WCLD: Targeted Exposure To Momentum Growth Stocks

The WisdomTree Cloud Computing ETF invests in companies generating the majority of their revenues from cloud-based software.

The cloud computing theme has outperformed the market this year, benefiting from trends like work from home and distance learning boosting growth.

WCLD is a good option to capture targeted exposure to a high-growth momentum segment of the market, although caution is warranted, as the profile of the fund is high-risk.

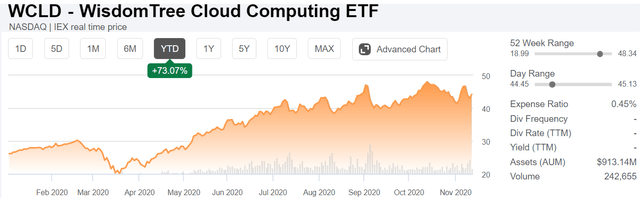

The WisdomTree Cloud Computing ETF (WCLD) is a theme-based exchange-traded fund that invests in companies focused on cloud software and services. This has been a high-growth segment of the market with this year's COVID-19 pandemic accelerating adoption given themes like work-from-home and virtual learning adding importance to online mobility. Indeed, WCLD is up 73% year to date, as the underlying companies have benefited from strong demand relatively resilient to economic disruptions of the pandemic. Recognizing the strong momentum and overall positive long-term outlook for the group of cloud computing stocks, we take a more cautious outlook over the near term considering the recently volatile market conditions and ongoing valuation concerns.

(Source: Seeking Alpha)

Background

According to WisdomTree, WCLD is meant to passively track the performance of the BVP Nasdaq Emerging Cloud Index, which is an equal-weighted index based on companies with cloud-based software solutions. Importantly, the inclusion of companies within the index is determined by Bessemer Venture Partners (BVP) through an established eligibility methodology. Accordingly, the companies considered must derive the majority of their revenues from business-oriented software products, which are both:

- Provided to customers through a cloud delivery model - for example, hosted on remote a multitenant server infrastructure, accessed through a web browser or mobile device, or consumed via an API.

- Provided to customers through a cloud economic model (subscription-based, volume-based, or transaction-based offering).

There is also a requirement that companies included in the index delivered annual revenues of at least 15% for each of the last two full fiscal years. Once included in the index, companies must also have grown annual revenue by 7% in at least one of the last two fiscal years to remain a constituent during the semi-annual reconstitution process. The index and the ETF, WCLD, are rebalanced in February and August of each year.

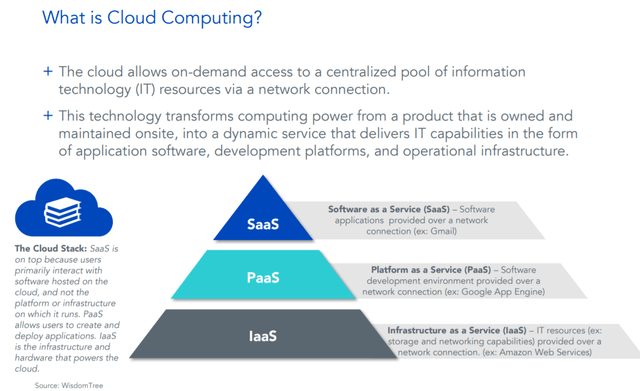

The concept of cloud computing is a generalized term to describe internet-based access to data, virtual computing power, or online software applications. The advantage is that computing resources can be shared across many users through a network connection. Cloud businesses can often generate better margins and growth, predictable recurring revenue, and higher customer retention. Business customers and end-users benefit from lower upfront costs, the ability to quickly install and deploy software updates, and the flexibility to scale as needed.

(Source: WisdomTree)

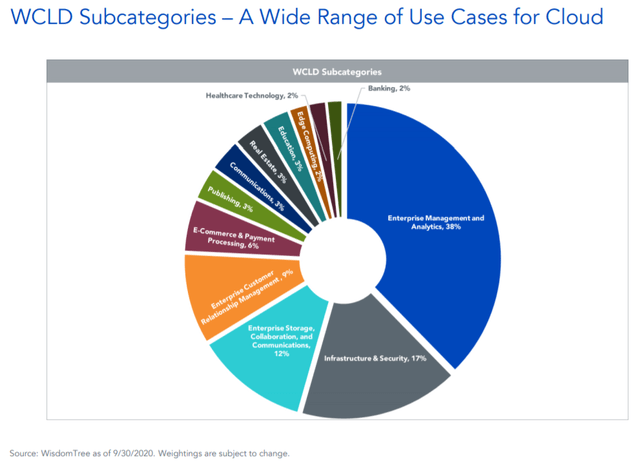

Within WCLD, companies selling Enterprise Management Tools and Analytics software represent nearly 40% of the fund, followed by 17% in Infrastructure and Security tools - these are the two most important sub-categories. Overall, there is a broader industry diversification, including companies focusing on payments and banking, real estate, and healthcare technology, among other areas.

