The Reason I'm Upgrading Gladstone Investment's Outlook

The warning signals that beeped at the onset of the pandemic are abating.

GAIN's investment portfolio demonstrated resilience in the third quarter.

Despite the sound portfolio, the risk that GAIN will cut its dividend still exists.

GAINL and GAINM are safer alternatives to investing in GAIN common shares.

Investment thesis

Gladstone Investment (GAIN) distributes almost twice as much as it earns, in the form of a monthly dividend. This is not sustainable and the company needs to either cut its dividend by half or double its earnings.

The investment portfolio demonstrated strength in the third quarter. There were limited cash injections, credit amendments, and no new defaults. This creates the necessary footing for GAIN to pivot its revenues up if the portfolio companies resume dividend distributions.

There is no guarantee that portfolio companies will resume paying dividends soon, but the chances are higher in the light of the new vaccine.

The company's preferred stocks are trading on the NYSE under the symbols (GAINL) and (GAINM), providing a safer alternative to common equity.

Business overview

GAIN has traditionally invested 25% of its capital in equity securities. The equity investments are usually paralleled with a larger debt investment in the same company. Below is an excerpt from the company's annual statement.

We expect that our investment portfolio over time will consist of approximately 75% in debt securities and 25% in equity securities, at cost

These investments provide GAIN with an income stream which, as a RIC, the company is required to distribute at least 90% to shareholders.

Revenue

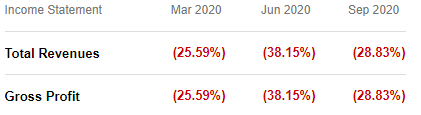

GAIN is one of the worst-performing business development companies "BDC" this year. Revenue was down ~29% in the three months ended September. Below is the YoY change in revenue for the three most recent quarters.

Source: SeekingAlpha.com

One might wrongly assume that the company's financial position is improving because the YoY decline narrowed in Q3; the YoY revenue contraction in Q2 is 38% compared to 29% in Q3.

This assumption is false. The improvement in revenue is a result of technical/accounting "anomaly" that artificially boosted revenue. Below is an excerpt from the Q3 earnings call last week that explains the issue.

Question: Mickey Schleien

I understand Julia. In terms of that pay down we're talking about Mason West, which is a new investment a couple of questions related to that. Can you just walk us through -- you made a new investment in Mason West and they turned around and repaid you very shortly thereafter. How -- what happened there? And is there any fee income, prepayment fee income associated with that that we can expect?

Answer: Julia Ryan

There's no fee income associated with that. This repayment was anticipated at closing. It just took a while to get it all figured out from a legal perspective between when we close the deal and when it is closed.

Answer: Dave Dullum

Mickey, a little more color on that the company did not repay us. We did the deal. And because of the size of the investment again we're in a position to close it. And as you know we do with the majority of the debt and the equity. But that was one where we were looking to bring in a partner to take part of it and that's where the paydown came from another investor coming in, which -- folks we've worked with before and that was what it was not that the company repaid us.

The impact of this "accounting glitch" is $1.3 million in additional "revenue". Excluding this from Q3 earnings puts GAIN's performance in line with the previous quarter, debunking the hypothesis that the performance is improving.

Why hasn't GAIN's revenue improved similar to its peers?

Reasons for the revenue decline

There are several reasons why GAIN revenue declined this year, including lower LIBOR, increase in default, and credit amendments, but the most prevalent is the portfolio companies' suspension of dividends and the absence of success fees.

Last year, GAIN's revenue from its equity investments was $8.9 million in the first three quarters. This year, it is ZERO. All portfolio companies suspended dividends in Q1.

Another reason for the revenue decline is the absence of success fees which are correlated with the sale of investments, which in turn is influenced by the level of economic activity. Since the COVID-19 outbreak, success fees are zero.

GAIN portfolio companies will resume paying dividends when the economic environment improves. Now that the world is closer to rolling out a vaccine, the chances that this will happen soon are higher. Also, improvements in the economic activity will hopefully increase the success fee income.

Risks

Logistic challenges can delay the delivery of a vaccine, prolonging the social distancing measures currently hindering economic growth. Also, there is no guarantee that GAIN's portfolio companies will resume paying dividends or that economic growth will materialize to push the success fees up.

The bullish case for GAIN rests upon one element, which is that economic growth will make portfolio companies comfortable enough to resume paying a dividend, and that success fees will return to normal level before the company is forced to cut its dividends.

