MarketAxess: A Fast-Growing Dividend Growth Stock

MarketAxess Holdings is an electronic bond trading platform that's revolutionizing the way the fixed-income market operates.

MarketAxess dominates the electronic dealer to consumer fixed income markets as it supports 85% of the total market.

MarketAxess increased its Q2 revenues by 47% annually in 2019 to $185 million, however, in Q3, growth moderated to just 24%, which is still very respectable.

Today, I assess MarketAxess's business model, after which I assess its intrinsic value and project what returns one might expect from owning the stock.

I'm neutral on MarketAxess as of today, though I see it as a great dividend growth investing play.

Source: Investor Relations | MarketAxess Holdings, Inc.

Investment Thesis

MarketAxess (MKTX) is a fintech company digitizing the fixed income market. In equity markets, electronic trading has been around since the 1980s. However, the fixed income market has not been so quick to evolve. MarketAxess offers an electronic trading platform for global fixed income instruments by which the company creates a more efficient and liquid market. As of 2017, 80% of the roughly $6 trillion traded annually in the U.S. fixed income market was traded over the phone, which represents a huge opportunity on which MarketAxess will capitalize.

MarketAxess is disrupting the traditional fixed-income process, especially as global trends are forcing people to transition to digital solutions. MarketAxess controls 85% of all U.S. electronic corporate fixed-income trading and offers Wall Street a new, optimal fixed-income trading platform that's less costly compared to the traditional process, while also creating a democratized, transparent bond market.

In this note, I illustrate MarketAxess' business in greater depth, after which I analyze its financials so as to ascertain a fair value for the company. MarketAxess has a high gross profit margin and currently is generating strong free cash flows. Moreover, the company, incredibly, is growing at 20%-plus while generating free cash flow margins of nearly 45%, all while returning capital to shareholders through a rapidly-growing dividend and very modest share repurchase program.

With all of this being said, MarketAxess is rather overvalued at present. Or perhaps I should say that one will receive compensation for the level of risk they will assume purchasing MarketAxess, which is rather minimal. That is, because we are buying a very obviously high-quality business with a high quality business model, our rate of return should naturally be lower.

- Risk = Return

Revolutionizing the Fixed-Income Market

Source: How technology changed the bond market | Fortune

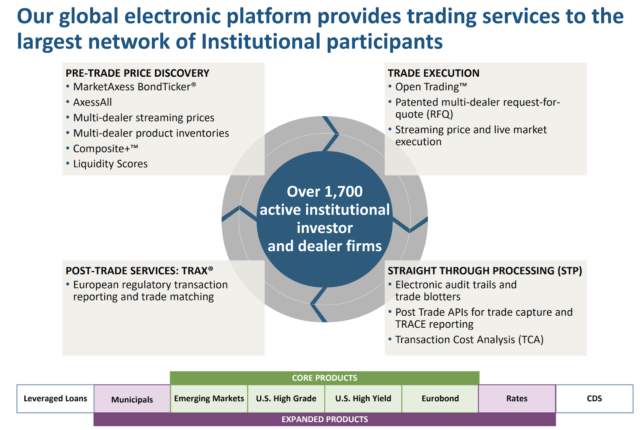

The video above highlights how MarketAxess was started and how it grew its market share to include more and more fixed-income markets, so as to decrease the costs of trading while democratizing the bond market. Today, there are more than 1,700 active institutional investors and dealer firms that use MarketAxess, as can be seen below.

Source: MarketAxess Investor Presentation Q2 2020

MarketAxess offers a variety of services so that institutional investors and dealer firms are equipped with the tools they need to navigate the fixed-income markets. The image above shows the core fixed-income instruments that can be traded on the platform as well as the additional services to make fixed-income trading simpler. MarketAxess uses data analytics and AI to enhance the efficiency and liquidity of the markets on their platform.

MarketAxess generates revenue by taking a fee from each transaction that occurs on its platform, which means it's volume-based. As the fixed income market is worth $50 trillion, MarketAxess will continue to expand its client base. In so doing, MarketAxess will continue to create the preferred platform as it will have access to more and more investors and dealer firms, who will then attract more traders since they’ll want the most active, transparent market to buy or sell.

This is a virtuous cycle that also will further develop the company's moat.

Solid Customer Base Leads to Competitive Advantage

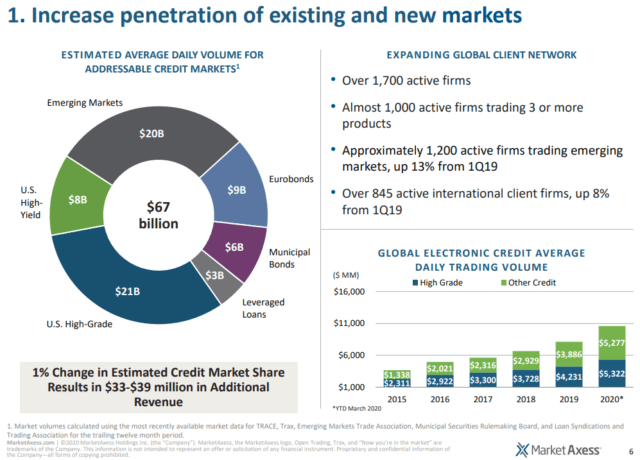

Source: MarketAxess Investor Presentation Q2 2020

MarketAxess already has a strong grasp on the electronic trading market and is consistently increasing its average daily trading volume. MarketAxess offers a wide realm of fixed-income instruments that derive from a variety of countries and the emerging markets, which will continue to expand the company’s moat and competitive advantage as it offers people across the globe access to a wide variety of fixed-income instruments.

