Major asset classes have registered positive returns year-to-date on the back of a strong recovery over the past six months.

However, some investor income portfolios are likely lagging this recovery.

In this article, we take a look at some of the possible reasons why.

Major assets have risen above their start-of-2020 levels on the back of a macro recovery, lower interest rates and positive news flow on vaccine development. Despite this strong market backdrop, some investor income portfolios are trading in the red for the year. In this article, we take a look at some of the reasons why this may be the case and if there are any lessons investors can take away.

Some of our takeaways are that investors should be careful in reaching for yield in a high-valuation market environment, take care in using appropriate sectors for CEF allocations and diversify across senior securities and open-end funds which haven't been caught up in the recent CEF discount widening trend.

Overextending On Yield At the End Of the Macro Cycle

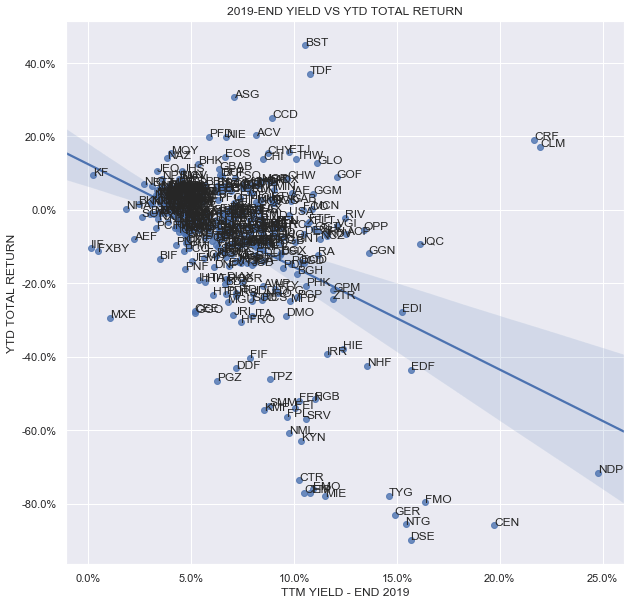

If we look at the relationship between various income asset yields on offer at the end of 2019 and the performance of these assets year-to-date, we see a clear relationship. The highest-yielding assets as of 2019 year-end have seen the lowest returns year-to-date. This chart suggests that the higher-yielding sectors tend to be less resilient during downturns and fail to bounce back during recoveries, locking in permanent capital losses for investors.

Source: Systematic Income

The picture is a bit more noisy in CEFs, but it points in the same direction.

Source: Systematic Income

If there was one consensus at the start of 2020, it was that the macro cycle was very long in the tooth and was likely to head south over the near term, and although the actual driver of the downturn was completely unexpected, that a downturn itself happened was not surprising. Investors don't need to be macro forecasters in order to gauge when to start taking chips off the table - market valuations provide more than enough information. And at the start of 2020, valuations were very expensive across a number of sectors.

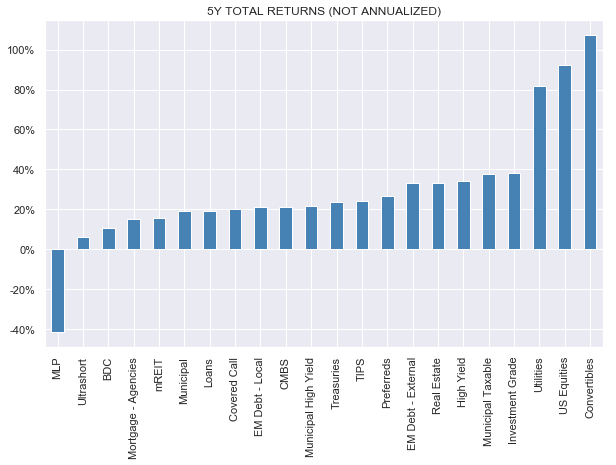

There are two counterarguments to these charts. One is that looking at past-year returns is not fair, and that over the longer term, higher-yielding assets would have delivered longer total returns. And second, it's not fair to use simple passive benchmarks to gauge the total return of sectors like REITs, BDCs, mREITs or MLPs. Investors should, instead, do their homework and practice active management, selecting those securities within these sectors that are likely to outperform in any given environment.

As far as the first argument, we don't see much evidence for this - the higher-yielding sectors have given up whatever total return outperformance they may have had prior to this year. Three of these sectors are in the bottom five of 5-year returns. This suggests that their total return advantage over any length of time may be illusory.

