IDV: High Dividend International Equities Offer The Best Of Both Worlds

Looking forward, it appears that international equities are favored over domestic and value stocks are favored over growth stocks.

By combining both value and international, the iShares IDV ETF has the potential to create a "double-barreled" alpha opportunity.

IDV has risen at a strong pace in recent weeks as its bank holdings rise on hopes of a COVID recovery.

The jury is out on a 2021 recovery, but IDV's low valuation and 6% yield make it an attractive long-term investment.

A potential long-term decline in the U.S. dollar will likely promote price-appreciation for IDV.

This year has been strange for most investors. The global pandemic and its lockdowns have resulted in a severe economic decline. While the economy remains in a weak position, most U.S. equity indices are near their pre-pandemic high or are often even much higher. During most economic recessions, investors can hunt for attractive bargains with fire-sale opportunities for cheap high-quality stocks. Unfortunately for U.S. investors, such bargains cannot be found today. In order to find truly undervalued opportunities, investors must venture outside of the United States.

One ETF caught my attention as a solid way for investors to gain exposure to undervalued international companies, the iShares International Select Dividend ETF (IDV) which trades under the ticker IDV. This ETF invests in developed-market companies with decent quality and high dividend yields. This fund currently offers an attractive 6% yield which is far higher than is seen in most U.S. equity ETFs. Its holdings are cheap and are of sufficient quality.

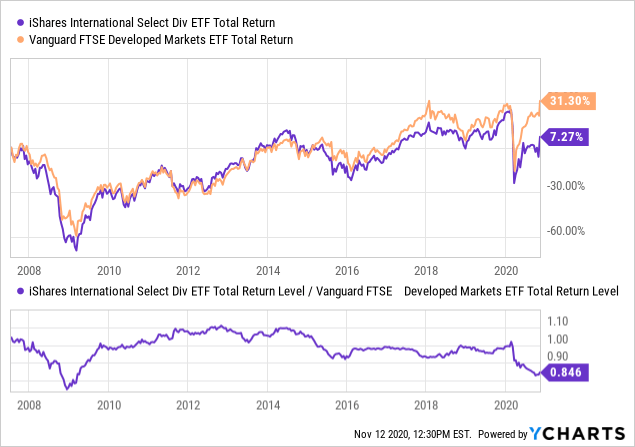

That said, the ETF has not delivered strong returns over the past five years and has underperformed the broader developed market ETF (VEA) as you can see below:

Data by YCharts

Data by YCharts

While IDV has underperformed, the IDV/VEA total return ratio is back at the bottom it made in 2009. The ratio bounced off this level in recent weeks which is a sign that it may be acting as long-term support which signals that international value/dividend is likely to outperform other international investment factors. This has occurred simultaneously with many signals that indicate U.S. value stocks are likely to outperform U.S. growth stocks over the coming years. Adding on the view that international equities will outperform U.S. equities, we have a solid alpha opportunity in the international dividend ETF.

A Look At The International Dividend Portfolio

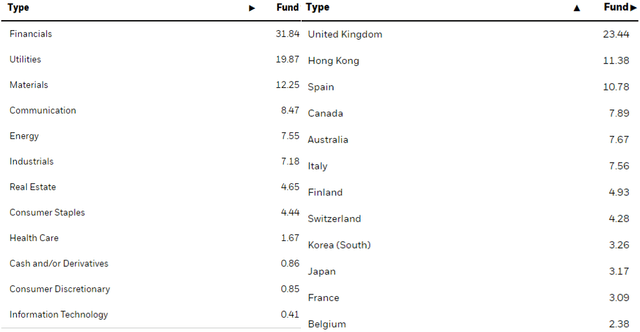

IDV holds companies from all over the world with banking centers like the United Kingdom and Hong Kong holding high weighting. Importantly, most high-dividend companies today are in the financial, utility, and materials sectors. The ETF's sector and country breakdown are shown below:

Financials hold the highest weighting, particularly because most bank stocks are very cheap today. Few have fully-recovered from the COVID-crash, particularly abroad where there has been a bit less support from central banks. Some were forced to temporarily halt cash dividends, but that is expected to end as we go into 2021.

In my opinion, IDV's sector exposure gives it slightly higher cyclical risks. If COVID lockdowns continue around the world into next year, many banks that have offered forbearance to clients will soon find themselves with significant non-performing debt. As you likely know, COVID cases are spiking again around the world, so governments may choose to keep lockdowns longer.

On that note, the possibility of a successful COVID vaccine will likely cause IDV to see significant gains. IDV rose about 9% when Pfizer (NYSE:PFE) announced a possible vaccine which was far more than most U.S. indices. This is because most of the companies in IDV have been hit very hard by the pandemic, particularly the banking, energy, and materials companies.

