Teva Q3 2020 In-Depth Review

Teva's revenues disappointed, but this was likely due to COVID-dependent market volatility.

In contrast, margins were up significantly, which should benefit long-term shareholders over time.

The key issue holding back the stock right now is the opioid litigation, which is unlikely to be solved quickly.

The quick take on Teva's (TEVA) Q3/20 results (slides - transcript): Revenues disappointed a bit, but cost savings saved the day. And everybody is sick of waiting for the opioid settlements which are unlikely to be finalized anytime soon.

Why did revenues disappoint? - Mainly for three reasons: Early in the year, customers purchased tons of OTC drugs like paracetamol in advance, which weighed on demand in Q2 and Q3. Second, Ajovy remains a bit slow to ramp. This is mainly because it did not have an autoinjector device early in the launch. While this is now available, COVID clearly makes sales reps promotion more difficult. Third, during lockdowns people simply go less often to doctors and pharmacies, which dampens demand for generics in general.

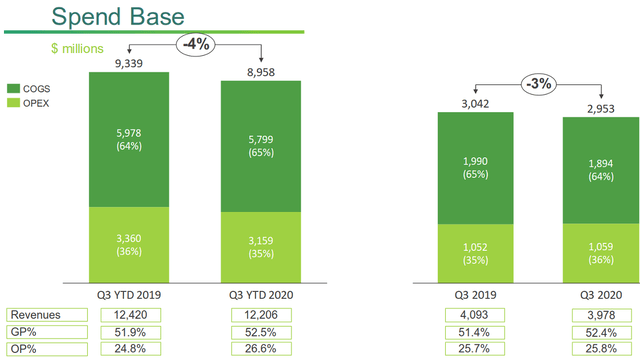

On the positive side, cost control was excellent. Despite lower sales YoY, margins were higher. Since COVID will likely pass within a few quarters, I would not be too concerned about minor sales decreases and sales volatility. On the other hand, the lower spend base will remain and will benefit shareholders for many years to come.

As a result of continuous good free cash flow generation, net debt is now down to $23.8B, a reduction of over $10B since the present management took over three years ago.

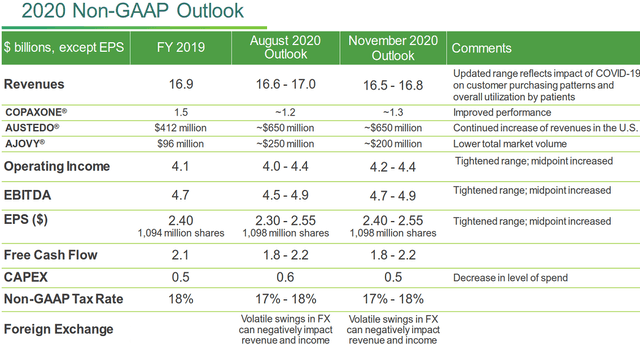

All this is reflected in Teva's updated guidance:

The midpoint of the revenue guidance is down by $150m compared to three months ago. $50m of this are due to Ajovy. Since Copaxone outperformed expectations, the reduced sales guidance must effectively be due to an underperformance of generics, a COVID effect. At the same time, however, the midpoint of the EBIT and EBITDA guidances increased by $100m. EPS is now projected to reach at least last year's level, despite more shares outstanding and the pandemic.

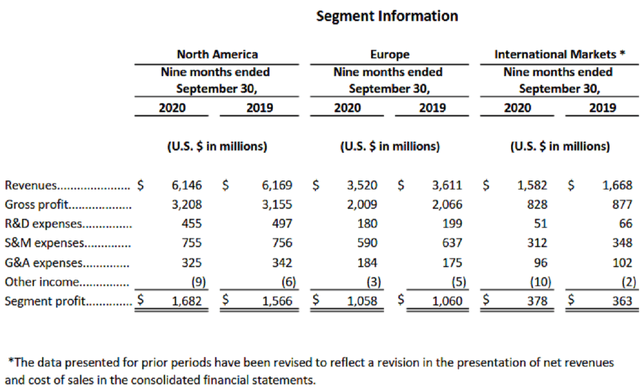

Looking deeper into these results, we see that the margin improvement is not confined to only one segment, but was realized in all major geographies:

Despite lower sales in all geographies, YTD profits were up or stable.

Despite lower sales in all geographies, YTD profits were up or stable.

Mylan (MYL) posted similar revenue trends YTD, which seems to confirm that Teva simply suffered from market volatility and not from homemade issues.

