GDS Holdings: Benefiting From The Acceleration Of Digitization In China

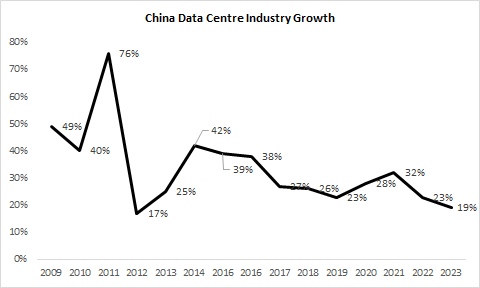

Data centre demand is expected to grow at a CAGR of 26% between 2019 to 2023.

GDS Holdings is expected to benefit from the industry tailwind due to its partnership with China's internet companies amidst tighter regulation.

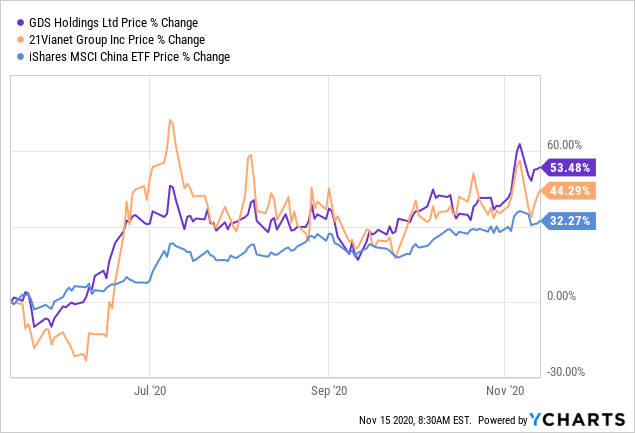

We expect an upside of 22% in the company's share price should GDS meet market's expectations for FY2020.

Introduction

Overall data centre demand has been surging in China and the industry is expected to grow at a CAGR of 26% between 2019 to 2023 due to: (1) accelerating industry demand amidst a potential supply constrain in tier-1 cities and (2) improving profitability due to a focus in the wholesale segment. GDS is currently trading at CNY 113,522M and we expect an upside of 22% should GDS meet market's expectations for FY2020.

Accelerating Industry Demand

Currently, there are three major trends in the data centre space in China. Firstly, 5G is driving revenue growth acceleration for companies such as 21 Vianet (VNET) and GDS Holdings (GDS). The launch of 5G in China is highly likely to spur increased demand for computing power, consequently, creating a large demand for data centres. Between 2009 to 2012, there was a similar data centre revenue acceleration in China. As such, the data centre industry's topline is expected to grow at a CAGR of 26% between 2019 to 2023E.

Source: Goldman Sachs and Company Filings

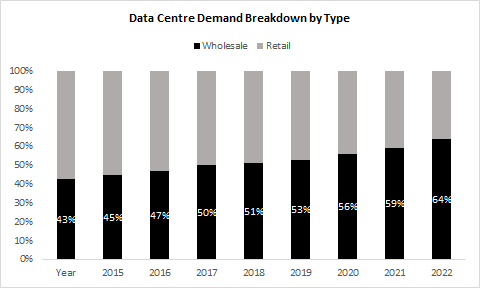

Secondly, there is an increasing cloud adoption that is further supporting the growth in the wholesale data centre segment. Enterprises are currently moving their IT premises onto the cloud, supporting the expansion of cloud infrastructure. Overall, this trend will favour the wholesale data centre segment, where the main customers are cloud service providers and major internet companies. Therefore, the wholesale segment is expected to account for 64% of the total demand by 2023E as compared to only 51% in 2019.

Source: Goldman Sachs and Company Filings

Finally, governments are restricting land resources for data centres in China; this is exceptionally blatant in China's tier-1 cities. The supply in these cities is constrained as the government are adopting stringent policy restrictions. Therefore, demand is flowing to other adjacent cities such as Kunshan in Jiangsu Province (~ 77km from Shanghai) and Langfan in Hebei (~ 55km from Beijing).

