The Southern Company: Solid Income Utility Expanding In Renewable Energy

The Southern Company is growing by buying bolt-on companies and expanding existing renewable production.

The Southern Company has increased its dividend for the past 19 years and has a yield of 4.27%, above average and has a 5-year dividend growth rate of 3.4%.

The Southern Company's total return overperformed the Dow average for my 59-month test period by 1.26%.

Renewable energy is the way to the future, and Southern Company is one of the leaders.

The Southern Company (NYSE:SO), one of the largest electric utility companies, is a buy for the conservative income investor. The management of Southern Company is good and has continued to grow the company by buying bolt-on companies and using its cash to expand existing renewable energy facilities and develop new ones. The company is being reviewed for The Good Business Portfolio, my IRA portfolio of good business companies that are balanced among all styles of investing.

Source: The Southern Company website

As I have said before in previous articles,

I use a set of guidelines that I codified over the last few years to review the companies in The Good Business Portfolio (my portfolio) and other companies that I am reviewing. For a complete set of guidelines, please see my article "The Good Business Portfolio: Update to Guidelines, March 2020". These guidelines provide me with a balanced portfolio of income, defensive, total return, and growing companies that hopefully keeps me ahead of the Dow average.

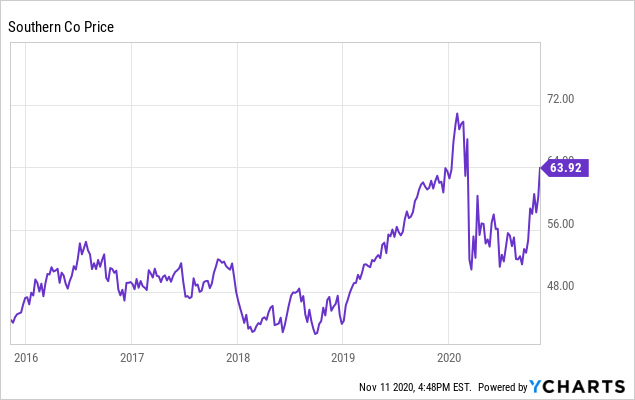

When I scanned the five-year chart, The Southern Company has a boring chart being flat for 2016-2018, then it hit the strong up year 2019 before the volatile COVID-19 virus hit in 2020. As new bolt-on companies are added and renewable energy production increases over the next 3-4 years, revenues and profits should continue its slow, steady growth.

Data by YCharts

Data by YCharts

Fundamentals and company business review

The method I use to compare companies is to look at the total return, as shown from my previous articles in the section below.

The Good Business Portfolio Guidelines are just a screen to start with and not absolute rules. When I look at a company, the total return is a key parameter to see if it fits the Good Business Portfolio's objective. My total return guideline is that total return must be greater than the Dow's total return over my test period. I chose the 59-month test period (starting January 1, 2016, and ending to date) because it includes the great year of 2017 and 2019 and other years with fair and bad performance.

The flat Southern Company's total return of 59.08% compared to the Dow base of 57.82% makes Southern Company a fair investment for the conservative total return investor that also wants a steadily increasing income. Looking back five years, $10,000 invested five years ago would now be worth over $16,100 today. This gain makes Southern Company a fair investment for the total return investor looking back, which has future growth as the United States' need for more electric power continues to grow.

Dow's 59-Month total return baseline is 57.82%.

|

The Southern Company does meet my dividend guideline of having dividends increase for 8 of the last ten years and having a minimum of 1% yield. Southern Company has an above-average dividend yield of 4.27% and has had increases for nineteen years, making Southern Company a good choice for the dividend growth investor. The dividend was last increased in April 2020 to $0.64/Qtr. up from $0.62/Qtr. or a 3.2% increase with increases expected to continue for many years. The five-year average payout ratio is high, at 80%. After paying the dividend, this leaves cash remaining for increasing the business of the company by buying bolt-on companies and expanding renewable energy operations.

I also require the CAGR going forward to be able to cover my yearly expenses and my RMD, which is zero in 2020, with a CAGR of 5.2%. My dividends provide 3.3% of the portfolio as income, and I need 1.9% more for a yearly distribution of 5.2%. The three-year forward S&P CFRA CAGR of 5% is all right, just meeting my guideline requirement. The good future growth for Southern Company can continue its uptrend benefiting from the continued strong growth of the United States' electricity demand.

I have a capitalization guideline where the capitalization must be greater than $10 billion. Southern Company easily passes this guideline. Southern Company is a large-cap company with a capitalization of $63.4 billion, well over the guideline target. The Southern Company 2020 projected cash available at $3.4 billion is good, allowing the company to have the means for company growth and increased dividends each year.

