British Land: Don't Take The Dividend For Granted

Developer British Land has had a historically attractive yield.

However, it suspended payment during COVID-19 and has now introduced a new dividend policy.

Below I look at why the new policy could mean less consistency in the dividend and quite possibly future cuts.

British developer British Land (OTCPK:BTLCY) reacted very positively to news of the Pfizer and BioNTech test results. Even so, it still offers a decent 3.3% yield at current share prices. But for the cancellation of its final dividend in March, that yield would be a very juicy 6.7%.

However, it is worth noting that the company’s historic dividend payouts are not necessarily indicative of future payouts. I explain this in detail below.

British Land’s Dividend Policy Has Changed

One of the attractions of the company has been its dividend, but that has been shown to be somewhat wanting during the pandemic.

The company had been growing its dividend by around 3% annually in recent years, which while not that exciting is alright.

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

Total dividend (P) | 26 | 26 | 26.1 | 26.4 | 27 | 27.68 | 28.36 | 29.2 | 30.08 | 31 | 15.97 |

Dividend growth | 0% | 0% | 1% | 2% | 3% | 2% | 3% | 3% | 3% | -48% |

Table calculated by the author using data from company annual reports and results releases

However, with the onset of the pandemic, the company suspended its dividend post haste in March. That payout, which would have been made in May, looks set to have gone forever and won’t be paid in arrears as an additional interim dividend, for example. For investors who saw British Land as staid but reliable with a good yield, that would have been disappointing.

The company announced last month that it planned to resume dividend payments in November. Henceforth they are to be biennial rather than quarterly. The plan is to pay them at a rate of eighty per cent of underlying earnings per share.

That equates to quite a meaningful shift in dividend policy. It is only now being introduced, so does not have any bearing on historical dividends. However, to understand what it would mean in practice versus the company’s current payout policy, I have looked back at the past ten years’ worth of British Land underlying earnings and dividend data. By my calculations, only in one of those years (2017) would the new policy have led to a higher payout than was actually made. Much more alarmingly, in nine of the ten years, the dividend which was paid was higher than would have been the case had the new policy been in place.

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

Total dividend (P) | 26 | 26 | 26.1 | 26.4 | 27 | 27.68 | 28.36 | 29.2 | 30.08 | 31 | 15.97 |

Underlying EPS (P) | 28.4 | 28.5 | 29.7 | 30.3 | 29.4 | 30.6 | 34.1 | 37.8 | 37.4 | 34.9 | 32.7 |

80% of underlying EPS (P) | 22.7 | 22.8 | 23.8 | 24.2 | 23.5 | 24.5 | 27.3 | 30.2 | 29.9 | 27.9 | 26.2 |

Variation vs. dividend (P) | -3.3 | -3.2 | -2.3 | -2.2 | -3.5 | -3.2 | -1.1 | 1.0 | -0.2 | -3.1 | 10.2 |

Table calculated by the author using data from company annual reports and results releases

That may be a good thing for the company if it is able to put more cash to work in a profitable way. From the perspective of a dividend seeking investor in the company, however, there are a couple of things to note here.

First, the trend of the past decade – a low single digit increase each year – is unlikely to subsist.

Secondly, the dividend could be cut in any given year, or indeed half year as the company said that the basis of calculation for the 80% will be on the most recent six month period. Depending on how rigorously the new policy is applied, it stands to reason that in any year when underlying EPS falls, the dividend would fall correspondingly. This also is more than a theoretical possibility. Looking at the past decade, for example, the underlying EPS fell in 2014. It then fell again in 2018, 2019 and again in 2020. So, underlying EPS clearly can fall in any given year for British Land, based on recent history, and under the new dividend policy, that would apparently lead to a dividend cut.

In practice, the board may decide to smooth the edges when implementing the dividend policy, so for example a relatively minor fall in underlying EPS could lead to a dividend being maintained rather than cut. But that is mere speculation on my part: for now, as the policy is articulated, British Land dividends are set to be less smooth than investors have been used to, and also look likely to fall relative to the historic payout ratio of the past ten years.

The Dividends Will Also be Affected by the Underlying Business

The above analysis holds true whatever happens to the property market. But it is also worth noting that British Land’s underlying EPS may well be volatile in coming years – affecting the dividend – because of the underlying health of its business.

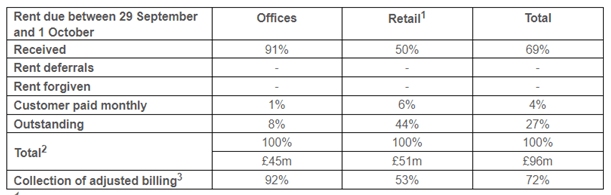

The shape and timing of recovery in the U.K. retail and office spaces remains to be seen, which matters a lot for British Land’s earnings given its exposure. As of 9 October, only 50% of September rent for retail had been collected – and even stretching back to the rent due for June, only 57% had been collected. Office collection rates have been much higher, at 91% for September, such that the total rent collection for September as at 9 October stood at 69%. The total rate for June at that date was 74%, meaning a quarter of all rent due hadn’t been collected over three months later.

The company hasn’t written these payments off, so could still collect it in theory.

Source: company trading statement (footnotes removed)

However, retailers have increasingly gone into administration and the company has already forecast a £11.6m reduction in annualised rents based on 16 of its occupiers who are operating under agreed terms on company voluntary agreements or administration, accounting for 80 units in British Land properties.

There are also signs of pressure on rent levels. The company noted that leases which have been signed between April and August for periods over 1 year were on average 11% below previous passing rent and 9% below ERV.

All of this adds up to a challenging business environment set to continue for the foreseeable future. That will feed directly into British Land’s profitability – which in turn will feed into the dividend level.

Conclusion: Lots to Like But Beware the Dividend

There remains a lot of attraction to British Land for an investor, but in this article I have sought simply to focus on what I see as potentially significant shifts likely in the company’s dividend attractiveness. If taking a position in British Land, be sure to consider the likely future dividend payout structure not just the dividend history.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.