First Trust Cloud Computing ETF: The Post-Pandemic Environment Will Drive The Future Growth Of Cloud Computing Industry

The post-pandemic environment will require even higher digitization rate of both large and smaller companies to deal with negative consequences of the COVID-19 pandemic.

This ETF has significantly outperformed the broader S&P 500 market index over the last five years.

This ETF is not suitable for income investors as it offers a very low dividend yield of approximately 0.40%.

This time, we will present our readers with the First Trust Cloud Computing ETF (SKYY) which was incorporated back in 2011. It has total net assets of approximately $4.8 billion and comes with an annual expense ratio of 0.60%. It offers investors a relatively low dividend yield of 0.39% as of November 06, 2020. We are bullish about this ETF, given the importance digitization has on our daily lives to deal with the COVID-19 pandemic. Cloud computing has basically enabled us to work remotely and to do all of the online activities like online shopping which were essential during stay-at-home orders. Besides, we believe that the rate of digitization will accelerate in the near future. For instance, innovations like a smart cart in grocery stores or an intelligent voice elevator will be essential to prevent any kind of pandemics in the near future. In terms of the key bullish catalysts, we find them as the following: (1) both large and small-to-mid-sized companies are required to increase IT spending for cloud computing offerings to improve their digitization rate, (2) positive secular trends of the Industrial Revolution 4.0 will require an enhanced cloud computing power and capacities, (3) customers who purchase food or items online will look towards a better delivery time, which should prompt up demand for cloud computing offerings.

The COVID-19 Impact On The Cloud Computing Market

(Source: Markets and Markets)

According to the figure above, the cloud computing market is expected to grow from an estimated $371.4 billion in 2020 to $832.1 billion in 2025 which makes up a CAGR of 17.5%. One of the biggest secular drivers looking forward is enhanced automation and the use of artificial intelligence in almost any business or daily tasks out there which will come with the development of 5G networks throughout our nation. In our view, it is a very difficult thing to predict now how quick will this transformation into a fully digital and autonomous economy be, given that we are dealing now with the global COVID-19 pandemic. But we remain sure that this process will be way quicker than previously anticipated a year ago, as the majority of the U.S. residents will most likely prefer to shop online or work remotely over the coming years. Let's take for example a shopping experience in Walmart (WMT) or a normal morning ride with the elevator to our corporate offices. We would definitely prefer to use a smart cart, Amazon (AMZN) has been developing lately that basically scans all of the products we put in our cart and most likely charges them from our Amazon account.

"When the cart is available, there will be a QR code in the Amazon app that will enable you to easily sign in and begin using the cart. After that, you'll just place your bags in the cart and start shopping. When you're done shopping, you'll simply exit through the store's Amazon Dash Cart lane, and your receipt will be emailed to you,"

(Source: Forbes)

That way we could purchase groceries in Walmart without any non-essential contact with its employees or cashiers. Or another example of an intelligent voice elevator, which doesn't require us to press any buttons. We basically say only which floor we are heading to.

Therefore, we anticipate that new features and innovations will most likely advance in the near future to battle the non-essential exposure to the COVID-19 virus or any other viruses we could get on the surface of elevators, shopping carts, doors, etc. That will definitely create a higher demand for cloud computing offerings, as for instance, smart carts in the major grocery stores will require enormous cloud computing power to store and process all of the data.

(Source: Forbes)

Another important secular driver is the enhanced automation of traditional manufacturing processes and practices as we are heading into an Industrial 4.0 revolution. As we have described in our article on ROBO Global Robotics and Automation Index ETF (ROBO) here, we see automation of non-essential practices in assembly lines as an important tool to fight or prevent a similar type of COVID-19 pandemic outbreaks in the near future. For instance, we believe that repetitive tasks should be entirely automated and workers should only monitor remotely what has been going on in the assembly line so they can deal with any critical alerts. That will also most likely increase the productivity of the companies. For instance, major warehouse centers might be able to process our online purchases way faster than they do today. On this front, United Parcel Service (UPS) has announced a new smart warehouse technology earlier this year, which enables faster processing and fulfillment of orders.