(Source: WisdomTree)

Fund Performance

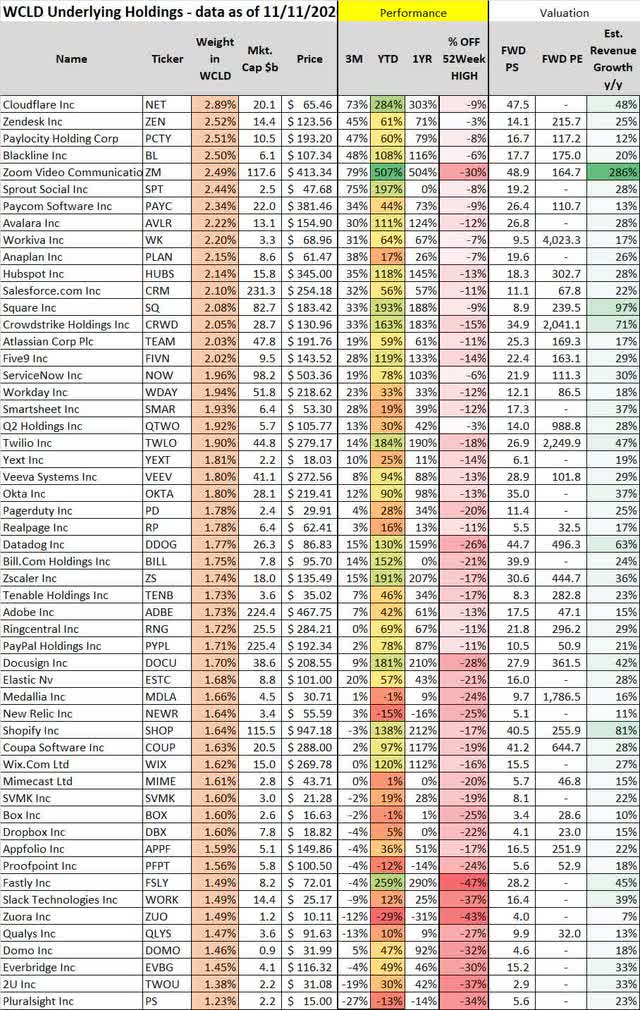

Across the top 10 current holdings of the fund, Zoom Video Communications Inc. (ZM) has been a standout performer this year, with the stock up over 500%. In many ways, the company exemplifies the dynamics this year benefiting cloud computing companies during the pandemic. Zoom's video conferencing and virtual collaboration tools became a nearly must-have application with people forced to work from home. The system also gained traction in the education field for remote learning. The company reported astonishing revenue growth of 355% y/y in the last quarter.

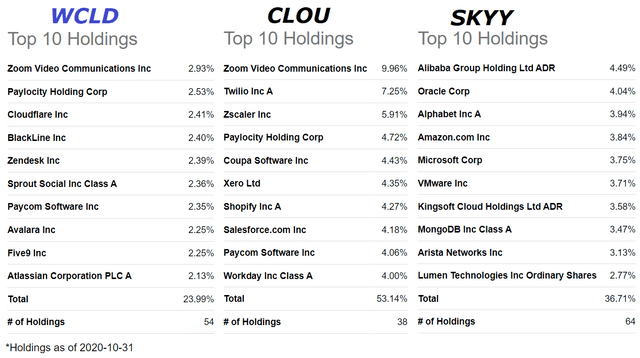

With a portfolio of 54 holdings, general themes within the group are strong growth momentum with an improving earnings outlook as the companies build on their early market leadership position in their respective niches. Along with Zoom, with a consensus estimate for 286% revenue growth this year, other notable stocks with significant top line momentum include Square Inc. (SQ) and Shopify Inc. (SHOP), with 97% and with 81% estimated revenue growth this year, respectively. The table below highlights the performance of WCLD stocks along with selected valuation metrics.

(Source: Data by YCharts / Table by BOOX Research)

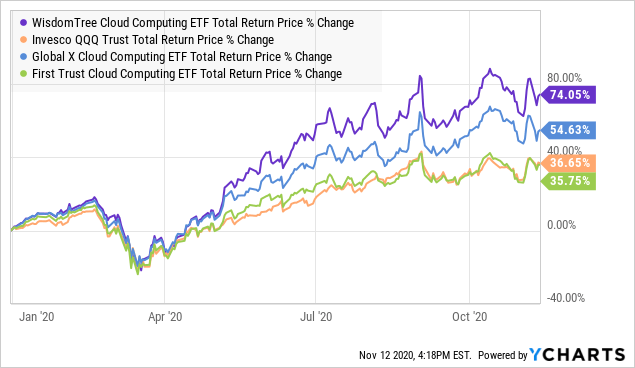

WCLD is up over 74% in 2020, supported by massive gains among several underlying holdings. Impressively, 17 of the 54 stocks are up over 100% this year. Cloud computing as a theme within tech has outperformed considering a 36% gain in the tech-heavy Nasdaq 100 (QQQ). While the cloud computing segment had already been a strong performer in recent years, the pandemic offered a boost of growth in some cases with the companies able to outperform expectations from the start of the year.

