Laurentian Bank: A 5.5% Dividend Yield While Trading At Just 9X Earnings

Laurentian Bank reduced its loan loss provision in Q3, resulting in a strong EPS and dividend coverage.

The 5.5% dividend yield is still attractive and the low payout ratio means the bank can continue to build its CET1 capital.

Almost half of the loan book consists of residential mortgages, of which the majority is insured. The visibility of the interest income should help Laurentian Bank.

I think the dividend is safe and could be hiked from next year on - if the loan loss provisions stabilize at the current levels.

Introduction

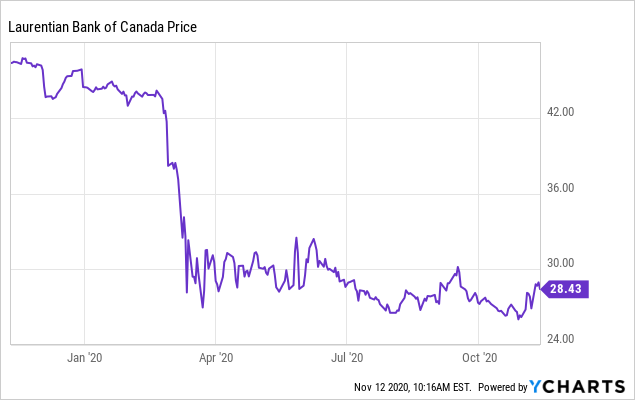

As it has been almost half a year since I had a closer look at Laurentian Bank (OTCPK:LRCDF) when the bank decided to cut its dividend, I wanted to check up on how the small Canadian bank performed in the two subsequent quarters. Most of the banks in Western countries have seen the loan loss provisions decrease as the fallout of the COVID-19 pandemic wasn’t as bad as most feared.

Data by YCharts

Data by YChartsThe Q3 results were very encouraging

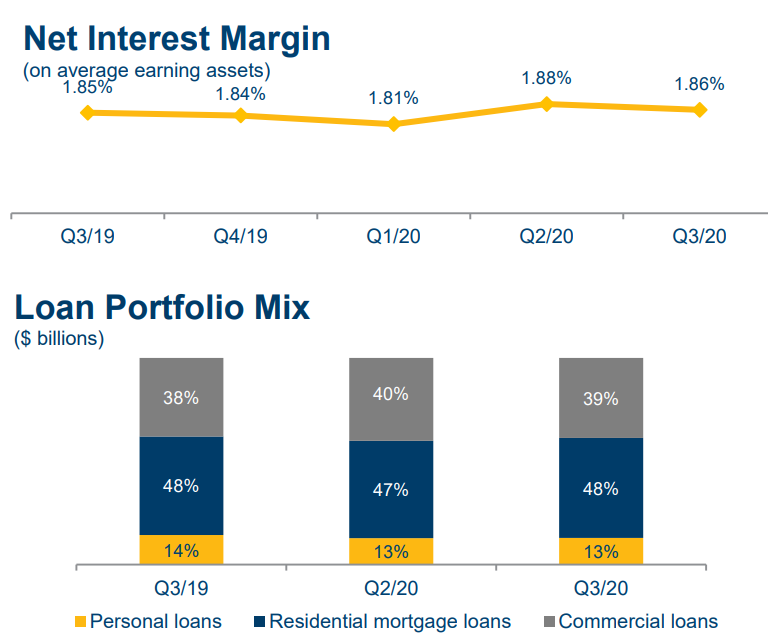

In the third quarter of this year, Laurentian Bank still faced substantial pressure on its interest income, but the bank actually performed pretty well. Yes, the interest income decreased by just over C$16M compared to Q2 2020 and is down C$46M compared to Q3 FY 2019, but the interest expenses decreased by respectively C$19M and C$43M in the same periods. This resulted in an increase of the net interest income on a QoQ basis, while the net interest decrease compared to Q3 2019 remained very manageable as a 2% reduction is better than expected.

Source: financial statements

As you can see in the image above, the net interest income in the first nine months of the financial year remained unchanged compared to 9M 2019, and that’s a good result. Surprisingly, and unlike US-based banks, the strong net interest income was not fueled by an expanded loan book. In fact, the balance sheet has shrunk a little bit compared to FY 2019: The total size of the balance sheet decreased from C$44.35B to C$44.3B while the equity portion increased by C$15M. So the strong net interest income is actually caused by relatively stable net interest margins and not by expanding the loan book.

The bank also recorded a non-interest income of C$75M and a non-interest expense of almost C$184M (including a C$11M restructuring charge) in the third quarter and this resulted in a pre-tax and pre-loan loss provision income of C$64.5M, almost 15% higher than in Q2 2020 and roughly in line with the Q3 2019 result, despite the high restructuring charge. Excluding that element, the pre-tax and pre-loan loss provision in Q3 2020 would have been higher than in the same quarter last year.

