Investors Title: Record Profits And A Gigantic Special Dividend

With the Pfizer vaccine news, investors are rotating into value stocks.

This should play out well for Investors Title, which remains cheap even after recent gains.

Thanks to the company's fantastic 2020 results, it just announced a $15/share special dividend.

This article was highlighted for PRO subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

Up until a few days ago, traders largely viewed financial stocks as a wasteland. Thanks to uncertainties around interest rates, a second wave of the pandemic, and perceived technological disruption risk, few people wanted to own financial stocks. That extended to the whole industry. Thus, many financial companies that were performing well were largely ignored as the sector was out of favor.

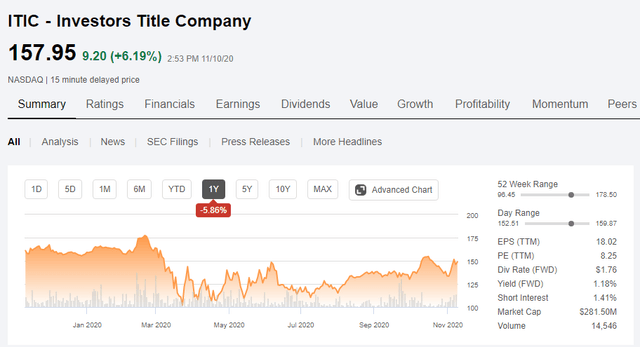

This brings us to Investors Title (ITIC). I recommended the stock in April, and shares have appreciated 30% since then. That's great in isolation, though it only modestly outpaces the S&P, which is up 24% over the same time period. There were a lot of cheap stocks in April. Regardless, my initial analysis of Investors Title holds true today, and I'd urge readers who want the broad fundamental case for the company to look at that article.

And since then, Investors Title has exceeded even my expectations, and is now having a banner year. The earnings reports since April have been exceptional. Now the company is spreading the wealth. Thanks to its great results, Investors Title just announced that it is giving shareholders a $15/share special cash dividend in December. Given that the stock is trading at $158 now, that's nearly 10% of the market cap coming back to shareholders.

Earnings Yield Transforms Into Dividend Yield

Source: Seeking Alpha

You might be wondering how a company can announce a $15/share special dividend out of the blue. Looking at the company's results, however, you'll see that they've earned $18.02 over the trailing twelve month period. Thus, $15/share of special dividend plus the $1.76 of normal ordinary dividends adds up to $16.76 of total payout for 2020. That's still fully covered out of the company's earnings.

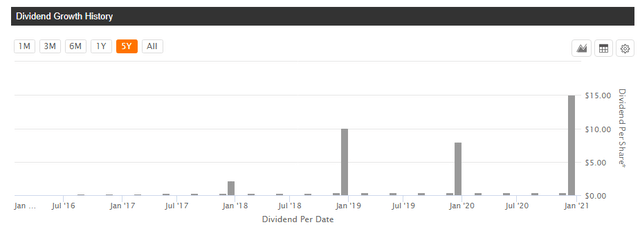

This is far from the first time Investor's Title has given its shareholders a big holiday bonus either. In fact, it's turning into quite the yearly tradition:

Source: Seeking Alpha

The thing is, these sorts of $8, $10, or now $15/share special dividends don't screen well. If Investor's Title paid the same dividend out as a regular quarterly offering, ITIC stock would show a 9% yield going forward on screeners. Instead, you see just a 1.2% yield on financial websites as they exclude special payments. This keeps many investors away from the stock. From a short-term share price maximizing viewpoint, Investor Title's management is probably not optimizing things.

But, as I discussed in my previous article about the company, this is a family-run operation. They have plenty of alignment with long-term share price appreciation. From that standpoint, it's easier to pay special dividends when you have windfall profits rather than setting a high ordinary dividend rate and then get stuck wondering if you'll have to cut the dividend during hard times. I'd much rather have a company be generous with us during good years rather than have too high a dividend and then be forced to slash it later.

In any case, Investor's Title is earnings tremendous sums of money; currently $18/share over the past 12 months, and is growing at a decent clip. Back in the spring, ITIC stock was selling at just 6x that earnings power, representing a 17% earnings yield.

Ultimately, Investor's Title can really only spend those profits in three ways. It can reinvest in the business, buy back stock, or pay additional dividends. There are limits to its ability to reinvest, given the stable oligopoly nature of the title insurance market. And there's only so much buyback volume that you can realistically execute on an illiquid stock like Investor's Title that is already tightly held. Hence, the increasingly large special dividends to make use of the record profits.

