With the Democratic Party retaining control in Congress and taking over the White House, solar and renewable energy companies are likely to benefit going forward.

Furthermore, the world is getting to a point when solar/renewable energy is becoming more efficient to derive than some widely used fossil fuels.

Solar and renewable energy is likely to continue to take market share away from oil, coal, and natural gas markets.

Several ETFs to consider that are likely to brighten up your portfolio going forward.

The solar/clean energy sector has essentially been asleep for around a decade.

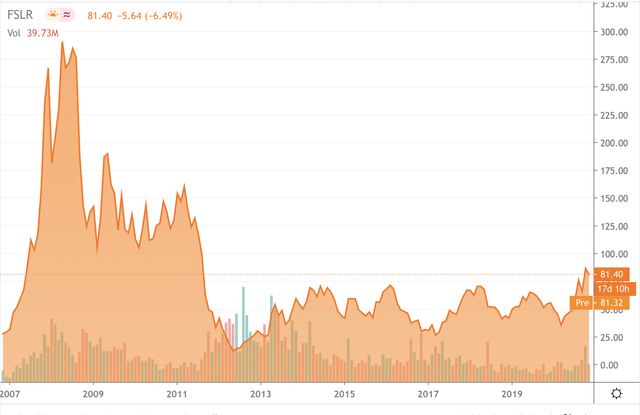

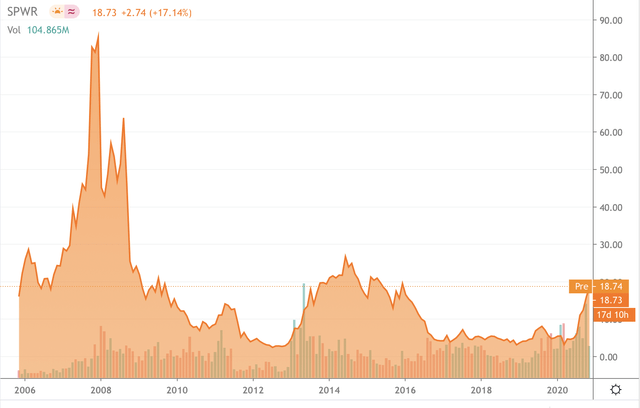

Key solar names such as First Solar (NASDAQ:FSLR), Sun Power (NASDAQ:SPWR), and others had huge run-ups into 2008, but post the financial crisis, many key players in this space disappeared or have largely traded sideways for the most part.

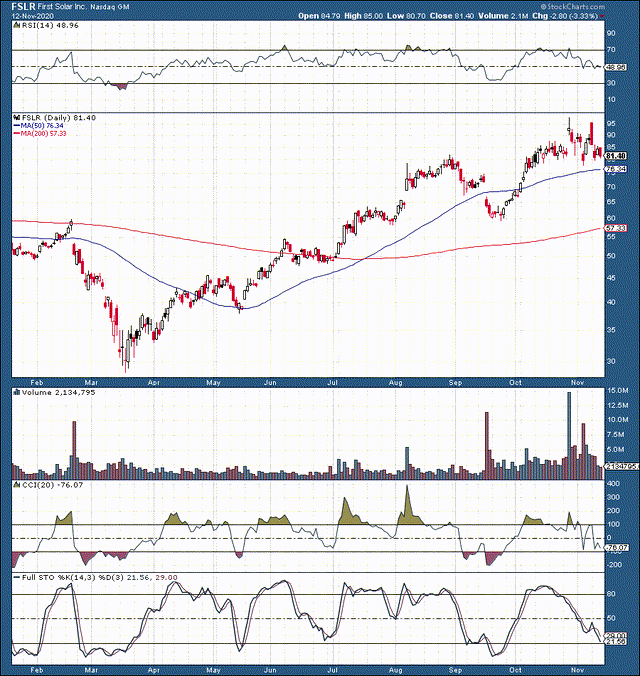

Well, until quite recently that is. For example, since the mid-March bottom, First Solar had roughly tripled from peak to trough.

