PCEF: CEF Index Fund, Strong 8.1% Yield, Diversified Holdings

PCEF invests in fixed income and equity CEFs.

The fund yields 8.10%, significantly more than most comparable index funds, while providing access to hundreds of funds and thousands of securities.

A look at the fund, its investment strategy, holdings, and performance since inception.

The Invesco CEF Income Composite Portfolio ETF (PCEF) is an index ETF investing in a diversified portfolio of more than a hundred fixed income and equity CEFs. PCEF's diversified holdings, strong 8.1% dividend yield, and the large discount to NAV of its underlying holdings make the fund a strong buy, especially for income investors or retirees.

Fund Basics

- Sponsor: Invesco

- Dividend Yield: 8.10%

- PCEF Management Fee: 0.50%

- Expense Ratio: 2.55%

- Total Returns (Inception): 5.83%

- Underlying Index: S-Network Composite Closed-End Fund Index

- Holdings: 130

Fund Overview

PCEF is an index fund investing in a diversified portfolio of CEFs, tracking the S-Network Composite Closed-End Fund Index. The index provider has a very informative, very persuasive, investor presentation here.

PCEF invests in investment grade bonds, high yield bonds, and equity option income CEFs, in roughly equal proportions. The fund provides investors with basically all the asset class diversification they need, serving to significantly reduce risk and volatility. As such, PCEF could easily be a core portfolio holding for a retiree or income investor.

PCEF doesn't use leverage, but many/most of its underlying holdings do, which serves to magnify both gains and losses. More conservative investors might prefer funds without the use of leverage, although there are few with similar assets or strategies to PCEF.

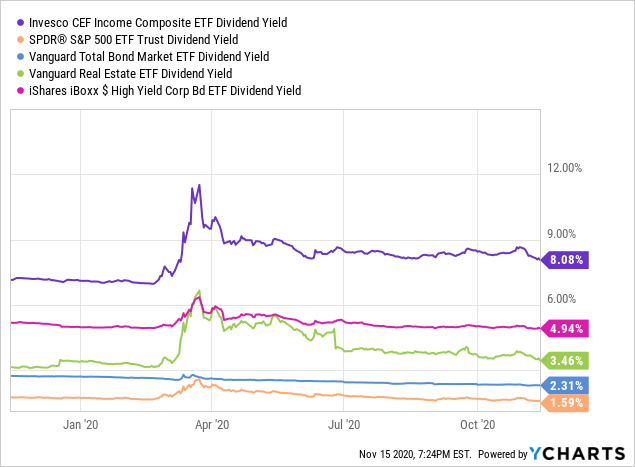

PCEF's focus on fixed income CEFs serves to boost the fund's dividend yield to 8.1%, quite a bit higher than that of most asset classes, a significant benefit for the fund and its shareholders:

Data by YCharts

Data by YCharts

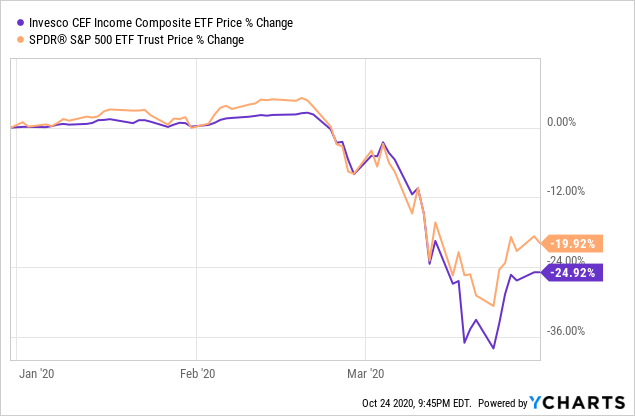

PCEF's focus on fixed income funds also serves to reduce risk, volatility, and losses during downturns, at least relative to the average CEF. PCEF seems to be about as risky as the S&P 500. PCEF sometimes posts greater losses than said index, like it did during the start of the ongoing coronavirus outbreak:

