The Reality Of Cedar Realty Trust

Numerous SA authors have described rosy prospects for Cedar Realty Trust (CDR) based on its portfolio of properties and the attractive valuation metrics of its stock.

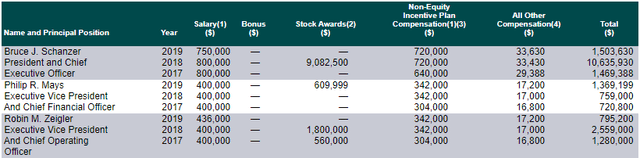

Meanwhile CDR's equity price continues its long-term and devastating downward trajectory.

CDR will not be an attractive investment until management aggressively supports its market price through cost cutting, a major shift in priorities and, eventually, share buybacks.

(Note: I am an activist investor and I have a very small long position in CDR.)

Cedar Reality Trust (CDR) is a REIT that owns, operates and redevelops 56 grocery-anchored and other shopping centers in Northeastern U.S. urban markets. CDR traded near $3 per share in the months prior to the pandemic, has more recently fallen below $1 per share and has announced another reverse split.

Devastating Shareholder Wealth Destruction

In its 34 years of existence, CDR has destroyed 85% of its initial shareholder wealth (i.e., its since-inception cumulative total return assuming dividend distribution has been -85%).

Data by YCharts

Data by YChartsShareholder wealth - after accounting for distributions - has been devastated over every important time interval. It was down in its first ten years, down in its last the last ten years and down this year.

The decline is especially remarkable because this 34-year period has been marked by robust returns throughout equity and fixed income markets in which most assets generated healthy income and massive capital gains. Equities in general are up roughly twenty-fold during the same time period that CDR has lost 85%. But, in all fairness, REITs have underperformed overall equity markets (unadjusted for risk). NAREIT provides extensive historical REIT return data broken into sectors and subsectors. Unfortunately the data only go back to 1994. According to my computations, from the start of 1994 to the end of 2019 the cumulative total return of the "Shopping Centers" subsector of the REIT index indicates an increase of 835% (cumulative total return with distribution reinvestment).

Comparing CDR's losses to the index's gains highlights how incredibly poorly CDR has performed. The bottom line is that while CDR has turned each $7 of shareholder wealth into $1 over 34 years, over a shorter time period (based on sub-sector data going back 24 years) overall REIT shopping centers have soared in value eight-fold: an incredible 56-fold differential.

Prior to the recent 2/3rds decline in CDR due to the pandemic, the total return over the lifetime of CDR up until the pandemic destroyed 50% of shareholder wealth (after including distributions). REIT indexes indicate that shopping centers have roughly broken even over the last five to six years (through the end of 2019) and have done much better than CDR since the pandemic began.

Page 24 of CDR's 2019 annual report summarizes CDR's performance against two benchmarks by reporting the accumulation in value from investing $100 in each investment on 1/1/15:

The results (especially the decline to $49.40 for CDR) reflect horrible returns on CDR relative to small stocks (a gain to $148.49) and overall equity REITs (a gain to $149.86).

Performance in 2020 continues to crush CDR shareholders. For example, from 12/31/2019 to Sept. 30, 2020 , the NAREIT shopping centers index is down about 45%, CDR was down about 75% over the same interval.

The pandemic simply continued CDR's dismal performance relative to reasonable benchmarks. CDRs problems have spilled over into its ability to maintain its distribution. Dividend.com notes CDR's recent and massive 80% cut to its distribution.

Cedar Realty Trust (CDR) – Cedar Realty reduced its distribution to one-cent per share to preserve capital. The REIT also drew down $75 million from its credit facility and has $20 million in remaining borrowing capacity. Management has also begun reducing near-term redevelopment and other non-essential capital expenditures.

Distributions have been slashed from 5 cents per share quarterly to 1 cent - an 80% reduction. Of course distributions are not a reward to shareholders. Distributions simply distribute shareholder wealth from inside the corporation to the corporation's owners. Nevertheless, it will be quite a while, if ever, before CDR can be touted again based on its distribution.

