Aytu BioScience: The Barcode King Is Poised For An Epic Breakout

Aytu reported Q4 results in October that beat estimates across the board with revenue of $14.86 million, surpassing the $11.24 million revenue analysts were projecting.

A careful review of the data supports an estimate of profitability in the upcoming Q1 and an expected increase in share price based on applying industry average benchmarks.

Aytu continues to explore exciting business opportunities including additional product acquisitions and development of their groundbreaking Healight technology, which is in FDA-approved human trials.

Editor's note: Seeking Alpha is proud to welcome Swich Research as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Those that have been following Aytu BioScience (NASDAQ:AYTU), a Colorado-based specialty pharmaceutical company focused on commercializing novel medical products, have witnessed the incredible transformational journey this dynamic young biotech has been on over the last year. Aytu's efforts to create an integrated Prescription Products and Consumer Health specialty company ignited last September after their merger with Innovus Pharmaceuticals, then picked up steam a month later with the acquisition of the Cerecor pediatric product portfolio. Both transactions are now closed, the entities are fully integrated, and all of this happened amidst the massive disruption caused by the pandemic, which included a lockdown and business restrictions.

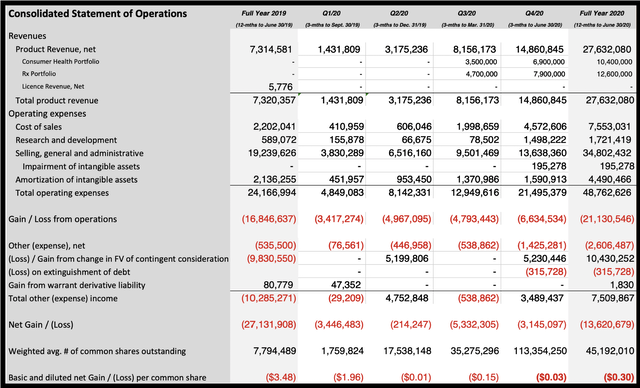

Despite those challenges, in their last earnings call with investors on October 6th, Aytu reported their highest revenue quarter in history, an increase of 82% sequentially from the $1.7 million in Q4, 2019. In fact, Q4 revenue was 2x higher than all four quarters of fiscal 2019 combined. From a 12-month perspective, the increase was a whopping 766% year-over-year. Aytu ended the year with $48.3 million in cash, restricted cash, and cash equivalents on the balance sheet with less than $1 million of debt while maintaining margins of over 65%. While Aytu is still losing money, at this pace profitability will be sooner rather than later.

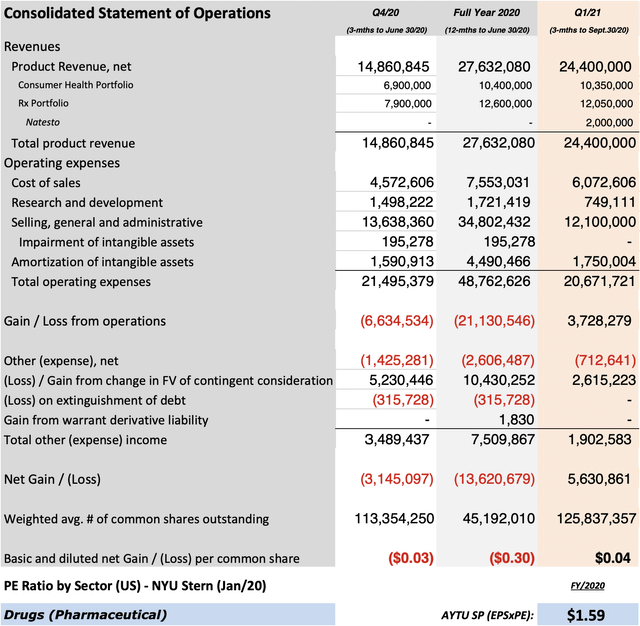

The strong performance jumps out at an investor when the detailed numbers are viewed together:

