CyberArk: Varonis Transition Teaches Us To Buy CyberArk Stock Now

CyberArk announced that the company is transitioning to a subscription business model beginning C2021. We expect the transition to complete in C2022 (1 year) earlier than a typical 8-10 quarters.

Investors should buy CyberArk on weakness or opportunistically, given that stock is likely to rally as Varonis did long before the transition is complete.

CyberArk is well on the way to becoming a subscription player, as more than 45% of its new license bookings in 3Q or 35% YTD are from SaaS and Subscriptions.

Identity Management and Privileged Access Management (PAM) are now at the top of CIO/CISO spending priorities. CyberArk stops the use of stolen credentials from accessing critical systems.

When a breach occurs, CyberArk is usually the 2nd phone call made, while breach remediation companies such as Mandiant are the first, indicating the essential nature of CyberArk's products.

CyberArk (NASDAQ:CYBR) is one of the best-positioned players in Privileged Access Management (PAM). CyberArk is essentially the last remaining sentry before hackers can get to valuable data stored on companies' servers and storage systems. PAM consistently remains one of the top two IT spending priorities for a CIO/CISO. Given the company's impending transition to subscription and the impending multiple expansion, position within the industry, ability to execute on its product roadmap and strategy, we remain a buy.

Pandemic driving demand and recurring revenue growth

According to the company, CyberArk's SaaS and Subscription products such as Privilege Cloud, Alero, Idaptive, and EPM are driving recurring revenue growth. If the customer demands to buy the core PAS as a subscription, CyberArk is willing to entertain the customer. In addition, the pandemic is forcing enterprises to evaluate how they buy and deploy software products.

CEO Ehud Mokady noted on 3Q earnings call,

"Our financial results show that customers are embracing recurring revenue consumption models. Without making any changes to our go-to-market approach, year-to-date, more than 35% of our new license bookings were from SaaS and subscription. In the third quarter, this mix reached over 45% of our new license bookings, including 7 of our top-10 license deals. This dramatic increase in the subscription mix was driven predominantly by record SaaS demand. We have the broadest, most feature-rich cloud portfolio to secure privileged access and identity security in the market. Our ongoing innovation, the breadth of our portfolio, and the maturity of our cloud offerings will be a key driver of our subscription transition program, adding incredibly valuable SaaS recurring revenue and deeper, long-lasting customer relationships."

Given that customers prefer to buy its products via subscriptions, CyberArk is transitioning to selling all its products on a subscription basis.

Digital transformation to accelerate the transition to subscription model

The pandemic has forced enterprises to evaluate how they buy and deploy software products. A majority of the enterprises are in the midst of digital transformation (DX). These enterprises are deploying applications in what we call a hybrid cloud architecture - i.e., applications are run on-premises as well as in multiple clouds, taking advantage of the best features each cloud vendor provides. Given this architecture change, enterprises are now much more comfortable buying software and services on a subscription basis, rather than only on a perpetual basis. Buying on a subscription basis conserves cash upfront and allows for more flexibility for the customer.

Expect the transition to complete in four quarters or by the end of C2021

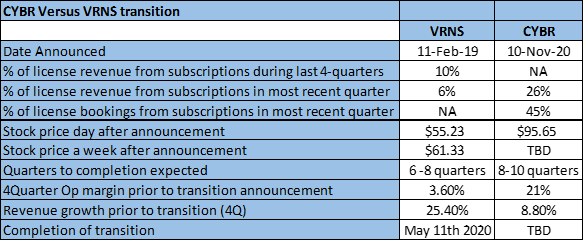

A typical subscription transition takes 8 to 10 quarters. We expect the CyberArk transition to complete earlier than this. We expect the transition to be complete by the end of C2021 in 4 quarters, after the transition begins in January 2021. Therefore, investors waiting for the transition to complete before buying the stock are likely to forego easier gains. During the transition phase, we believe the multiple will expand from the current levels much more readily than post-transition. A case in point is Varonis (NASDAQ:VRNS) transition to a subscription model that began in C1Q19 and was complete by the end of C4Q19.

Lessons from Varonis transition

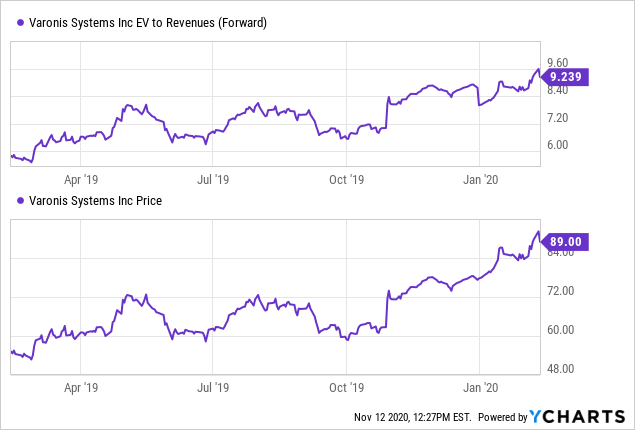

Varonis announced the transition to subscription on February 11th, 2019, after market close. The following day the stock fell from the previous day close of $63.96 to $55.23, a whopping 13.6% pullback. Within a month, the stock was up 12.4%, and the stock closed at $61.33 on March 12th, 2019. Within a year, the stock was up 65% and closed at $90.97 on February 12th, 2020. The following charts illustrate Varonis's stock appreciation and valuation since the announcement of the transition.

