Global X Video Games & Esports ETF: Power-Up With Exposure To Digital Gaming And E-Sports Assets

The Global X Video Games & Esports ETF allows investors to insert a coin on the emergent digital gaming industry.

As a developing video game super cycle commences with offerings from both Sony and Microsoft, consider electronic gaming to power up.

The rampant Sars-Cov 2 virus has provided a shot in the arm for global gaming at a time when lockdowns and isolation have forced interaction online.

Professional gaming leagues, such as Major League Gaming, are becoming increasingly prominent.

The Global X Video Games & Esports ETF provides investors immediate risk exposure and diversification benefits without requiring them to be a digital gaming grandmaster.

Overview

The Global X Video Games & Esports ETF (HERO), issued by Mirae Asset, is a $380M exchange-traded fund that allows investors to plough money into the burgeoning digital gaming and electronic sports industry. In accordance with sheet documentation, an algorithm filters company filings to identify suitable securities. These incorporate firms who have 50% of proceeds derived from video games and e-sports activities. The ETF provides capital for assets globally without geographical or sector constraints in the assortment of digital gaming assets.

Source: ETF.com

The ETF is open-ended, with an expense ratio of 0.50%, and has an MSCI ESG Fund Rating of BB based on a score of 3.93 out of 10. This rating sizes the fund's risks and opportunities around environmental, social and governance factors. While this is not wholly consequential for the digital gaming industry, it is discerning to understand the basket of securities, especially if country specific reporting requirements are not as stringent as what exists in the United States.

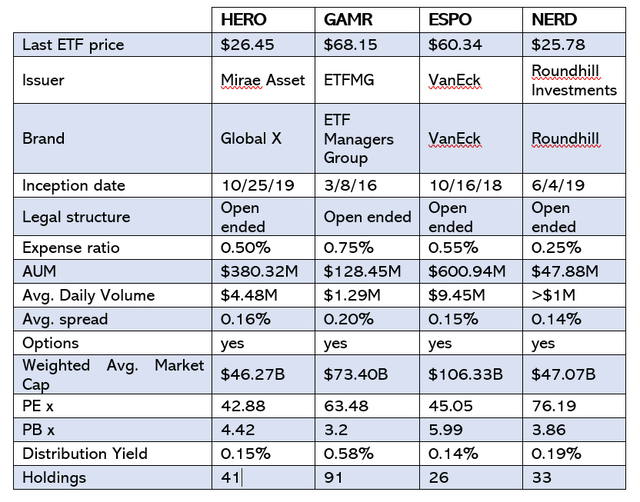

The weighted average market cap of the ETF is $46.27B, with a price earnings ratio of 42.88X and currently encompasses a basket of 41 securities. The fund measures up to the ETFMG Video Game Tech ETF (GAMR), the VanEck Vectors Video Gaming and eSports ETF (ESPO), and the Roundhill BITKRAFT Esports & Digital Entertainment ETF (NERD) whose principal traits I have summarized in the table below.

Source: Compiled by author with data from ETF.com

Breakdown

The Global X Video Games & Esports ETF is a comparably recent ETF offering, pitching itself with a 50 bps mid-range expense ratio in an open-ended structure. Its $380M in total assets under management illustrates the degree with which the fund has managed to attract new capital promptly given its relatively short life. Average daily volume weighs in above requirements, allowing for efficient position entry and exit despite being at the higher end of average % spread.

Not unlike its counterparts, the ETF also has an options market which has monthly maturities. Liquidity in the options market of any of the digital gaming ETF offerings is not exceptional, but it does provide investors a chance to deliver superior active risk-adjusted returns either by selling calls on a holding or selling short puts as a target entry price to build into a position. I recommend investors put to good use these tools where possible as a means of optimizing a holding in digital gaming assets.

The Global X Video Games & Esports ETF, while not as concentrated as its VanEck and Roundhill counterparts, does tout some degree of concentration risk.

A list of its latest major holdings includes:

- Sea Ltd. (NYSE:SE) 7.71%

- Nvidia Corporation (NVDA) 6.73%

- Nintendo Co. (7974) (OTCPK:NTDOY) (OTCPK:NTDOF) 6.21%

- NetEase (NTES) 5.14%

- Activision Blizzard (ATVI) 5.13%

- Nexon Co. (3659) (OTCPK:NEXOF) (OTCPK:NEXOY) 4.82%

- Electronic Arts (EA) 4.62%

- Capcom Co. (9697) (OTCPK:CCOEY) (OTCPK:CCOEF) 4.56%

- Joyy Inc. (NASDAQ:YY) 4.52%

- Ubisoft Entertainment (UBI1) (OTCPK:UBSFY) (OTCPK:UBSFF) 4.51%

Total top 10 weighting = 53.96%

Source: ETF.com

Pivotal differences in holdings compared to counterparts include:

- GAMR invests more heavily into gaming hardware and equipment.