If one reads through articles regarding CDR on Seeking Alpha there appears to be nearly unanimous praise for its high distribution yields and excellent managerial decisions regarding property selection and management. I provide details on that later in this article. First, let's look at CDR and its stock splits.

Past and Planned Reverse CDR Stock Splits

The devastating destruction of the wealth of CDR shareholders has been masked in part by reverse stock splits. CDR traded above $20 per share at its start in 1986 and remained above $20 per share through 1988. In fact, 17 years ago there was a direct split: in July of 2003 CDR executed a 2-1 direct stock split. But only three months later in 2003 CDR executed a 1:6 reverse stock split! The net result is a 1:3 reverse split for a stock that began at $20+ and ended up trading recently well below $1 per share.

As reported by Seeking Alpha's internal news team, CDR is in jeopardy of losing its listing on the NYSE if the stock stays below $1.00 per share (the minimum average share price required to maintain listing on the NYSE).

CDR said it will continue to monitor the closing price of its common stock and consider available options, such as a reverse stock split, if it appears unlikely that the minimum share price requirement will be satisfied by Dec. 31, 2020.

On October 27, 2020, the Board of Directors approved a plan for a 6.6 for 1 reverse common stock split, which will be completed prior to December 31, 2020

Past and present reverse-splitting is a harmful way to address the core problem of long-term decline in the share price of CDR. Randy Woolridge and I published the seminal article on the deleterious effects of reverse splits on shareholder wealth. Reverse splits can be signals that management sees little hope of a return to financial health in the near future.

Current and prospective shareholders should take a sober look at this recent and supposedly pandemic-caused decline in CDR. Given the long-term total return performance of CDR it is just another sad chapter in a long sad story. Most firms with long-term catastrophic stock price declines exhibit the same phenomena: In good years they generate little or no profit. In bad years they suffer devastating loss. CDR has followed that disastrous pattern for its entire history.

Even if its often-touted distribution yield is included in measuring shareholder returns CDR has destroyed most of its shareholders' wealth. The downward trajectory did not start with COVID and it will not end if management and shareholders keep doing the same thing while expecting a different result.

A Deep Dive on Free Cash Flow, Depreciation Expense and Asset Losses

Accounting performance of ordinary corporations focuses on net income. Accounting performance of real estate properties (and REITs) focuses on FFO (funds from operations). The primary difference in real estate funds between net income and FFO is that FFO adds back in depreciation since it is a non-cash accounting number.

Viewing a REIT's financial performance through the lens of FFO relies on the premise that its deprecation for accounting purposes is not a "real" expense. This view may be valid when the assets are holding stable market values or even rising.

For example, when the market price of a building is rising in value (e.g., keeping up with inflation) and its owners are allowed to deduct depreciation expense in determining taxable income, the property's depreciation may be viewed as offering an important tax advantage when held directly. In that case the FFO provides the investor with a meaningful measure of true profitability by adding back the depreciation to net income .

The "elephant in the room" is that FFO is not a meaningful measure of CDR's performance because CDR has been consistently losing money on its properties. When a real estate investor's properties are actually declining in value, depreciation is not an incidental accounting number that generates tax advantages, it is a real loss. And in the case of CDR the losses have been huge.

If the book values of CDR's properties were simply being reduced in value through depreciation by the same amount that the true values of the properties were declining, then CDR's net income would be a far better measure of its performance than its FFO. But, in fact, it's worse: CDR's properties have been declining at a faster rate than the allowed depreciation! So FFO massively overstates true economic performance when it adds back depreciation in cases where the depreciation is understated. CDR's history of impairments (detailed in the next section) indicates that CDR has been expensing depreciation too conservatively and that the financial statements understate the losses in value of CDR's assets. So in the case of CDR the reported FFOs are a ridiculous metric for shareholders to view as being indicative of profit.