Why CyberArk's transition should be faster than Varonis'?

We believe CyberArk's transition should complete faster than Varonis' transition, given that CyberArk already receives a significant number of new bookings from subscriptions. During F3Q20, CyberArk received more than 26% of license revenue from subscriptions. More importantly, more than 45% of CyberArk's license bookings were from subscriptions. CyberArk has a number of products such as Idaptive, Alero, and Endpoint Privilege Manager (EPM) that are sold only on a subscription basis. All these products are driving the growth of the company's subscription revenue. With the company now set to actively push for the subscription model, we expect the transition to complete sooner than many on the street expect. The following charts illustrate CyberArk is already well ahead of Varonis on the path to subscription transition.

Source: Author from Refinitiv data

Valuation

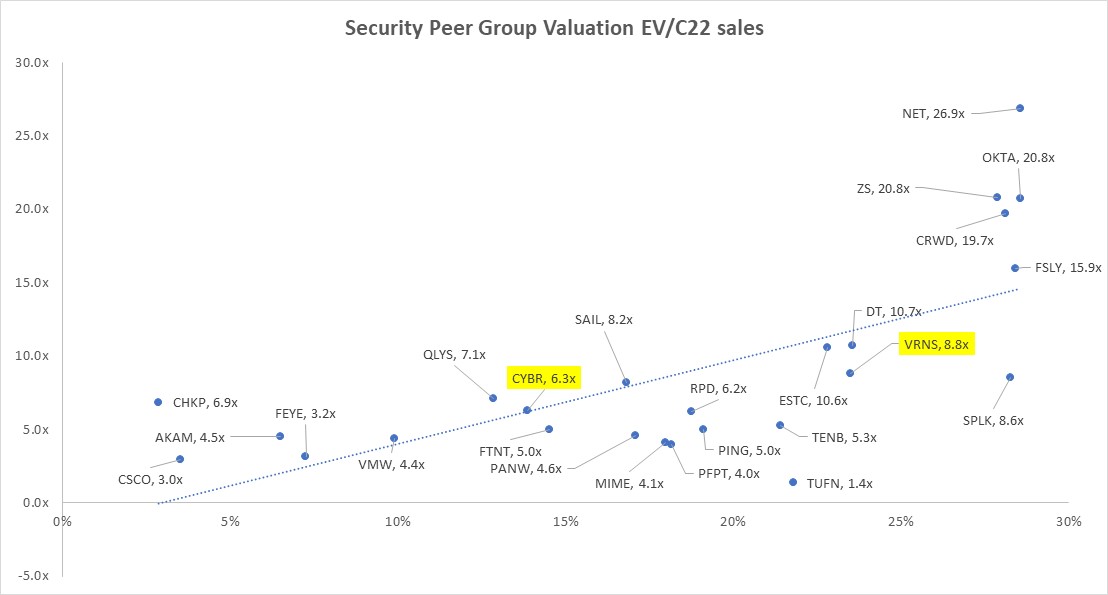

CyberArk currently trades at 6.3x EV/C2022 sales versus the peer group average of 8.9x, while growing 14% versus 18% for the peer group. This revenue underperformance versus the peer group can easily be attributed to an increasing mix of subscription revenue. Due to COVID-19, many customers are opting to buy subscriptions, even when the software is installed on-prem. On-prem software is typically sold using a perpetual license. During F3Q, subscriptions created a $14 million headwind, and this is up from a $9 million headwind in 2Q and $5 million in 1Q. This increasing mix of subscriptions skews the revenue growth metric. The following charts illustrate CyberArk's valuation relative to the security peer group.

Source: Author based on Refinitiv data

What to do with the stock - Buy opportunistically now and not wait for the transition to complete

While there is some uncertainty with the subscription transition, we believe the company is in better shape than many investors believe. The company already derives a significant portion of its revenue from subscriptions. The stock is already up about 8% since the company announced results earlier this week (November 10th). We believe the company will be afforded a subscription multiple by the middle of C2021, as we expect the subscription trajectory to be better than many investors expect.

Barring a major shock to the economy, we expect the sentiment on the stock to improve as the quarter progresses and into next year. We expect the mix of subscription revenue to increase during 4Q. Given the estimates are reasonable and the company already guided EPS down, we expect the company to beat estimates when it reports results in February 2021.

Given our confidence in the CyberArk story and its position within the security landscape, and the confidence in the subscription transition, we would be buying shares opportunistically on any weakness now.

Disclosure: I am/we are long VRNS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.