Data by YCharts

Data by YCharts

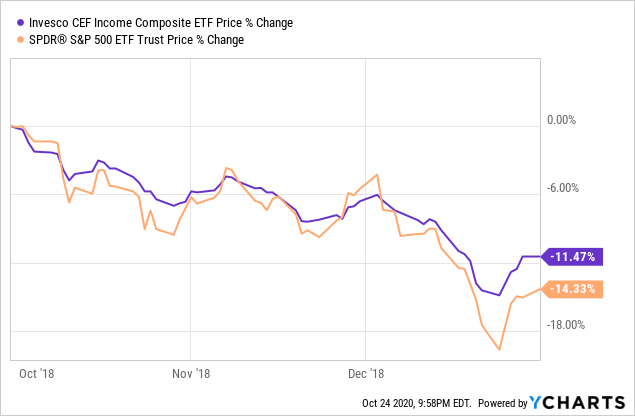

Sometimes posts less, as it did during late 2018:

Data by YCharts

Data by YCharts

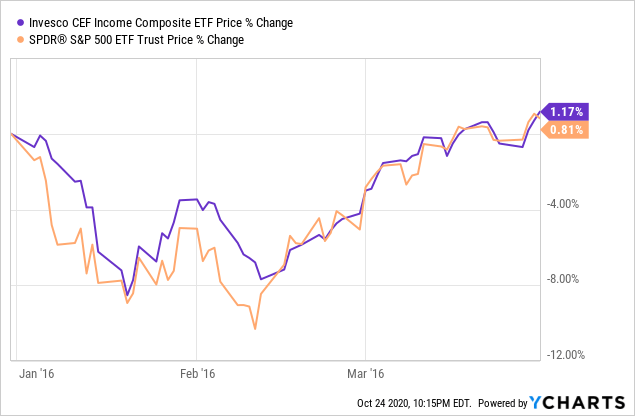

and sometimes posts about the same, as it did during early 2016:

Data by YCharts

Data by YCharts

Comparable levels of risk, volatility, and losses during downturns to the S&P 500 is quite good for a fund focused on CEFs, which are generally quite risky.

PCEF's focus on fixed income funds also reduces the potential for long-term capital gains, a significant negative for the fund and its shareholders.

Technically, PCEF only invests in funds meeting a set of liquidity, size, discount, and expense criteria, although the requirements are quite lax, so the fund excludes few CEFs. As such, expect PCEF's returns to closely track those of its underlying index / indexes, as the fund is invested in so many different funds and holdings.

PCEF's holdings are weighted according to their net asset value and their discount to NAV, with highly discounted funds afforded a greater weight, and vice versa. Focusing on highly discounted funds is a strong benefit for PCEF and its shareholders, as it directly leads to greater dividends, and could lead to greater capital gains if discounts narrow.

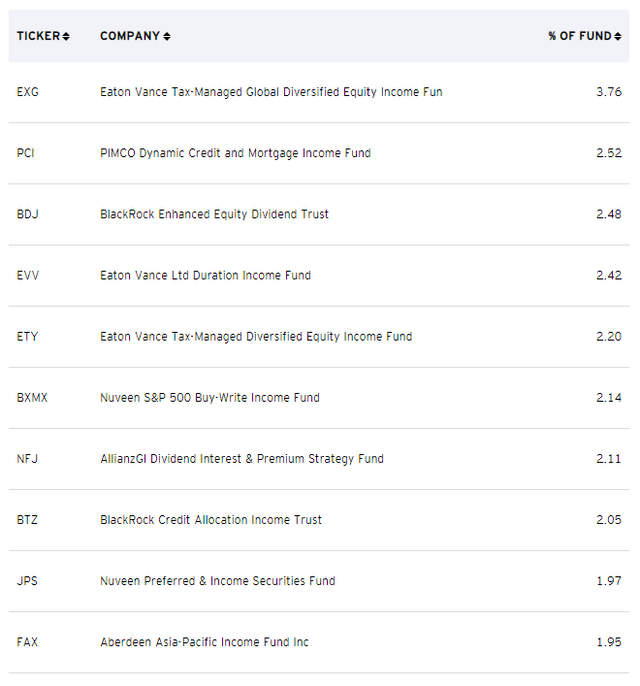

PCEF currently holds 130 CEFs, with no single fund accounting for a significant portion of its total assets. PCEF's holdings are well-diversified, with the top ten holdings comprising about 23% of the total value of the fund:

(Source: PCEF Corporate Website)

Investing in so many funds serves to significantly reduce portfolio risk and volatility, and precludes the possibility of substantial overperformance or underperformance, as the fund is invested in both the best and worst funds in the market.

