111, Inc.: Cheap But Risky And Controlled By Founders

111, Inc. runs an online healthcare platform in China.

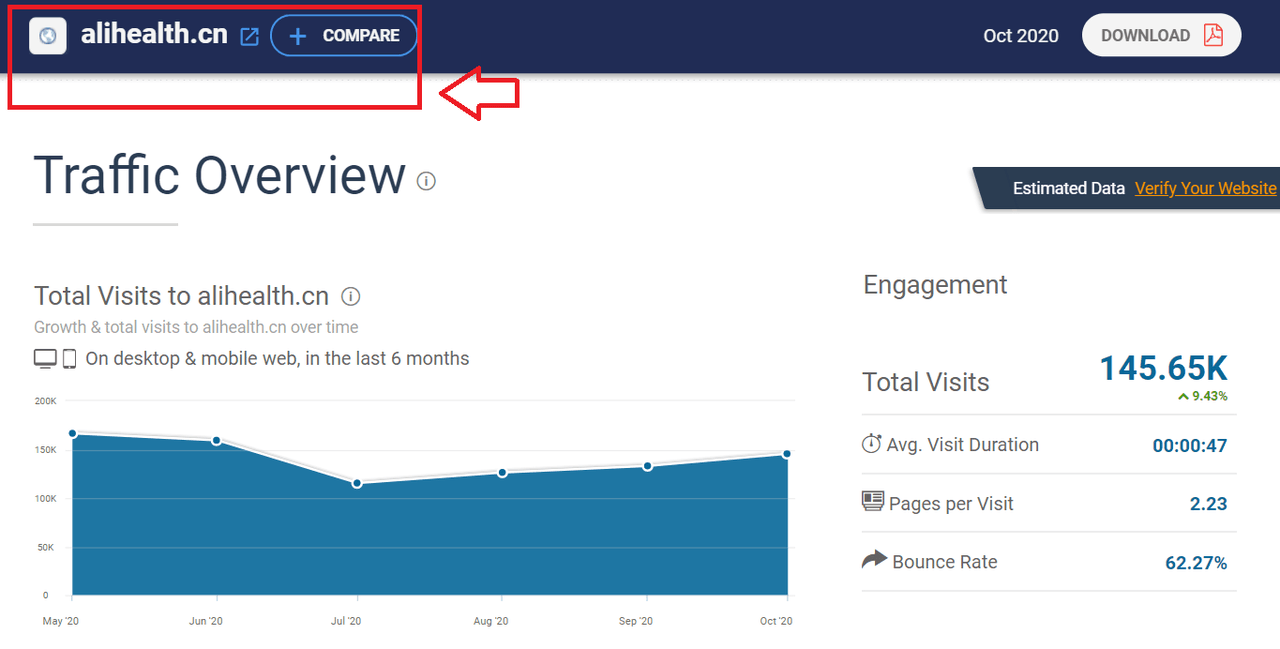

The company’s main website receives 0.299 million visits per month and 6.73 pages per visit. 111, Inc. website receives more visits than the website of Ali Health.

With forward 2021 sales of $2 billion, the company trades at 0.3x forward sales. In my view, 111, Inc. is extremely undervalued by the market.

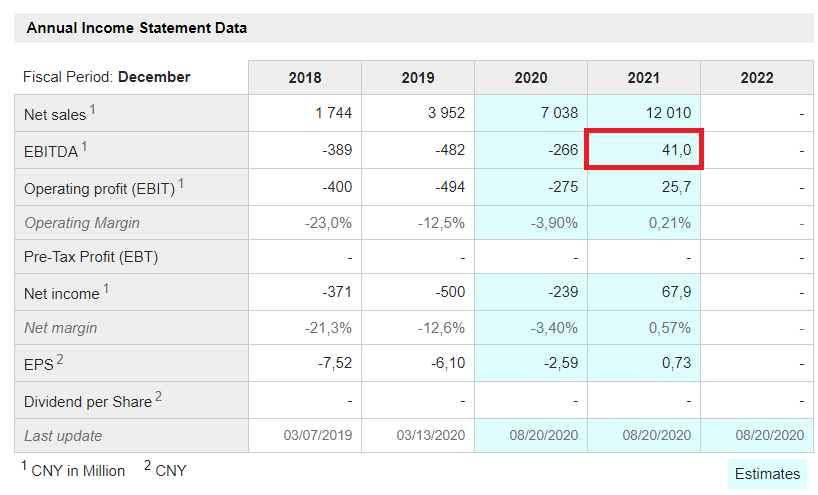

111, Inc. is reducing losses and may soon reach profitability. Analysts believe that the company may show positive EBITDA and net income by 2021.