Source: Systematic Income

And on the second argument, it is our view that investors shouldn't have to be analytical heroes in order to have resilient portfolios. By and large, they simply don't have the time or the background for deep research into individual securities.

Our mantra has been to be long-term greedy, which means positioning income portfolios in a countercyclical way - to build up dry powder reserves when valuations are rich and spend it when valuations are cheap. This allows investors to grow not only the total wealth of their portfolios, but also grow total income.

Another pillar of our investment approach has been to use senior securities instead of common stock for more volatile asset classes. For example, preferred stocks and baby bonds of CLO equity, BDCs and mREIT sectors have mostly ended up with positive total returns for the year, in contrast to common equity exposure to these sectors.

So, where are we now in the investment cycle? All evidence points to a market that is priced for perfection. High-yield credit spreads at around 450 basis points do not leave much room for further outperformance or a margin of safety if the macro picture turns out to be more challenging. An expected default rate of 6-7% next year alongside below-average historical recovery rates means that 80-90% of the high-yield corporate credit yield is expected to be lost, leaving investors with a thin loss-adjusted income cushion.

This suggests that rather than chasing yield at this stage, investors should begin to allocate some capital to higher-quality sectors and more resilient securities.

Failing To Maintain Some Dry Powder

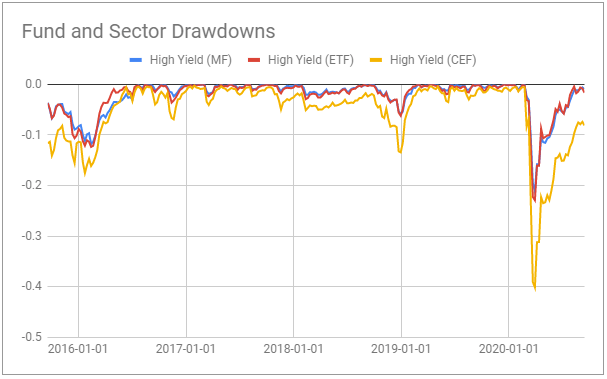

Maintaining dry powder is an important tool for building long-term income and wealth. This is because different sectors and investment vehicles will tend to have varying drawdowns in response to a market shock. These varying drawdowns allow investors to rotate from more resilient to less resilient investment options within the same sector, locking in higher yields.

Source: Systematic Income

This ability to rebalance relies on holding more resilient securities in the portfolio. This does not necessarily imply having to hold cash, however. Rather, investors can allocate across the entire spectrum of a given sector, which can include target-maturity ETFs, mutual funds, term CEFs, and others.

Overallocating To Sectors Less Suitable to CEFs

It is tempting for income investors to think of allocating capital in two distinct stages, first by identifying attractive income-producing sectors and then selecting the investment vehicle that extracts the highest yield out of that sector.

The trouble with this approach is that some investment vehicles are not suitable for all income sectors. In particular, leveraged CEFs are less appropriate for holding very volatile assets such as MLPs and CLO equity. Time and time again, we see these CEFs go through bouts of deleveraging, forcing them to lock in permanent capital and income loss.

The reality is that volatility is not going away, so this pattern will continue to play itself out. Ultimately, during sharp drawdowns, CEFs will tend to either defend their senior securities ahead of common shareholders (for those that use preferreds or baby bonds as a source of leverage, such as CLO equity CEFs) or they may be forced to cut leverage by their bank counterparties if they use credit facilities, loans or repo as a source of borrowing.

This dynamic will prevent CEFs allocated to these sectors from delivering on the investment premise of their underlying sectors. For example, the two longest-trading CLO equity CEFs have delivered flat returns since 2015 - a far cry from the double-digit yield on their underlying portfolios.

Our stance has been to allocate to either open-end funds or senior securities of these sectors, which avoids the deleveraging dynamic. For instance, as we show below, CLO equity senior securities are firmly in the green this year.

Ignoring Fat Relative Valuation Pitches

Investors in CEFs have an additional dimension to consider when allocating their capital - that of discounts. This might not matter a whole lot if CEFs were efficient in how their discounts evolved over time in relative terms. However, this is not the case, as discounts can be wildly volatile in absolute and relative terms. This means that investors who ignore relative value opportunities posed by CEFs are also avoiding an additional way to boost income and returns.

Some investors look down on relative value positioning in CEFs as mere "trading", however, it is also possible to look at it from a fundamental value-based perspective. Since many CEFs hold broadly similar portfolios, their divergent discounts allow investors to acquire similar assets at a significantly lower price. This means that even when underlying asset prices remain stable or go negative, investors can experience a positive return due to this alpha tailwind.