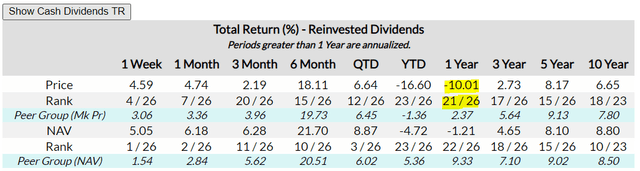

As an example, last year, as per PCEF's latest annual report, the fund was heavily invested in both the BlackRock Enhanced Equity Dividend Trust (BDJ) and the BlackRock Credit Allocation Income Trust (BTZ). BDJ was one of the worst-performing CEFs in its asset class in the year:

(Source: Cefdata.com)

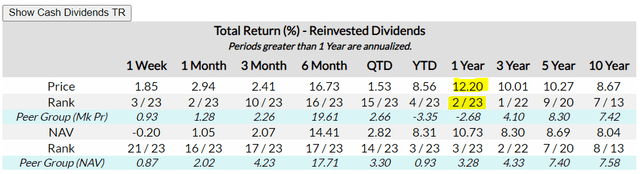

While BTZ was one of the best:

(Source: Cefdata.com)

PCEF's investors will receive the returns of both the best funds, like BTZ, and the worst, like BDJ, so overall returns will be very close to the market average. A tailor-made, more concentrated portfolio could always outperform relative to PCEF, so the fund is less appropriate for more aggressive and hands-on investors.

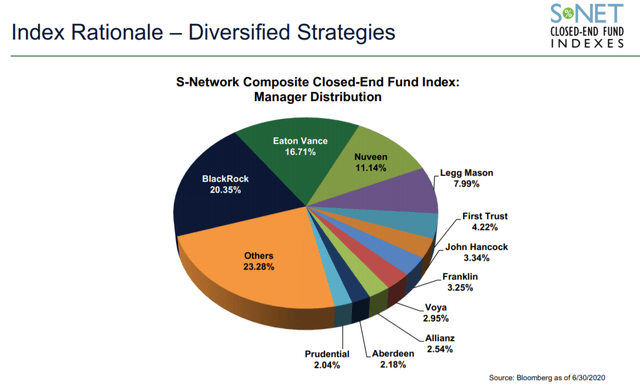

PCEF's holdings are also well-diversified across asset managers:

(Source: Index Investor Presentation)

PCEF's diversified holdings reduce portfolio risk and volatility, a strong benefit for the fund and its shareholders.

Finally, a note on the fund's fees. PCEF itself charges investors a 0.50% management fee, reasonable for an actively-managed fund focusing on CEFs. On the other hand, PCEF's underlying holdings also charge investors management fees. Add these up, and the fund's expense ratio rises to 2.55%, a figure which is significantly higher than average, and a negative for the fund and its shareholders. These are pricey products, and investors should at least consider the possibility of creating their own portfolios to avoid these expenses.

In my opinion, PCEF's overall investment strategy and holdings are perfect for income investors and retirees, and the fund could easily serve as a core, even only, portfolio holding. On the other hand, its strategy and holdings also preclude the possibility of substantial capital appreciation or outperformance. More aggressive, hands-on investors, which I believe includes many Seeking Alpha readers and subscribers, should consider creating their own diversified portfolio of funds, which has the potential for greater dividends and returns when compared to PCEF, and would be somewhat cheaper too.

With the above in mind, let's take a look at the fund's dividend and performance.

Dividend and Performance Analysis

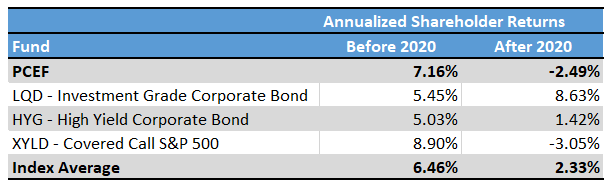

I'll be comparing PCEF to the largest investment grade bond, high yield bond, and covered call index fund, as well as to an average of the three, when applicable. In general terms, the fund compares somewhat favorably to its peers, but only slightly so, consistent with the fund's investment strategy and holdings.

