Pfizer reported encouraging interim data for its COVID-19 vaccine with a 90% efficacy rate, which makes us hopeful for other read-outs.

This is the big catalyst for sentiment in value stocks, which have not been this cheap compared to growth stocks in 20 years, to improve.

In this article, I will discuss why we expect value stocks to keep thriving in the future.

However, I want to warn investors to not get caught by their emotions during this rally of value stocks. Some of them are very bad long-term investments.

During pre-market hours on Monday, November 9, Pfizer (PFE) and BioNTech (BNTX) announced very encouraging interim data for its COVID-19 vaccine. This news has major implications for the stock market. Or, should we say market of stocks?

Value stocks reacted very positively, while growth stocks lagged on Monday. This significant divergence was clearly visible in the indices: the Dow Jones (DIA) gained 2.98%, the S&P 500 (SPY) gained 1.17% and the Nasdaq (QQQ) lost -1.53% at the close.

At the individual stock level, stay-at-home sentiment stocks like Amazon (AMZN), Wayfair (W) and Zoom (ZM) lost respectively 5.06%, 21.85% and 17.37% in one day. On the contrary, companies hit by the pandemic, like Carnival Corp. (CCL), Delta Air Lines (DAL) and Darden Restaurants (DRI) gained respectively 38.99%, 17.03% and 18.05% in one day.

With all this news and stock market volatility, it is very hard to distinguish the rumours from the facts. Was the vaccine data really that important, and are value stocks likely to thrive in the future? That's what will be discussed in this article.

A quick look on the vaccine data

Pfizer, one of the biggest pharmaceutical companies worldwide, and BioNTech SE have been dedicated over the past months to cooperatively create a vaccine for the COVID-19 virus, which has caused more than 1.2 million global deaths to date.

After the read-outs of preclinical and clinical studies of several RNA vaccine candidates, BNT162b2 has been chosen as lead candidate at the end of July.

Back then, Pfizer and BioNTech decided to start a global phase 2/3 study of up to 30,000 participants, which was later increased to 44,000 participants.

Here is how Pfizer described the trial:

The Phase 2/3 trial is designed as a 1:1 vaccine candidate to placebo, randomized, observer-blinded study to obtain safety, immune response, and efficacy data needed for regulatory review. The trial’s primary endpoints will be prevention of COVID-19 in those who have not been infected by SARS-CoV-2 prior to immunization, and prevention of COVID-19 regardless of whether participants have previously been infected by SARS-CoV-2. Secondary endpoints include prevention of severe COVID-19 in those groups.

On November 9, Pfizer published an interim analysis of the phase 2/3 data which pushed the market higher. An external, independent Data Monitoring Committee ("DMC") analysed that the vaccine has an efficacy rate of above 90% at 7 days after the second dose of the vaccine, indicating that the vaccine protects humans from the COVID-19 virus 28 days after the first initiation. Importantly, no safety concerns have been observed.

Pfizer now expects to have full vaccine data available in the third week of November to be eligible for a potential Emergency Use Authorization.

Given these strong efficacy and safety read-outs, it is highly probable that Pfizer's/BioNTech's vaccine will get approved in 2020. Pfizer announced that it expects to produce up to 50 million vaccines in 2020 and 1.3 billion in 2021. They have an agreement with the USA, the EU and Japan for respectively 600 million, 200 million and 120 million doses.

Moreover, this stronger-than-expected read-out is hopeful for other vaccine read-outs over the coming months from pharma companies like AstraZeneca (AZN), Johnson & Johnson (JNJ) and Moderna (MRNA).

As such, it can be expected that a major part of the worldwide population will receive a vaccine in 2021 and that life can return to normalcy. So, what are the key takeaways of this news for value stocks?

(Source: thenationalnews.com)

Expected impact vaccine on value stocks

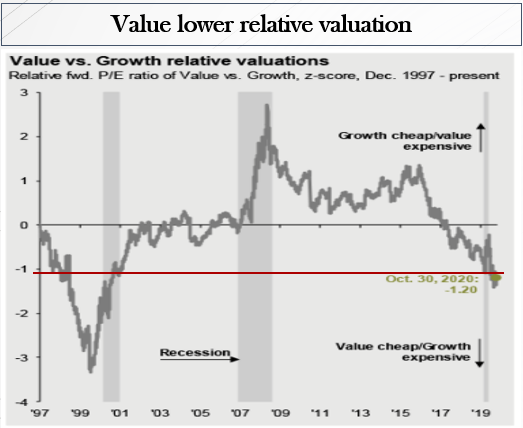

Over the past months, I have written several articles regarding the relative outperformance of growth stocks compared to value stocks. As of last week, value stocks were the cheapest compared to growth stocks since the dot.com bubble, as you can see in the chart below.

