A cash balance has many uses in a portfolio.

Cash is exposed to inflation risk far more than any other asset class.

Short-term investment-grade bond funds provide a good cash equivalent with low exposure to credit and inflation risks.

We will have a look in this report at the best options to park your cash to protect yourself against inflation and get a little yield too.

Co-produced with PendragonY

Introduction

Just under a year ago, we wrote an article about how to address the competing priorities of having a significant amount of cash on hand while not taking a big hit to income and inflation. On the one hand, it's nice to have cash ready to pay both expected and unexpected expenses, and even to take advantage of a price drop opportunity in a company you want to own. It's also good to have the cash already available so one doesn't have to sell shares at a time when the prices are low. So we looked at several funds that, while not exactly cash, could have similar benefits as cash while not being reduced by inflation.

One will want to keep some actual cash on hand, but as a cash equivalent, we want funds holding short-term bonds or bonds with only a short time remaining until they mature. The short amount of time remaining to maturity will help reduce interest rate risks. This is because the fund will buy new bonds, which have a higher rate, by redeeming older, lower-rate bonds at par, rather than selling them on the market at a price below par.

As a test, we invested $180,000 into each of four ETF funds approximately five years ago and then made 20 quarterly withdrawals that were inflation-adjusted starting at $9,000. A fund passed the test if money remained in the fund account after all the withdrawals, and we compared the ending values. We used inflation-adjusted withdrawals to see if the ETF was able to beat inflation or not.

As a test, we invested $180,000 into each of four ETF funds approximately five years ago and then made 20 quarterly withdrawals that were inflation-adjusted starting at $9,000. A fund passed the test if money remained in the fund account after all the withdrawals, and we compared the ending values. We used inflation-adjusted withdrawals to see if the ETF was able to beat inflation or not.

MINT ETF

The first fund we looked at was the actively managed fund PIMCO Enhanced Short Maturity Active ETF (MINT) which now has a yield of 1.45%. Originally we looked at a five-year period that started on Nov. 1, 2014. We will now look at a period that starts Oct. 1, 2015 (so we again have a period where there are 20 quarters). So how much of the original $180,000 survives after 20 withdrawals?

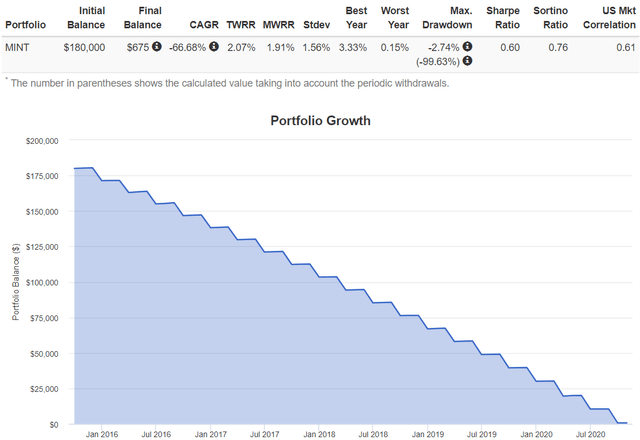

Source: Portfolio Visualizer

As per the assumptions above, we started in October of 2015 with $180,000 worth of MINT. Beginning in December of 2015, and at the start of each subsequent quarter, $9,000 (adjusted for inflation) was withdrawn. The test ended on Oct. 31, 2020. With $675 left, MINT passes the test and did better than in our original test, where MINT had $537 left over. So once again, an investment in MINT provided full protection from inflation.

MINT is an actively-managed ETF that benchmarks the performance of its portfolio against the FTSE 3-Month Treasury Bill Index. By investing in dollar-denominated short-term investment-grade bonds and similar securities issued by both private and public entities, the fund holds exactly the type of investments we want.

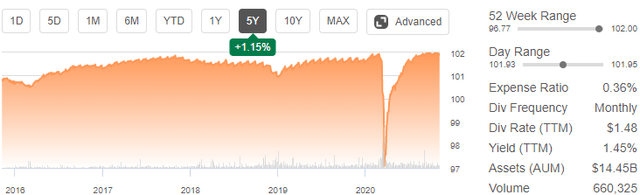

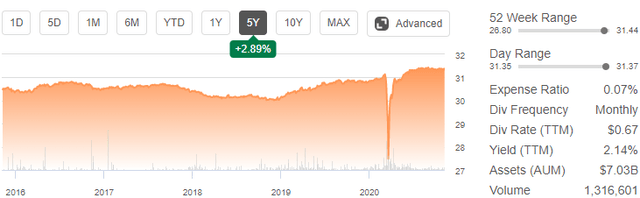

Source: Seeking Alpha MINT

We can see the big dip in share price in March due to COVID-19. As it happens the timing of withdrawals in our test resulted in little impact from this price drop. But one might want to delay an extra payment or two in actual cash to ensure that a longer-lived price impact didn't require selling at low prices.

More ETFs

In the original article we wanted to look at more ETFs that invest in short maturity bonds, and found the following three that did well in total return:

- iShares 0-5 Year Investment Grade Corp Bond ETF (SLQD) - Yield 2.48%.

- SPDR Portfolio Short Term Corp Bond ETF (SPSB) - Yield 2.14%

- Invesco Ultra Short Duration ETF (GSY) - Yield 1.76%

One note is that all four funds we looked at in the original article now have a lower yield than previous. As interest rates have declined this year, this is to be expected.

