IPO Update: Aspire Real Estate Investors Finalizes IPO Effort

Aspire Real Estate Investors has filed to raise $300 million in an IPO.

The firm is preparing to launch as a REIT owning multifamily properties in Opportunity Zones.

ASPI has grown revenue from a small base but its initial distribution yield is also tiny, so I'll watch the IPO from the sidelines.

Quick Take

Aspire Real Estate Investors (ASPI) has filed to raise $300 million plus $30 million in concurrent transactions from the sale of its common stock stock in an IPO, according to an amended registration statement.

The company will own, develop and operate primarily multifamily properties in Opportunity Zones.

ASPI faces uncertainties surrounding the continuation of the Covid-19 crisis, there are unknown aspects of Opportunity Zone returns for property owners and the initial distribution yield is miniscule, so I'll pass on the IPO.

Company & Technology

Irvine, California-based Aspire was founded to purchase an initial portfolio of nine multifamily projects and develop or acquire additional similar projects, with up to 30% of its portfolio being 'stabilized and value add properties for which we do not intend to undertake significant redevelopment work.'

Management is headed by president and CEO Daryl Carter, who has been with the firm since the company's formation in January 2020 and was previously founder, Chairman and CEO of Avanath Capital Management, an investor in multifamily properties.

Below is a brief overview video of opportunity zones:

Source: Break Into CRE

Of the nine initial properties, six are located in Opportunity Zones, which are economically distressed areas where new investments meeting certain conditions are eligible for preferential tax treatment.

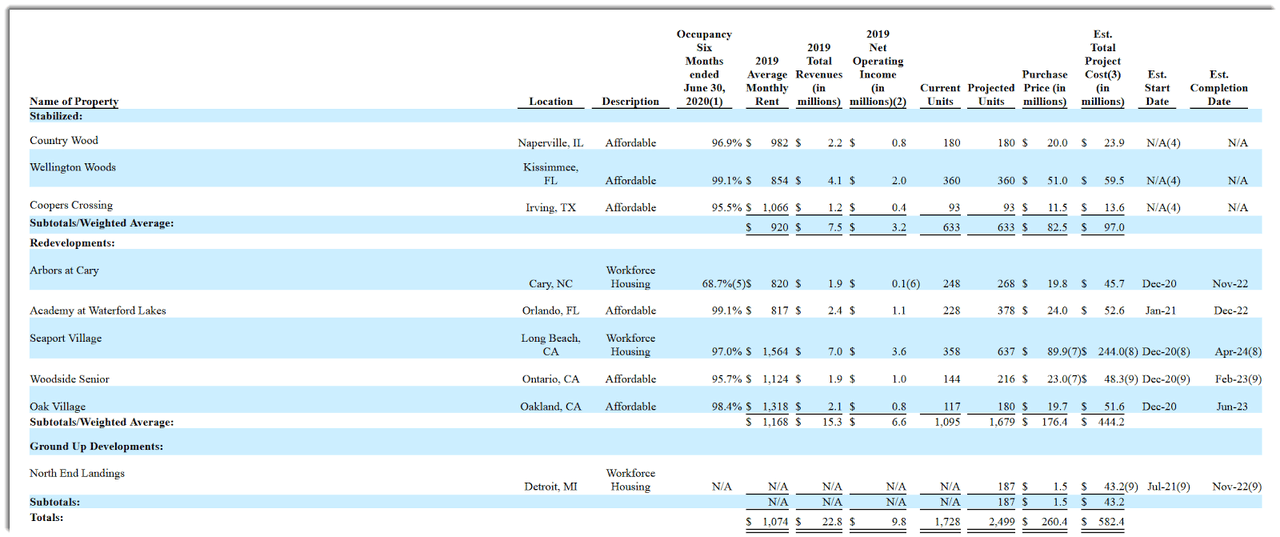

The nine initial properties are shown below:

Aspire has received at least $16 million from investors.