GDS as an Industry Leader

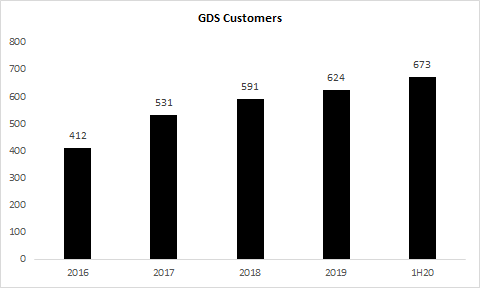

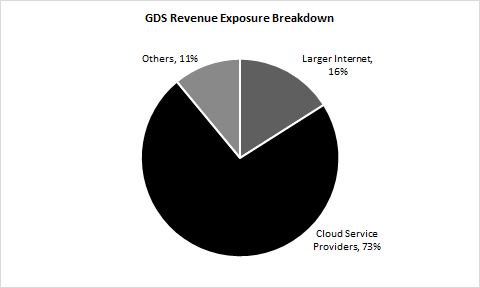

There are three major factors that differentiate GDS as an industry leader as compared to other players, allowing GDS to outperform in the long run. Firstly, GDS has forged long-term partnerships with all the right customers in China. As of today, GDS has a total of 673 customers. More importantly, the company has established partnerships with all of the leading cloud service providers such as Alibaba, Tencent PinDuoDuo, ByteDance, and Kingsoft. As compared to other players such as 21 Vianet and Sinnet, GDS has the highest revenue exposure from cloud service providers and leading internet companies. For example, GDS has 72.6% and 16.2% revenue exposure from cloud service providers and leading internet companies respectively. 21 Vianet / Sinnet only have about 70% / 45% of revenue exposure from cloud/internet companies.

Source: Goldman Sachs and Company Filings

Source: Goldman Sachs and Company Filings

Secondly, GDS has a major presence in all of the critical data centre markets in the Tier 1 cities such as Beijing, Shanghai, Shenzhen, and Guangzhou. Currently, GDS has about 266k sqm area; 76% of the capacity are located in tier-1 cities and another 11.1% is in tier-1 adjacent cities. As supply remains constrained in tier-1 cities, we see a high likelihood that GDS will benefit from all of strict policies employed by the Chinese government in tier-1 cities.

Source: Goldman Sachs and Company Filings

Finally, GDS has a strong pipeline over the next two years. The company is currently intending to push out 70k / 76.5k / 7k sqm in 2020E / 2021E / 2022E with a pre-commitment rate of 62%. 51% of the sqm will be located in tier 1 cities whereas the remaining 49% will be in tier-1 adjacent cities such as Langfang, Kunshan, and Changshu. Currently, GDS has the most aggressive expansion pipeline, with almost 40k cabinets per year.

Improving Profitability & Returns

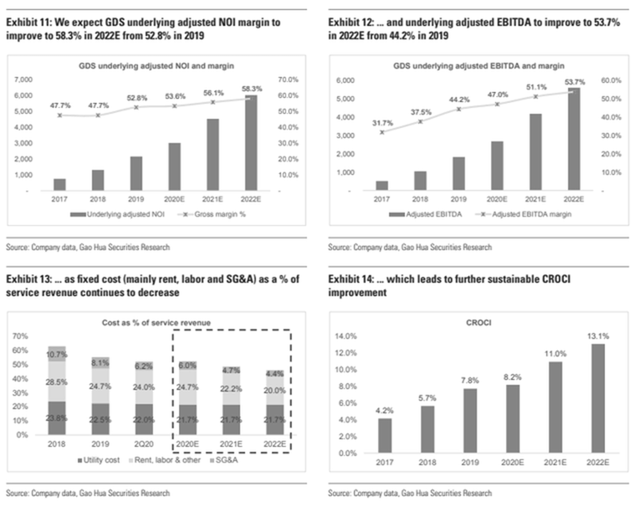

GDS profitability metrics have been improving mainly due to higher utilization rate and operating leverage as the company focuses in the wholesale segment. Moving forward, we can expect the wholesale segment to increase from 53% in 2019 to 64% in 2022. As the wholesale segment revenue exposure increases, the NOI margin and EBITDA margin has increased to 53.7% / 47.2% in 2Q20 from a mere 52.8% / 44.2% in 2019. This trend is expected to sustain as the company's major fixed costs such as rent and labour and major variable cost such as utility costs remain stable. According to Goldman Sachs, it is highly likely that the adjusted EBITDA margin further increases to 53.9% in 2022E as compared to 47.8% in 2Q20 as the company continues to scale the wholesale segment.