Work From Home Pours Fuel On MarketAxess' Fire

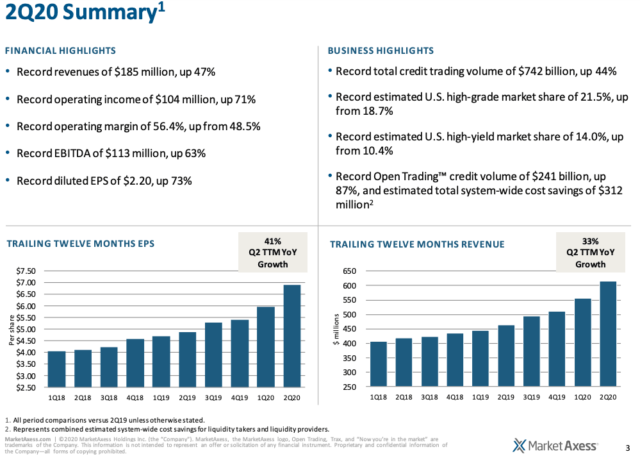

Due to an increase in volatility and people being forced to work from home due to the virus, this resulted in a very strong Q2 for MarketAxess, as can be seen below.

Source: MarketAxess Q2 Conference Call and Webcast

Earlier this year, MarketAxess posted a huge second quarter, with revenues up 47% and witnessed record-setting trading volumes. MarketAxess completed about $12.2 billion in total credit trading volume per day in the quarter and helped investors and dealers gain access to the fixed-income market from their remote locations.

MarketAxess recently reported its Q3, in which growth moderated to 24%. However, as with most industries, the elevation in usage is likely to remain at least partially.

Check out how MarketAxess was a fundamental part of enabling the market, and its platform is creating a sticky customer base in this link, a short response from the CEO, Richard McVey.

MarketAxess has a very strong core business that's creating value for its customers and continues to expand its moat as it offers a wide realm of fixed income instruments. MarketAxess represents an ideal solution that's cost effective and transparent, but just because a company is clearly a winner doesn't mean it will be clearly a good investment.

Next, we will assess the company from a financial perspective.

Financial Analysis

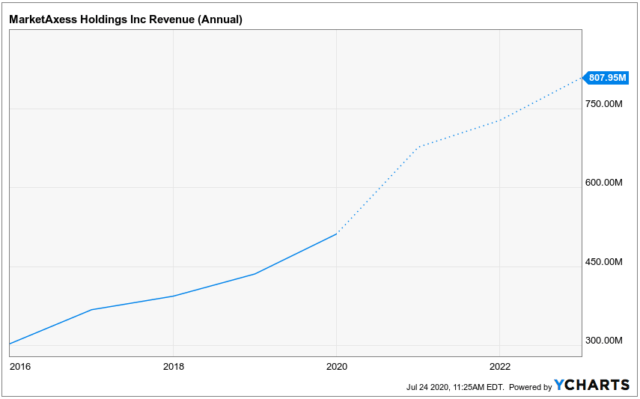

MarketAxess expects to continue to grow rather robustly over the coming few years, as can be seen below.

Source: Ycharts.com

MarketAxess increased its revenue by a 17.5% CAGR to $510 million in 2019 and a 14% CAGR since 2014. While the company hasn’t released revenue guidance for 2020, I anticipate that revenues will increase sharply during this period as there was an increase in trading volume due to the virus, which led to strong year-over-year revenue growth in Q1 and Q2 of 2020. According to Ycharts estimates, MarketAxess will increase its revenue by 32% in 2020.

As an investor, the revenue growth is exciting but MarketAxess is a free cash-generating company and has very strong margins. The company need not grow at breakneck speeds forever in order for it to be a good investment. All that's needed is modest growth, share repurchases, and solid dividend growth.

If we purchase at the right price, then astride those three factors our investment will likely do very well.

So what is the right price? Let's find out.

