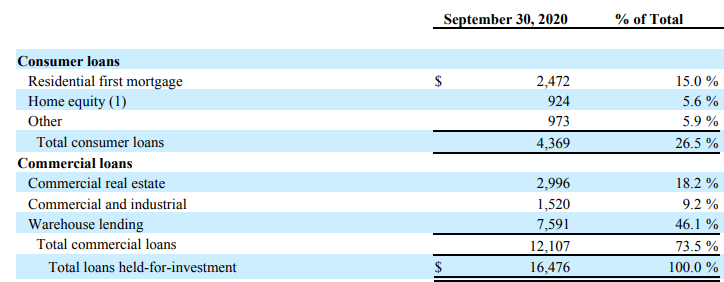

If we exclude the $5.5B in loans held for sale from the loan book and solely focus on the loans held for investment ($14.8B), we see some interesting details in the $16.5B portfolio. Residential mortgages account for just over 20% of the loans held for investment (but as you saw in the image above, the weight of residential loans in the total loan book is less than 15%).

Source: SEC filings

Source: SEC filings

Perhaps a word about warehouse lending. Although this technically is mentioned as a commercial lending operation, the underlying ‘product’ are residential mortgages. Or as Flagstar explains it:

"We offer warehouse lines of credit to other mortgage lenders which allow the lender to fund the closing of residential mortgage loans. Each extension, advance, or draw-down on the line is fully collateralized by residential mortgage loans and is paid off when the lender sells the loan to an outside investor or, in some instances, to the Bank."

So, although these loans are classified as a commercial loan, the underlying collateral consists of mortgages on residential assets and are thus perceived to be less risky. This means that of the $16.5B in the loans held as an investment, the weight of the residential-related loans actually approaches 2/3rd of the loan book. And this makes the difference for me between discarding Flagstar Bancorp and keeping it on my watch list.

No LTV ratios were shared for the warehouse lending division, but considering the other mortgages on the balance sheet are strong (residential: 52% LTV, 738 FICO, home equity: 54% LTV and 746 FICO, commercial real estate: 53% LTV), I would expect the LTV ratio of the underlying mortgages to not be extraordinarily high either.

Investment thesis

Flagstar Bancorp doesn’t have a high dividend yield, and truth be told, the share price evolution in the past 3-4 years wasn’t great either. But it looks like Flagstar’s share price was running a bit ahead of itself as the bank was trading at a double-digit PE.

Nothing wrong with that, but it also means we will likely get back to the same multiples. Unfortunately, the non-recurring gains are boosting this year’s EPS, but even based on the 2019 EPS, Flagstar Bancorp doesn’t appear to be expensive.

I currently have no position in Flagstar Bancorp, but the bank has been added to my watchlist.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.