"The new Warehouse Execution System (WES) enables UPS to better leverage our global warehouse network and integrated technology to help our customers reduce capital, improve service and speed to end customers," said Philippe Gilbert, president of Supply Chain Solutions. "We also can create more custom and turnkey outsourced fulfillment services to meet our customers' unique supply chain needs."

(Source: Press Release)

As our world is heading into a higher portion of the stay-at-home economy, any kind of reduction in our order delivery time will require an even larger demand for cloud computing products and processes. Let's take, for example, a basic food order on Uber Eats (UBER). Most of us might think it is a very easy task to process for the underlying software. We only place our order in the system, both restaurant and delivery-partner receive that order and enable the delivery of our meal as quickly as possible.

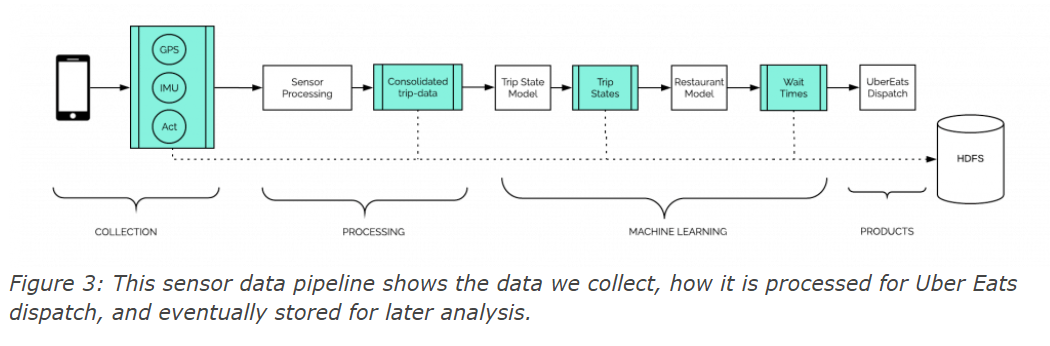

(Source: Uber Engineering)

However, it requires sophisticated machine learning processes to find the closest available Uber Eats delivery-partner to our home and restaurant location as well. Then Uber has to process the vast amount of GPS data to find the quickest route for our order to be delivered. Apart from that, Uber also analyzes the waiting time of delivery-partners at each restaurant.

