Perrigo: Undervalued Transformation Deserves A Closer Look

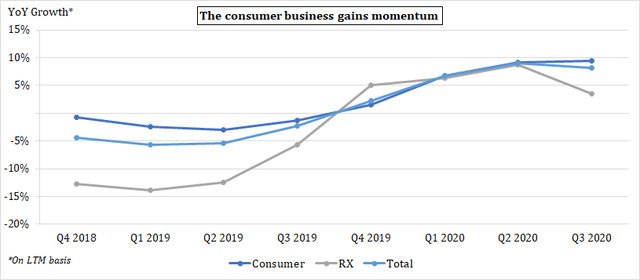

In its journey to become a consumer-led player, Perrigo has already achieved its long-term sales targets well ahead of the schedule.

Partly helped by pandemic-driven changes to consumer habits, the highly profitable consumer business is boosting its contribution to the top-line.

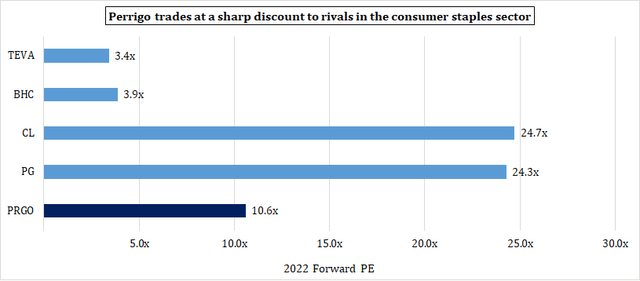

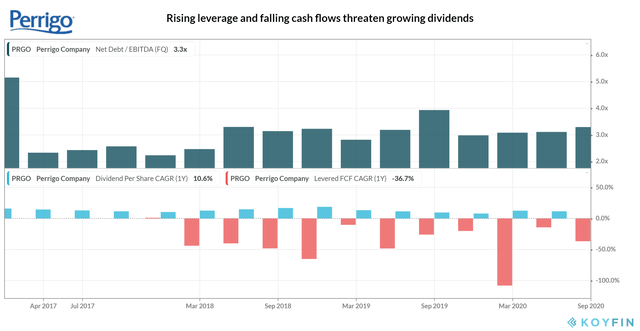

Yet, the company continues to trade at a sharp discount to the sector leaders as rising leverage and falling free cashflows threaten the dividend safety.

However, the investment-grade credit ratings and improving operating cashflows alleviate the liquidity concerns.

Along with consensus earnings, even a partial lift to forward PE in line with historicals indicate a premium, unveiling a long-term ‘Buy’ as the pandemic turbocharges the consumer-driven growth.

Investment Thesis

As its recent acquisitions indicate, Perrigo Company plc (PRGO) is successfully transforming into a consumer self-care player. Even at the halfway mark of the journey, the company has already surpassed its long-term target of organic sales growth. Accelerated by the pandemic-induced changes to shopping behavior, the revenue contribution from the consumer segment is rising along with its profitability. The market leader in private-label brands is likely to enjoy a lasting post-pandemic benefit to the top-line as consumer habits remain sticky.

The shareholder returns are increasing, so is gearing threatening the durability of rising shareholder returns as free cashflows shrink. But the consumer shift is driving the operating cash flow higher, and with an unchanged investment-grade credit rating, the company can easily tap into debt markets. Trading at a sharp discount to the peers in the consumer sector, 2022 forward PE even with a modest lift in line with historical average unveils compelling ‘Buy’ assuming the consensus per-share earnings for the year. As the repositioning from healthcare to consumer self-care powers the trading multiples, Perrigo is a ‘Buy’ for the long-term investor.