The company has two types of shares, class A and class B. Thanks to this bad corporate governance practice, the founders control more than 90% of the total voting power.

111, Inc. (NASDAQ:YI) has a market capitalization of $492-656 million, double-digit sales growth, and 2021 forward sales of $2 billion. Most analysts would accept that the company is very undervalued by the market. Having said that, investors need to understand that company does business outside the United States, which is quite risky for American shareholders. The fact that the founders control more than 90% of the total voting power is also very worrying. That is why many investors are not buying shares, and the valuation is that limited.

Pharmaceutical Products And Medical Services

Founded in 2010, 111, Inc. runs an online healthcare platform in China. The company raised $101.2 million in 2018 and trades on the NASDAQ.

The company's main business is 1 Drugstore, which is presented as one of the most relevant online retail pharmacies in China:

"Today, we provide hundreds of millions of consumers with better access to pharmaceutical products and medical services, directly through our online retail pharmacy and indirectly through our offline pharmacy network." - Source: Annual Report

Source: Company's Website

The company's main website receives 0.299 million visits per month and 6.73 pages per visit. 111, Inc. website receives more visits than the website of Ali Health (OTCPK:ALBHF). Remember this fact because we will compare these two companies later:

Source: Similar Web

Source: Similar Web

In addition, from 2016, 111, Inc. has been offering online medical services with online consultation, and electronic prescription services. The company sells products to pharmacies, hospitals, and clinics. It also functions as a wholesale pharmacy business:

"We create value for various participants in our integrated online and offline platform in the healthcare ecosystem in China: (i) consumers who purchase pharmaceutical and other health and wellness products and seek medical services; pharmacies, including independent pharmacies, pharmacy chains and in-house pharmacies within clinics and private hospitals who purchase pharmaceutical products and interact with consumers through our platform; suppliers, such as pharmaceutical companies and distributors; marketplace sellers, who use our platform to distribute and sell their products; insurance companies, which are integral to the roll out of our new closed-loop internet "healthcare + pharma" pharmacy benefits management model and medical professionals who provide healthcare services through our platform." Source: Annual Report

While the company does both B2C and B2B, B2B represents 80.1% of the total amount of sales. Interestingly, in the last two years, the company has gone from 89.9% B2C to 19.3% B2C. The wholesale business model appears to be growing very fast:

Source: Annual Report

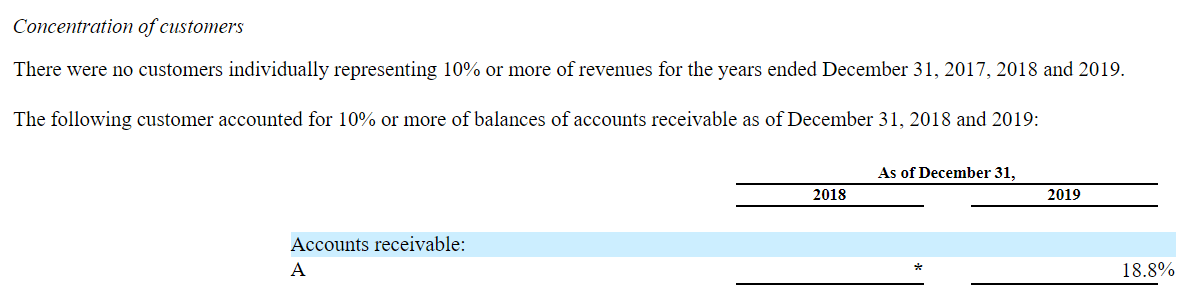

Since the amount of B2C customers is significant, we need to check the concentration of customers. If 111, Inc. would receive money from a few customers, the business model may be a bit risky. It does not seem the case here. In the annual report, the company reported that no customer represents more than 10% of the total amount of sales:

Source: Annual Report

Individuals interested in the type of products sold should have a look at the image below. 90% of the total amount of revenue comes from the sale of drugs. Other products sold include nutritional supplements, contact lenses, and other medical supplies. In 2019, sales from medical services were not significant. Don't buy 111, Inc. if you are looking for a telemedicine business.