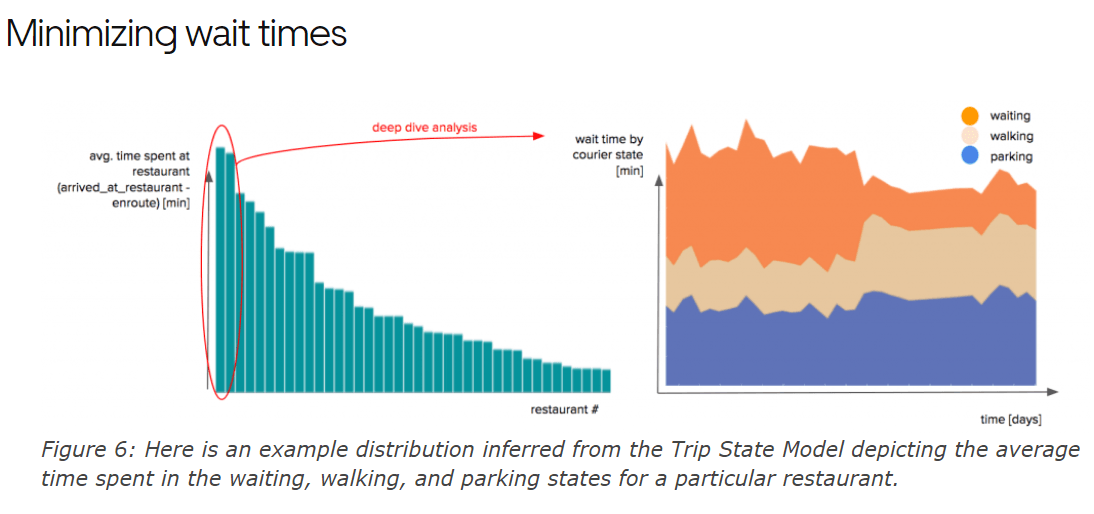

(Source: Uber Engineering)

"When we dispatch a delivery-partner to a restaurant, we can use the detailed historic breakdown of trip states (as shown in Figure 6) to ensure they arrive just when the food is ready. This dispatch method minimizes the wait time for the delivery-partner at the restaurant and, ultimately, helps them complete more trips. For the eater, we can offer better ETDs and ensure that the food is delivered as soon as possible after it is prepared-resulting in a fresher meal and shorter wait time."

(Source: Uber Engineering)

We have used Uber Eats only as an example of how many advanced and complex IT processes the company must incorporate to deliver our order in the fastest possible time. As online shopping grows in the near future, plenty of companies might face the increased need for machine learning and cloud computing power to satisfy customer needs and deliver orders in an even faster time. Therefore, we believe that is another critical secular trend for the growth of the cloud computing market in the near future, which should have a positive performance on this ETF.

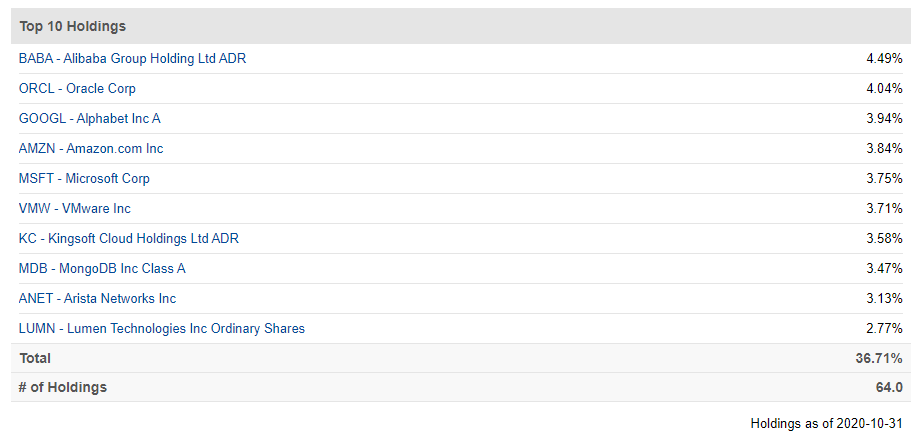

Top 10 Holdings

(Source: Seeking Alpha)

The top 5 holdings consist of the largest cloud computing players on the market including Alibaba (BABA), Oracle (ORCL), Amazon (AMZN), Google (NASDAQ:GOOG) (GOOGL), and Microsoft (MSFT). We believe that all companies should remain in their dominant positions in the near future. Besides, the top 10 holdings make up more than a third of the total holdings of this ETF, which places a lot of exposure to the most dominant players. We believe that the largest players in the cloud computing industry have a strong moat. In our view, smaller players or any other start-ups have a difficult task to obtain a significant market share, given the security reasons surrounding all of the data which is stored on the cloud. For instance, a major company like Boeing (BA) will most likely think twice to store its critical business data on some smaller cloud provider, which might be even majority-owned by the Chinese entity. Apart from that developing cloud solutions also require significant industry-wide knowledge and significant financial resources, which create a significant competitive advantage for the largest tech companies.