Market & Competition

According to a 2020 market research report by RealtyMogul, the U.S. market for multifamily real estate is expected to continue to grow, as real estate firm CBRE expects that 280,000 units will come to market in 2020.

However, this was a pre-Covid-19 pandemic estimate and the effects of the pandemic on construction have been significant, at least in the short term

Ultimately, it is the Millennial generation that will drive demand, which may increase outside of large cities as the pandemic persuades increasing numbers of younger persons to move outside the city and into suburban areas.

With interest rates at a historic low, developers will have friendly financing rates to reduce their financing costs, incentivizing them to build in locales where they previously may not have considered.

Major competitive or other industry participants include:

Public REITs

Private REITs

Private equity investors

Institutional investment funds

Financial Performance

Aspire’s recent financial results can be summarized as follows:

Growing topline revenue

Increasing operating income and margin

Growing EBITDA

A swing to positive net income

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Nine Months To Sept. 30, 2020 | $ 5,826,000 | 6.2% |

2019 | $ 7,410,000 | 6.1% |

2018 | $ 6,983,000 | |

Operating Income (Margin) | ||

Period | % Variance vs. Prior | |

Nine Months To Sept. 30, 2020 | $ 2,660,000 | 12.6% |

2019 | $ 1,005,000 | 64.8% |

2018 | $ 610,000 | |

EBITDA | ||

Period | EBITDA | % Variance vs. Prior |

Nine Months To Sept. 30, 2020 | $ 2,660,000 | 12.6% |

2019 | $ 3,170,000 | 17.1% |

2018 | $ 2,707,000 | |

Net Income | ||

Period | Net Income | % Variance vs. Prior |

Nine Months To Sept. 30, 2020 | $ 341,000 | -394.0% |

2019 | $ (114,000) | -78.6% |

2018 | $ (532,000) | |

IPO Details

Aspire intends to sell 15 million shares of common stock at a midpoint price of $20.00 per share plus $30 million in concurrent transactions for gross proceeds of approximately $330.0 million, not including the sale of customary underwriter options.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO would approximate $395.7 million.

Per the firm’s most recent regulatory filing, the firm plans to use the net proceeds as follows:

We intend to contribute the net proceeds from this offering and the concurrent private placement to our subsidiary partnership in exchange for interests therein. Our subsidiary partnership will utilize such proceeds to acquire the nine multifamily projects that will comprise our initial portfolio for an aggregate cash purchase price of approximately $260.4 million, to develop or redevelop the six properties in our initial portfolio that are located in Opportunity Zones, and to acquire and, if they are located in Opportunity Zones, develop or redevelop other properties, which may include properties in our acquisition pipeline, and for general corporate and working capital purposes.

Management’s presentation of the company roadshow is available here.

Listed underwriters of the IPO are Morgan Stanley, B. Riley Securities, Wells Fargo Securities, BMO Capital Markets, KeyBanc Capital Markets, Loop Capital Markets, Ramirez & Co. and Siebert Williams Shank.

Commentary

Aspire is seeking public investment via an IPO to fund the purchase of its initial portfolio as the firm pursues affordable housing properties in Opportunity Zones.

ASPI’s financials indicate moderate topline revenue growth for this tiny REIT with big ambitions.

The market opportunity for multifamily properties in Opportunity Zones is an unknown quantity as OZs have a limited history. The wider multifamily market is expected to continue to grow supply due to historically low interest rates fueling construction.

Based on the firm’s existing funds from operations, I calculate an expected distribution yield on the initial nine properties of only 0.63%.

By comparison, Equity Residential (EQR) has a current distribution yield of 3.92%, so Aspire will need to add significantly to its portfolio, perhaps through issuing debt for purchase contracts, in order to increase its yield.

Given the uncertainties surrounding the continuation of the Covid-19 crisis, the unknown aspects of Opportunity Zone returns for property owners and the initial tiny distribution yield, so I'll watch the IPO from the sidelines.

Consider becoming a member of IPO Edge.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.