One of my guidelines is that the S&P rating must be three stars or better. SO's S&P CFRA rating is three stars or hold with a target price of $63, passing the guideline. SO's price is presently 1% above the target price. SO is at the target price at present and has an average forward PE ratio of 19, making SO a buy at this entry point for the conservative income investor. If you are a long-term investor that wants a good steady increasing dividend income and fair total return, you may want to look at this company.

One of my guidelines is, would I buy the whole company if I could. The answer is yes. The total return is fair, and the above-average growing dividend makes Southern Company a good business to own for income and slow growth. The Good Business Portfolio likes to embrace all kinds of investment styles but concentrates on buying businesses that can be understood, makes a fair profit, invests profits back into the business, and also generates a good income stream. Most of all, what makes Southern Company interesting is the potential long-term growth of their business as their customers' need for electric and gas energy increases. The Southern Company gives you a steadily increasing dividend for the dividend investor and a fair total return, so you can sleep well at night.

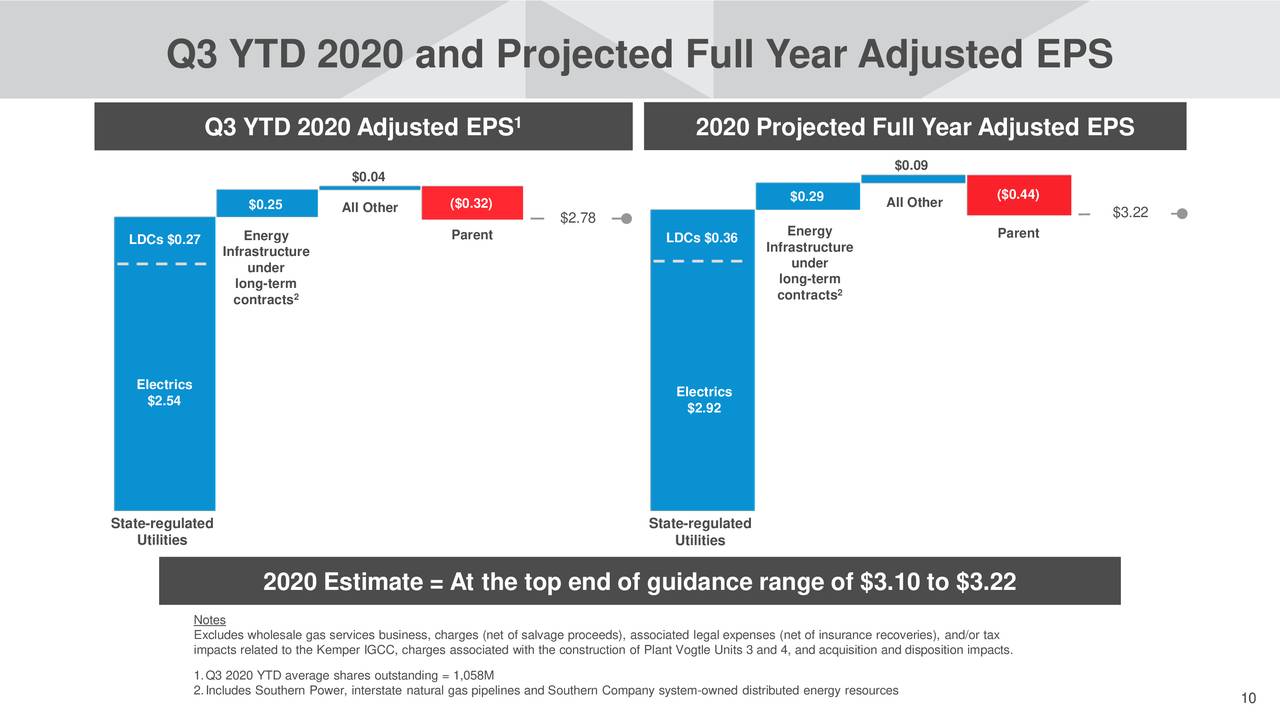

I look for the earnings of my positions to consistently beat their quarterly estimates. For the last quarter on October 29, 2020, Southern Company reported earnings that beat expected by $0.01 at $1.22, compared to last year at $1.34. Total revenue was lower at $5.62 billion less than a year ago by 6.26% year over year and missed by $671.18 million with the expected total. This was a good report, considering the COVID-19 virus with bottom-line beating expected, and the top line decreasing with a decrease compared to last year. The next earnings report will be out January 2021 and is expected to be $0.39 compared to last year at $0.42, a small decrease. The graphic below shows the projected earnings for 2020 and the third quarter YTD.