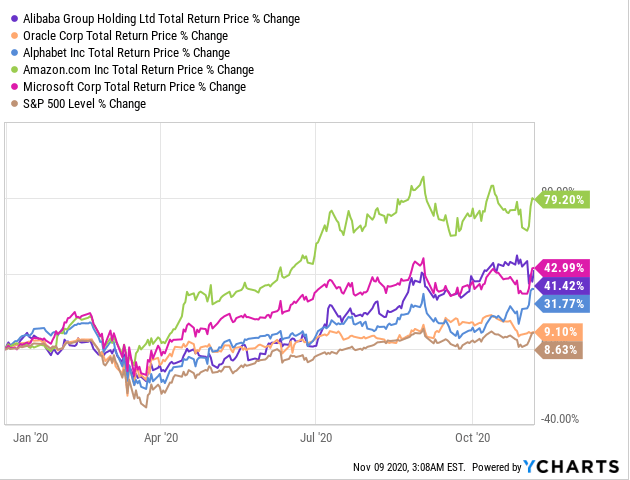

If we take a look at the historical stock price performance of the TOP 5 holdings of this ETF, then we can spot a strong outperformance of all companies except for Oracle compared to the broader S&P 500 index. The reason being is of course the increased rate of digitization due to the COVID-19 pandemic. Now we will focus on the SA Quant Rating analysis for the two largest cloud players on the market, Amazon and Microsoft.

SA Quant Ratings

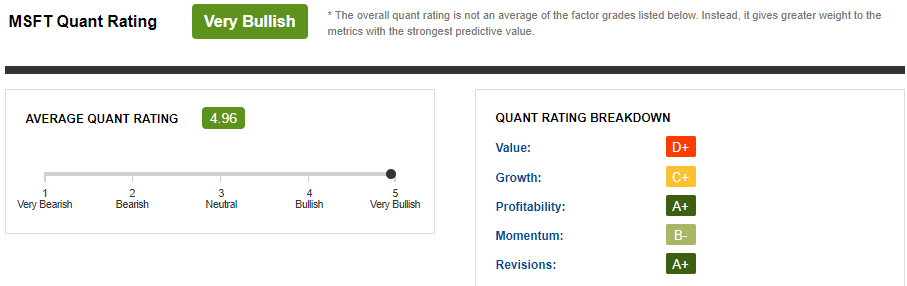

(Source: Seeking Alpha)

Microsoft has a 'Very Bullish' SA quant rating, which is in line with the current Wall Street sell-side estimates. MSFT has an A+ rating for profitability, primarily driven by the strong cloud segment performance so far in 2020. The COVID-19 pandemic environment has driven the digitization rate and IT spending for companies in most industries. Microsoft has been one of the strongest beneficiaries of its Azure and Hybrid cloud offerings. For example, the largest customers of Azure like Verizon (VZ) need a very strong cloud computing power and capacity to process the vast amount of communication data of its users.

MSFT has recently reported better-than-expected Q1 FY 21 earnings and we believe that the growth trajectory should continue over the next couple of quarters. It will be primarily driven by robust demand for commercial and hybrid cloud offerings and the Office 365 bundle. Likewise, Wall Street analysts have remained bullish about the future outlook of the company, which is also reflected as an A+ SA Quant rating for revisions.

Wedbush analyst Daniel Ives notes that Microsoft just reported its Q1 results with headline numbers that handily beat Street expectations. The analyst believes the strong numbers from Microsoft is a broader indication of strength he expects to see across the enterprise cloud software landscape throughout Q3 earnings season.

Oppenheimer analyst Timothy Horan estimates that total cloud revenue grew 23% compared to 22% last quarter, and points out that Microsoft is seeing stronger usage across its platforms amid social distancing and cloud spending could weaken owing to increased customer churn and enterprises looking to conserve cash. However, long-term enterprise migration to cloud is inevitable, the analyst contends. Long term, Microsoft remains the dominant hybrid cloud platform, but Horan believes slowing cloud growth could increase competition and trim spending by enterprises. He has a Perform rating on the shares.