Source: 38th Annual J.P. Morgan Healthcare Conference

Source: 38th Annual J.P. Morgan Healthcare Conference

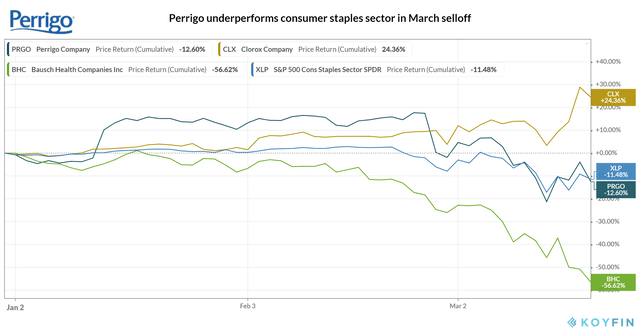

Pandemic-Driven Demand Fails To Impress Investors

The pandemic became a boon for consumer self-care companies when the lockdown fears prompted a stockpiling frenzy earlier this year. With revenue growth accelerating, as a result, the stocks such as The Clorox Company (CLX), The Procter & Gamble Company (PG), and Colgate-Palmolive Company (CL) fared better than the broader market during the March selloff. Riding on the wave, Perrigo, with a consumer division accounting for more than three-quarters of net sales globally, saw its organic sales growth reaching ~9.9% (without forex changes) in Q1 2020 (first quarter of 2020) from a year ago. Yet in the March selloff, the stock continued to underperform the wider consumer staples sector, as illustrated in the graph.

Source: Koyfin

Source: Koyfin

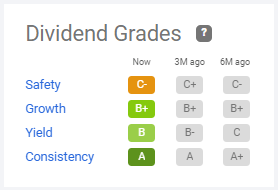

Few concerns are likely to have unsettled the market sentiment. With debt-fueled acquisitions funding the transformation, the leverage was on the rise, and despite declining free cash flows, the company has kept on raising the per-share dividends. The dividend safety, as measured by Seeking Alpha’s Dividend Grades, has worsened to C- from C+ three months ago.

Source: Seeking Alpha

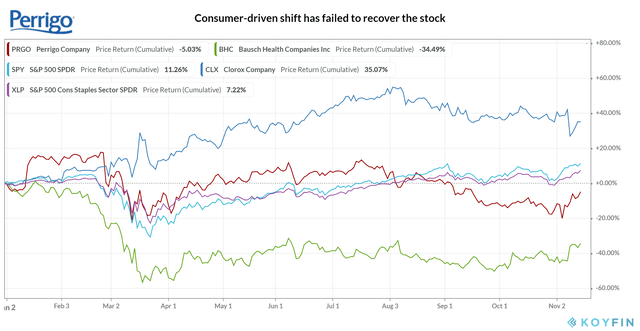

The lawsuits and product recalls have inflicted further damage. In August, the company announced a voluntary recall of albuterol sulfate inhalation aerosol. By then, the fast-acting treatment for wheezing and shortness of breath had netted $23 million of sales for the first half of Q3 2020, equivalent to ~3.8% of sales for the period. And on the day of the latest earnings release, Perrigo’s tax dispute in Ireland took a turn for the worse. When it emerged that the country’s High Court had refused to overturn a revised tax demand of €1.6 billion due from the company, the stock sank ~9.0%. It has risen by ~18.8% since then, well outperforming the ~4.1% gain in the S&P 500 Index, yet with a ~5.0% decline compared to the ~11.0% rise in the S&P 500, year-to-date underperformance persists. Despite the product recall, the company sticks to its revenue guidance issued earlier in the year, and tax dispute will not require an immediate payment as legal dispute drags on, the management insists. Are those reassurances enough to soothe investor concerns as the company repositions itself from healthcare to consumer self-care? Let’s find out.

Source: Koyfin

Source: Koyfin

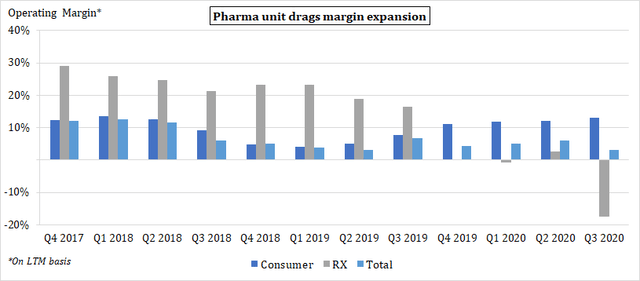

Shift From Healthcare to Selfcare Succeeds

With higher margins compared to the prescription pharmaceuticals (RX), the consumer business looked promising. A new CEO with a background in consumer staples joined in October 2018, and the three-year transformation to a consumer-led brand began in May last year. From ~77.6% of net sales in 2017, the revenue contribution from the worldwide consumer segment has risen to ~80.5% in the LTM (last twelve-month) period. After back-to-back contractions in 2017 and 2018, the 12-month revenue is expanding year-over-year since 2019, partly driven by bolt-on acquisitions, most notably Ranir Global Holdings, LLC, the world’s biggest private-label oral care company acquired in May 2019. After staying flat in 2019, even net organic sales have risen ~3.1% YoY (year-over-year) in Q3 2020 on an LTM basis.