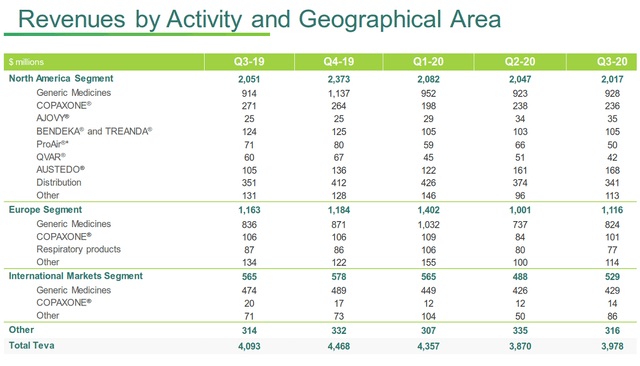

Copaxone revenues have clearly stabilized, while the new branded drugs more than compensated for the decline thanks to the very strong North America segment:

While Ajovy was below expectations, the launch of the Ajovy auto-injector will soon provide greater benefits, as explained during the call:

"Now, we have launched the auto-injector back in May and what you see here is something that I've only seen, I think, once before in my 30 years in pharmaceuticals. It's a really successful re-launch, in this case driven by a device. And what you see is that the capture rate sort of has more than doubled in a few months from being close to 11% to now being nearly 25%. And you can see now that it starts to carry through to the TRx count. So, I'm very optimistic that we will continue to see AJOVY growing nicely.

And I can tell you it's not on this slide, but in Europe, we see the same very nice development in a big market such as Germany where we also launched the auto-injector. We also see a constantly growing market share also to the same level of sort of 20-some percent. And I expect that this market share will continue to grow throughout next year, both in US and in Europe."

Overall, operationally the company is in good shape. While it still has no new growth driver, it has certainly stabilized and should be able to reduce its debt load to a sustainable level within a couple of years. Given that it trades for only ~4x EPS and below 5x FCF, there can be no doubt that the only issue holding back the stock is the settlement of its legal proceedings, which are related to opioid sales and price fixing allegations.

Regarding these two issues there were no material updates, unfortunately. The pandemic has delayed all settlement talks, as trials have been postponed.

One day after the earnings release, we learnt separately from other defendants in the opioid litigations that they may be nearing a settlement. So things are moving forward. The amounts mentioned in the linked article are similar to those expected over one year ago, when the settlements first became a real possibility. Back then, a potential Teva settlement was also reported for the first time and backed up by precise figures. Hence, if the other defendants can move forward on roughly the same deal as one year ago, we should expect that even for Teva there won't be any material changes. The timeline, however, remains to be seen and will likely be more extended for Teva, as stated on the call:

"It's quite obvious that there has been ongoing negotiations between us and the AGs and between the four other companies that are participating in the framework. And I will say that they are maybe more progressed in terms of the fact that they have reached another financial number than they started out with, all of them it seems like. But it's important to mention that, from the beginning, we were five individual companies that were negotiating at the same time with the AGs, but we didn't negotiate a, you would say, combined deal. It's five deals, so to speak.

Each company having a deal with the AGs and the plaintiff lawyers. So, I'm still very optimistic that we will have a chance of seeing that whole thing come to a solution where we see a settlement, where we will be supplying Suboxone to all of the US. And that is really the best solution, because in doing so, we will be able to help people to wean off the issues of opioids. So, that's really what's the situation on opioids."

As far as the price fixing allegations are concerned, Teva confirms that it would like to settle if it could do so without having to admit to criminal acts. The company believes that the evidence against it is very weak and that it makes sense to go to trial instead of settling on bad terms. So no news on this front either.

Regarding potential growth drivers are concerned, the CEO sees single-digit revenue growth over the coming years as the most likely result of stronger sales contributions from branded drugs, some growth from biosimilars and a rather stable pricing environment for generics. While this is certainly nothing to be overly enthusiastic about, it certainly doesn't justify a 4x EPS multiple.

How important the opioid litigation has become was also evidenced by the large write-down taken in the quarter, which was exclusively due to a mismatch between asset values on Teva's balance sheet and the company's market cap:

"And if you have that for more than a year, then it's good practice to take a good look at it and look at whether you should adjust your accounting, in this case, the goodwill, to bring your market cap closer to the actual or rather bring your net assets closer to the market cap. … It is just an overall assessment that there are factors in the market that probably will continue such as the opioid litigation and price fixing litigation. We do believe that due to COVID-19, this could be very prolonged. They could go on. The price fixing litigation could go on for years. And as a consequence of that, we can't say that the overhang on the share price will be removed soon. And as a consequence of that, we decided to make a write-down on the goodwill."

Clearly, the now more likely availability of a vaccine should accelerate the timeline for a potential settlement or at least make such a settlement more likely. That said, the U.S. will first need to get through what is shaping up as an extremely tough winter with millions of infections and many deaths. Which means that Teva investors will need more patience.

In my opinion, the settlement of all these legal issues is only a question of time. The last thing a country needs right now is to drive the world's largest maker of generic drugs into bankruptcy. This would not only drive up prices at the remaining competitors, but would also send a clear threat to other manufacturers (probably the equivalent of yet another incentive to raise prices). And the world clearly depends on the anti-COVID efforts by those manufacturers right now. So it might be better for everybody to remain on good terms.

Once a settlement is done, Teva should re-rate to a much higher multiple and the stock could easily double or even triple.

Disclosure: I am/we are long TEVA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.