Medical Properties Trust: Hospital Owner And Paradoxical Beneficiary Of COVID-19

MPW was not hurt by COVID-19 nearly as badly as the market initially thought it would be. In fact, the pandemic might actually provide further growth opportunities for the REIT.

MPW has collected 98% of contractual rent this year, and the remaining 2% was deferred with interest.

Governments have demonstrated their unwillingness to allow hospital operators to close their doors or curtail operations in the midst of a pandemic.

The dividend yield of 5.57% is well-covered by cash flows, and the payout is likely to continue growing in the years to come.

Investment Thesis

Medical Properties Trust (MPW) is an internally managed real estate investment trust formed in 2003 that owns net leased hospitals across the world. The "net leases" require the tenant to bear most or all of the property-level expenses, such as insurance, real estate taxes, and building maintenance. MPW is mostly concentrated in the United States and Europe, with a small presence in Australia and, after a recent deal, a handful of sites in Colombia.

The REIT's portfolio consists of 385 properties with a combined ~42,000 beds, leased to 46 individual operators, across 33 US states and 9 countries around the world. The vast majority of its properties also operate under master leases.

Despite MPW's stock price being down 8% year to date due to concerns around COVID-19, the REIT has actually performed phenomenally well this year. Moreover, due to the pandemic's detrimental effect on many health systems around the world, more acquisition opportunities will likely arise for the hospital owner.

And as proven by the COVID crisis, nations around the world will do whatever is necessary to keep their hospitals operational in order to provide the best care possible. As CEO Edward K. Aldag, Jr. put it on the third quarter conference call,

Hospitals are the center point of the healthcare delivery system all over the world. And civilizations will do whatever they have to, to ensure their populations have access to hospitals.

Source: Q3 Supplemental Presentation

Source: Q3 Supplemental Presentation

An Expanding Portfolio

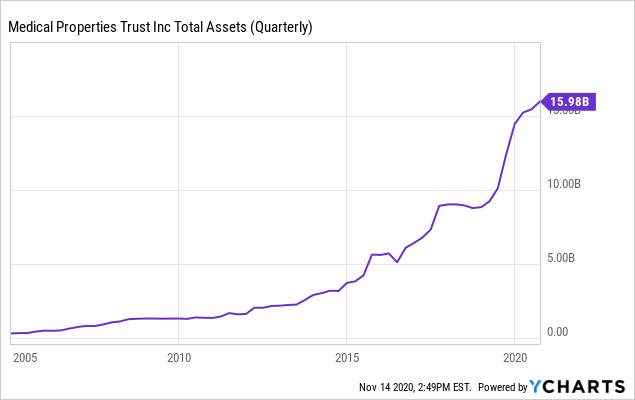

MPW's hospital portfolio has expanded rapidly in the last decade, and especially in the last five years. Just since 2015, MPW's asset base has risen by 330%, or 57.4% annually.

Data by YCharts

Data by YCharts

The above chart shows total assets, which includes items like cash, rent receivables, and other non-real estate assets. Considering only real estate investments, MPW's portfolio is worth a little more than $14 billion, up 23% from the $11.4 billion portfolio size at the end of 2019.

During the most recent quarter (Q3 2020), MPW actually sold four properties for a slight net loss of around $900,000 total. For the year as a whole, however, MPW is on track for around $3 billion in total acquisitions.

Moreover, the pipeline for 2021 also appears to be quite deep. MPW estimates the total pipeline of attractive operator-owned hospitals in its target markets at between $500-750 billion. And despite being the second largest hospital owner in the US, the American Hospital Association puts the total number of community hospitals in the US at over 5,200, giving plenty of opportunities for acquisitions in the future.

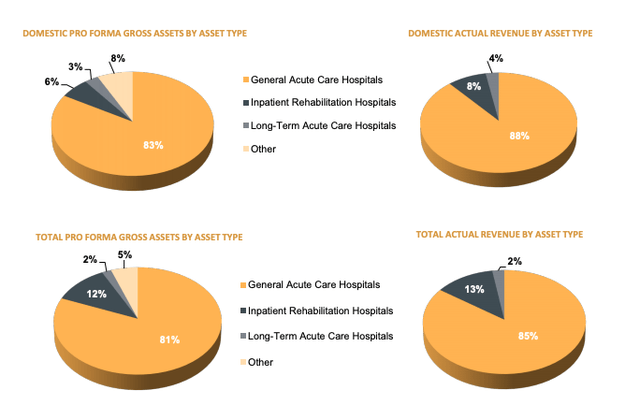

The portfolio is made up mostly of standard, general acute care hospitals, with 15-20% of revenue derived from more specialized hospitals.