Source: StockCharts.com

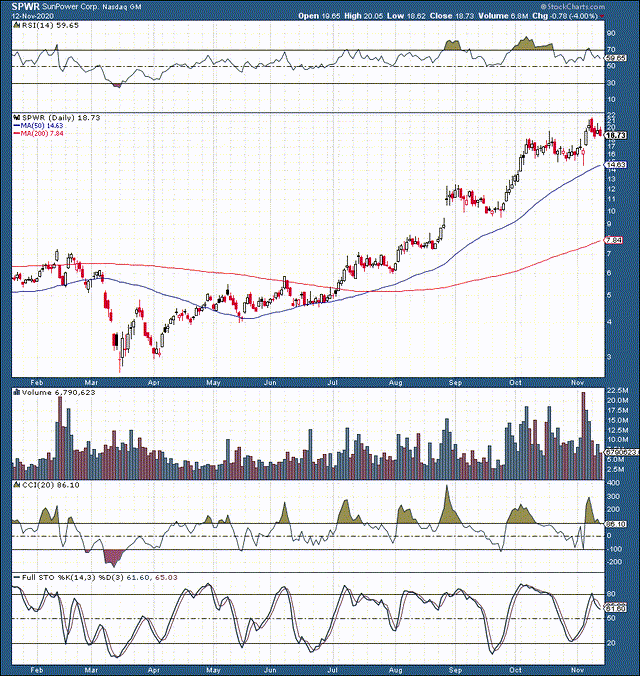

Having said that, the stock is only up by around 25% from its pre COVID-19 meltdown. Naturally, First Solar is not alone. SunPower was up by as much as around 650% from its mid-March bottom until the stock hit a recent short-term top at around $22 several days ago.

Other key names in this segment such as Brookfield Renewable Partners (BEP), Sunrun (RUN), Enphase Energy (ENPH), Plug Power (PLUG), and others have appreciated remarkably from their mid-March lows. Some by 200-300%, and some by roughly 1,000% or so.

I know, I know, some of you are screaming bubble right now. However, I don't think so, and here is why:

- This sector has been essentially dead for years, a decade or so in many areas.

- Solar and other renewable energy sources are becoming cheaper and more efficient to derive relative to drilling for oil and attempting to extract it miles underneath the sea as well as in other areas.

- There is increasing demand and continuously more real world applications for solar/renewable energy and lithium.

- Having a Democratic President in the White House is a positive catalyst, as investment and government subsidies are likely to increase in this sector.

- Generally, the world is making a tectonic shift away from highly pollutant fossil fuels.

- The shift towards electric vehicles/EVs in the auto industry should play a big role as well in propelling the world towards cleaner energy and more lithium consumption.

- Solar, clean energy, lithium, EV names should continue to take market share away from fossil fuel dominated markets going forward.

The Bottom Line: Instead of picking and choosing select names, here are several ETFs to consider:

