LabCorp: Making The Most Of Its Windfall Profits

LabCorp is a mission-critical company that has been on the forefront of testing for COVID-19.

I'm encouraged by the strong revenue backlog of its Covance drug development business, and by the secular growth trend of healthcare spend.

I see management as making the most of its cash flow windfall from the current pandemic to create shareholder value.

When it comes to COVID-19 winners, names like Clorox (CLX) and Zoom Video Communications (ZM) often come to mind. Those companies have been popular with retail investors, given that they are household names. In this article, I’m focused on Laboratory Corporation of America (LH), which has similarly benefited from COVID-19, and is a less popular stock that I believe deserves more attention. I evaluate what makes this stock worth owning at the current valuation, so let’s get started.

(Source: Company website)

A Look Into LabCorp

LabCorp is a global life sciences company whose focus is to guide patient care through its comprehensive clinical laboratory and end-to-end drug development services. It employs nearly 65,000 employees worldwide and serves a wide range of customers, including biopharmaceutical companies, hospitals and health systems, contract research organizations, physicians, and patients.

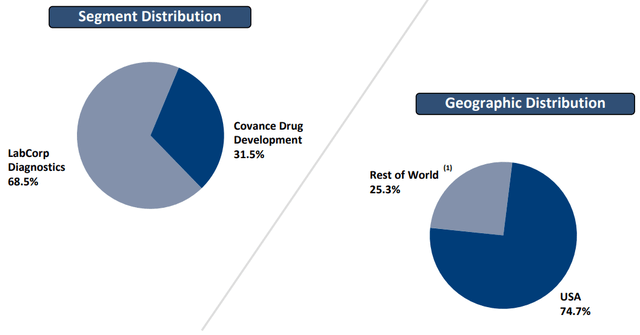

Its business can be divided into two primary segments. LabCorp Diagnostic is the more visible segment, representing 68.5% of Q3’20 revenues, and is responsible for providing clinical testing services. Covance Drug development assists pharmaceutical companies with drug trials, and represents the remaining 31.5% of Q3 revenue. As seen below, LabCorp does about three-quarters of its business in the U.S., and one-quarter internationally.

(Source: Q3’20 Investor Presentation)

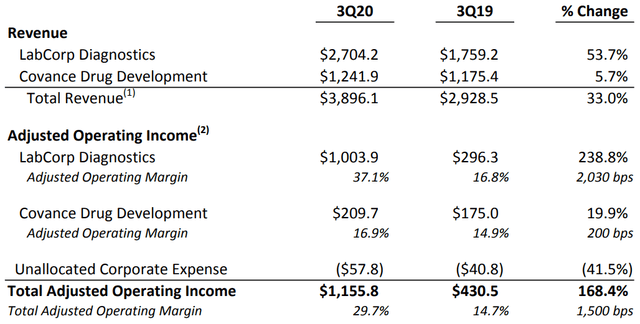

LabCorp just reported Q3 results that were rather impressive. Revenue increased by 33% YoY, to $3.9 billion, beating expectations by $247M. Adjusted EPS landed at $8.41, beating expectations by $3.09. Importantly free cash flow nearly doubled, from $363M in Q3’19 to $709M in the latest quarter. This was the result of a combination of higher operating cash flow, and a $15.4M YoY reduction in capital expenditures, to $77.2M in Q3’20.

As seen below, much of the positive results were driven by the diagnostics business, with revenue increasing by nearly 54% YoY for this segment. So far this year, LabCorp has administered 22 million COVID-19 tests. I’m also encouraged by the revenue growth in the Covance segment as well. It should be noted, however, that much of the revenue increase for Covance also had to do with COVID testing, as organic revenue was flat. Management estimated that organic revenue for Covance would have grown in the mid- to high-single digits had it not been for the effects from the pandemic.

(Source: Q3’20 Investor Presentation)

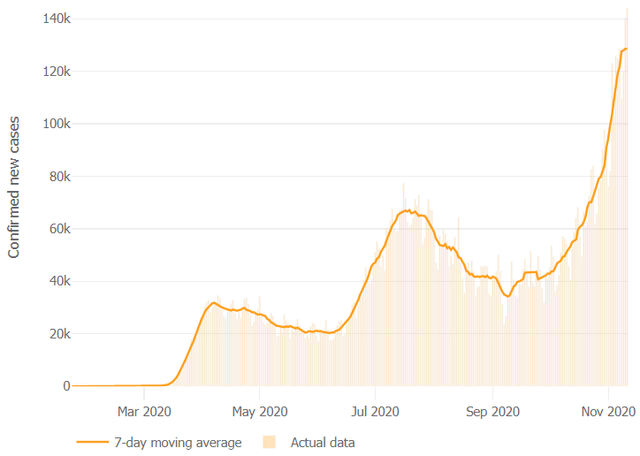

Looking forward, I expect to see continued strong results for LabCorp, as the COVID infection rate is surging again in the U.S. As seen below, new daily infections have risen past the 100K level since the beginning of this month. As such, incremental demand for LabCorp’s testing services should continue to be strong as we head into the winter season.

