iShares PHLX SOX Semiconductor Sector Index ETF: Soaring Above The Storm Clouds

Pent-up demand has been released during the acceleration of trends during the covid-19 wave.

IT infrastructure has accelerated the spread of demand for increased semis.

The 5G boom is the next wave to ride for investors.

In investing, what is comfortable is rarely profitable.

- Robert Arnott

The iShares PHLX SOX Semiconductor Sector Index ETF (SOXX) invests in the public equity markets of the United States. The fund invests in stocks of companies operating across information technology, semiconductors, and semiconductor equipment sectors, and it seeks to track the performance of the PHLX Semiconductor Sector Index.

The fund generally invests at least 90% of its assets in securities of the underlying index and depository receipts representing the underlying index's securities. The underlying index measures the performance of US-traded securities of companies engaged in the semiconductor business.

The PHLX Semiconductor Sector Index is a capitalization-weighted index composed of 30 semiconductor companies. The companies in the Index have primary business operations that involve the design, distribution, manufacture, and sale of semiconductors. The index is designed to track the performance of listed semiconductors.

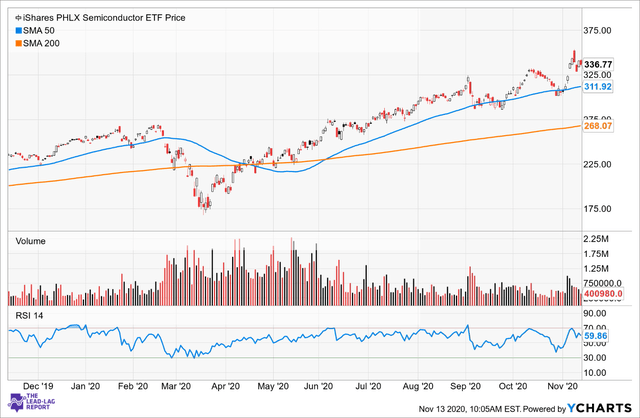

February and March 2020 saw the expected decline of the fund's price, in line with the rest of the market, as the global economic recession started. We had the coronavirus pandemic to thank for that, as businesses had to shut down and life came to a grinding halt. During this time, the fund's price reached a low of $176.66 in March 2020. However, the price then saw a healthy recovery, soaring beyond its previous high to reach a new high, and is currently above the $340 level.

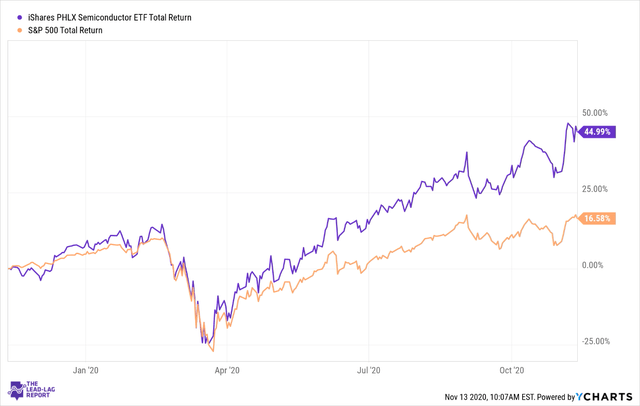

The comparison chart of the fund's total return compared to the S&P 500's total return tells an exciting story. The total return was almost wholly in line with the rest of the market, especially during the March crash. However, the fund pulled away from the rest of the market, registering an impressive total return of almost 45% compared to the S&P 500's total return of just under 17%. A study of the underlying reasons behind this builds a case for investing in SOXX.

Holdings Breakdown

The fund has invested in the 30 companies that make up the Index it is meant to track. However, it is skewed towards the chip business's most prominent players, with the top 10 making up 60.05% of its portfolio. Based on the most recent quarterly results available for the third quarter, two-thirds of the fund's 30 companies showed increases in revenue for their most recently reported quarter from a year earlier, which led to a boost in their price.

Looking to the future, Qualcomm (QCOM) and Intel (INTC) are exceptionally well-placed to see the catalytic demand for 5G smartphones and infrastructure that will be placed on them. Apple (AAPL) iPhones, for example, will see themselves being powered by Qualcomm's modem chips.

Chip stocks have shown strong resilience amid the coronavirus pandemic on the stay-at-home trend, which has bolstered the demand for gaming chips and data center business. Online activities - both essential and non-essential - have increased, which has increased the demand for smartphones, tablets, and laptop computers as more people work from home and more children gain their education remotely.

The pandemic has also resulted in the speeding up of IT infrastructure by businesses, governments, and healthcare systems to meet remote work demands. This also has led to increased demand for cloud services, data centers, and the servers required to run such services - resulting in another factor that has led to increased demand in computer chips.

The rapid adoption of cloud, Internet of Things (IoT), autonomous cars, gaming, wearables, virtual reality devices, drones, artificial intelligence, cryptocurrencies, 5G, and other advanced information technologies will continue to fuel growth for ever more powerful computer chips and semiconductors.

The sector has also seen a release of demand pent-up during the pandemic as logistical supply chains either slowed or stopped to meet the more immediate needs of public health supplies. This has been seen primarily in China, where demand for chip-based products has rebounded post the coronavirus lockdown. If China is a guide, we can further expect a similar revival in most other global economies once the pandemic is behind us.

The 5G boom seen globally has also been a boon for chip demand on two fronts, first in the form of the 5G infrastructure that has to be laid out for the public, and second, the need for 5G capable devices that can handle those extraordinary speeds. By the end of 2020, 5G handset sales (15-20 million units) should make up about 1% of total smartphone sales. In this, too, we have seen China taking on a leading role and leading to high demand for chips.

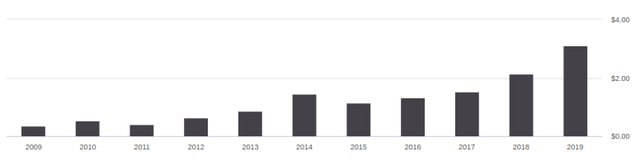

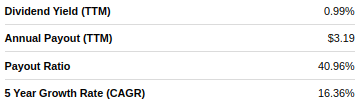

SOXX's dividend has been performing well, showing an overall upward trend, with the only decline coming in 2015.

The fund shows a low dividend yield of 0.99%, which is lower than the market standard of 2%, but this isn't because of the low dividend payout. A fund unit's price has shown a steep incline recently, which has demonstrated its effect on the yield. The dividend payout is a healthy amount and not to be ignored by investors. This, plus the healthy compounded annual growth rate of the dividend, indicates that future dividends may be better still.

Risks

With their application in commercially and militarily sensitive technologies, computer chips have emerged as the new battlefield for the war between China and the US over technological supremacy globally. With sanctions and embargoes being placed by the US on Chinese entities, a new layer of uncertainty for the industry is apparent.

Other risks include general market risks and heightened volatility in the sector, especially as new competition comes to market. Apple recently ditched Intel for its Mac computer processors, instead relying on its in-house development. Whether or not the company increases output and takes some market share down the road is a question and risk to be aware of.

Investor Takeaways

The growth trend is overwhelmingly on the industry's side. With the advent of 5G technologies, remote working, and the Internet of Things, we can only see the demand for high-performance computer chips increasing and the sector reaching new heights. Therefore, even with the price increase, the fund is cheap compared to the future prices it should go to. The opportunity is there for the taking.

*Like this article? Don't forget to click the "Follow" button above!

Anticipate Stock Crashes, Corrections, and Bear Markets

Anticipate Stock Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.