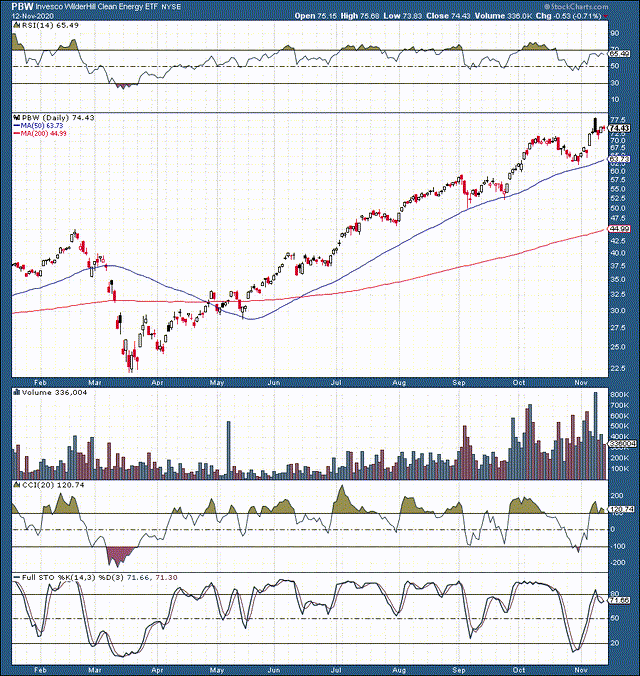

Invesco WilderHill Clean Energy ETF (NYSEARCA:PBW)

This ETF is quite unique as it is mostly comprised of solar/clean energy, lithium providers, and even EV manufacturers. In fact, the largest holding in the fund is a Chinese EV manufacturer NIO (NIO). Other key holdings include JinkoSolar (JKS), SunPower, First Solar, Livent Corp. (LTHM), Lithium Americas Corp. (LAC), and others. This fund's top ten holdings account for about 30% of total holdings (49), so it is quite diversified and not that top heavy.

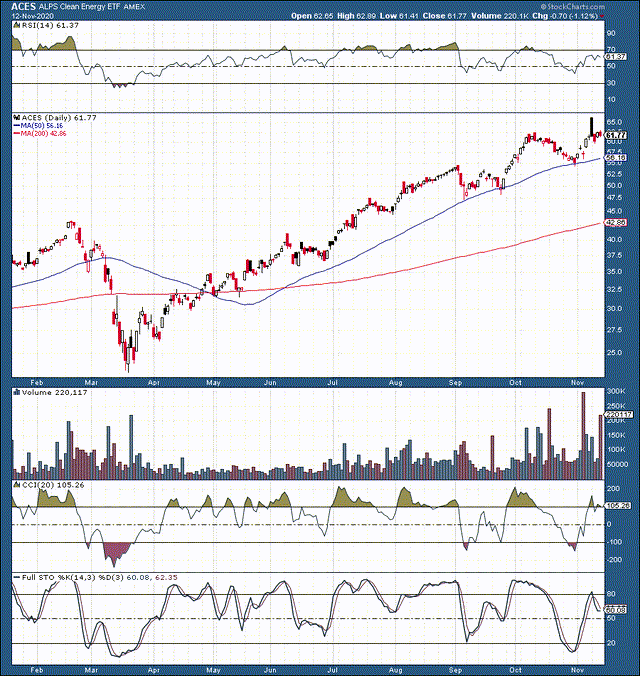

Alps Clean Energy ETF (ACES)

With 37 holdings and with top 10 accounting for roughly 54% of its weight, this ETF is more top-heavy and is more focused on solar names. However, it also has some interesting holdings outside of solar. Some key names include Sunrun, Enphase Energy, Plug Power, First Solar, Tesla (TSLA), and others.

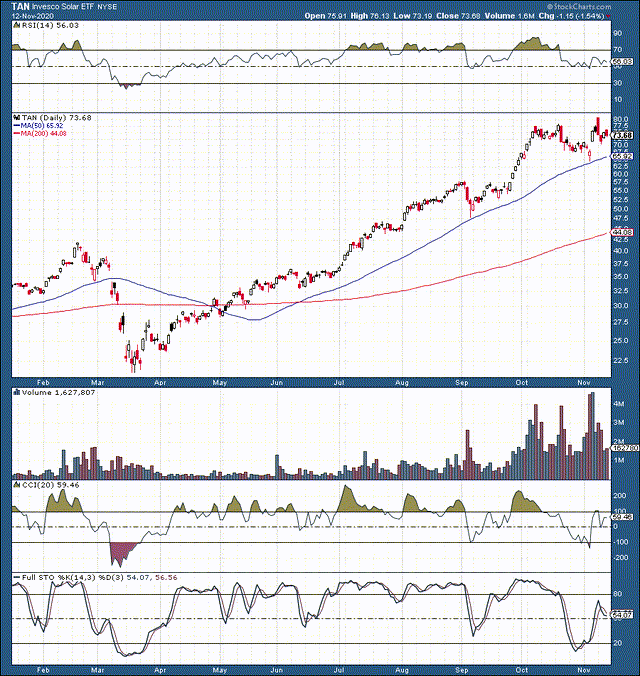

Invesco Solar ETF (TAN)