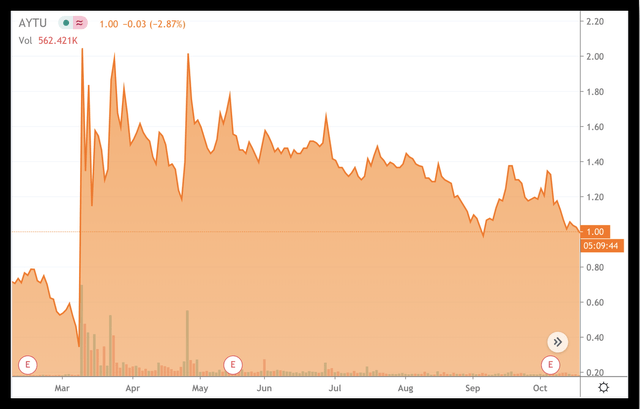

For almost any other public company, confirmation of such historic achievements would have sent the share price soaring. Unfortunately for Aytu investors, after a very bullish rise in March, the share price has been a story of disappointment and frustration over the last seven months.

Source: Seeking Alpha

The daily Aytu share price action is often referred to as "barcoding" for the small penny trade movements up, then down for long periods of time. Some of this is due to significant dilution. From Q4, 2019 to Q4, 2020, shares outstanding have grown from around 7.3 million to over 125 million. There are also over 25 million outstanding warrants at strike prices from $1.85 - 3.78. This has produced a depressed valuation that has scared off many investors.

However, for a more compelling view of the improvements across the board for Aytu, compare the company's key business fundamentals, both against themselves and against the Biotech Industry Average, based on data from January-March and April-June 2020.

You can see the improved performance in almost all Aytu's numbers, versus an actual decline in the quarterly KPIs for the biotech industry. On certain factors, like "Valuation" and "Profitability", Aytu is hitting home runs compared to the industry averages. When you consider how low Aytu's Price-to-Sales or Price-to-Book ratios are relative to the industry in this comparison, there is strong evidence to support an undervaluation claim for the share price, which we will explore further in this article.

The big challenge for Aytu now is how do they follow up such a historic quarter. Fortunately for investors, based on our research, the answer to that question is shaping up to be potentially an even more epic performance across the board in the upcoming Q1 ER, which has been announced for after hours on November 12th. A deep dive into the data, which we will cover below, shows that the Aytu share price could more than double from current levels.

EPS and Share Price Projection for the Upcoming Q1, 2021

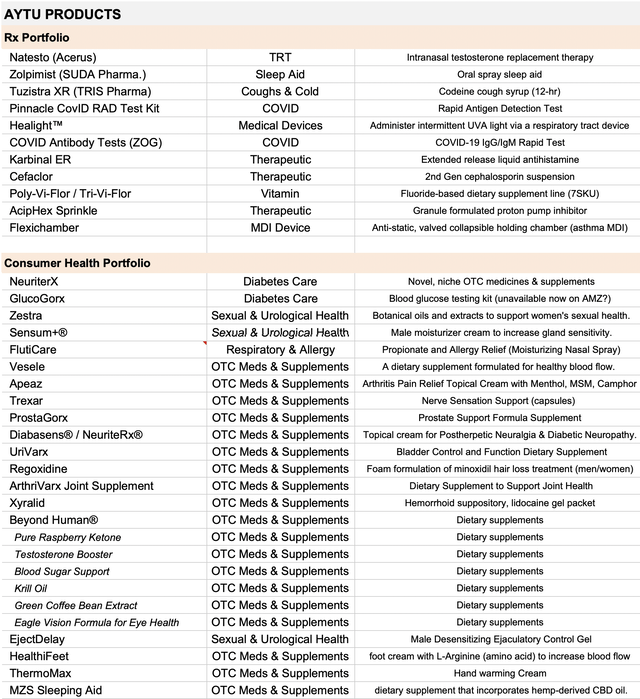

Aytu is clearly a different company today than it was just a year ago and the breadth and diversity of their comprehensive product portfolio bears that out. There are seven core prescription products and almost two dozen Consumer Health products driving the company's growth trajectory going forward. In Q4, Consumer Health Net Revenue was $6.9 million compared to $3.5 million in Q3. Revenue in the Rx segment was $7.9 million in Q4, a significant increase compared to $4.7 million in Q3. The e-commerce business, bolstered by the Innovus products and channels, is also much stronger.

