Gilead Sciences: Back In The Growth Game

Gilead Sciences has seen the stock fall to multi-year lows as the Remdesivir excitement disappears.

Acquisition of Immunomedics adds to the growth profile of the biopharma.

The stock has a consistent earnings stream in the $6.50 range with upside potential from the HIV franchise and Trodelvy going forward.

Despite having a successful treatment for COVID-19, Gilead Sciences (GILD) trades at multi-year lows due to high spending and reduced patient starts in more traditional drug therapies. My investment thesis was more negative on the stock towards $80 as the Remdesivir benefits were always short term. Gilead Sciences is now a bargain at $60 as the biopharma gets back in the growth game.

Image Source: Gilead Sciences website

Remdesivir Impact

When the stock was elevated due to the potential for a COVID-19 treatment, my previous warnings surrounded the disconnects due to the increased spending and limited long-term revenue benefits. The market likes simple growth stories, and Remdesivir made the story more complex to understand.

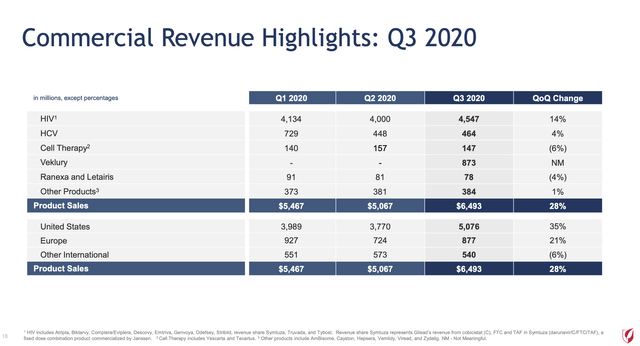

The prime example is the Q3 results. Gilead Sciences reported Remdesivir (Veklury) sales hit $873 million, pushing total product sales up 18% for the quarter to $6.5 billion. The problem is that ex-Remdesivir sales only grew 2% due to slower patient starts and likely a corporate focus on the virus treatment.

The investment story even gets more murky when attempting to view the earnings picture due to the higher level of spending this year. These numbers are even more complicated by the acquisition of Immunomedics going forward.

For Q3, Gilead Sciences increased R&D spending by $127 million YoY while SG&A expenses were up $50 million or 5%. The amounts are troubling since the biopharma was required to pause or postpone some clinical trials due to COVID-19 while chasing the short-term treatment.

Due to the higher Remdesivir sales, Gilead Sciences was able to boost EPS to $2.11 in the quarter, up from $1.11 in the prior quarter. The average EPS in the last two quarters was only $1.61 or very similar to the original expectations, as the disruption of drug sales and higher expenses offset the boosted sales for Remdesivir.

With the Pfizer (PFE) vaccine showing 90%+ efficacy, the Remdesivir treatment appears to have limited sales potential much past the spring as vaccines are quickly distributed to the vulnerable class needing the COVID-19 treatment from Gilead Sciences. In those regards, the market probably doesn't like how the biopharma had turned primarily into an HIV company. HIV drug sales accounted for nearly 81% of sales ex-Veklury and the stock will start facing headwinds from the virus treatment sales disappearing.

Source: Gilead Sciences Q3'20 presentation

Going Forward

Whether good or bad, the HCV franchise has about dipped to irrelevance. Going forward, Gilead Sciences will trade based on the HIV drug franchise, Cell Therapy drugs along with Trodelvy acquired via Immunomedics. The declining HCV franchise will have little impact on the financials going forward as a rebound in patient starts could provide a revenue bounce.

Analysts had Immunomedics revenues targeted to rise from $314 million in 2021 to about $1.2 billion by 2023. If the drug ramp goes as expected, and the start was exceptional with Q3 sales at $53 million, each year beyond 2023 would add another $500 million to the revenue totals to reach total sales around $4.0 billion by the end of the decade. These revenues add to the existing Gilead Sciences business at ~$24 billion.

Where the stock gets interesting here around $60 is that Gilead Sciences had a solid $6.50 per share earnings stream before COVID-19. The Immunomedics deal isn't accretive until 2023, but the biopharma now has a clear path to growth after struggling for years with the disappearance of the HCV business.

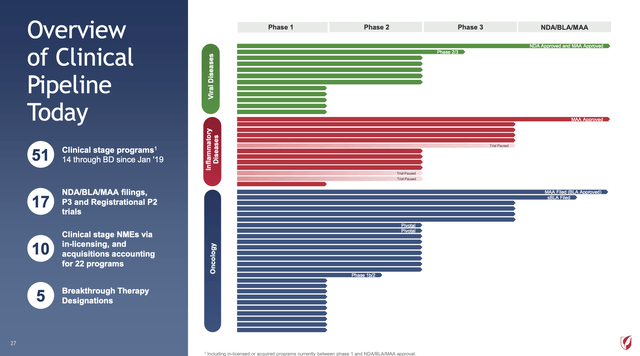

Considering the deal was for ~$21 billion in cash at low-cost debt and cash on hand, the financial impact is very limited outside of the debt load increase. The upside to the stock comes from the additional revenue growth that will build momentum in the business along with a strong existing drug pipeline.

Source: Gilead Sciences Q3'20 presentation

Source: Gilead Sciences Q3'20 presentation

Anytime an investor can grab a drug stock trading below 10x existing earnings with momentum in their drug business, one should look to acquire shares.

Takeaway

The key investor takeaway is that Gilead Sciences is finally back in the growth game. The top drug prospects of Biktarvy and Trodelvy are under patent exclusivity for years now and the overall business is back in growth mode with the HCV franchise effectively irrelevant to the business going forward. The stock trades at only 9x EPS estimates with upside potential going forward as Trodelvy ramps.

If you'd like to learn more about how to best position yourself in undervalued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GILD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.