Not surprisingly, TAN is almost exclusively solar in nature. Also, it is extremely top heavy with just 33 holdings, and with the top ten accounting for nearly 64% of its total weight. Some of this fund's top holdings include: SolarEdge Technologies (SEDG), Enphase Energy, First Solar, Canadian Solar (CSIQ), and others.

Other Viable Clean Energy ETFs

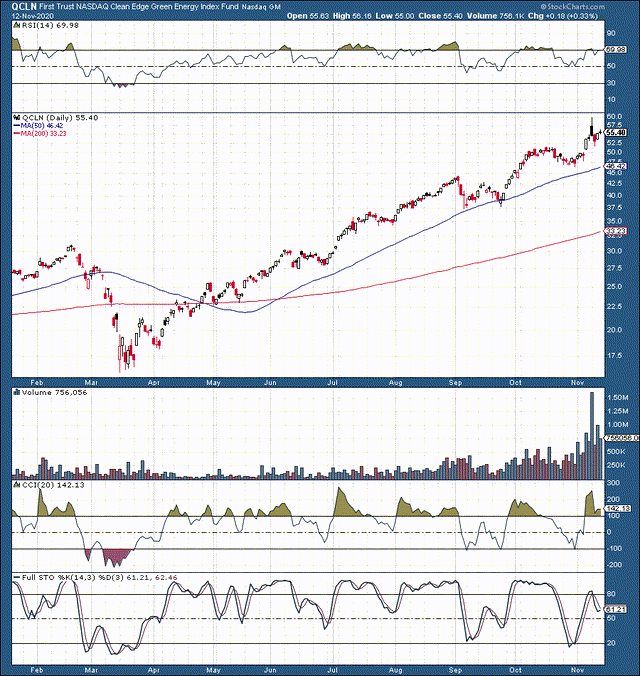

First Trust NASDAQ Clean Edge Green Energy Index ETF (QCLN)

This is a nicely diversified top-heavy ETF with 45 total holdings, and with its top ten accounting for about 56% of this ETF's total weight.

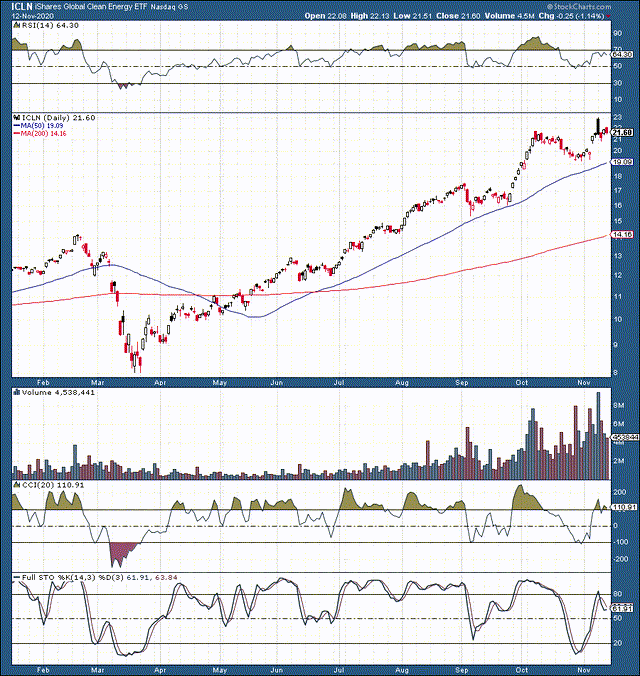

iShares S&P Global Clean Energy Index ETF (ICLN)

ICLN is an interesting split of solar and other renewable/clean energy names. This ETF is well diversified with a total of 48 holdings, with its top ten accounting for roughly 47% of its weight.

