Amidst volatility in the equity market investors have resorted to profit booking. Hence, inflows in equity-oriented mutual funds, including inflows in Equity-linked Savings Schemes (ELSS), have remained muted over the past few months. Poor performance of schemes across categories as compared to the benchmark can also be attributed for lack of investors' interest.

Despite this, ELSS cannot be ignored as a worthy tax-saving instrument because it offers the dual benefit of tax saving as well as capital appreciation. Many ELSS have performed well over the longer time frame of five years or more.

ELSS has the potential to generate higher returns than other tax saving instruments, which mostly invest in fixed-income instruments. Thus, it can help you to beat inflation and move closer to your desired corpus.

Canara Robeco Equity Tax Saver Fund (CRETS) is one of the oldest schemes in the ELSS category that has made it to the list of top performers due to its superior performance in the last couple of years.

--- Advertisement ---

Okay... Who Else Wants to Catch a FREE REPLAY of Richa Agarwal's MEGA Summit...

Our No.1 Stock - 2021 MEGA summit that went live yesterday received an amazing response.

However, it seems like you missed it.

No problem.

Catch a FREE REPLAY Now

------------------------------

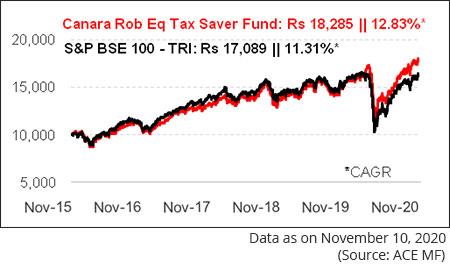

CRETS has generated returns at 18.6% CAGR since its inception in 1993. However, the journey of its performance was not very smooth. The fate of the fund as well as the fund house was influenced by the instability of the fund management team that saw a high churn during 2011-2012 and 2014-2017, the impact was witnessed across its schemes. However, the current team seems to be relatively stable as it has expanded over the years with proper back-ups at the core position. Moreover, the performance of almost all the schemes across the fund house has improved over the last couple of years and made it to the list of top quartile performers. In the last 5 years, CRETS has appreciated at a CAGR of 12.8% CAGR, better than 11.3% CAGR generated by its benchmark S&P BSE 100 - TRI index. An investment of Rs 10,000 in the fund 5 years back would now be worth Rs 18,285, as against Rs 17,089 for the simultaneous investment in its benchmark.

--- Advertisement ---

Today, Grab 1-Year of Hidden Treasure FREE

Equitymaster wishes you a Very Happy Diwali

On the occasion of this festive season, we're offering a select group of readers 1-Year of FREE ACCESS (worth Rs 6,000) to Our Proven Smallcap Service - Hidden Treasure.

Click Here to Know How to Claim Your Free Year

For years and years now, we've been explaining to you why smallcaps are the way to go if you want to create potentially HUGE WEALTH over the long run...

PLUS, we've also shown you the massive results our own recommendations have produced.

If you too want to create LIFE-CHANGING wealth using smallcaps, grabbing this virtually FREE 1-year subscription to Hidden Treasure could be the perfect start.

Agree?

Know How to Get Your FREE Year of Hidden Treasure here.

------------------------------

| Scheme Name | Corpus (Cr.) | 1 Year (%) | 2 Year (%) | 3 Year (%) | 5 Year (%) | 7 Year (%) | Std Dev | Sharpe |

|---|---|---|---|---|---|---|---|---|

| Canara Rob Equity Tax Saver Fund | 1,217 | 16.79 | 15.27 | 11.38 | 12.81 | 15.35 | 20.44 | 0.099 |

| Mirae Asset Tax Saver Fund | 4,463 | 14.34 | 15.66 | 10.48 | -- | -- | 22.18 | 0.082 |

| Axis Long Term Equity Fund | 22,632 | 6.88 | 12.94 | 10.10 | 12.96 | 19.37 | 19.55 | 0.060 |

| Quant Tax Plan | 19 | 25.27 | 15.64 | 9.37 | 16.21 | 20.10 | 24.45 | 0.082 |

| BOI AXA Tax Advantage Fund | 319 | 21.18 | 18.29 | 8.15 | 13.55 | 16.28 | 21.91 | 0.051 |

| Invesco India Tax Plan | 1,154 | 9.61 | 10.77 | 7.82 | 12.37 | 17.51 | 20.60 | 0.055 |

| JM Tax Gain Fund | 40 | 6.86 | 12.81 | 6.73 | 13.53 | 17.26 | 22.06 | 0.027 |

| Union Long Term Equity Fund | 274 | 10.91 | 11.76 | 6.60 | 8.81 | 11.53 | 20.53 | 0.029 |

| Kotak Tax Saver Fund | 1,312 | 8.25 | 11.31 | 6.47 | 11.80 | 16.39 | 21.17 | 0.032 |

| BNP Paribas Long Term Equity Fund | 453 | 10.91 | 14.06 | 6.33 | 10.53 | 15.09 | 18.77 | 0.024 |

| S&P BSE 100 - TRI | 6.94 | 9.3 | 6.93 | 11.3 | 12.39 | 21.24 | 0.034 |

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

The recent performance of CRETS has been exceptional, which has helped in scaling up its performance over the long term. CRETS not only has the ability to participate in the market recoveries and rallies, but has also limited the downside for its investors.