Source: Annual Report

Massive Sales Growth

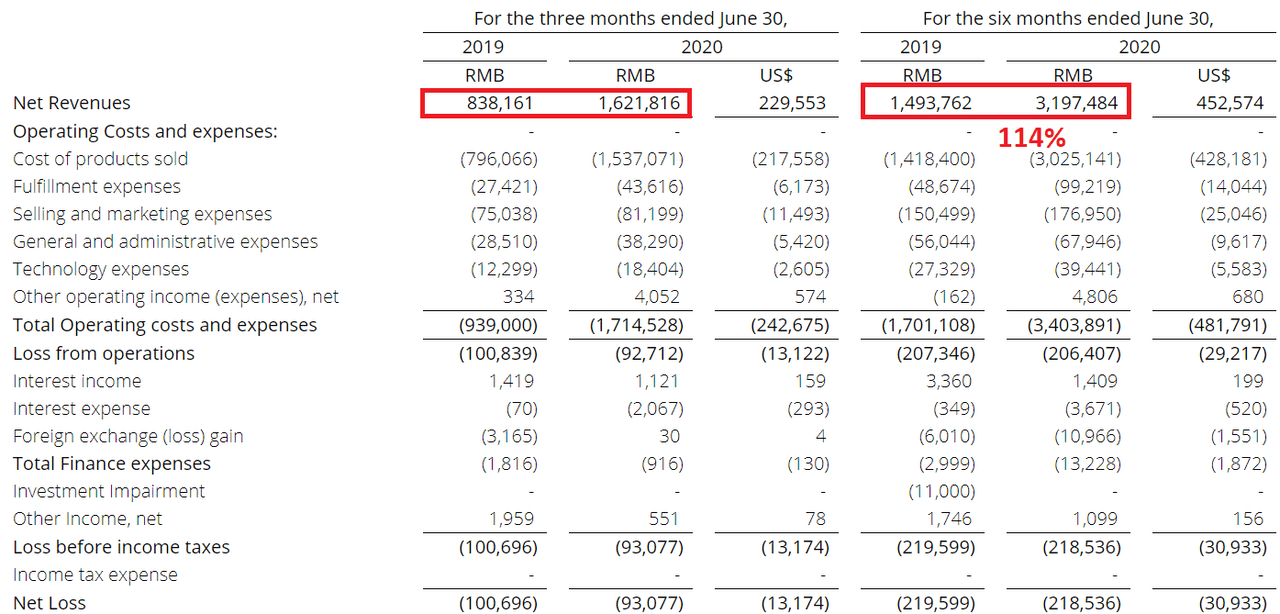

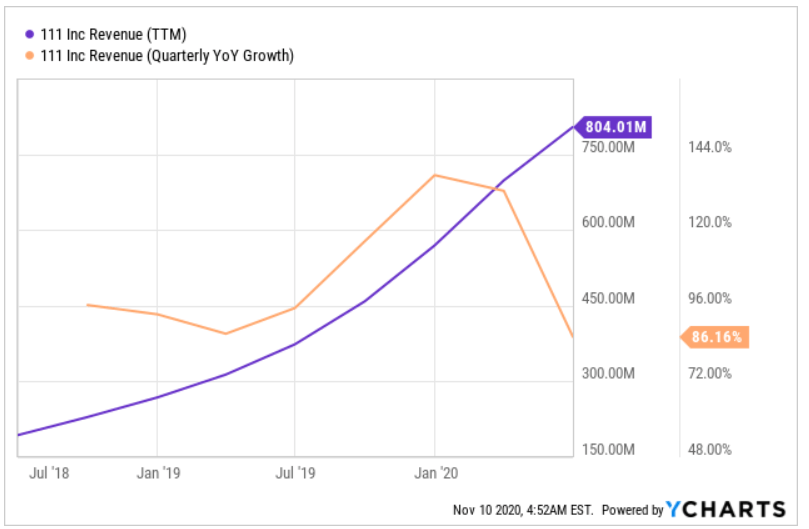

In the six months ended June 30, 2020, 111, Inc. delivered sales growth of 114% and sales of $452 million. The company has not delivered positive operating income. 111, Inc. will most likely be followed by growth investors looking for large sales growth and higher gross profit margins. Value investors may also be interested in the company's business profile.

Source: 10-Q

The net losses in H1 2020 were -$30 million, which is a bit better than that in H1 2019. 111, Inc. appears to be reducing losses and may soon reach profitability. Financial analysts believe that the company may deliver positive EBITDA and net income by 2021. It means that from 2021, value investors may commence to seriously study the company that may create, in my opinion, an increase in stock demand, which could lead to higher share prices.