PCEF's current 8.1% dividend yield is quite high, and much greater than all of its peers, a strong benefit for the fund and its shareholders. On the other hand, the fund's dividend has very slightly decreased throughout the years, somewhat of a negative for investors.

(Source: Seeking Alpha - Chart by author)

Decreased dividends are almost certainly due to lower bond interest rates, as these have affected most fixed income funds and CEFs, including PCEF's fixed income peers. Dividends have increased for most covered call equity funds, as increased volatility and market turmoil boost the premiums received from writing covered calls, although that hasn't been reflected in PCEF's dividend.

In my opinion, PCEF is likely to see further reduction in its dividends, as interest rates have gone down these past few months to combat the ongoing coronavirus outbreak. Nevertheless, I believe that the fund's strong 8.10% dividend yield more than outweighs any possible future dividend cut, especially so as the fund's peers will most likely also see dividend cuts.

PCEF's overall performance track record is also reasonably good, although the situation is quite complicated. PCEF had generally outperformed its peers until 2020, due to the leverage of its underlying holdings, its greater dividend yield, and due to some small amount of management alpha. It has moderately underperformed since, as the leverage used by its underlying holdings magnified losses during the ongoing coronavirus outbreak, and due to widening CEF discounts.

(Source: Seeking Alpha - Chart by author)

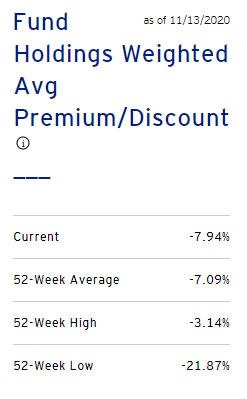

In my opinion, PCEF is likely to outperform in the future, for the same reasons it outperformed before 2020. At the same time, the fund's underlying holdings have very slightly higher discounts than in the past. If these narrow, returns would increase as well:

(Source: PCEF Corporate Website)

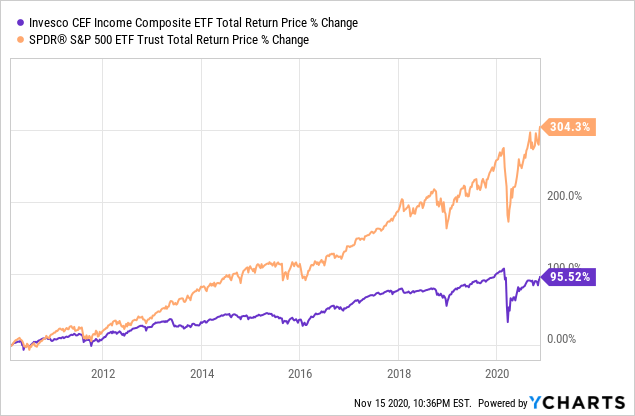

PCEF's focus on fixed income funds means that the fund will almost certainly underperform relative to equities, at least in the very long term. This has been the case since the fund's inception:

Data by YCharts

Data by YCharts

Investors looking for equity exposure and attendant returns should consider an alternative to PCEF.

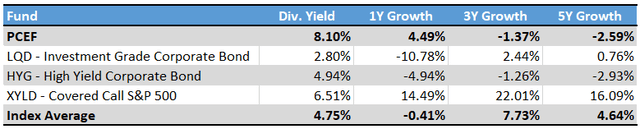

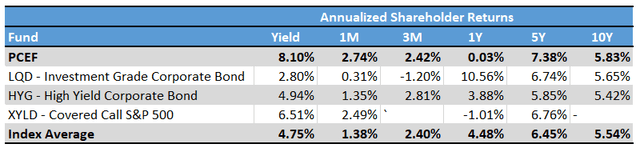

Finally, a quick table summarizing the yields and returns of the fund, its peers, and the index average:

(Source: ETF.com)

As mentioned previously, PCEF's performance track record is reasonably good, although not fantastic, which is about as good as you can expect for a diversified index fund.

Conclusion

PCEF's diversified holdings, strong 8.1% dividend yield, and the uncharacteristically large discounts of its holdings, combine to create a strong investment fund, especially so for income investors and retirees.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.