Zogenix Has A Wide Margin Of Safety After A 60% Sell-Off

Zogenix just launched Fintepla, a product to treat Dravet syndrome.

GW Pharma already has a Fintepla competitor Epidiolex approved and growing big sales in Dravet syndrome and other indications that Fintepla will likely expand to.

Zogenix’s major sell-off makes its valuation look like the more attractive one as compared to GW Pharma despite both companies' promising long-term potential.

Zogenix (ZGNX) is a newly commercial-stage biotech whose first product Fintepla was recently approved and launched for the treatment of the rare disease Dravet syndrome. This is a somewhat competitive space with GW Pharma (GWPH) already having Epidiolex marketed in Dravet syndrome and Lennox-Gastaut syndrome which is Zogenix’s next target and Biocodex’s Diacomit in Dravet syndrome. Despite that, at least one Key Opinion Leader has suggested Fintepla shows impressive durability and could potentially take some market share here. Zogenix shares have dropped over 60% from the low $50’s to around $20 on what was considered disappointing, though still positive, trial results in Lennox-Gastaut syndrome as well as a subsequent cash raise.

Figure 1: Zogenix Stock Chart (source: finviz)

My strong assumption as to why it has stayed down, and even decreased further, since its precipitous drop in February/March has to do with skepticism over launching Fintepla into a competitive and difficult market with COVID-19 still very much affecting drug launches as well as a recent convertible note raise to further shore up the balance sheet.

In this article, I discuss some of the comparative results from GW and Zogenix to help get a sense of Fintepla’s competitiveness in the market. Although Diacomit is also in this market, I do not analyze it here because less info is available given that Biocodex is a private company, and sales have been very slow compared to Epidiolex, too. On top of this, Diacomit acts through the GABA pathway that most traditional anti-epileptic drugs utilize whereas both Epidiolex and Fintepla utilize novel mechanisms of action that distinguish them from the rest of the market.

I’ll also discuss the moves that management has made and whether we should trust their decision-making and value-creation potential. Finally, I discuss the margin of safety I currently see in Zogenix.

Fintepla Looks Pretty Similar to Epidiolex Despite the Market’s Reaction

Zogenix’s main product is Fintepla. Fintepla (generic fenfluramine) is an amphetamine-derived stimulant given in a low dose that can affect serotonin storage levels and acts as a modulator on serotonin transport. Fenfluramine was actually a part of the diet drug Fen-Phen that was withdrawn from the market and the subject of many lawsuits alleging fatal cardiovascular problems. For the record, Zogenix has stated that there was no associated between Fintepla and these types of adverse events in its clinical trials. For seizures, Fintepla modulates serotonin levels to reduce seizure frequency, which again is different from the more typical pathway involving GABA.

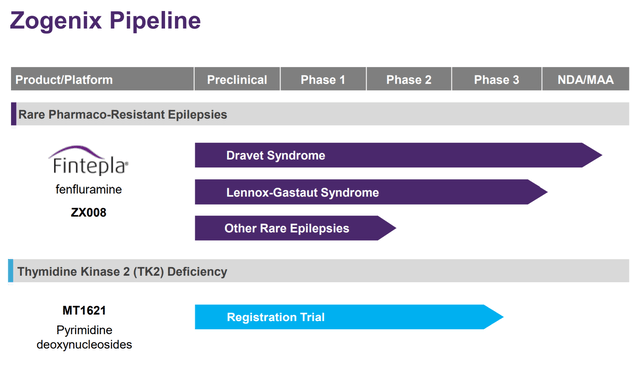

Figure 2: Zogenix’s Pipeline (source: corporate presentation)

Fintepla was launched in the US for Dravet syndrome at the end of July, and Zogenix hopes it will be approved in the EU in Q4. Zogenix has already reported that Fintepla booked $1.5 million in sales during its first quarter on the market. Zogenix has also said that over 360 physicians have already completed the required certification to be able to prescribe Fintepla, a promising sign in my opinion. Zogenix should also be submitting an sNDA in Lennox-Gastaut syndrome this quarter.