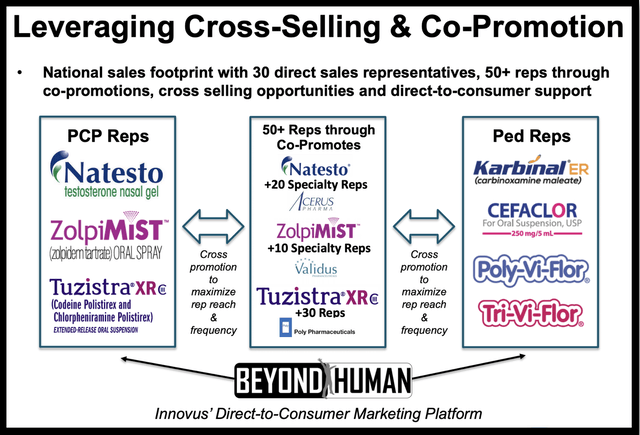

Despite the impact the COVID restrictions had on Aytu's sales team access to physician offices during the lockdown, company growth was fueled by improved sales execution from the Cross-Selling / Cross-Promotion strategy referred to in their Corporate Presentation. Aytu is sure to benefit after confirming that sales rep activity is now picking back up to pre-COVID levels.

A good indicator of what might be in store for Aytu in the upcoming Q1 are the Press Releases from July through September that highlight the events that will contribute to strong performance:

- Sep 8, 2020 - Aytu BioScience Announces Global Agreement to Distribute Pinnacle IVD Corporation's 15-Minute COVID-19 Antigen Test

- Aug 19, 2020 - Aytu BioScience Announces Launch of Nationwide Mobile COVID-19 Testing Initiative

- Aug 17, 2020 - Aytu BioScience Announces Manufacture and Delivery of Healight(TM) Devices for Use in COVID-19 Clinical Study

- Jul 30, 2020 - Aytu BioScience Announces Regulatory Approval of ZolpiMist(R) by Australian Therapeutic Goods Administration

- Jul 27, 2020 - COVID-19 IgG/IgM Rapid Test Cassette Distributed by Aytu BioScience Featured in Business Insider Article

- Jul 20, 2020 - Aytu BioScience Announces Expansion of Natesto U.S. Commercial Team

- Jul 10, 2020 - Aytu BioScience Announces Distribution Partnership with Apollo Med Innovations to Expand Distribution of COVID-19 IgG/IgM Rapid Test in United States

The previous ER call also provided clues to help estimate Q1 revenue when Aytu CEO and Chair Josh Disbrow confirmed that, "…the Rx and Consumer Health businesses have continued to hold strong through the pandemic and that this core business has been augmented, not supplemented by COVID test sales."

What Mr. Disbrow was signaling is that the COVID tests that Aytu sold in Q4 allowed them to hit the quarterly numbers that they would have achieved with just their traditional products if there were no lockdown impacting sales. Therefore, we can use that roughly $15 million as a baseline for Aytu product revenues then apply a reasonable growth factor of 50% to determine the likely numbers for the upcoming Q1. This multiplier is supported by the over 80% growth rate from Q3 to Q4, as well as by the greater physician and patient access for the sales team.