Source: The Author; Data from Company Financials and Latest Earnings Release

Now, the management forecasts ~6.5% YoY growth for 2020 at the midpoint, more than double that in 2019. Barely after the halfway mark of the transformation, the ~3% net organic sales growth target for 2020 is set to once again exceed the long-term target. The pandemic-driven changes to consumer shopping habits have accelerated the drift. According to a survey done by McKinsey & Company and cited in Q3 2020 earnings call, 75% of consumers have tried a new shopping method since the pandemic started, and ~25% have adopted the private-label brands. With ~80% of them indicating to stick to the habit, the changes in shopping behavior are likely to outlast the pandemic to the benefit of the consumer-led brands such as Perrigo. Being the market leader in store brands in the Americas, which account for over half of the net sales, the company has an added advantage over national brands as consumers tend to prefer cheaper store brands amid the ongoing recession.

Yet to Trade on Par with Consumer Brands

However, investors are not convinced. The company currently trades at ~10.6x in terms of 2022 earnings, less than half of the ~24.3 - 24.7x range of peers in the consumer staple sector such as Procter & Gamble and Colgate-Palmolive trade. For the past one-year and three-year period, the forward 12-month PE of Perrigo has averaged 12.5x and 13.2x, respectively. Conservatively, assuming the same given the room for upside as consumer shift takes place, the consensus per-share earnings estimate for 2022 at $4.63 suggests a premium of ~18.0 - 24.6%.

Source: The Author; Data from Seeking Alpha

Source: The Author; Data from Seeking Alpha

Liquidity Concerns Are Overblown

Yet, the debt-heavy balance sheet threatens the continuity of acquisition-led transformation. The leverage in terms of net debt/ EBITDA has ticked up to ~3.3x in Q3 2020 from ~2.3 in 2017. Worse, the levered free cash flow is on the decline, and the company keeps boosting the shareholder returns. For the LTM period, returns of both dividends and share buybacks have jumped ~10.9% from a year ago keeping per-share dividends for the period ~40.6% higher from 2017.

Source: Koyfin

Source: Koyfin

During Q4 2018 - Q3 2019, the operating margins of the consumer segment have risen from mid-single digits to low teens on an LTM basis. As those of the RX unit shrinks and drags down the overall profitability, divestment of the unit makes sense for an immediate cash injection. But given the low multiples of the sector, it’s wise to resist the urge for the moment. The management has instead settled for debt and piecemeal divestments to fund the acquisitions. The sale of animal health business raised ~$185 million in 2019, and UK-based Rosemont Pharmaceuticals, was sold for ~$195 million in May. With credit ratings unchanged at investment grade from 2019, tapping into credit markets will not be costly either: partly due to the debt issuance worth ~$750 million in May, the cash and equivalents have more than doubled from 2019 year-end. From a decline of ~34.6% YoY in 2019 to ~24.9% YoY growth in the last twelve months, the operating cash flows are improving to ease the liquidity concerns as consumer business gains traction.

Source: The Author; Data from Company Financials

Source: The Author; Data from Company Financials

Conclusion

Perrigo is at the halfway mark of its transition to a consumer-focused company. Driven by pandemic-induced shopping behavior, it has already surpassed the long-term organic sales target. When the pandemic ends and the economic slowdown begins, the market leader in store brands is likely to dominate the budget-conscious shopping when new-found shopping habits remain sticky. The acquisition-led transformation has driven the gearing higher, but with investment-grade credit ratings and rising operating cashflows, there are no immediate threats to liquidity. Trading at a sharp discount to market leaders in consumer staples, even a modest lift to 2022 forward PE in line with historical average indicates a premium, unveiling a buying opportunity for long-term gains.

If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.