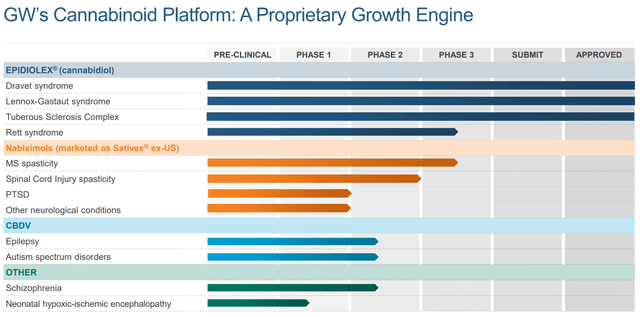

GW’s main product Epidiolex is also targeting the exact same rare epilepsies as Fintepla. Epidiolex though has a significant first mover advantage, having garnered approval in Dravet syndrome in 2018 and already having subsequent approvals in Lennox-Gastaut syndrome and Tuberous Sclerosis Complex also. Because of how long it's already been on the market, Epidiolex already has substantial sales at a time when Fintepla is just launching.

Epidiolex is a formulation of cannabidiol or CBD that has also been shown to reduce seizure frequency in these rare seizure disorders. CBD has long been researched for its effects in various conditions, but as best I can tell, scientists do not conclusively know how Epidiolex has its seizure reducing effects. The most likely hypothesis I’ve seen is through an interaction with certain cannabinoid receptors in the brain. Regardless, Epidiolex has been very successful and achieved a substantial level of sales in two short years.

Figure 3: GW’s Pipeline (source: corporate presentation)

As you can see from Figures 2 and 3, there’s a significant amount of overlap in the top portions of both charts that show opportunities in rare forms of epilepsy. Epidiolex has a pretty significant first mover advantage and also the fact that its often perceived as a natural, plant-derived product is perceived as a benefit by many consumers. Both drugs were highly effective versus their respective placebo arms, but there was no head-to-head comparison that would allow for a direct assessment of efficacy that might help Fintepla take market share.

In Dravet syndrome, the data points a bit more towards Fintepla. Fintepla showed a 74.9% reduction in convulsive seizure frequency in patients already on 2+ other anti-epileptic therapies versus a placebo response of just 19.2%. On the same measure, Epidiolex showed a 39% reduction versus a 13% placebo response. For Fintepla, the drug response was nearly 4x that of the placebo and the raw percentage point difference for Fintepla was 55.7% over the placebo. For Epidiolex, the drug response was 3x that of the placebo and the raw percentage point difference for Epidiolex was 26% over the placebo. This suggests to me that doctors might have an incentive to try swapping Dravet syndrome patients to Fintepla.

In Lennox-Gastaut syndrome, the data was far more mixed. Fintepla showed a 26.5% reduction in monthly drop seizures versus just 7.8% for the placebo. Epidiolex on the other hand showed a 42% reduction in monthly drop seizures versus a 17% reduction in the placebo group. Stated one way, Fintepla had 3.4x the efficacy of its placebo versus just 2.5x for Epidiolex. But alternatively, Epidiolex lowered seizures by 25 percentage points more than its placebo whereas for Fintepla it was only about 19 percentage points.

As you can see, there’s certainly some suggestion of comparative efficacy for Fintepla beyond what’s seen with Epidiolex, and the completely separate mechanisms of action combined with data showing strong overall efficacy versus placebo should allow both of these products to carve out a niche in the market. Importantly though for this comparison, the entire rest of Zogenix’s and GW’s pipelines beyond rare epilepsies are completely divergent, meaning there’s no reason to think these companies can’t co-exist either way.

Zogenix’s MT1621 was brought in through an acquisition in 2019. MT1621 is a treatment for thymidine kinase 2 deficiency, a rare disorder that results in a depletion of mitochondrial DNA, leading to severe muscular weakness and often death. Unfortunately, there are currently no approved treatments. MT1621 is considered substrate enhancement therapy and essentially works by providing additional building blocks for the mitochondrial DNA that gets depleted in patients with this disease. Positive Phase 2 data was announced for this program in October 2019, and Zogenix recently met with the FDA to figure out what else will be needed to support an NDA submission that the company now says will come in the first half of 2022.