Natesto

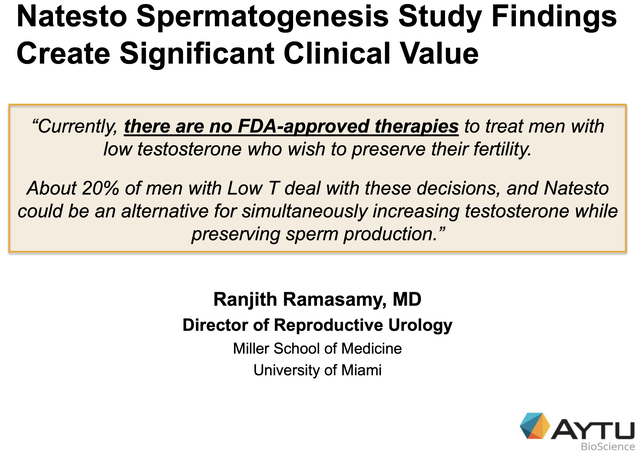

Recent developments for Aytu's key product Natesto® will also provide additional value in this upcoming ER. Its new preferred status on Express Scripts National Formulary and the Aytu-sponsored Natesto Spermatogenesis study, published in the Journal of Urology, should help increase physicians' prescribing of Natesto® for the over 13 million men in the U.S. diagnosed with hypogonadism. The U.S. Testosterone Prescription Market is estimated to be over $1 billion annually and there were more than 7 million prescriptions written for testosterone in 2019. Consider that estimates of the average monthly cost for users of Natesto could be as high as $700, and that's a potential goldmine for Aytu if they can increase their penetration with patients and physicians.

Source: Aytu Website

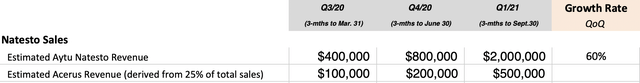

This month Acerus, which produces Natesto, reported revenues of $500k for the last quarter (July-September), almost all derived from Natesto sales in the U.S. Their contract with Aytu includes a tiered structure whereby Acerus receives a "variable rate" commission based on Natesto revenue generated from those sales. Acerus likely earned that US$500k in revenue based on $2M in total Natesto sales for the quarter ($2M * 25%, for U.S. sales $0-5.5M).

Looking back at the Acerus earnings over the last three quarters, which were essentially all derived from commissions on U.S. sales, it shows us that Natesto has a QoQ growth rate of around 60% and provides a view of the likely historical Aytu sales volumes for their key product over the quarters to come. We used an estimated $2 million of revenue in our projections.

Source: Author's Estimates

COVID Tests

In the previous ER, Mr. Disbrow emphasized that Aytu sold more antibody tests in the September quarter than they did in June, likely aided by the Cardinal Health and Apollo sales channels, which would help move the Aytu products. Although no details were provided Mr. Disbrow confirmed that, "Aytu sold a significant number of antibody rapid tests over the last 2 quarters to a wide range of customers, including global oil and gas companies, large and small municipalities, hospitals, clinics, a wide range of first responders and others".

Therefore we can estimate sales of one million COVID test kits (from the 1.4 million shipment that arrived in late June) during the July-September time frame when daily COVID testing skyrocketed nationally. For our calculations, we used a conservative $7 price per test based on Internet research that shows heavy competition in this space has been driving the price down but there is still a roughly 60% margin for Cost of Goods sold.

Costs / Expenses

For Q1 costs and expenses, the ER provided another strong clue, this time from Aytu CFO David Green, who stated that the level of adjusted cash-based operating expense reported for Q4, roughly $12.1 million, is in the range of what they expect for Aytu's core operation going forward (excluding investment in the Healight program and potential new business development opportunities). We reduced the Cost of Sales (COS) by an additional 10% in our Q1 projections because we removed the one-time $1.3 million inventory write-off in Q4. COVID antibody test COS was added to the estimate at a 60% margin, which is reasonable based on data from other test distributors.

The R&D line item was reduced by 50% assuming the heavier cost burdens were in Healight prototype design and development, not the trials. SG&A "adjusted" costs were maintained based on the CFO's comments about consistent expense burn going forward and a similar amortization was applied. Other expenses were reduced by 30%, assuming many were acquisition-related, and Contingent Considerations were cut by 50%, assuming previous numbers were related to annual, not quarterly targets.