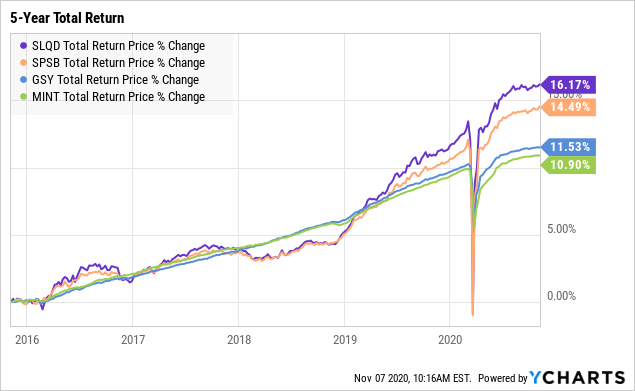

Data by YCharts

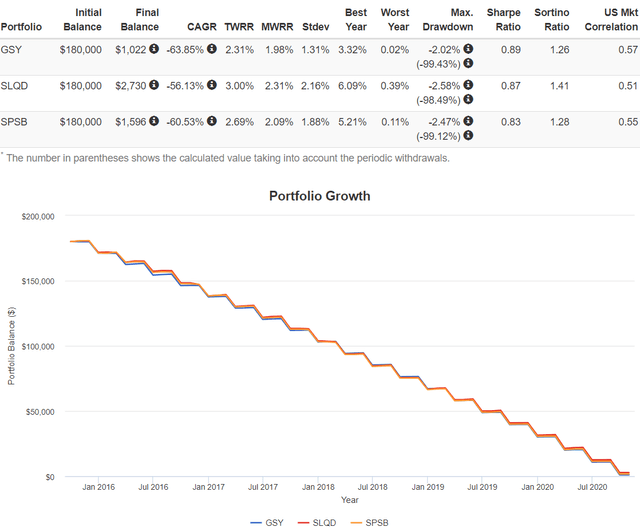

Data by YChartsUsing the same backtest we just ran on MINT, we see that these three funds - SQLD, SPSB and GSY - left even more money after the 20 withdrawals – just like they did in the backtest from the original article.

Source: Portfolio Visualizer

Starting with a purchase of $180,000 and withdrawing $9,000 (inflation-adjusted) per quarter over 20 quarters (or five years), investors would have remaining cash of:

- $2,730 in SLQD

- $1,596 in SPSB

- $1,022 in GSY

Even with the March crash, an investor will get full protection against the impact of inflation, plus some money left over, investing in these ETFs.

More about SLQD, SPSB and GSY

Pick #1: SLQD

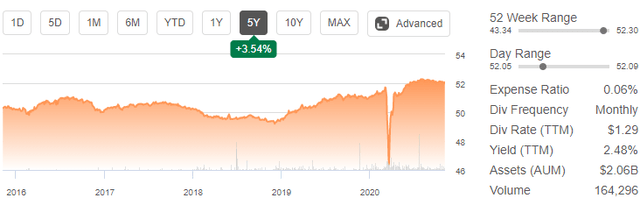

SLQD had both the highest total return and the highest remaining cash from the five-year backtest period. Using a representative sampling method, the fund invests in the U.S. dollar-denominated investment-grade corporate debt with maturities less than five years seeking to match the performance of the Markit iBoxx USD Liquid Investment Grade 0-5 Index. This is another fund that invests in short maturity bonds that we see as providing protection against both credit risk and inflation. The current yield is 2.48%.

Source: Seeking Alpha SLQD

Pick #2: SPSB

SPSB came in second place in both the total return and remaining cash from the backtest. The fund also uses the representative sampling method to track the performance of the Bloomberg Barclays U.S. 1-3 Year Corporate Bond. SPSB invests in corporate bonds with a remaining duration of more than one year but less than three years. Again, exactly the type of securities we want to protect us from both credit risk and inflation. The current yield is 2.14%.

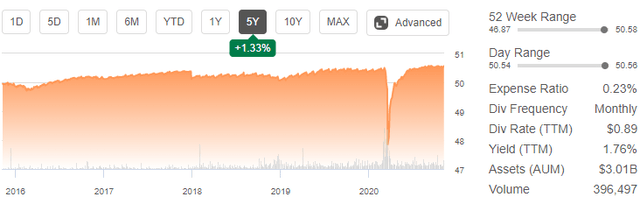

Source: Seeking Alpha SPSB

Pick #3: GSY

GSY came in a respectable third place. GSY is different than the other funds because it doesn't just buy debt securities, but also includes shares of other funds that buy similar investments. The fund tracks its performance against the ICE BofAML US Treasury Index and the Bloomberg Barclays 1-3 Month Treasury Bill Index. This short-term bond focus is what we are looking for to protect us against credit risk and inflation. The current yield is 1.76%.

Source: Seeking Alpha GSY

Lessons Learned From COVID-19

Back in March, many markets crashed quite dramatically. Normally low volatility bonds and preferred shares were hit pretty hard. Our four funds, MINT, SLQD, SPSB and GSY, were no exception. As it happened the timing of our withdrawals was opportunistic in that the funds recovered quickly and we didn't have to sell at low prices. But that was mostly luck. Going forward it's prudent to keep enough cash on hand to pay for six months or so of expenses, in order to avoid withdrawals at inopportune times. The six months of cash will allow an investor time for the funds to recover. Once they do, then the cash buffer can be refilled.

Final Thoughts

Investors have many reasons for wanting to keep a significant amount of cash in their investment accounts. This cash balance can free you from worry about the timing of dividend payments and it can be available for unexpected events. Using these ETFs gives you some of the benefits of cash while reducing your exposure to the ravages of inflation.

All four of these funds work well as a cash equivalent. They are a good way to protect the money you will need fairly soon from inflation. They can play an important role, along with actual cash in managing cash flow from your portfolio.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

High Dividend Opportunities, #1 in Dividend Stocks

HDO is the largest and most exciting community of income investors and retirees with over 4,400 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting +9% yield, our bond and preferred stock portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Preferred Stock Trader all are supporting contributors for High Dividend Opportunities.