Fund Spotlight: Reasons I Have Been Buying PHD

PHD is a junkier floating rate loan fund that has been attacked by Saba for the last year or more.

Saba had collected almost a quarter of the outstanding shares of the fund and began an activist push in August.

Pioneer and Saba came to an agreement at the end of August for a 50% tender offer at a 1.5% discount.

For those who like floating rate funds here - like me - this is a good kicker to owning the space.

(This report was issued to members of Yield Hunting on Oct. 23. All data herein is from that date or prior.)

This is a floating rate fund that was attacked by Saba and is undertaking a large tender offer of 50% of all shares at a 1.5% discount. The tender expires on Dec. 20, 2020. With a -8% discount currently, the tender looks compelling. We run through the numbers below.

Pioneer Floating Rate Trust (PHD)

Fund Characteristics

- Total assets: $270M

- Leverage: 28.2%

- Holdings: 295

- Management Fee: 1.03%

- Total Expense Ratio: 2.34%

- Effective duration: 1.87 yrs

- Distribution yield: 7.40%

PHD is a smaller traditional floating rate fund with $270M in total assets. Approximately 85% of the assets are in senior secured floating rate loans with the majority of the remainder in fixed coupon corporate bonds.

The fund has great long-term performance which is odd since Saba is attacking it with one of the reasons being poor performance. For the last 10 years, the fund has outperformed the S&P/LSTA Leveraged Loan Index benchmark by 1.3% per year on a NAV basis. That's extremely good and places it at number four of all loan funds.

Should I Invest In Floating Rate Today?

Since the start of the year, investors have been fleeing floating rate loans as an asset class simply because rates continued to fall. Once COVID-19 hit, short-term rates quickly went to zero as the Federal Reserve took unprecedented action. Many investors took that to mean that loans were heading lower as the income payments reset for the lower rates.

Most loans are paid based on 1M or 3M LIBOR plus a spread. If LIBOR declines, the fund resets the income it pays every 30 to 90 days. Additionally, many of the loans that were issued in the last few years came without what is called a LIBOR floor. This is a minimum payment that the loan would pay regardless if rates went down.

Despite the drop in rates, yields in loans today are higher than both high yield fixed coupon bonds and even emerging market debt. Spreads are wider on loans compared with bonds by nearly 50 bps. That means prices of BB loans vs. BB bonds are lower. This chart details the stark differences between the prices of similarly rated loans and bonds.

(Source: Eaton Vance)

(Source: Eaton Vance)

Since B-rated bonds are priced at $99.70 vs. a similarly rated loan which is priced at $97. While it doesn't sound like much, that lower price equates to a moderate amount of cushion against potential defaults. At the same time the default rate for bonds is higher than loans (5.8% vs. 4.2%). So while loans are priced cheaper, they are seeing less defaults.

Add in the closed-end fund wrapper and you get the potential for a double-discount benefit. The senior loan category in CEFs is one of the cheapest of all categories and the second cheapest in the fixed income asset class behind convertibles.

With the underlying bonds at a discount to par and the fund trading at a discount to NAV, you achieve a double discount. How good is that? If the average loan price is $95 and the fund is trading at a 10% discount, that's similar to getting the loan at 85 cents on the dollar. If the loan pays 5%, that extra discount means nearly 60 bps more in yield or an extra 12% more income.

The "Juicy" PHD Tender Offer

Saba began building a position in PHD in early 2019 with an initial 13G filing in early April showing 5.6% of all shares. By October of last year, they had doubled that stake to 10.6%. And by the end of 2019 it was nearly 12% and by the end of May it was 14%.

Then they really ratcheted up their buying after Saba issued a proxy notice to get three of their nominees on to the board of the fund. By June 17, they owned 24.8% of the outstanding shares, which is where it stands today.

This is when the proxy battle began and Saba and Pioneer solicited shareholders peppering them with dozens of proxy voting cards. Saba laid out its case in a filing on Aug. 25. First they discuss what they want and detail why it's needed (under performance).

Saba attempted to get shareholders to terminate the advisory agreement with Pioneer. This is what happened with Bulldog when they attacked the Putnam CEF that became High Income Securities (PCF).