L.A. Stevens Valuation Model

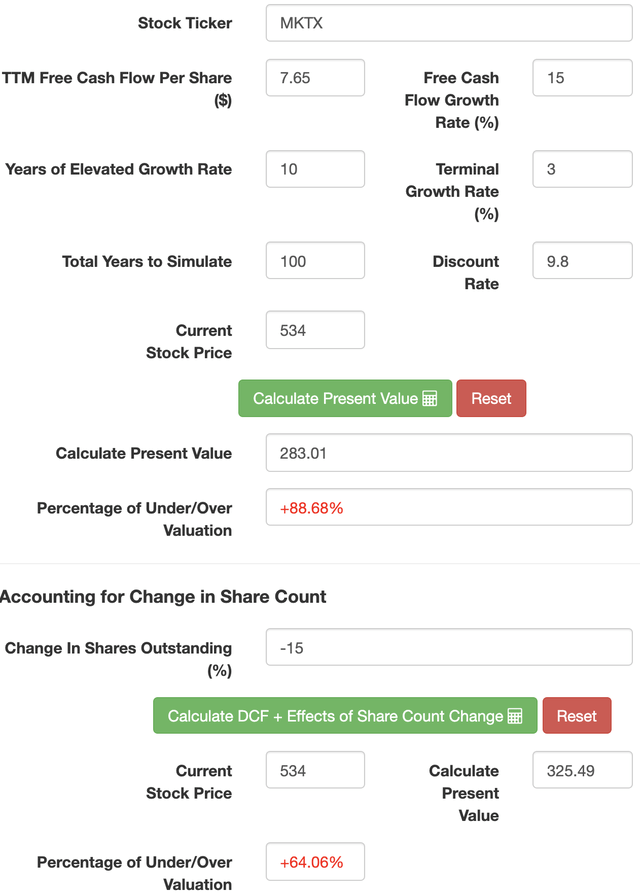

To determine a fair value for MarketAxess, we will employ my proprietary valuation model. Here's what it entails:

In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

In step 3, we normalize valuation for future growth prospects at the end of the 10 years. Then, using today's share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

In step 4, the model accounts for the effect of dividends.

Now, let's check out the results!

Assumptions:

Assumption | |

Free cash flow per share | $7.65 |

Free cash flow per share growth rate | 15% |

Terminal growth rate | 3% |

Years of elevated growth | 10 |

Total years to stimulate | 100 |

Discount Rate (Our "Next Best Alternative") | 9.8% |

Source: L.A. Stevens Valuation Model

Based on the L.A. Stevens Valuation Model, MarketAxess is overvalued today with an intrinsic value closer to about $325, accounting for MarketAxess to buyback shares.

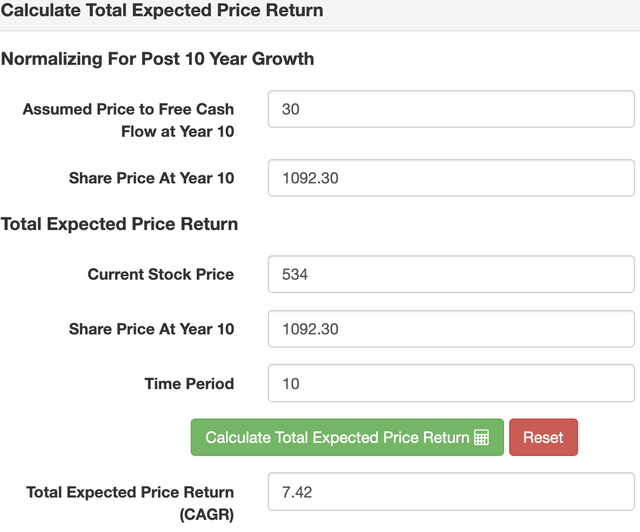

Next, let's check out expected return, which is simply a function of the growth of free cash flow per share based on the growth assumptions shared in steps 1 and 2.

Once we grow free cash flow per share over the course of 10 years at our assumed rate (15%), then we apply a price to free cash flow multiple (in this case 30x), so as to arrive at a target share price for 2030. We then use that target share price and today's share price to arrive a projected annualized returns.

Of course, all of this is automated, so you won't see the math, but I promise it's all happening behind the scenes below!

Expected Return

Source: L.A. Stevens Valuation Model

As can be seen above, through share price appreciation alone, MarketAxess is not very compelling as of today.

However, the company pays a dividend, and luckily, the L.A. Stevens Valuation Model was designed such that it can account for the added returns that would be generated from a dividend.

Check out the total return when accounting for the company's annual dividend:

Expected Return

Accounting For Annual Dividend

Source: L.A. Stevens Valuation Model

Concluding Thoughts

Long term, I'm bullish on MarketAxess. However, I don't like the current share price. It appears that the market is pricing the stock such that it will grow at its recent elevated rate for the next 10 years.

While this may be possible, it's more likely that growth will moderate 1) as we emerge from COVID-19 and 2) as it continues to trend toward market saturation, which is admittedly a ways away.

With that being said, while I don't love it, for the right investor, namely dividend growth investors, MarketAxess might be a very worthwhile bet to consider!

As always, thanks for reading, remember to follow for more, and happy investing!

Beating the Market: The Time Is Now

There has never been a more important time in stock market history to buy individual stocks at the heart of secular growth trends. Mature market performers/underperformers and index funds simply will not cut it, as we face a decade during which there is absolutely no guarantee the overall markets will rise.

This is why the time is now to discover high-quality businesses with aggressive, visionary management, operating at the heart of secular growth trends.

And these are the stocks that my team and I hunt, discuss, and share with our subscribers!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.