With an absolute return of 16.8% in the last 1 year, the fund has outscored the benchmark and category average by a remarkable margin has turned out to be the top performers. Its returns over the longer time horizon is reasonable, where the fund has beaten some of the popular category peers and delivered returns higher than the benchmark.

With a standard deviation of 20.44%, the fund has shown lower volatility in performance and generated superior risk-adjusted returns for its investors. Its Sharpe Ratio indicating risk-adjusted returns reflecting its ability to contain risk has been among the best in the category, far better than the benchmark.

Urgent: It's time to load up on this defence stock

CRETS is an actively managed fund that focuses on growth-oriented investment style with an aim to generate long-term capital appreciation. It follows a multi-cap portfolio strategy and holds a well-diversified portfolio spread across market caps.

The fund follows a mix of top-down and bottom-up approach to stock picking with preference for high growth oriented stocks in attractive looking sectors. CRETS seeks to benefit from long term investing due to its lock-in and has a blended portfolio of diversified stocks with GARP (Growth at Reasonable Price) style of investing.

The fund seeks to identify companies with strong competitive position in good business and having quality management. The fund management gives high importance to Qualitative features, management and governance. It also looks at Quantitative parameters by analyzing the balance sheet.

The core focus remains on earnings, growth and cash flow generating businesses. The fund managers use valuation to determine the weight, i.e. underweight / overweight position of stocks and sectors in the portfolio. CRETS holds a pre-dominant large cap portfolio, where at least 60% of its asset is invested into large caps and maximum 40% into mid and small caps.

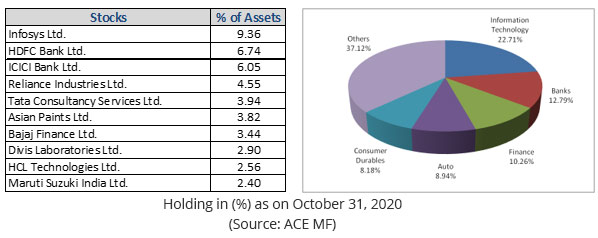

CRETS usually holds a well-diversified portfolio spread across market caps. As on October 31, 2020, the fund held 52 stocks in its portfolio with top holding in large cap names like Infosys, HDFC Bank, ICICI Bank, Reliance Industries, TCS, etc. The top 10 holdings in the portfolio together accounted for around 46% of its assets. With active portfolio management, the level of churning in the portfolio is on the higher side. The turnover ratio of the portfolio is currently trending in the range of 150% to 200%.

The fund's encouraging performance in the last one year has been driven by stocks like Divi's Laboratories, L&T Infotech, Atul, Asian Paints, Aarti Industries, etc. In the recent past, the fund managers have booked substantial profits in names like Alkem Laboratories, Shree Cement, Escorts, BhartiAirtel, among others.

In terms of sector holdings, CRETS maintains a mix of defensives and cyclicals in the portfolio. Banking and Finance stocks together form around 23% of its portfolio while Infotech follows closely behind. Auto, Consumer Durables, Pharma, Consumption, etc. were among the other core sectors in the portfolio. Over 88% of its portfolio was concentrated across the top 10 sectors.

CRETS maintains a well-diversified portfolio of quality stocks with a long-term investment view. Despite being an aggressive growth-oriented fund, the fund managers avoid taking momentum bets and focus on quality stocks with solid growth potential in the long run.

Being benchmark agnostic, CRETS clearly avoids benchmarking the index. The fund managers decide the weight on each stock, irrespective of their weightage in the index. Hence, the performance of the fund may deviate significantly from the benchmark.

While the prolonged underperformance of the fund in 2016-2017 was a major concern for its investors, its current performance is exceptionally on track. This makes CRETS suitable for investors with high risk appetite and investment horizon of at least 5 years.

Editor's note: The last few years have not been among the best for equity mutual funds. While most funds have underperformed or are struggling to match the returns of the benchmark, there are few funds that have the potential to constantly generate alpha for its investors. And we have identified five such high alpha generating funds, in our latest report 'The Alpha Funds Report 2020'. Do not miss our latest research finding. Get your access to this exclusive report, right here!

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

In this video, I'll show you how to short sell effectively.

Ajit Dayal on the urgent need to fix the disparity between the rich and the poor in the US.

Why I admire the approach that Richa uses to zero in on stocks with huge upside potential.

Rahul Shah discusses why he preferred a little known stock over Nestle Ltd and how he was proven right.

In this video, I'll show you how to make the best trading system.

More Views on NewsWill Joe Biden be good or bad for the markets if he becomes the next US president?

In this video, I present my top 5 ideas for traders this festive season.

Nov 11, 2020Investing in this smallcap could open doors of huge, long-lasting wealth.

What should be your action plan in view of the Nifty PE reaching an all-time high?

Ajit Dayal warns us on the dangers of the power of money in politics.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!