(Source: Johns Hopkins University)

This near-term growth is further supported by LabCorp’s recent expansion in testing capacity, as it administered 120K COVID tests per day in the month of October. Additionally, it’s the first laboratory to offer physicians the ability to order a combined test for respiratory infections, including COVID-19, RSV and the flu. Plus, I see incremental growth opportunities for LabCorp’s at-home kits, for which it recently filed an Emergency Use Authorization to make the tests available to individuals.

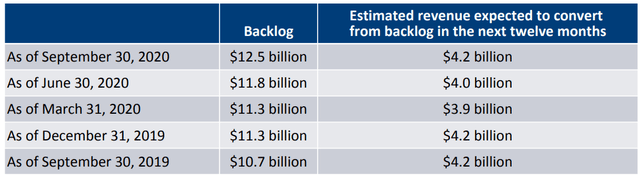

As one could imagine, an eventual easing of the pandemic could be a negative for LabCorp’s business, as that would reduce the amount of testing that is needed. I don’t see this happening in the near-term, given the surging COVID infection rates across much of the country. In addition, an easing of the pandemic would be net positive for the Covance drug development business, as management noted that this segment would have seen single- to mid-digit revenue growth if it hadn’t been for the pandemic. This is supported by the strong $12.5 billion revenue backlog for this segment, with $4.2 billion expected to be converted to revenue in the next twelve months.

(Source: Q3’20 Earnings Presentation)

Meanwhile, I see LabCorp creating shareholder value with its “COVID windfall” through its announcement of reinstating its share repurchase program. Plus, LabCorp invested $204 million in acquisitions during the latest quarter, and paid down $412 million of debt. As such, I see management as making the most of its COVID-related surge in cash flows.

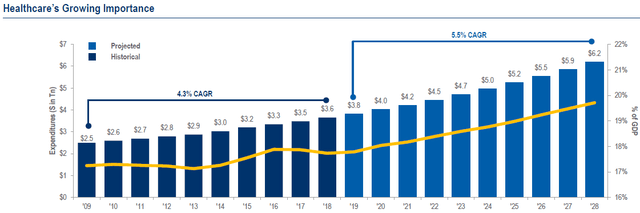

In the long-term, I see LabCorp’s business benefiting from the demographic tailwinds of a fast-rising adult senior population. According to the U.S. Census Bureau, the 65+ age group is growing at a faster rate than that of the general population. By 2030, it projects there will be 95 million people aged 65 and over, representing 23% of the population. As seen below, healthcare spend is expected to grow at a 5.5% CAGR through at least through 2028, representing over 21% of the GDP by that time.

(Source: Centers for Medicare & Medicaid Services)

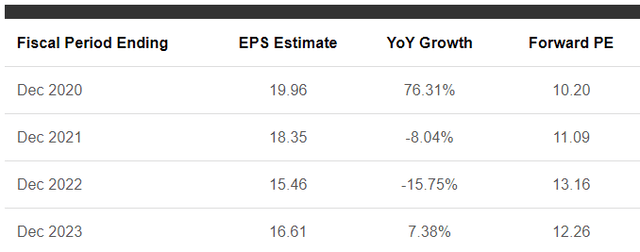

Turning to valuation, it’s fairly apparent that analysts don’t expect LabCorp’s “COVID windfall” to continue forever, with the expectation of a drop in EPS for the years 2021 and 2022. However, growth is expected to pick back up in 2023. I see the shares to be attractively valued at the current price of $201.54, considering that the forward P/E ranges between 10x and 13x between now and 2023. Plus, no one know for sure how long COVID-19 will last, as it could continue on for longer than what analysts expect.

(Source: Seeking Alpha)

Analysts seem to agree that the shares are undervalued, with a consensus Strong Buy rating (score of 4.5 out of 5), and an average price target of $242.53, which sits 20% above the current price.

Investor Takeaway

LabCorp has benefitted from the current pandemic with strong revenue and cash flow growth. I expect this to continue in the near-term, considering the surge in daily new COVID-infection rates. While I don’t expect this windfall to continue forever, I see LabCorp as making the most of this opportunity to create shareholder value, with the reinstatement of the share buyback program, acquisitions, and debt reduction.

I’m also encouraged by the strong revenue backlog in its Covance drug development business, and expect organic revenue for that segment to ramp back up in the coming year. In addition, it's uncertain when COVID-19 will end, so the benefits to LabCorp’s business could last longer than what analysts anticipate.

In the long term, LabCorp benefits from the secular growth trend in the adult senior population and rising healthcare spend, which is expected to grow at a 5.5% CAGR through 2028. I see the shares as being attractively valued, with a forward P/E of just 10x to 13x over the next three years, based on analyst estimates. For the reasons stated above, I see upside potential for the share price.

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.