This trend of growth stocks' outperformance has been going on for several years, and increased due to the COVID-19 crisis, as this accelerates the digital transition and puts temporary pressure on the financials of value stocks. In particular, the big tech stocks like Facebook (FB), Apple (AAPL), Microsoft (MSFT), Amazon and Google (GOOG, GOOGL) fuelled this trend.

(Source: J.P. Morgan research)

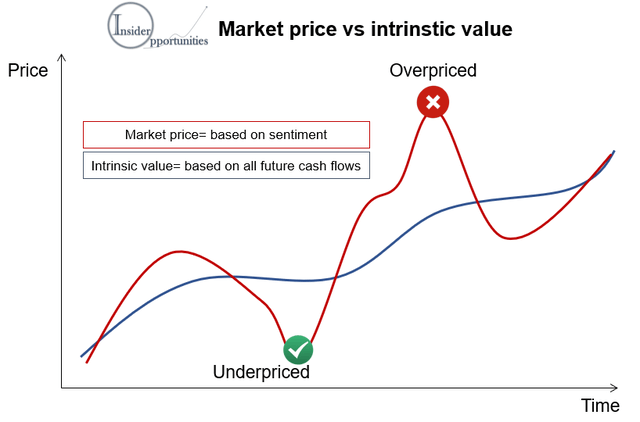

Instead of being misled by sentiment, at Insider Opportunities we always stay with the fundamentals: the valuation of a stock is based on all future cash flows discounted to today.

If the long-term perspectives of the underlying company are not damaged, the short-term impact of a crisis on financials should only have a minor impact on the stock price.

In contrast, we saw that many value stocks were hammered by the market, which resulted in the stock price of these companies dropping much lower than their intrinsic value. We took these buying opportunities with both hands.

(Source: Insider Opportunities)

Is there still upside for value stocks left after this recent outperformance? We believe there is.

We believe that this recent Pfizer announcement was just the first catalyst for value stocks to start outperforming. Over the coming months, more positive vaccine data (starting with the possible approval for Pfizer in the third week of November) and a sequential improvement of quarterly financials is anticipated to lift up value stocks even more.

Another positive sign for value stocks is the fact that Warren Buffett's Berkshire Hathaway (BRK.A, BRK.B) increased its share buybacks to $9 billion in the third quarter, up from $5.1 billion in Q2. This is a positive indicator that the worst for value stocks might be behind us.

As you can see in the J.P. Morgan chart, value stocks still have a big valuation gap to fill compared to growth stocks. The narrower this gap becomes, the more we will start recommending growth stocks again.

But be aware to not get caught by your emotions

As much as we warned investors to stay away from the sentiment-based growth stocks over the past months, we also want to warn investors from getting caught by strong short-term sentiment in several value stocks today.

Let me repeat an important sentence of the prior paragraph, but with emphasis on the first part:

IF the long-term perspectives of the underlying company are not damaged, the short-term impact of a crisis on financials should only have a minor impact on the stock price.

As expected, the most hammered "value" stocks during the pandemic shot up the most on the vaccine news. However, it is important to take into account that many of these stocks' long-term perspectives have been damaged by the pandemic.

For example, cruise lines and entertainment stocks like Norwegian Cruise Line (NCLH), AMC Entertainment (AMC) and Six Flags (SIX) needed to either raise enormous amounts of debt or dilute shareholders by raising equity. This short-term disruption had such a significant impact on their balance sheets that they are unlikely to be good long-term investments.

Moreover, we believe that several industries are facing long-term disruptions from this pandemic. For example, the shift from department stores to online shopping accelerated and is unlikely to slow down. The Amazons of today are long-term winners, and we believe stocks like Macy's (M) and Nordstrom (JWN) will keep facing trouble.

So, if you are looking for great value stocks today, always remember to not get caught by short-term emotions, but keep looking at the long term. Analysing the impact of the pandemic on the balance sheet and the future relevance of the companies' sector are two key elements.

At Insider Opportunities, we still primarily recommend new value stocks given their relative attractiveness today. However, the stronger the outperformance at value stocks due to a change in sentiment over the coming months, the more attractive growth and tech stocks will become.

High-quality value stocks which are still worth buying

Despite the recent stock appreciation, we still believe there are significant opportunities at several value stocks in the market today.

To confidently find the winning value stocks of today, you should consider joining Insider Opportunities, one of the strongest growing SeekingAlpha communities led by insider experts.

Via its proven algorithms, Insider Opportunities provides members winning stock ideas that insiders purchased. By trying a membership for free HERE, you will receive our current 8 exclusive high-conviction picks, updated with new ones regularly. Our outperforming strategy helps dozens investors, like you, surpass their investing goals. Don't hesitate to try it out as well for free!

Via its proven algorithms, Insider Opportunities provides members winning stock ideas that insiders purchased. By trying a membership for free HERE, you will receive our current 8 exclusive high-conviction picks, updated with new ones regularly. Our outperforming strategy helps dozens investors, like you, surpass their investing goals. Don't hesitate to try it out as well for free!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.