Impairments are Measures of Losses on Properties

Real estate financial statements use the word impairments to indicate losses on properties. Impairments take three general forms: realized losses on property sales, expected losses on properties held for sale, and impairments on properties held for use.

Realized losses on sales are quite clear (although shareholders should be aware that managers can temporarily mask true losses by holding on to distressed properties and only selling the healthy ones).

Estimation of impairments on assets "held-for-sale" is problematic. Estimation of unrealized losses on those assets can be quite subjective. Further, the decision of which assets to place in "held-for-sale" is up to management and can influenced by preferences to accelerate or defer accounting recognition of losses.

However, impairments on properties "held for use" (i.e., not held for sale) are the typically the largest category of assets and are potentially even more problematic. They are measured using estimates of expected future cash flows without discounting for time or risk (which contradicts virtually every valuation concept in modern finance):

[properties not held for use]...recognize an impairment loss only if the carrying amount of a long-lived asset is not recoverable from its undiscounted cash flows

The above standard ( FASB Statement No. 144) for recognizing impairments on assets "held for use" ridiculously underestimates impairments by limiting an impairment to only those cases where the book value of the asset is less than the sum of all the future expected net cash flows over the asset's entire useful life (without discounting for the time value of money and risk)! Real estate investors therefore should view total impairments as potentially being tremendously underestimated and that management can delay recognizing asset losses by simply keeping the worst assets in the category of "held for use".

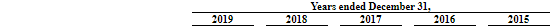

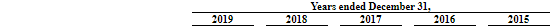

Estimating the true market value of real estate holdings of CDR is difficult. What do the accounting statements of CDR reveal about the actual market value of CDR's properties? One indication is based on the impairments reported each year in CDR's income statement. The graphics below (from page 25 of the 2019 annual report) indicate that for the previous five years CDR has been recognizing large impairments since 2016.

Impairments (e.g., losses on property sales) have been huge for the last four calendar years. The key point is this: CDR has been losing money and its distributions are coming out of capital, not income. Commentators should be concerned whenever a REIT with a high distribution rate is actually losing money. Page 25 of the 2019 annual report indicates huge losses starting in 2016:

To the extent that depreciation has not been keeping up with declines in property values on "held for use", the huge losses in 2016-2019 (above) understate the true economic losses. The distributions for the last 4.5 years have not been pass-throughs of profits - they have been distribution of assets.

Financial statements with information back to 2009 indicate sporadic annual impairments. However, 2011 (the year when the current CEO took over) had an $88 million impairment. Impairments were modest until 2016 (shown previously).

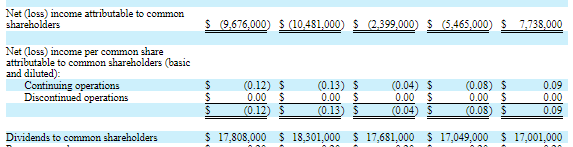

Impairments reduce accounting-based measures of performance during the period in which they are recognized and reduce book value per share from that point on. Impairments are one reason why the book value of the stock (per share) has been declining. The following chart shows how the book value declined in the years of large impairments: 2011 and 2017-2019:

Data by YCharts

Data by YChartsThe above diagram of declining book value by roughly 50% in 5-6 years is evidence that the book values of CDRs assets are declining rapidly - and the long record of impairments indicates that they are falling faster than indicated by depreciation alone.

The scary possibility is that while the firm has recognized $45 million of impairments on properties from 2016-2019, such losses might only partially reflect the disastrous reality of the firm's portfolio of properties. My experience in asset management is that portfolio managers with poor performance often sell their best-performing assets rather than their worst-performing assets in order to avoid posting disastrous realized accounting losses.

A key issue is whether or not CDR's currently-reported property values are accurate indications of their true market values. In theory the financial statements should indicate that information. But ultimately the proof of how much assets are worth is revealed each year from the cash flows generated while the assets are being operated and in the asset's final year when the assets are sold and the sales price can be compared to the book values.