Source: Market Screener

Balance Sheet: No Raise Of Capital Needed

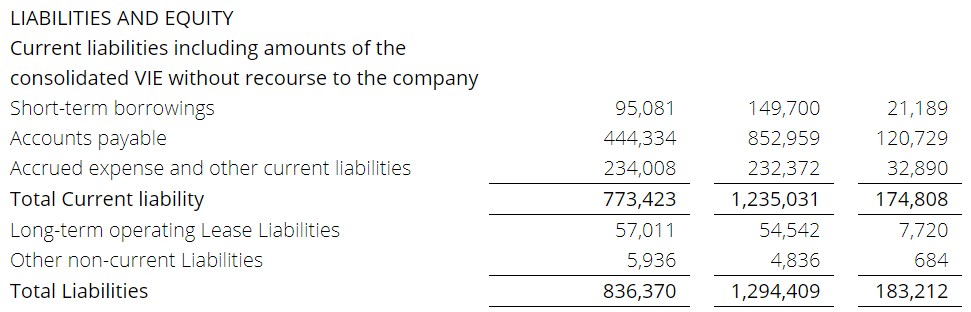

On June 30, 2020, the company reported cash on hand of $99 million and financial debt of $28 million. Hence, I am not really worried that 111, Inc. will be selling shares anytime soon. Note that in H1 2020, the company reported a positive CFO of $1.99 million. It means that the management is not burning cash or needs a lot of financing to run operations.

Source: 10-Q

In June 2020, the asset/liability ratio was equal to 1.45x, and the largest liability was accounts payable worth $120 million. I would not expect growth investors or value investors being afraid of the company's obligations:

Source: 10-Q

Sales Expectations And Value

In H1 2020, the company reported sales of $452 million. Sales growth in the past was close to 80-120%. Hence, 2021 sales of $2 billion appear very reasonable.

Source: YCharts

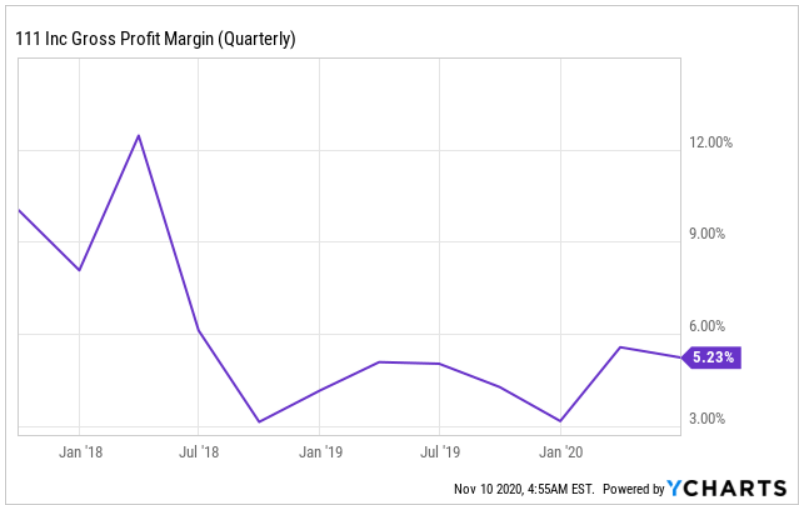

111, Inc. reports massive revenue growth. However, the gross profit margin is low. The cost of products sold represents a significant cost for the company, which is not ideal. Perhaps, 111, Inc. is still too small to negotiate with pharmaceutical providers. Some analysts would expect gross profit and profitability to grow when the company reaches a large size. Right now, the gross profit is at 5-9%:

Source: YCharts

The company competes with large operators like Ali Health and JD.com (NASDAQ:JD). In my opinion, the business of Ali Health is similar to that of 111, Inc. Ali Health reports negative operating margin and massive sales growth like 111, Inc. Using the valuation of Ali Health for obtaining the valuation of 111, Inc. makes sense.

"We believe our business model is unique and our services encompass the entire pharmaceutical value chain. We believe there are no comparable companies that directly compete with us. However, we face intense competition in certain business segments and verticals: We compete against other pharmaceutical retail companies including traditional offline pharmacies and online platforms, such as Ali Health and JD.com." - Source: Annual Report

With more than 80% sales growth, Ali Health trades at more than 29x sales. The company has a total valuation of $39 billion with close to 990 employees. 111, Inc. has sales growth of 80%-120% and 1,932 employees. With a share count of 82 million and a share price of $6-8, the market capitalization of 111, Inc. is $492-656 million. If 2021 forward sales are equal to $2 billion, the company would trade at 0.3x forward sales. Hence, in my view, the company is extremely undervalued by the market.