IDV does hold some equities which counterbalance the risks in financials. About 20% of the fund is in utilities which usually carry lower risk and higher dividends than most other equities. Today, communications stocks also carry generally low risk. If there is another wave lower for cyclical stocks, it is likely that these holdings will continue to make dividend payments and are unlikely to fall too far.

Even still, the weighted-average "P/E" ratio in IDV is only 11.3X. To compare, the S&P 500's is currently over twice as high at 24X. Even the iShares Core MSCI International Developed Markets ETF (IDEV) which does not allocate toward high dividend stocks has a higher valuation of 16.7X. Of course, lower "P/E" valuation usually comes with lower historical EPS growth and higher risk. However with the economy as it is, EPS growth is likely to be poor for most companies. Quite frankly, it seems IDV's holdings may be the few that are sufficiently discounting the economic situation today.

Bearish U.S. Dollar is Bullish For IDV

The major benefit of international equities is that they gain when the U.S. dollar declines. International equities are priced in their local currency, so when those currencies rise against the dollar, the dollar value of those equities usually increased. This creates an additional alpha opportunity that allows investors to diversify their exposure. I believe this is critical in times like today when monetary policy has put the U.S. dollar in a precarious position.

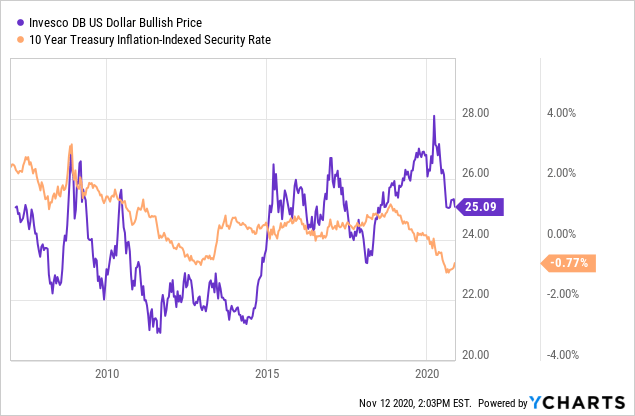

The U.S. dollar has been very strong over the past five years since the inflation-indexed yield (i.e. real-yield) has been higher than in Europe and other areas. This is a major reason why IDV has underperformed by such an extreme extent since 2015. Fortunately, the Federal Reserve's dovish policy stance has caused the inflation-indexed yield to plummet which makes the U.S. dollar a less attractive investment. As you can see below, this has already led to a steep sell-off in the U.S. dollar (UUP):

Data by YCharts

Data by YCharts

In the short term, the U.S. dollar may bounce slightly higher since the inflation-indexed yield has risen over the past few weeks. However, the U.S. dollar is quite high and another round of stimulus may pressure the dollar to decline lower.

In my opinion, the U.S. dollar is a long-term factor to consider. The simple fact is that monetary and fiscal policies today are both aggressive and are changing rapidly. There has not yet been any large inflationary spike in the U.S. However, with the global economy as it is it seems wise for investors to look to diversify their monetary exposure. I believe that IDV is one of the easiest ways to do so in a manner that still generates a sufficient yield and appreciation potential.

The Bottom Line

Overall, IDV is one of the few funds that appear attractive for long-term investors. Uncertainty is quite high today and I have a generally bearish view on the global stock market as a whole, so IDV may see a short-term decline. Still, if stocks are headed lower, I do not believe IDV will decline as much as most ETFs since it is already trading at a very low weighted-average valuation. Additionally, its diversified exposure across many nations and high utility and communications holdings offset its other cyclical risks.

If we are indeed looking at a COVID-recovery and an end to global lockdowns, I believe IDV will outperform by a wide margin. Its bank holdings will likely rise the most as the risk of a large increase in non-performing debt subsides and dividends are increased. Additionally, this would likely increase yield curve and inflation rates which usually make banks and commodity-producers more profitable.

Regardless of the economy, I believe the U.S. dollar is headed lower over the coming years. The dollar has held a long-term trading range for many decades and is currently at the high end of the spectrum. Over the coming years, the near-zero rate policy in the U.S. may cause inflation to rise faster than for peers which could further promote a bearish move in the dollar. If so, this will bring additional alpha to IDV.

In the short run, I am officially neutral on IDV since I believe investors should reduce exposure to equities. However, I will be looking to buy the dips on the ETF and its constituents.

Interested In More Alternative Insights?

If you're looking for (much) more research, I run the Conviction Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios as well as weekly commodity and economic research reports. Additionally, we provide actionable investment and trade ideas designed to give you an edge on the crowd.

As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. You can learn about what we can do for you here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.