It's also worth noting that WCLD has outperformed two alternative "cloud computing" ETFs this year, including the Global X Cloud Computing ETF (CLOU) and the First Trust Cloud Computing ETF (SKYY), which have climbed 54% and 36% respectively.

Data by YCharts

Data by YCharts

Taking a look at the underlying portfolio of both CLOU and SKYY, it's evident that each of these funds takes a different approach to the theme, while passively tracking separate indexes. Despite some overlap between WCLD and CLOU among top holdings, CLOU uses a modified market cap-weighted methodology and thus presents a more concentrated and top-heavy portfolio. CLOU is essentially overweight the largest companies with WCLD, while underweighting the smaller holdings which have been strong performers this year.

(Source: Seeking Alpha / image composite)

SKYY, on the other hand, has a broader approach to the theme of cloud computing by including mega-cap tech leaders like Amazon.com (AMZN) and Microsoft Corp. (MSFT). These companies are indeed are a big part of cloud computing infrastructure with their respective Amazon Web Services and Azure segments. Still, we would argue that the companies' stock price performance is more related to other factors and trends beyond the cloud. The inclusion of stocks like AMZN, MSFT in the SKYY ETF limits its value as a tactical trading tool and portfolio diversifier, which are strengths of WCLD.

We think WCLD has an advantage among these ETF alternatives, as the methodology is more targeted towards the types of companies that are directly benefiting from the theme. The equal-weighted methodology can capture the trends from the smaller companies that are exhibiting high growth in the segment, which explains the outperformance of the fund this year. On the other hand, is that it's also possible WCLD may be the riskier option in the segment, while SKYY, with holdings in more mature tech companies, exhibits lower volatility in a future bear market. It's possible WCLD could underperform going over any period going forward.

Analysis and Forward-Looking Commentary

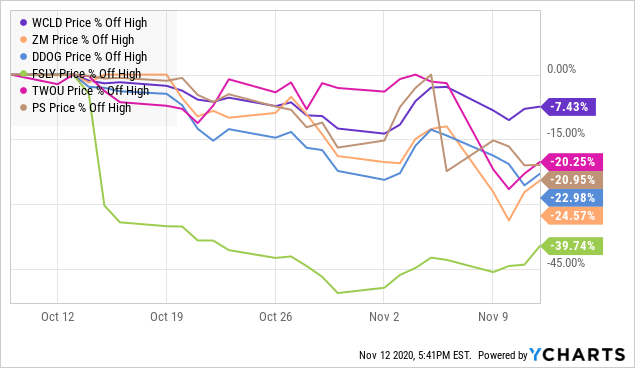

The past couple of weeks in the market have been defined by higher volatility and some divergences among equity factors. While broad market indexes like the S&P 500 (SPY) are trading near an all-time high, high-growth stocks including many of the underlying holdings in the WCLD ETF have pulled back with an ongoing rotation in the market.

With the recent announcement by Pfizer Inc. (PFE) that its COVID-19 vaccine candidate is effective and could be ready for distribution by the end of the year into 2021, there are hopes that the pandemic is ending. As it relates to WCLD, the thought is that many of the trends that have powered these stocks higher over the past year may slow going forward. What we've seen is that many of the top-performing stocks have sold off from their highs, and in some cases significantly, over the past several weeks. Zoom Video Communications, Datadog Inc. (DDOG), Fastly Inc. (FSLY), 2U Inc. (TWOU), Pluralsight Inc. (PS), for example, are each down by more than 20% from their recent highs.

Data by YCharts

Data by YCharts

The other concern here remains valuation, as many of the stocks in this group continue to trade at what can otherwise be considered an extreme growth multiple based on expectations of runway expansion over the next decade. From the data table in the previous section of this article, we highlight that the average forward P/S multiple of the stock in WCLD is currently 19x. Similarly, among the 34 out of 54 companies expected to have positive EPS in the current year, the average forward P/E ratio is 171x.

While these multiples can sometimes be justified given the high growth momentum and positive outlook for certain stocks, the result is a high-risk fund that can be exposed to wide swings of volatility. Our take is that enthusiasm for the segment is already extremely high, and companies will be challenged to meet and exceed expectations, which may be necessary for the underlying WCLD stocks to climb higher. The potential that a company underperformed expectations can result in a reassessment of the long-term growth outlook lower. We believe a cautious outlook is warranted.

Final Thoughts

WCLD is a quality fund that offers targeted exposure to a high-growth market segment that has been particularly hot this year. For investors that are bullish on the theme of cloud computing, the fund is a good option to complement a diversified portfolio that can add a momentum component by capturing trends from emerging and disruptive companies. While the fund has been a strong performer over the past year, keep in mind the relatively high-risk profile which can create the potential for large swings of volatility.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.