Source: financial statements

Laurentian recorded a C$22.3M loan loss provision, which is almost twice as high as in Q3 2019 but substantially lower than the almost C$55M recorded in Q2 2020. The net income in Q3 came in at C$36.2M of which C$3.2M was paid to the preferred shareholders leaving C$33M on the table for Laurentian’s common shareholders. This represents an EPS of C$0.77 and this means the dividend of C$0.40 per quarter is fully covered.

In the first nine months of the year, net income reached C$68M after taking the preferred dividends into account and despite the almost C$100M in loan loss provisions, the new (lower) dividend of C$0.40 remains fully covered as well.

Source: company presentation

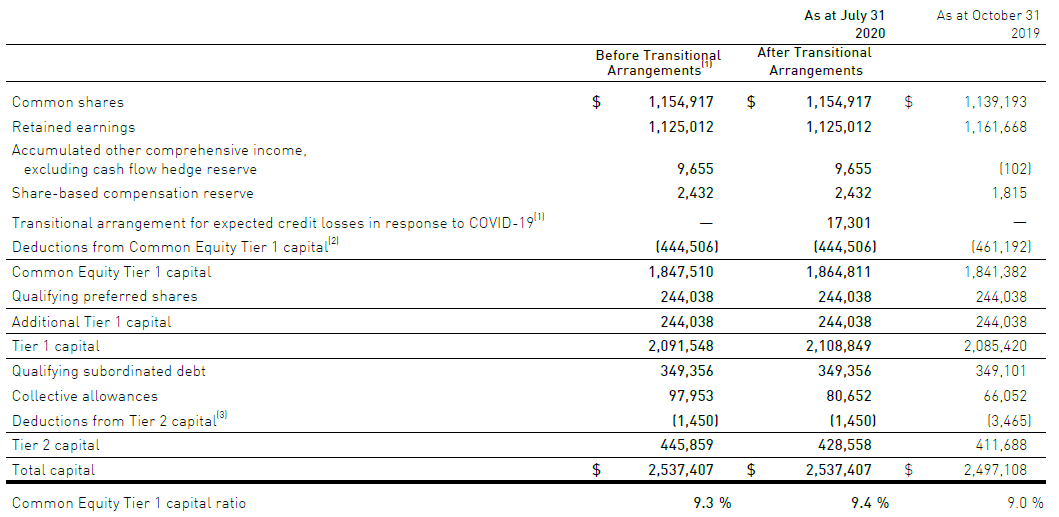

The capital position remains strong

As mentioned in the previous section of this article, the net interest income remained stable thanks to the stable margins and the balance sheet did not expand since the end of last year. And despite recording C$92.1M in loan loss provisions, the equity value on the balance sheet has actually increased. The book value per share is almost C$54 while the tangible book value per share is approximately C$42.5/share. Trading at around 0.7X tangible book value makes Laurentian relatively interesting.

The higher equity portion of the balance sheet helped to increase the CET1 capital: Whereas the CET1 capital reached C$1.84B as of the end of FY 2019, this has now increased to almost C$1.85B. This, in combination with a slightly lower total of Risk-Weighted assets boosted the CET ratio from 9.0% as of the end of FY 2019 to 9.3% at the end of Q3 2020. This is substantially higher than the minimum required CET1 ratio of 7%, as required by the regulator.

Source: financial report

Investment thesis

Back in June I wasn’t 100% sure if the reduced dividend would still be sustainable, but now, two quarters later, it looks like income-oriented investors should be able to rely on the C$0.40 quarterly dividend. Not only is the dividend fully covered by the EPS (both in Q3 FY2020 as well as in 9M 2020), the bank’s payout ratio of less than 100% has helped to strengthen the balance sheet and the CET1 capital boosting the total CET1 ratio from 9.0% to 9.3%. With almost C$26B of the C$32.8B loan book designed as loans with "very low risk" and "low risk," it looks like the worst may be behind us and loan loss provisions may stabilize at the current levels.

That would mean Laurentian Bank is still trading at just 9 times its earnings while the dividend yield has reached a very handsome 5.6%. In fact, if the situation doesn’t get worse, Laurentian shareholders may be able to look forward to a dividend hike in the next few years but let’s first wait to see what the next few quarters will bring.

The option premiums on out of the money put options remain relatively high and I may be interested in writing a P28 December for an option premium of C$0.55. This would reduce my average purchase price to C$27.45 and boost the dividend yield to almost 6%.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.