Some commentators on CDR promote the view that the poor performance is from legacy assets relative to the current management team. But note that CDR's top two officers have been with CDR since June 2011. How long will the losses continue from poor investments? A key question is whether the huge losses on disposition of assets is over. Management indicates that their properties are "highly desirable" and that CDR has a "remarkable track record of success". The latter claim is patently in contrast to the evidence, so can the former claim of having highly desirable remaining properties be believed?

A Deep Dive on Expenses

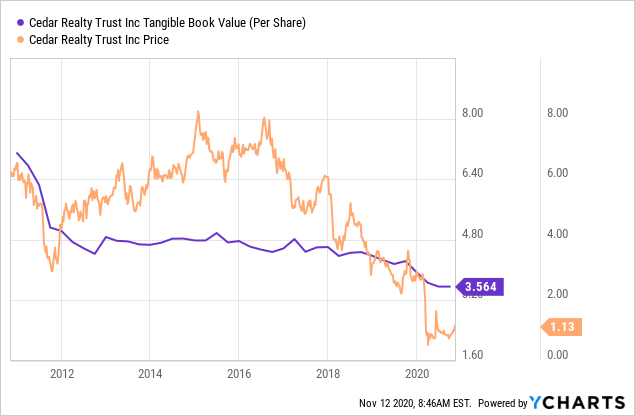

Given the abysmal performance of CDR over various time horizons from the perspective of shareholders, one would think that CDR's management would be exhibiting extraordinary efforts to reign in expenses in an effort to stop the downward spiral of its value. Unfortunately the opposite is occurring:

While lower interest rates (or lower borrowing through debt as opposed to preferred stock) may have contributed to lowered financing costs, CDR's general and administrative expense (expressed as a percentage of annual revenues) and its total operating expense (also as a percentage of annual revenues) are high (by subsector standards) and increasing.

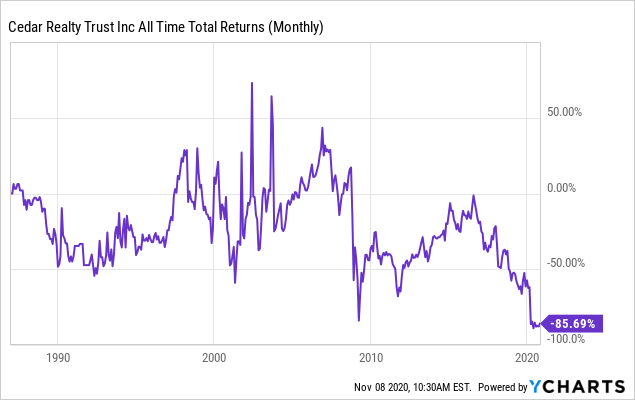

Its hard to understand the decisions being made on executive compensation during these disastrous years (proxy page 40):

Shareholders Should Consider Being More Proactive

A positive outlook can be useful in business and in life. But CDR's public-facing façade indicates a denial of reality. Here are some headlines and important points from the CDR website accessed November 2020 that, among other things, features photos of 13 vice presidents"

- We maintain a strong balance sheet

- Our company has made remarkable strides since we first established our business.

- [CDR is] A high performing REIT

- We carefully underwrite investment opportunities to ensure we achieve attractive returns on capital for our shareholders.

- This combination has allowed us to achieve a highly desirable portfolio by migrating our capital into the highest density markets between D.C. and Boston, while establishing a solid balance sheet.

- A disciplined strategic focus, thoughtful capital allocation and culture of everyday excellence contribute to our record of impressive results

- A Real Estate Investment Trust ROOTED IN RESULTS [emphasis not added]

- We consistently set and meet the highest standards in delivering results, both for our shareholders and the communities we serve.

- Our remarkable track record of success is due to a culture of everyday excellence built on a core set of values and company benefits.

- By investing into our centers, we meet the needs of the urban communities we serve, while generating substantial long-term returns on capital.