Source: Goldman Sachs and Company Filings

Key Risks

Currently, there are three major risks for GDS: (1) Customer Concentration Risk, (2) Utilization & Pricing Risk, and (3) Financing Risk. Firstly, GDS has a large revenue exposure from its larger customers. In 2019, 2 customers accounted for almost 50.7% of the company's total revenue. The withdrawal of such contracts from these large customers will affect the company's operations and financials significantly.

Secondly, there is a risk of near-term oversupply as numerous data centre players in China are expanding and adding capacity aggressively to cover the demand from Chinese enterprises. If capacity is not taken up in a timely manner, there is a potential that the company's utilization rate will reduce. The company may also have to engage in a pricing competition with its peers to attract more contracts.

Thirdly, GDS uses debt capital to fund more than 60% of its new projects. In addition, the company is expecting capital expenditure spending of RMB 7.5B, of which RMB 4.5B will be funded through debt raising. If the company fails to source sufficient capital to fund its aggressive expansion plans or refinance its current leverage, GDS may not be able to operate efficiently in the short-run.

Financial Outlook & Valuation

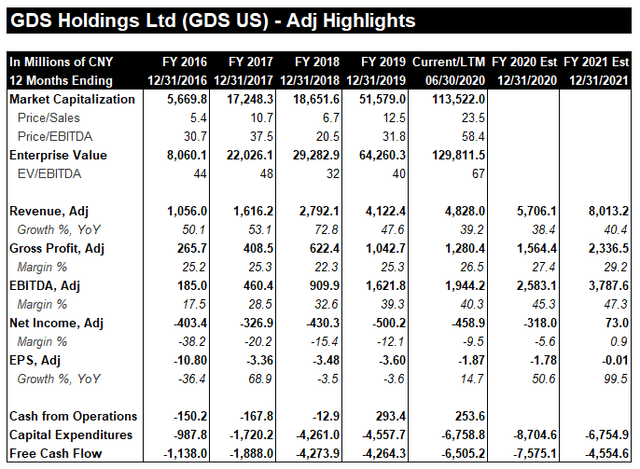

Currently, market consensus is expecting GDS to end FY2020 with topline growth of 38.4% which is higher than the industry's growth. We believe this assumption is justifiable as the operations and customer mix of GDS are much better than that of Sinnet's and 21 Vianet. The company's FY2021 revenue is expected to come in at CNY 8,013M, indicating a growth of 40.4%. More importantly, the company's profitability metrics are expected to improve over the next two years as the industry demand continues to surge. By 2021, the company is expected to achieve positive net income. It is important to note that the company has been burning FCF since 2016 and is expected to continue burning its FCF well into FY2021.

Source: Bloomberg

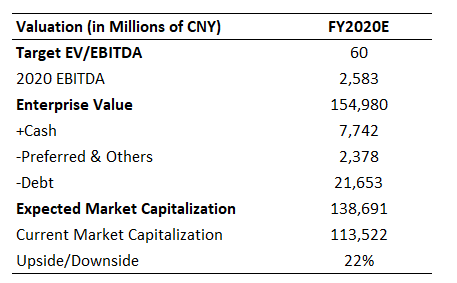

Currently, the company is trading at a market capitalization of CNY 113,522M. We expect the company's EV/EBITDA to normalize to 60x. Based on a target EV/EBITDA of 60x and an EBITDA of CNY 2,583M, the company should be valued at CNY 138,691M, indicating an upside of 22%.

Source: Bloomberg

Disclosure: I am/we are long GDS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.