The Company Trades Very Undervalued Because Of Several Risks

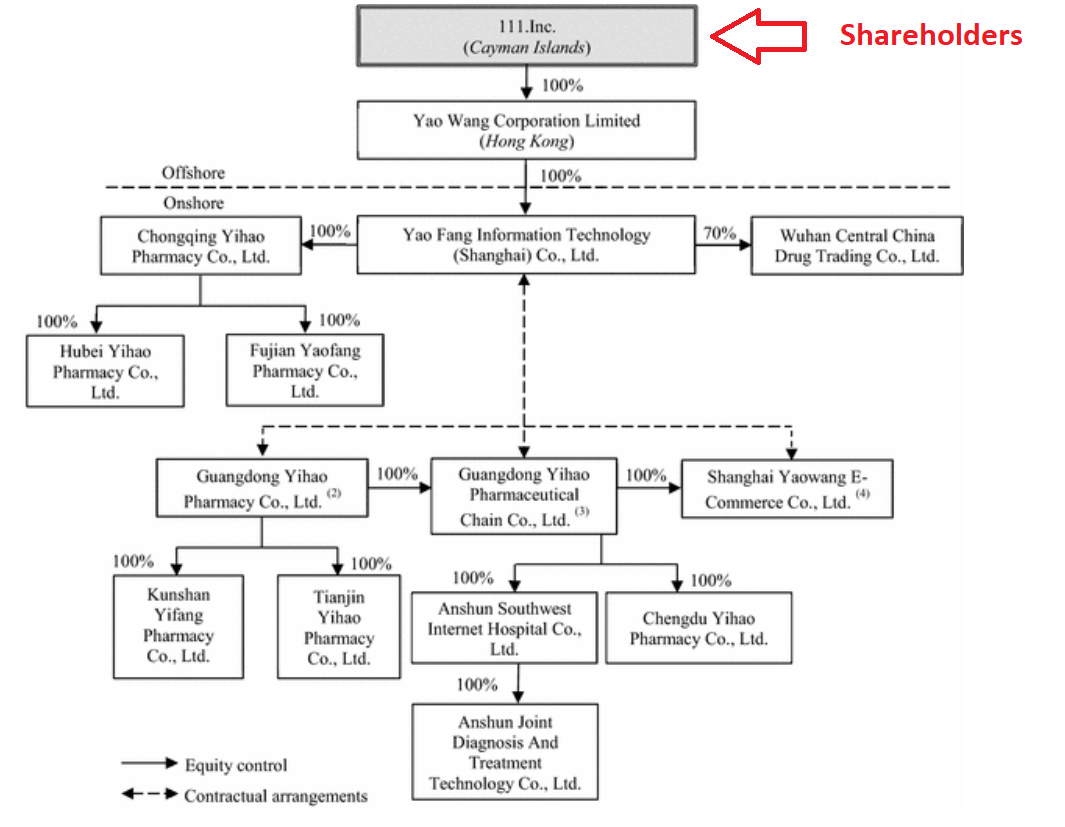

The company is very undervalued as compared to competitors because traders don't want to buy shares. There are several reasons. In my view, the fact that 111, Inc. was incorporated in the Cayman Islands may not be helping the company.

Source: Annual Report

Company law in Cayman is very different from that in the United States. Securities law is also very different. Hence, protection of shareholders may be limited as compared to Delaware or Nevada. Besides, the company does not operate in the United States and does not have assets there. Thus, judges in the United States may have many problems while enforcing actions against the Board of Directors or the company:

Our corporate affairs are governed by our memorandum and articles of association, the Companies Law (2020 Revision) of the Cayman Islands and the common law of the Cayman Islands. The rights of shareholders to take action against our directors, actions by our minority shareholders and the fiduciary duties of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from the common law of England, the decisions of whose courts are of persuasive authority, but are not binding, on a court in the Cayman Islands. Source: Annual Report

There is another worrying fact. The company has two types of shares, class A and class B. Thanks to this bad corporate governance practice, the founders control more than 90% of the total voting power. This is very bad for minority shareholders. If the management or the Board of Directors does not perform, changing the directors or the CEO may be very difficult.

As of March 31, 2020, our founders, Dr. Gang Yu and Mr. Junling Liu, beneficially own all of our issued and outstanding Class B ordinary shares. These Class B ordinary shares constitute approximately 43.7% of our total outstanding share capital and 92.1% of the aggregate voting power of our total outstanding share capital due to the disparate voting powers associated with our dual-class share structure. Source: Annual Report

Conclusion: Undervalued, But The Risk Is Very Significant

I do very much like the business model of 111, Inc. I also appreciate the sales growth. In my view, the company is extremely cheap at a market capitalization of $492-656 million. With sales of $2 billion and double-digit sales growth, a valuation of $1.5-$2 billion would make much more sense. Having said that, I dislike that the company was incorporated in Cayman. Most investors will not buy shares because of this fact, and they are correct in doing so.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.