Let's Take a Look at Recent SA Articles on CDR

Overall coverage of CDR by Seeking Alpha authors gives CDR a Bullish 4.0 score.

Robert Lewis provides a great in-depth analysis of CDR's assets and its Funds from Operations or FFO, describing CDRs stock price as "cheap" and is bullish. Dane Bowler provides detailed descriptions and insights on the poor quality of CDR's previous assets and the firm's efforts to strengthen the quality of its portfolio of properties. Rida Morwa's February 2020 article focused on CRD's common equity raised concerns about expenses:

One potential concern that investors might have looking at the income statements is the relatively large G&A expenses relative to revenue.

I think Morwa was on target with this criticism. Brad Thomas published a Very Bullish rating on CDR in February 2020 a few weeks after the overall market tanked on pandemic concerns. His analysis of CDR's properties is detailed and generally positive. Finally, Brant Munro reiterates the valuation proposition and the attractiveness of the properties, but notes some concern (May 2020) over its debt burden:

On the surface it would appear that the 8.4x Debt/EBITD...at 2019 YE which rose from 7.7x at 2018 YE looks precarious. Although this is high even for a REIT, given the stable tenant mix, cash flows should not be hugely affected and this level of debt should still be manageable.

In summary, coverage of CDR on SA has a history of consistently positive praise for CDR based on optimistic views of its portfolio of properties and its apparently attractive valuation (e.g., discount to its book value). Nevertheless, the stock price has continued to under-perform its benchmarks and its distributions have been cut 80%. In my opinion the pandemic magnified but did not cause CDR's underperformance. CDR's problems are long-term and structural.

Hoya Capital Real Estate provides an extensive analysis of the Shopping Center industry through May 2020. CDR does not look good relative to its peers in terms of leverage and performance.

I believe that most reviews have focused too much on valuation ratios and management's portrayal of the portfolio properties. In my experience attractive multiples for firms with long-term structural problems (e.g., GE) that are not being addressed should be discounted. Perhaps the authors have under-appreciated how long-term and negative the total return has been and the importance of having management that protects its investors by being proactive in providing long-term capital growth in its equity's market price. This key issue is addressed in the next several sections.

CDR's Will Underperform Unless These Three Things Happen

If CDR's long-suffering shareholders are going to recoup the huge losses of their market value, they need to see a "righting of the ship".

1. Instead of adding and renovating assets, CDR should liquidate assets and invest in CDR by repurchasing shares when the shares are trading at a discount from true net asset value. The share repurchase part of this strategy is already noted in its 2020Q3 Corporate Presentation: "Repurchase shares when stock is trading at a discount to NAV" and CDR has indeed recently repurchased shares at a price in excess of $3 per share. Share repurchases should be funded by asset liquidations and should take place after CDR makes other reforms.

2. CDR should embark on a severe expense-reduction program to free additional cash for repurchasing shares.

3. CDR needs to take actions that ensure its shareholders that they recognize how bad long-term performance has been and provide evidence-based indications of why the future will be different than the past. CDR needs to stop putting lipstick on the pigs and to start bringing home some bacon through liquidation of assets. expense reductions and share buybacks.

If Nothing Changes then Nothing Changes

"If nothing changes then nothing changes" is often used on the TV series Intervention as friends and family coalesce to save a person from destruction due to dysfunction. The time has come for shareholders to save CDR from 34 years of dysfunction. CDR will not heal itself, it will keep reverse splitting its price to mask its failures. It will keep reinventing its asset acquisition and renovation strategies like a crew rearranging the deck chairs on the Titanic. It will keep posting presentations and web pages with outlandish claims of success despite a history of remarkable failure.

Simply put: If stakeholders of CDR do not have a rendezvous with reality then investors shouldn't have much hope for a positive result from their investment.

Disclosure: I am/we are long CDR.

Additional disclosure: I am an activist investor and I have a very small long position in CDR.