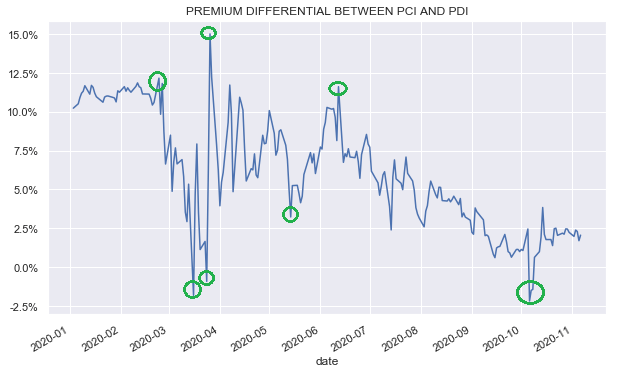

For example, the chart below shows the differential in the premium of two popular PIMCO CEFs that hold broadly similar portfolios with the turning points in the differential highlighted. Obviously, we only know the turning points in retrospect and investors aren't going to be able to hit them all or even most of them. That said, the clear pattern of the premium differential for these two funds has been the range from low single digits to low double digits. Rotating based on this premium differential range has offered investors rotation opportunities, particularly during more volatile market periods.

Source: Systematic Income

Allocating Exclusively To CEFs

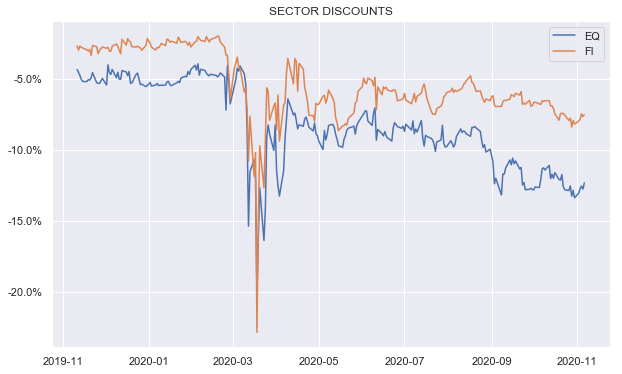

Investors who allocate entirely or almost entirely to CEFs may believe that they are running a diversified portfolio, particularly if their CEF holdings span a range of different sectors. However, because CEF discounts can co-move, this diversification can be somewhat illusory.

We plot average equity and fixed-income CEF sector discounts in the chart below. The chart shows that, in aggregate, CEF discounts have tended to move wider after a brief tightening rally after the end of the March drawdown.

Source: Systematic Income

It is not entirely clear why CEF discounts have trended wider despite strong NAV performance - perhaps some CEF investors simply threw in the towel entirely or have engaged in heavy tax-loss selling.

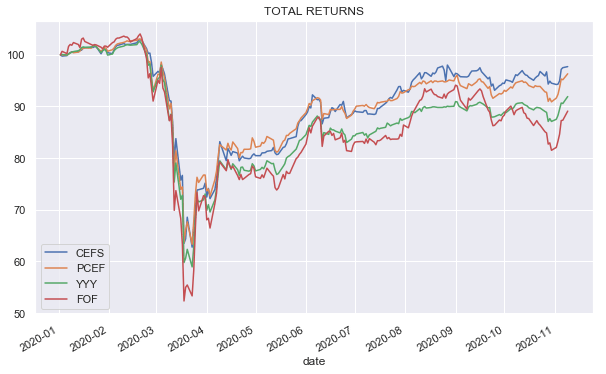

We can see this dynamic in the performance of funds of CEFs which have not yet regained their pre-drawdown levels and are still trading in the red on a year-to-date basis despite a strong market recovery.

Source: Systematic Income

By diversifying across open-end funds and senior securities, investors can mitigate this exposure to broad-based discount trends. Alternatively, tilting to term CEFs can provide additional discount control and visibility.

Takeaways

Now that major asset prices have mostly recovered and valuations have richened, it makes sense to take stock of the performance of income portfolios and any lessons learned. Investors who are intent on preserving the value of their portfolios can use a number of strategies. They can begin to rotate into more resilient investment options such as open-end funds and senior securities as valuations continue to richen. They can avoid the dangerous combination of CEF leverage and highly volatile assets. And they can begin to build up dry powder reserves to take advantage of the inevitable drawdown in order to boost their sustainable income levels.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the closed-end fund, open-end fund, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.