Source: Q3 Supplemental Presentation

Source: Q3 Supplemental Presentation

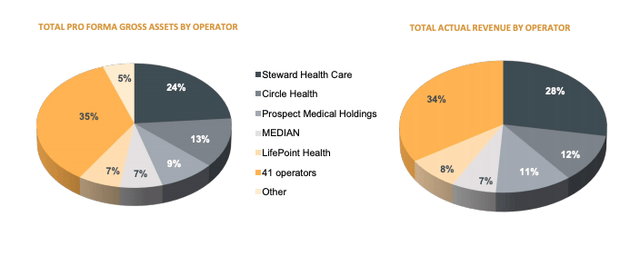

In the last few years, MPW has also done a good job of lowering its reliance on its largest tenant, Steward Health Care, from 38% at the end of 2018 to 24.5% in Q3 2020.

Source: Q3 Supplemental Presentation

Source: Q3 Supplemental Presentation

In spite of a worldwide pandemic, MWP has performed very well this year. Year-over-year, revenue rose 47% in Q3, while funds from operations rose a phenomenal 24%.

MPW may actually be a beneficiary of COVID-19 in the long run, due to the financial strains the pandemic put upon many health systems. The lack of elective surgeries has been a significant liability for most hospitals, and many of them are running short on cash. Those health systems that own their own real estate may find it necessary to monetize that real estate in order to pull out capital for other uses. MPW stands ready to provide that capital by buying the real estate.

Moreover, in some countries, delayed elective surgeries at publicly owned hospitals due to the pandemic has been a positive catalyst for MPW's privately owned hospitals. As those procedure schedulings have flooded back in during the second half of the year, public hospitals have become overwhelmed and sent many patients to the private hospitals. This is what MPW has observed in Spain. In the UK, private hospitals have collaborated with the National Health Service ("NHS") like never before. It is estimated that as many as 10 million patients will be on the NHS's waitlist backlog by the end of 2020.

Source: Q3 Supplemental Presentation

Source: Q3 Supplemental Presentation

Over 97% of MPW's leases have contractual rent escalations, typically on an annual basis, either tied to a consumer inflation index or fixed at a certain percentage from 0.5% to 3% per year.

Through the first nine months of 2020, MPW collected 98% of contractual rent, and the company has deferral agreements (with interest!) in place for the remaining 2%. As of October, MPW collected "substantially all" rent and interest payments, and they expect that to continue going forward.

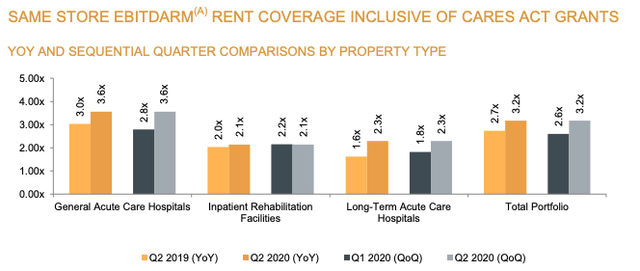

MPW's tenants remain in decent shape, as far as rent coverage is concerned. For the trailing twelve months ending June 30th, 2020 (because full information on tenant financials becomes available about a quarter behind the most recently reported MPW quarter), EBITDARM coverage for all of MPW's tenants on a same-store basis came to 2.12x. Even for acute care, probably the hardest hit sector through COVID-19, same-store EBITDARM coverage was 2.16x, a 29% fall year-over-year.

Long-term acute care hospitals ("LTACH") and inpatient rehabilitation facilities both had EBITARM coverage right around 2x, each increasing YoY. And all of the above metrics are not considering government grants provided during the pandemic. With such grants included, TTM EBITDARM coverage for the full portfolio would come to 3.17x.

Source: Q3 Supplemental Presentation

Source: Q3 Supplemental Presentation

General and administrative expenses to revenue (what I refer to as the "management fee") came in at 9.6% in Q3 2020, down 10.4% in the same quarter last year. While it's good to see G&A to revenue coming down over time, the metric is still on the high side considering MPW's $14 billion portfolio. Fellow multi-continental net lease REIT W.P. Carey (WPC) has a similar portfolio size, but it's G&A to revenue is 5.9%.

Then again, MPW has offices on three continents, and the portfolio is growing rapidly, which requires lots of due diligence and other upfront work. Such work costs money.

Mesquite Specialty Hospital, Owned by MPW; Image Source

Even in the midst of rapid expansion, MPW's debt load is by no means sky high, even if somewhat elevated. Net debt to EBITDA sits at 6.1x as of Q3. Net debt to gross real estate assets currently is 58.4%.

The REIT also enjoys a low weighted average interest rate on debt of 3.83% in Q3 2020, compared to 4.3% in Q3 2019. MPW's ability to borrow in European credit markets helps to lower its average rate, and the vast majority of debt is fixed rate.

