Thursday's minor weakness has not changed the status of near- term positive trend of the market, says Nagaraj Shetti of HDFC Securities.

The market failed to retain the momentum seen in the previous eight consecutive sessions, with the benchmark indices falling half a percent on November 12. Even the announcement of Rs 2.65 lakh crore stimulus package under AtmaNirbhar Bharat 3.0 by Finance Minister Nirmala Sitharaman could not let the market hold uptrend.

The BSE Sensex declined 236.48 points to 43,357.19, while the Nifty50 slipped 58.40 points to 12,690.80 and formed a small-bodied bearish candle which resembles a Doji kind of pattern on the daily charts.

"The formation of minor weakness with range-bound action, post sharp trended upmove of the last 7 sessions could be positive for the bulls to make a comeback. This pattern could indicate an inherent strength of a recent uptrend and lack of selling enthusiasm in the market at the new highs. Normally, such a pattern could eventually result in an upside breakout, after some more choppy movement," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

The market breadth was in positive on Thursday despite weakness in the benchmark index. About three shares advanced for every two declining shares on the NSE.

related news

As a result, the broader markets outperformed benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices have ended on a positive note by registering gains of around 0.60 percent and 1.31 percent respectively. This is a positive indication, Shetti feels.

"Thursday's minor weakness has not changed the status of near term positive trend of the market. Hence there is a possibility of further 1-2 sessions of consolidation movement with minor weakness, before showing any upside breakout above 12,770 levels. Immediate support is placed at 11,580," Shetti said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,630, followed by 12,569.2. If the index moves up, the key resistance levels to watch out for are 12,746.4 and 12,802.

Nifty Bank

The Bank Nifty fell 566.20 points or 1.96 percent to 28,278.80 on November 12. The important pivot level, which will act as crucial support for the index, is placed at 28,005.63, followed by 27,732.46. On the upside, key resistance levels are placed at 28,612.43 and 28,946.07.

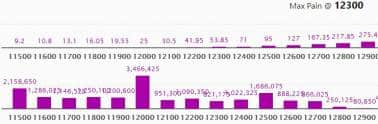

Call option data

Maximum Call open interest of 20.36 lakh contracts was seen at 13,000 strike, which will act as crucial resistance level in the November series.

This is followed by 13,500 strike, which holds 15.67 lakh contracts, and 12,000 strike, which has accumulated 12.33 lakh contracts.

Call writing was seen at 13,500 strike, which added 3.46 lakh contracts, followed by 12,700 strike which added 1.82 lakh contracts and 12,900 strike which added 1.34 lakh contracts.

Call unwinding was seen at 13,200 strike, which shed 2.22 lakh contracts, followed by 13,600 strike which shed 1.31 lakh contracts and 12,300 strike which shed 43,500 contracts.

Put option data

Maximum Put open interest of 34.66 lakh contracts was seen at 12,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 21.58 lakh contracts, and 12,500 strike, which has accumulated 16.86 lakh contracts.

Put writing was seen at 12,500 strike, which added 2.11 lakh contracts, followed by 11,600 strike, which added 2.1 lakh contracts and 12,000 strike which added 2.02 lakh contracts.

Put unwinding was seen at 11,700 strike, which shed 1.5 lakh contracts, followed by 11,500 strike, which shed 1.17 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

41 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

20 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

42 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

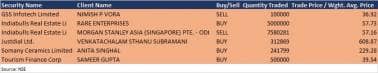

Bulk deals

(For more bulk deals, click here)

Results on November 13

ONGC, Tata Steel, Apex Frozen Foods, Equitas Holdings, Eveready Industries, Future Retail, General Insurance Corporation of India, Graphite India, Hindustan Aeronautics, Indiabulls Real Estate, IVRCL, MMTC, NLC India, Prabhat Dairy, Repco Home Finance, Sadbhav Engineering, Satin Creditcare Network, Spandana Sphoorty Financial and Sunteck Realty are among 504 companies to declare their quarterly earnings on November 13.

Stocks in the news

Mahanagar Gas: The company reported a lower profit at Rs 144.3 crore in Q2FY21 against Rs 270.6 crore, revenue fell to Rs 549 crore from Rs 861.5 crore YoY.

Eicher Motors: The company reported a lower profit at Rs 343.3 crore in Q2FY21 against Rs 572.7 crore, revenue declined to Rs 2,133.6 crore from Rs 2,192.5 crore YoY.

Sun TV Network: The company reported a lower profit at Rs 335.1 crore in Q2FY21 compared to Rs 368.7 crore, revenue dropped to Rs 768.7 crore from Rs 803.9 crore YoY.

Grasim Industries: The company reported a lower standalone profit at Rs 360.2 crore in Q2FY21 against Rs 526.5 crore, revenue declined to Rs 3,438.2 crore from Rs 4,795.1 crore YoY. The board approved the sale of fertiliser operations to Indorama for Rs 2,650 crore.

HUDCO: The company reported a lower profit at Rs 457.2 crore in Q2FY21 compared to Rs 725.8 crore, revenue dropped to Rs 1,833.6 crore from Rs 2,035.7 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,514.12 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,239.43 crore in the Indian equity market on November 12, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Eight stocks - BHEL, Canara Bank, Indiabulls Housing Finance, Jindal Steel & Power, LIC Housing Finance, SAIL, Sun TV Network and Tata Motors - are under the F&O ban for November 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.