Distribution

GAIN kept its distributions to shareholders steady this year, despite all that is happening. Currently, the company is distributing more than it earns. Undistributed earnings from last year helped fund part of this year's dividends.

GAIN pays $0.07 per share monthly dividend. In the six months ending September, the company distributed $17 million, compared to the net interest income of $8.5 million for the period. Net realized capital gain was $1.4 million, which is not enough to cover the deficit.

Status of GAIN portfolio

GAIN portfolio performed better than expected in Q3. There are still some problems with few companies, but overall, the portfolio demonstrated resilience.

Phoenix Door Systems, a manufacturer of commercial doors, and Edge Adhesives Holdings, a manufacturer of industrial tapes and sealants continued to tap their credit lines provided by GAIN during Q3.

GAIN continued to provide some accommodations to its portfolio companies. For example, it extended the maturity date of SOG Knives from December 2020 to December 2023 and made a few amendments on the covenants of its loan to PSI Molded Plastics "PSI".

PSI also received a fresh cash injection in Q3 in the form of equity interest.

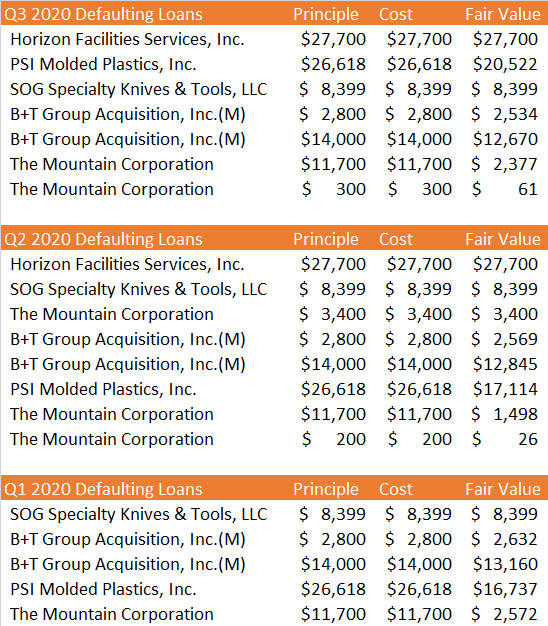

Defaulting Loans

GAIN did not add any new company to the defaulting list in Q3. This is an improvement from Q2, which saw the value of defaulting loans increase by 50% because of the addition of Horizon Facilities Services, also known as Managed Labor Solutions "MLS" to the default list, along with two additional loans from The Mountain Corporation, an apparel company.

Below is a list of defaulting loans since the start of the year.

Source: Table created by the author. Data sourced from company financial statement.

Leverage and expenses

In the three months ending September 2020, GAIN paid $3.2 million in interest and mandatory distribution on redeemable preferred stock; GAINM and GAINL. The company paid an additional $3 million for base management fees. After deducting all expenses, what is left from the original $11.8 million revenue is a mere $4.4 million.

Management

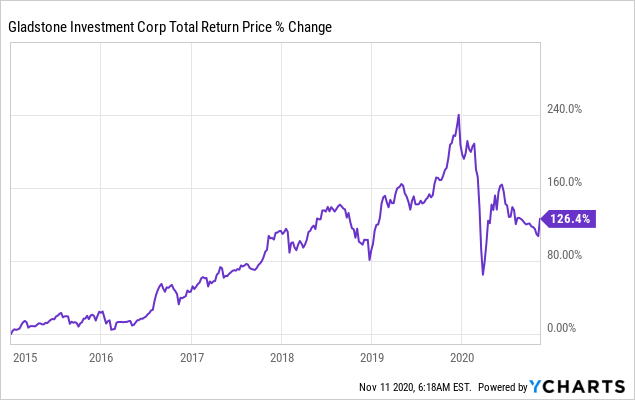

Julia Ryan delivered exceptional returns to investors since she assumed her position as the CFO in 2015.

David Gladstone, 78, has been scaling back his participation in the company's earnings call for some time now.

Data by YCharts

Data by YCharts

Summary

GAIN's portfolio demonstrated resilience in Q3, providing a solid vantage for revenues to pivot upwards once portfolio companies resume paying dividends.

Cash injections, investment add-ons, credit amendments were limited to a few portfolio companies, demonstrating portfolio strength.

Risks regarding the timing of the recovery of GAIN's revenue might lead the company to cut its dividends, sending the stock lower. GAINL and GAINM provide safer alternatives to investors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.