MT1621 fits in well with Zogenix’s focus on rare diseases, and there are numerous recent examples of rare disease therapies that have made lots of money for the companies that make them.

Zogenix has a Strong Balance Sheet that Should Limit Future Dilution

At the end of Q3, Zogenix had $525 million in cash and equivalents. The company's net loss ballooned somewhat to just over $60 million in Q3, but even at this higher rate one would expect that Zogenix should have around 2 years’ worth of cash runway even without factoring in the potential for Fintepla sales to start offsetting some of that cash burn.

One of the biggest risks though for a company like Zogenix is that more substantially more dilutive capital might have to be raised if Fintepla sales are slow to pick up. Biopharma launches are expensive, and good sales growth is far from guaranteed. Current investors in Zogenix could be adversely affected in a very material way if such a downbeat scenario were to play out.

Zogenix’s Valuation is Compelling at these Levels

Zogenix has a bright sales outlooks that makes it a potentially attractive investments. GW's Epidiolex had $132.6 million in sales in Q3 after being on the market for only about two years, and GW is on track to likely exceed $500 million in sales for the year. Given that Zogenix’s entire market cap is only about $1.16 billion at present, the company arguably wouldn’t even need to achieve the level Epidiolex currently has to support the current valuation given the typical 4x to 5x multiplier that companies in the sector tend to be valued at. That said, analyst estimates I’ve seen for Fintepla in just Dravet syndrome and Lennox-Gastaut syndrome are higher than these current Epidiolex sales, pegged by one analyst at $1.1 billion. Another estimate I saw was for $500 million to $800 million in peak sales in Dravet syndrome alone. The biggest risk for Zogenix is just that sales could still disappoint and never get to levels required for investors to get a decent return on their invested capital at this point.

As stated above, Zogenix’s current market cap is around some estimates of Fintepla peak sales that I’ve seen, but if you factor in Zogenix’s net cash position of likely around $350 million, then Fintepla is in theory only being valued at about $800 million, still only within the range of sales estimates I’ve seen for Fintepla in Dravet syndrome alone. This basically makes the MT1621 and expanded Fintepla opportunities into essentially free call options with tremendous future upside potential for Zogenix.

Thus, Zogenix’s present valuation leaves a substantial amount of room for error. Zogenix has differentiated technology from other players in the rare epilepsy market as well as targeting a completely new market with MT1621. Zogenix's management has maintained a strong balance sheet while getting its initial product to market, and I like the move to acquire MT1621 to add upside potential. This type of acquisition is a good indicator that Zogenix's management will be on the lookout for advantageous ways to utilize cash flow when it comes.

This is a delayed release article from my Marketplace Service, Biotech Value Investing. Subscribers received this 30 days ago, but I believe the research is still applicable today. The version available to Subscribers also provided more detail on Zogenix's valuation including results of my discounted cash flow analysis. Biotech Value Investing provides in-depth coverage of my approach to finding high-quality, value-oriented companies in the biotech sector and is intended to use the inherent volatility of the sector to our advantage by using options to help generate a high compounded return while ensuring optimal entry and exit points. Check us out today with a free trial.

Disclosure: I am/we are long ZGNX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment adviser. Please do not mistake this article, or anything else that I write or publish online, as any type of investment advice. This article and anything else that I post online are for entertainment purposes only and are solely designed to facilitate a discussion about investment strategy. I reserve the right to make any investment decision for myself without notification except where required by law. The thesis that I presented may change anytime due to the changing nature of information itself. Despite the fact that I strive to provide only accurate information, I neither guarantee the accuracy nor the timeliness of anything that I post. Past performance does NOT guarantee future results. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. Any buy or sell price that I may present is intended for educational and discussion purposes only. Please think of my articles as learning and thinking frameworks--they are not intended as investment advice. My articles should only be utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should consult with your own financial adviser for any financial or investment guidance, as again my writing is not investment advice and financial circumstances are individualized.