The result is a projection for Aytu to report a Net Gain of around $5.6 million in Q1, which, if applied against the 125 million shares outstanding and estimated Q1 EPS, is a positive $0.04. Using a Forward Price-to-Earnings (PE) ratio of 35.5% from NYU Stern that has Aytu in the Pharmaceutical segment, and applying this benchmark to our projected EPS, we arrive at a fair value estimate for Aytu of over $1.50 just on this metric alone.

Source: Author's Calculations

Include other catalysts into the mix, like solid forward guidance or other business developments and there could be an additional $1-2 lift to the share price. A successful result in the Healight trial and there's no telling what lofty heights this share price could be headed to. All of this more than meets the conservative but healthy $60 million annual revenue run rate that Mr. Disbrow alluded to in the Q4 call.

Near-Term Opportunities for Aytu

Let's take a closer look at two compelling business opportunities that could add value for Aytu in the very near future.

New COVID Rapid Antigen Tests

In September, Aytu announced the signing of a distribution agreement for a COVID rapid antigen test developed by Pinnacle IVD Corporation. This test is a lateral flow immunoassay that delivers a result in 15 minutes. In a clinical validation study, the test demonstrated 100% specificity and 86.7% sensitivity when nasopharyngeal swab results were compared with RT-PCR. The test positive predictive value is 100% and negative predictive value is 97%.

As far as Aytu's progress in rolling this out, the strong clinical performance results, which ranks it among the top antigen test performers, and other data have been included in an Emergency Use Authorization submission to the FDA that, according to Mr. Disbrow, "is moving along well." In the meantime, the Pinnacle test is currently available for sale to organizations that meet the CLIA standards, such as labs or hospitals. Pinnacle reportedly has worked quickly to scale its U.S. manufacturing capacity to 25 million tests per month to meet the high demand expected. Research indicates Aytu will likely levy a $15-25 retail cost per test based on volume purchased.

Mr. Disbrow doesn't see the need for testing going away anytime soon, especially given the ongoing spikes in COVID cases nationwide. He also believes there will continue to be a balance between the need for diagnostic tests like the antigen and PCR testing, as well as surveillance serology testing with the antibody kits. Mr. Disbrow said this to investors,

"There'll continue to be a role for both, even on the other side of a vaccine. We obviously don't expect broad distribution of the vaccine in the immediate term…even then, there's going to be a continuing need for diagnosis, and there's going to be a continued need for surveillance."

With the number of daily tests across the U.S. continuing unabated (a mix of antibody, antigen and PCR), the business opportunity for companies like Aytu, now with two rapid tests that can be deployed from virtually anywhere to support in the global fight to contain the virus, will be lucrative for months to come.

Healight

Back in April, Aytu secured global licensing from the Cedars-Sinai Medical Center for the Healight ultraviolet light technology platform. Aytu believes Healight has great potential as a first-in-class treatment for severely ill patients intubated in the ICU and, in the near-term, as a potential COVID-19 treatment for those most severely ill patients. In September, Aytu announced that the FDA has approved Healight for clinical trials involving humans under the leadership of Cedars-Sinai. The trial, called simply: "UVA Light Device to Treat COVID-19", got underway in October to test Healight on five COVID-19 patients on ventilators to see if the device can lessen their viral load and disease severity.

Source: Aytu Website

You can read more about Healight and its exciting progress in this comprehensive article here. Mr. Disbrow provided this optimistic view of its potential, "We see broad potential application well beyond Healight's use in COVID. [it] has the potential for significant use in other conditions, including Ventilator-Associated Pneumonia, severe influenza, and other infections. As UV light is agnostic, so to speak, to the pathogens it kills, and is so different in the way it does it, the antimicrobial applications for Healight are broad."