On Aug. 31, 2020, we received an announcement that Saba and Pioneer reached an agreement:

Under the terms of the agreement, the Fund will commence a cash tender offer for up to 50% of the Fund’s outstanding shares of common stock at a price per share equal to 98.5% of the Fund’s net asset value ("NAV") per share. The tender offer will not expire prior to Dec. 20, 2020. The Fund will repurchase shares tendered and accepted in the tender offer in exchange for cash. Amundi Pioneer Asset Management, Inc., the Fund’s investment adviser, has agreed with the Board of the Fund to limit ordinary operating expenses of the Fund for the benefit of the Fund’s remaining shareholders. Saba has agreed to certain standstill covenants.

This means that Saba cannot attack the fund for a certain period of time- likely 2 years.

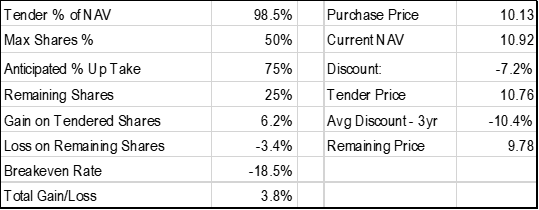

So we get at least 50% of our shares tendered at a -1.5% discount to NAV. Let's run through the math to see how we would come out.

If we tender all our shares, we assume that we get 75% of them taken out. That's because some shareholders will fail to tender their shares for a host of reasons. Maybe they don't want to sell because of the taxable gains. Or maybe they are restricted by compliance at their firms from selling. Their are many reasons why a shareholder may not tender but number one would be that they are just don't know, or are lazy, or forget.

Many shareholders probably get the tender docs in the mail still - if they do not have paperless at their brokerage. Those docs come and they look like gobbledygook. Perhaps the shareholder didn't understand and simply threw them away. Or maybe they put them docs in their to do pile and never got back to it. But some people simply forget.

So 75% of our shares are sold at the then (on Dec. 21, 2020) NAV of PHD. In the box below we assume the NAV does not change between now and then ($10.92). That means the investor if they bought today at $10.13 would sell at $10.76 and in the meantime collect two distributions of 12.5 cents. The total gain would be 7.5% (below we exclude the distributions).

On the remaining 25% that doesn't get tendered, we would likely see the price drop back to the levels we saw before the announcement of the tender in late August. At that time the shares were trading at an approximately -9.5% discount. On the current NAV that is $9.883. In the box below we made a conservative assumption that the selling pressure causes the price to 'overshoot' to the downside and fall to $9.78.

That would equate to a 3.4% loss on the remaining shares excluding the distributions. If we add in the distributions, the loss on the 25% remaining shares would be just 2.22%. The total gain/loss would be +3.8% excluding the distributions and +5.1% with the distributions.

The Portfolio

The holdings in PHD are fairly average but do skew slightly to the junkier end of the spectrum. Just 13.6% is rated BB when most other loan funds have something in the 20%-35% at that level. In CCC, there is 12.1% of the portfolio whereas only six funds in the entire loan space have double-digits in the CCC category.

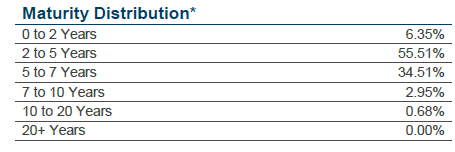

The maturity breakdown is obviously short as is typical in most loan funds. Most of the debt matures in the next five years and nearly all of it in the next seven years. But interest rate risks are not relevant here since most of the holdings are floating rate. In fact, higher short-term rates would benefit the fund but I don't think we will see it as those rates are dictated by the Fed and the chairman has made it clear that they are not moving for several years.

PHD has leverage of 28.2% but they did have to de-lever back in March and April of this year. At the start of the year they had $139.5M of debt outstanding and as of the end of May that was reduced to $103.5M.

The fund reduced the distribution slightly in May as a result of that but re-increased it again in August, possibly due to the activism in the fund. Earnings coverage as of the end of May was 91.7% and UNII was basically zero. So I don't think there is any impending distribution cut. The fund can sell off the lower yielding holdings for the tender and improve net investment income per share following it.

Conclusion

If you like floating rate loans here (and I do), this is a great way to play the space with a kicker. The portfolio is a bit junkier than the average loan CEF but not nearly as junky as the CLO funds like ECC or OXLC. The hold time is about two months before the kicker comes into fruition.

We would recommend buying at a discount of -7% or greater to get the most bang for your buck. I have been legging into it using a staggered set of limit orders at various discount levels.

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

Disclosure: I am/we are long PHD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.