Source: 3rd Earnings call slides

As per data from Reuters:

The Southern Company is a holding company. The Company owns the traditional electric operating companies and the parent entities of Southern Power Company (Southern Power) and Southern Company Gas and owns other direct and indirect subsidiaries. The Company owns Alabama Power Company (Alabama Power), Georgia Power Company (Georgia Power), and Mississippi Power Company (Mississippi Power), each of which is an operating public utility company. The primary business of the Southern Company system is electricity sales by the traditional electric operating companies and Southern Power and the distribution of natural gas by Southern Company Gas.

Overall, The Southern Company is a good business with my estimated 5-6% CAGR growth next year as the United States economy grows going forward, with the increasing demand for Southern Company's electric supplies and distribution. The good dividend income brings you cash as I continue to see further growth as the economy grows after the virus pandemic is controlled in a few months.

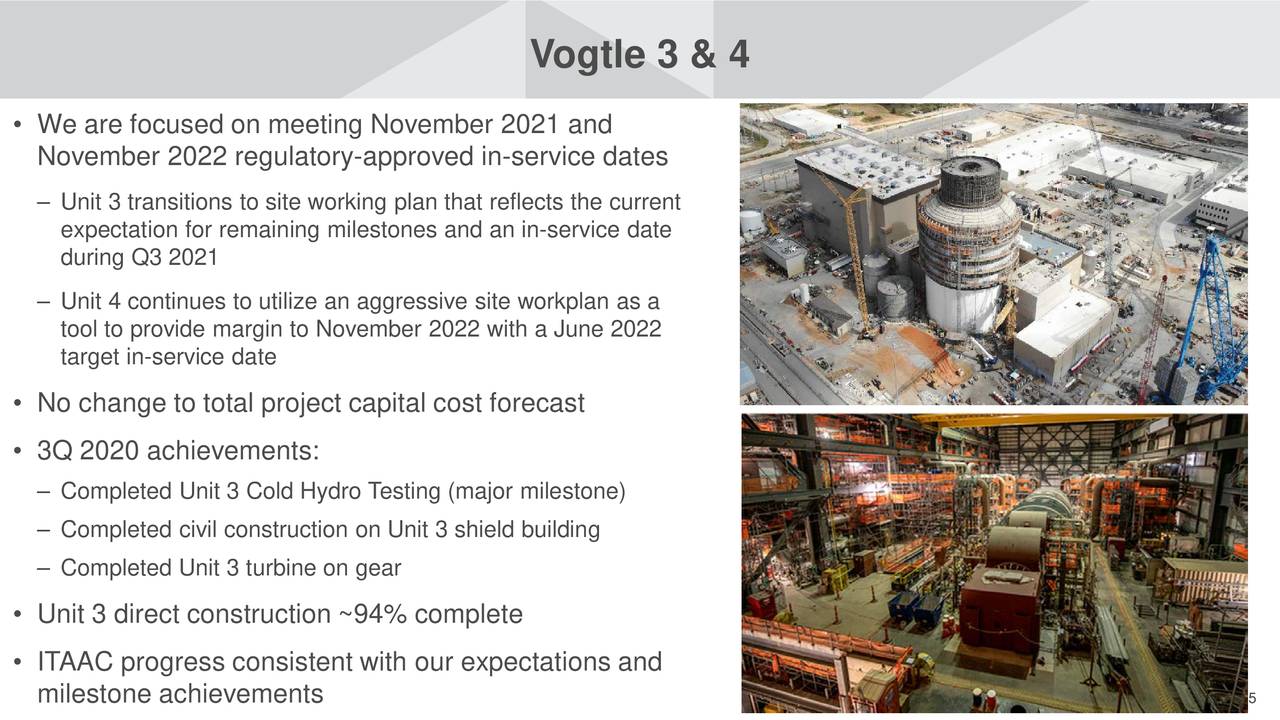

From the 3rd quarter earnings call, Southern Company reported strong adjusted results for the third quarter, ahead of the estimate provided from the previous conference call. They expect adjusted full-year earnings per share to be at the top end of our guidance range. They are projecting an increase of long-term earnings per share growth rate and improvement of cash flow and a dramatically improving dividend payout ratio as they reach completion of Vogel Unit 3 and continue significant progress on Unit 4. They now expect that the in-service date for Unit 3 to be during the third quarter of 2021, ahead of its November 2021 regulatory approval and service date. The next major milestone, hot functional testing, will start in January 2021, followed by fuel load in April of 2021.