Earnings Surge: ITIC Is A Growth Company At A Value Price

Investors Title reported its Q3 earnings last week. And the story remains full-steam ahead. Just look at the figures from the Q3 report:

The Company reported net income of $15.3 million, or $8.07 per diluted share, for the three months ended September 30, 2020, compared to $8.0 million, or $4.20 per diluted share, for the prior year period. All-time quarterly records were set for total revenues, net premiums written, and net income.

Revenues increased 41.1% to $67.6 million, compared with $47.9 million for the prior year quarter. Net premiums written increased 42.4% to $57.2 million, as lower average mortgage interest rates continued to drive increases in refinance activity, while the level of home sales remained strong as well.

That's $8.07 of earnings for a single quarter, by the way, not the whole year. It amounts to nearly a double over the past year. Revenues surged 41% for the period, rivaling many software companies in terms of growth rate. Investor's Title is also showing tremendous scale; employee and personnel costs only rose 9% to generate that 41% increase in revenues and 42% increase in premiums. If you're looking for a company that can add tons of incremental high-profit margin revenues from a surging housing market, look no further than Investor's Title.

Do note that Investor's Title owns equities as part of its overall investment portfolio. That's not unusual for insurance companies that invest their premiums. Not surprisingly, these equities generated significant losses in Q1 and sizable gains since then. Thus, taking the whole nine months of 2020 so far to smooth out asset price swings, Investors Title has earned $12.02 per share. Notably, Investors Title's investment portfolio has produced a lower return compared to 2019 on net. Thus, the company's 14% year-to-date earnings growth is due to stronger performance in the core insurance business rather than primarily being the result of stock market gains.

As it turns out, the $12 of earnings year-to-date implies a $16 full-year earnings run-rate once Q4 is added to the mix. And, arguably, that EPS figure should be ticking nicely higher moving forward as housing market activity slowed to a halt during spring of this year. By contrast, 2021 should lap that with excellent comps out of the housing market. Assuming current conditions keep on as is, with Investors Title pumping out double-digits revenue growth and positive operating scale, there's a feasible path to $20+ EPS next year and beyond.

The stock is selling at $158 now, so it's still trading around 8x trailing and forward earnings today. And once they dividend out the $15 next month, the stock effectively drops back to $143 assuming the share price falls equally to the dividend payout.

That implies just a little over 7x forward earnings for a company that -- I'd remind you -- is growing revenues at 41%/year at the moment. Even given the decent run in ITIC stock over the past few months, shares are still dirt cheap. The only way shares have meaningful downside from here is if the housing market suddenly rolls over. However given the vaccine news, consumer activity should remain robust.

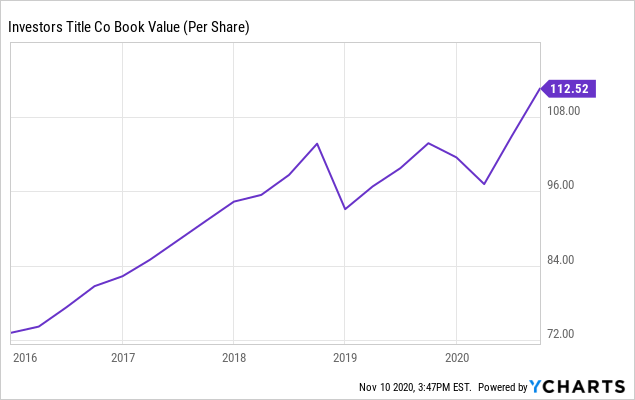

Data by YCharts

Data by YCharts

Finally, I should mention book value, as many people value insurers on price/book rather than earnings. As you can see, aside from the special dividend payouts at year-end 2018 and 2019, ITIC's book value has risen steadily and at an aggressive clip.

Investors Title has earned a median ROE of 12% over the past decade, which suggests investors should pay a modest premium to book value, as above 10% ROEs in insurance are generally lauded. And in recent years, Investors Title's ROE has trended up, hitting 17% for 2019. If Investors Title can maintain its ROE at that level -- or continue to see improvements as is likely for full-year 2020 -- it'd be reasonable for price/book to move up to 2x. That would imply a valuation of around $200 (assume book value of approximately $100 for Q4 '20 once the $15 is paid out as a dividend).

Regardless of whether you prefer an earnings or book value based approach, ITIC stock is still attractively priced. And if housing keeps revving up, shares could rip sharply higher in 2021. In the meantime, there's a fat $15 per share dividend coming up with an ex-dividend date of Nov. 30 with payout on Dec. 15.

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

Disclosure: I am/we are long ITIC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.