Healight, if successful, could become an important tool in hospital ICUs around the world. Currently, there is no competing device to Healight but this could change over the coming years as companies and even countries race to find similar solutions. While only a very small circle of insiders know the exact costs, design, and deployment approach for Healight, one possible scenario is that the Healight platform includes a mobile base unit that employs a disposable catheter device, similar to other in-vitro surgical devices. A "highly speculative" conservative estimate for the selling price of the base unit range anywhere from $25-40k. The single-use catheters (i.e. not reusable except on the same patient and even then, likely limited use) have been estimated to sell for possibly $1-2k each.

Let's do some simple but eye-popping math for illustrative purposes: There are currently 1,920 Covid-19 patients on a ventilator in the U.S. In another usage scenario, there are between 250-300k Ventilator Assisted Pneumonia (VAP) cases in the U.S. per year. Across the U.S. there are 6,150 hospitals. If Healight were to prove successful, you could envision every hospital having at least one Healight device available but possibly more like 5-10. At $25k, that would be a $775 million market opportunity just in the U.S. alone. There could also be an annual usage rate of over 500k disposable catheters. This "razor and blades" deployment strategy for the breakthrough technology, featuring both one time and ongoing revenue streams, could be enormous. All of this is pure speculation though until more details are made public.

Risks and Conclusion

It is always risky to invest in microcap stocks and Aytu is no exception. The Board of Directors is controlled by insiders so effective accountability is something that needs to be monitored carefully by investors. Adding to that risk is the lack of comprehensive coverage from truly independent investment analysts and minimal details provided by the company in terms of specific product sales, frequent press releases, or firm forward guidance. Investors are essentially left to fend for themselves and expend a lot of effort to validate the opportunities and threats, including long-term contract risk with many of the core products they license.

Aytu's share price action over the last seven months has attracted a lot of criticism from retail investors as well. In contrast, small caps have been a major standout in October with the Nasdaq 100 up 68% from its March low and the Russell 2000 not far behind with a gain of nearly 65%. Meanwhile, the Aytu SP languishes in the depressingly low $1 range. One theory posits that the share price "manipulation" has been deliberately orchestrated to encourage institutional investors to accumulate shares within agreed-to share price ranges.

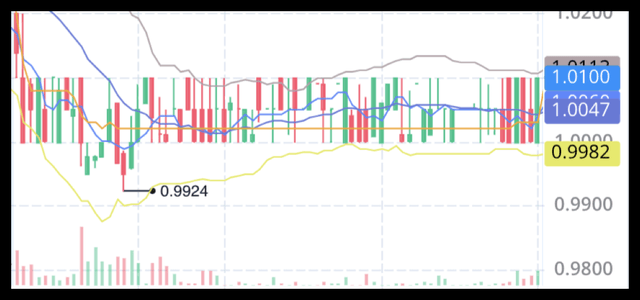

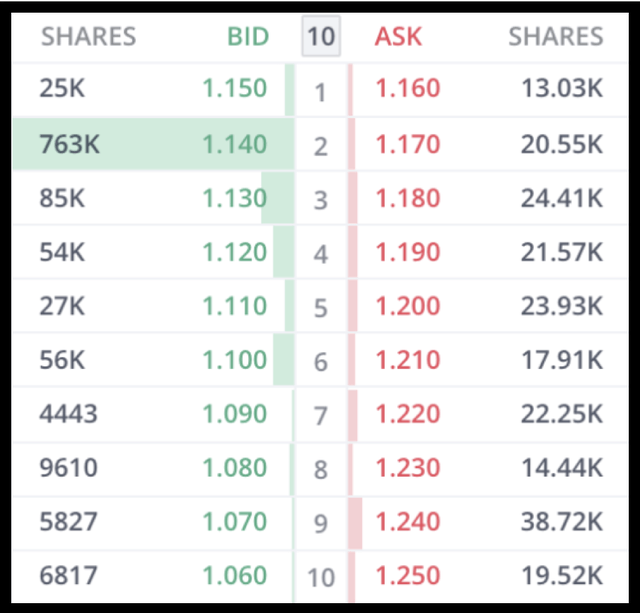

Support for this theory can be seen in the Level 2 action on a typical trading day, which usually features a volume between 1-2 million shares exchanged. In this example from October 7, large blocks of shares were available on the Bid/Ask between a set range of $1.10 - $1.25. There are also extraordinarily large numbers of shares at certain prices ($1.14 in the example below), possibly to encourage large fill orders.