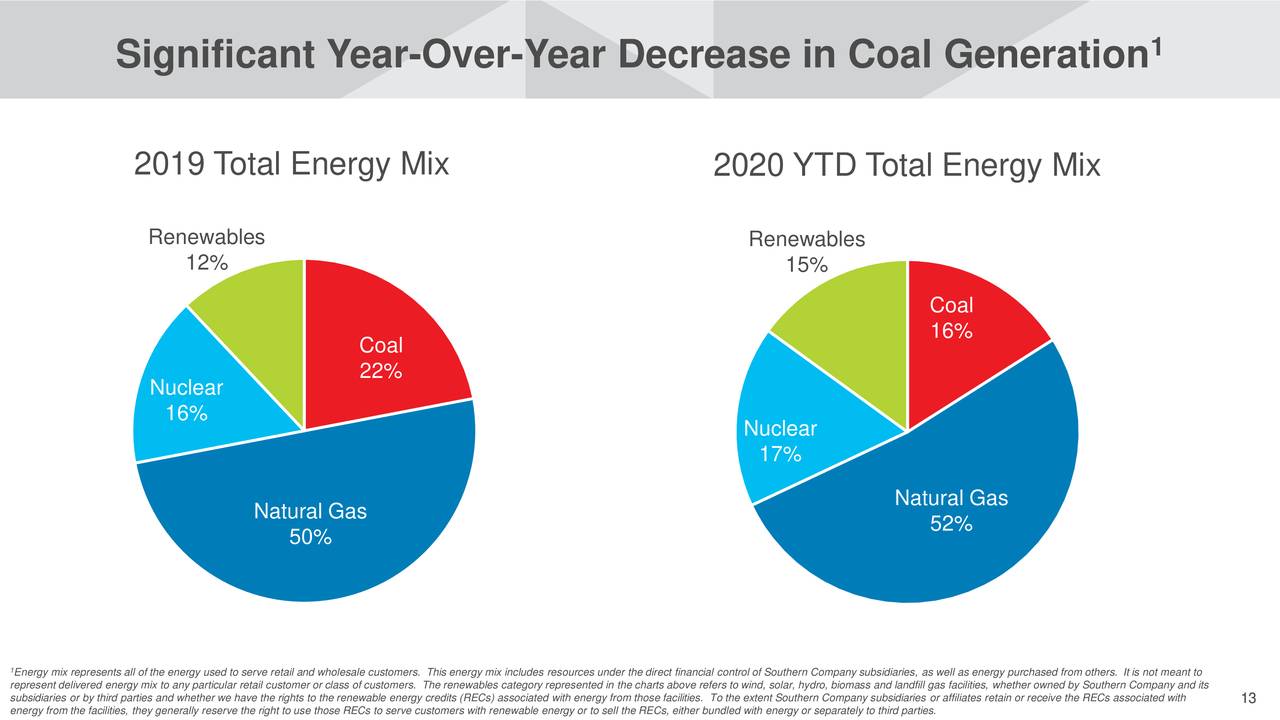

The graphic below shows the renewable energy expansion impact on coal reduction, which is the wave of the future.

Source: 3rd Earnings call slides

This shows the feelings of top management for the continued strong development of the changes necessary for the continued growth of the Southern Company business and shareholder return. Southern Company has good constant growth and will continue as the economy and population grows. The growth is being driven by buying bolt-on companies and an expansion of existing properties. The graphic below shows the future of renewable energy for the United States in the development of nuclear energy plants, giving present status and projected milestones.

Source: 3rd Earnings call slides

Conclusions

The Southern Company is a great investment choice for the income investor with its above-average yield and a fair choice for the total return investor looking back. The Southern Company will be considered for The Good Business Portfolio when cash is available. I buy what I consider great businesses that are fairly priced, and the present Southern Company entry point looks fair, considering the solid income stream. Good growing businesses do not come cheap, but over time, they grow and grow. If you want a solid growing dividend income and fair total return in the electric supply business, Southern Company may be the right investment for you.

The total return for the Good Business Portfolio is ahead of the Dow average from 1/1/2020 to November 6 by 1.91%, which is a gain above the market loss of 0.71% for the portfolio, with Boeing (BA) a drag and 737 MAX expected to fly this year. Each quarter after the earnings season is over, I write an article, giving a complete portfolio list and performance. The latest article is titled "The Good Business Portfolio: 2020 2nd Quarter Earnings and Performance Review". Become a real-time follower, and you will get each quarter's performance and portfolio companies after this earnings season is over.

Disclosure: I am/we are long BA, JNJ, HD, DHR, MO, PM, MCD, PEP, DLR, AMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Of course, this is not a recommendation to buy or sell, and you should always do your own research and talk to your financial advisor before any purchase or sale. This is how I manage my IRA retirement account, and the opinions of the companies are my own.