- ESPO maintains resolutely American flavor in its asset selection with notable exposure to chip manufacturers.

- NERD, while focusing on US digital gaming market, also has more China exposure. It hones in on gaming hardware, equipment and software.

Source: Seagroup.com

HERO's composition exposes it markedly to Sea Ltd., which, while not being well known in North America, is widespread in South East Asia. Not only does it develop a range of mobile gaming platforms, but it also owns Shopee which is one of South East Asia’s biggest digital marketplaces, competing with the likes of Alibaba Group’s (NYSE:BABA) Lazada digital marketplace.

I remain resolutely bullish on the development of digital marketplaces in South East Asia which are presently less extensive than in the United States. So, HERO provides some great exposure to digital marketplace advancement in a high growth region absent in other ETF proposals.

Here's a link to an excellent article on the battle for South East Asia’s online shoppers so you can build a better understanding of potential market size, etc. Shopee’s presence in Sea Ltd.’s portfolio will have a momentous impact on ETF performance.

Main country risk exposures for HERO are:

- United States 26.35%

- Japan 26.22%

- China 11.57%

- Korea 9.10%

- Singapore 7.55%

- Sweden 7.05%

- Hong Kong 5.93%

- France 4.63%

- United Kingdom 1.23%

- Taiwan 0.37%

Country risk for the ETF remains predominantly balanced between the United States, Japan and China. The global nature of digital gaming assets and e-sports intimates that comparable ETFs maintain fairly similar global risk exposures.

Material Events

There are a few crucial events which should power up the Global X Video Games & Esports ETF active returns potential which I have tabled below:

- We are entering a new console super-cycle with both Microsoft (NASDAQ:MSFT) and Sony (NYSE:SNE) releasing 5th generation gaming powerhouses. Both new units will have digital optionality; the Sony unit, for example, has a disc-less option, which will encourage digital marketplaces and distribution channels.

- With this console super cycle, we will witness increased programmer and developer activity – case in point is Capcom which will release its time-tested blockbuster Resident Evil series along with the new PlayStation 5. Activision will release bestseller Call of Duty – Black Ops Cold War to accompany the console mega-release, boosting earnings. Clearly, gaming houses in both the United States and Japan will remain busy into the new year.

- The COVID-19 pandemic has not only locked down households promoting increases in online gaming, but it has also radically altered and in some instances cancelled live sports. A compelling example of this was the Formula 1 season, which, while temporarily suspended, set up a range of online racers with real drivers racing in live-streamed arenas.

- The ETF’s exposure to Sea Ltd. and the company’s diverse set of assets imply that investors will be exposed to the digital marketplace growth engine which is revving up in South East Asia. With a regional population in the vicinity of 400 million (there are 250M people in Indonesia alone), this provides diversification benefits away from handheld gaming.

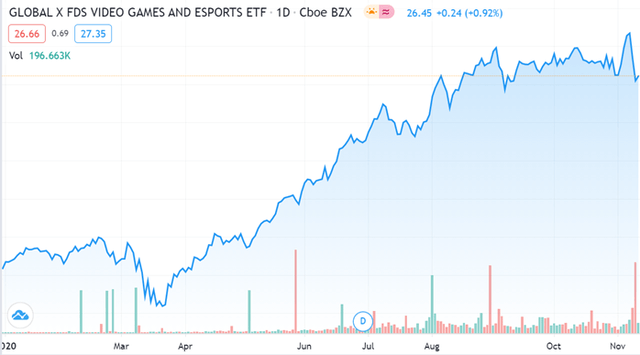

Source: Tradingview

Source: Sony.com

Key Takeaways

HERO is a well-structured package permitting investors to take on risk exposure in the global digital gaming and e-sports space which has been boosted by shutdowns and stay at home regimes across the globe. We await the start of a new super cycle of console and hardware releases from Sony and Microsoft, which in hand will keep developers resolutely busy for the foreseeable future.

Growth of the digital entertainment space was never disputed; it is now more than ever in the spotlight as consumers seek escape from a broad range of meaningful and far-reaching debacles. Until now, there has not been a more compelling time to look at digital gaming and e-sports assets as an actionable investment theme.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.