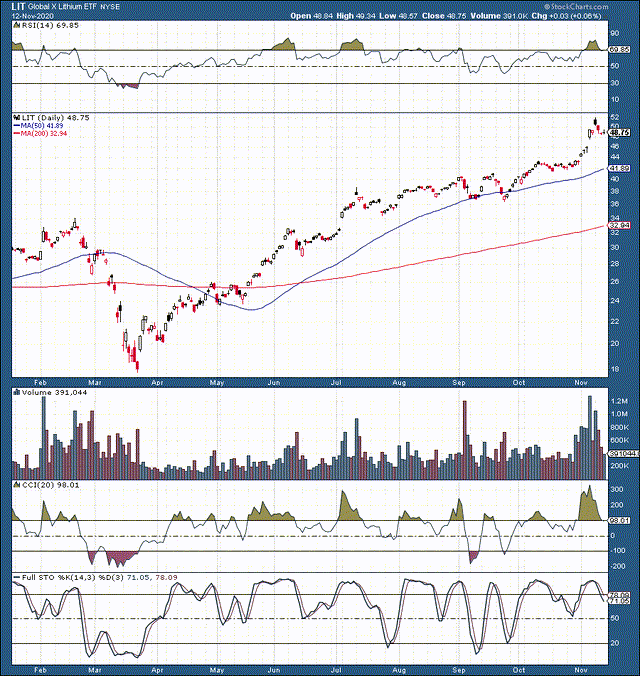

Global X Lithium & Battery Tech ETF (LIT)

LIT is an extremely interesting ETF that largely consists of lithium providers as well as electric vehicle companies such as Tesla and BYD Ltd. (BYD). This ETF has a total of 48 holdings but is quite top heavy with top ten holdings accounting for roughly 60% of this ETF's total weight.

The Takeaway

Solar, clean energy, electric vehicles, lithium and other products and services in this space are the future. Solar and other renewable energy sources are becoming cheaper and more efficient to derive. Additionally, there is increasing demand and continuously more real world applications for solar/renewable energy, lithium, EVs, etc. Having a Democratic President in the White House is a positive catalyst, as investment and government subsidies are likely to increase in this sector going forward.

The tectonic shift away from highly pollutant fossil fuels appears to be here, and the shift towards EVs in the auto industry should play a big role in expediting this process. Therefore, solar/clean energy should continue to take market share away from fossil fuels going forward. Despite likely pullbacks, corrections, and consolidation phases, the six ETFs discussed in this article should continue to trend significantly higher in the intermediate and long term.

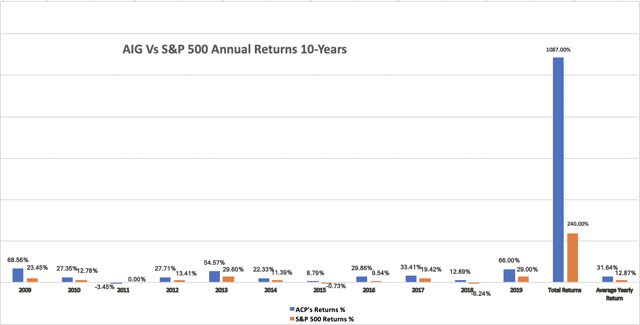

Want the big picture? If you would like full articles, daily market updates, comprehensive technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight along with top-performing growth strategies.

- Receive access to our top-performing real-time portfolio which returned 58% through Q3 2020 and is up by 62% YTD (10/27/2020).

-

Click here to find out more, become a member of our investment community, and start beating the market today!

Disclosure: I am/we are long TAN, ICLN, ACES, LIT, TSLA, LAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.