Source: Webull Level 2 Chart

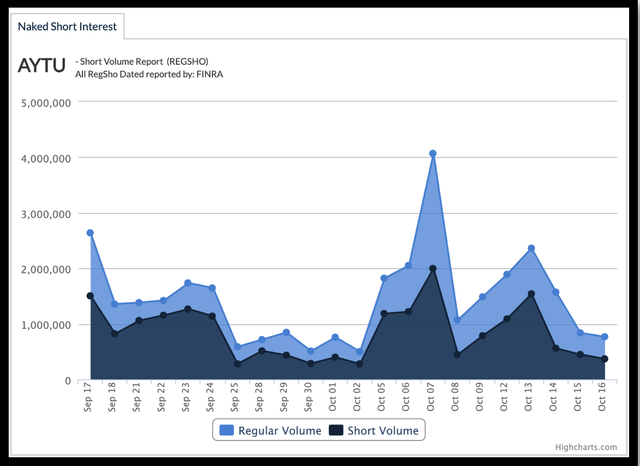

Add the extremely high daily shorting activity, including significant levels of naked shorting, to this hypothesis and the evidence is strong that the share price is being managed to achieve an objective.

Source: Naked Short Report

Consider this summary by Market Chameleon on the Aytu daily trading activity for October 16th:

AYTU Dark Pool Trades Dark pool trades reported for AYTU have accounted for 66% of the total volume today. Over the past 20 days, the average dark pool volume has been 67%. Total volume in the dark pool is 1.4 million. The VWAP price for only the dark pool trades is 1.03.

AYTU Sweep Orders Sweep orders that seek immediate execution are considered a more aggressive order type. These sweep orders have represented 14% of the stock volume in AYTU today, totaling 295,741 shares for a VWAP price of 1.03.

Block Trades Large block trades in AYTU, which often represent institutional trading, have accounted for 19% of all the volume on the day, for a total of 384,326. The 20-day average volume percentage has been 22%.

It is common practice that Market Makers will use the regular market for benchmarking the price which is then used in the dark pool. If the regular market is shorted heavy and there is a high % of the daily volume taking place in the dark pool, it is reasonable to suspect accumulation. When you consider the growth in institutional ownership in Aytu, it also seems to support the idea that accumulation has been happening.

Conventional wisdom states that if you want to make big money in the market, you must learn to gauge institutional support because it is one of the most important factors in a stock's long-term success. Well Aytu has grown to at least 134 institutional owners and shareholders holding over 14.45 million shares, according to the 13D/G/F forms filed to date with the Securities Exchange Commission (SEC). The largest shareholders include Vanguard Group, BlackRock, and Bank of America. But despite that growing interest by big money, repeated earnings beats, and record Q-o-Q revenue growth, the Aytu share price has remained stagnant or declined.

What is an Aytu investor to do facing this prolonged period of share price stagnation?

The senior leadership team of Josh and Jarrett Disbrow, as well as Bassam Damaj, former CEO of Innovus and now President of Consumer Health at Aytu, have all created successful, multi-million dollar pharmaceutical companies before. They've been there, done that, and appear to be doing it again very effectively. Aytu's financial position is strong enough that they returned the federal PPP. They also have not yet publicly announced any federal assistance to fund Healight development. The strong cost management and transparency demonstrated by Aytu also minimizes the risk of near-term dilution. This is a company that demonstrates a disciplined, methodical, and well-planned strategic approach to its growth. My advice for investors in Aytu is to employ that same patience and buy when institutions are buying.

Disclosure: I am/we are long AYTU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.