Risks

The first and most obvious risk facing MPW has been covered above already. It's COVID-19. The delay in elective surgeries threatened to drain hospital operators' bank accounts as their income dried up. But, as explained above, governments around the world were unwilling to risk hospitals closing their doors or curtailing operations in the middle of a pandemic. Hence we find the wave of grants injected into hospital systems in the Spring.

I believe that governments would provide similar grants if a second wave of the virus caused more delays in elective surgeries this Winter.

What about the other obvious political risk facing MPW? The constant fear among investors is that a significant change in the political climate could result in a large-scale socialization of healthcare provision, or some other change that would result in for-profit business models being wiped out. On this point, it's worth quoting CEO Edward Aldag from the Q3 conference call:

Over the 35 years I've been investing in hospitals, the legal obligation of hospitals to treat all patients regardless of their ability to pay has been a constant. And the amount of funds spent at hospitals is only increased. Since CMS began tracking nominal U.S. healthcare spending in hospitals in 1960, 12 presidential administrations ago, nominal spending in hospitals has grown at an 8.8% compound annual growth rate with no single negative year.

I say this because Republican or Democrat, no ACA or expanded ACA, an increasing amount of money is likely to be spent on hospitals. Each generation expects to have better health care than the last. Countries will continue to fund healthcare even in the worst of times, as we've seen during this pandemic.

For the last 35 years, I've seen many changes in how hospitals are reimbursed. But the one constant is that as a population, we've always demanded and gotten better health care. Relative to the $1.2 trillion spent at hospitals, as officially measured in 2019 in the U.S. the impact of potential changes or repeal of the Affordable Care Act is marginal.

Our experience tells us that in any case, the same doctors will treat the same patients, overall spending will grow, and our rent will be paid regardless of changes resulting in shifts in payer mix at any related health care insurance reform.

Investors can decide for themselves whether the find the CEO's statement regarding the political risk convincing.

The last risk I'll bring up pertains to interest rates. As a net lease landlord, MPW is sensitive to interest rate movements. Higher rates would be a headwind, and a sudden spike in rates would be very detrimental. The good news is that interest rates are likely to remain low for the foreseeable future, and MPW's leases have at least some inflation protection built in. A prolonged environment of low rates and low inflation is very beneficial for MPW.

Dividend: History and Future

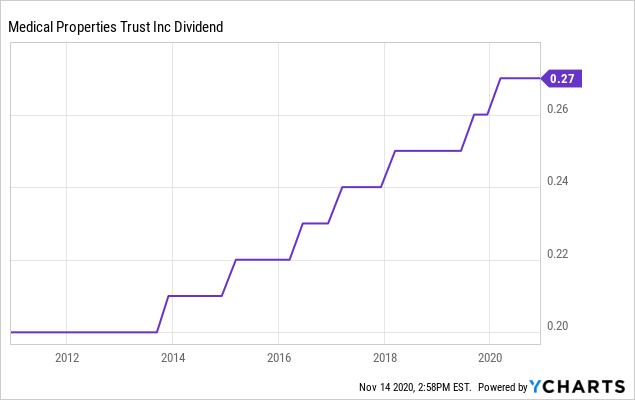

MPW has raised its dividend every year for the past seven years, four cents per year (a penny per quarter, on average):

Data by YCharts

Data by YCharts

That works out to about 4% average dividend growth per year.

In Q3, the dividend payout ratio was a very low 65.9%, and for the full year it is expected to come in at a very comfortable ~70%. The low payout ratio, along with attractive growth prospects, provides ample upside to the dividend in the coming years.

Based on the current share price of $19.40, the annualized dividend of $1.08 per share works out to a 5.57% dividend yield. If the same pattern of four cents per year dividend raises continues uninterrupted, the payout will come to $1.48 per share in ten years. That would work out to a 10-year yield-on-cost of 7.6%.

I would consider that an excellent YoC for dividend growth investors.

Conclusion

Even at $19.40 per share, up around 50% from its COVID-19 low, MPW still looks attractive as a dividend growth investment. The REIT's tenants operate in a government-favored environment, and yet the financial strains that many health systems have suffered this year could prove a catalyst for more sale-leaseback deals for MPW in the coming years. The high yield is well-protected, and the dividend payout looks likely to continue growing for years to come.

If you find this content valuable, please follow me by clicking the orange "Follow" button at the top of the page!

What Are We Buying?

We are sharing all our Top Ideas with the 2,000+ members of High Yield Landlord. And you can get access to all of them for free with our 2-week free trial! We are the largest real estate investment service on Seeking Alpha with over 2,000+ members on board and a perfect 5 star rating!

Join us today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!

Disclosure: I am/we are long MPW, WPC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.