Credit Suisse analyst Brad Zelnick raised the firm's price target on Microsoft to $235 from $225 and keeps an Outperform rating on the shares. The analyst notes that Microsoft reported "strong" Q1 results, overachieving on headline metrics with strong Commercial Cloud and Azure growth.

(Source: The Fly)

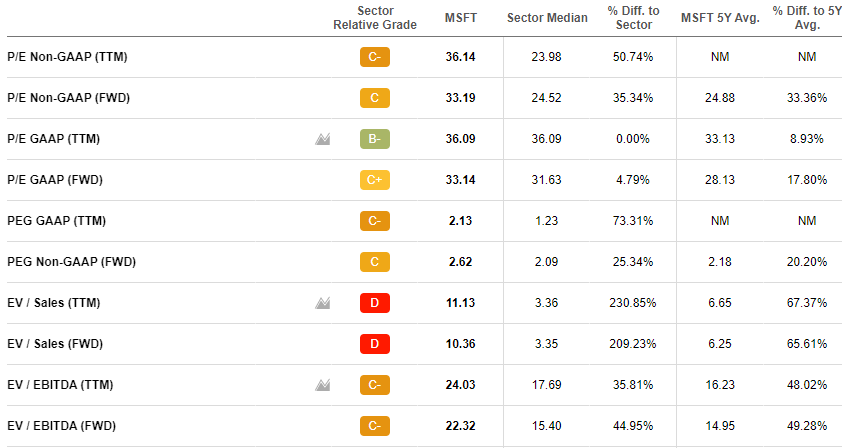

On the other hand, value has a very weak rating of D+ given that the stock price performance has been greater than 70% YTD. Consequently, the company has been trading at very hefty multiples throughout 2020.

(Source: Seeking Alpha)

According to the figure above, both P/E non-GAAP (ttm) and EV/Sales (ttm) are trading way above the sector median. Pfizer (PFE) has recently released a COVID-19 vaccine with strong efficacy data and the FDA will most likely grant it a green light to be distributed to all Americans. Therefore, we anticipate that the growth stocks might come under pressure and a potential rotation from growth into value stocks seems very likely to occur over the coming months. In our view, trading multiples like P/E GAPP (ttm) should fall closer to the historical S&P 500 market average P/E of approximately 15-20.

(Source: Seeking Alpha)

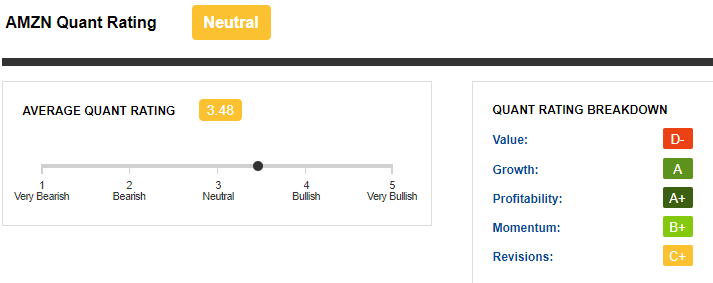

Amazon has a 'Neutral' rating, which differs from the current Wall Street sell-side 'Very Bullish' rating. AMZN is A-rated or better for both growth and profitability quant metrics, as its main cash cows - e-commerce and Amazon Web Services - have both achieved robust revenue growth amid the COVID-19 pandemic. Amazon management reflected the future growth opportunity of the cloud business during the most recent earnings call, as plenty of customers are basically forced to look for a way to drive down costs because of the COVID-19 pandemic environment.

"So I would say that majority of the companies though are looking for ways to cut down on expenses. Going to cloud is a good way to cut down on expenses long-term. To trying to cut down on their short-term costs in the cloud, by tuning their workloads and we're helping them do that and doing the best we can to help them save short-term dollars and again tune their usage again some of our benchmark."

(Source: Q3 20 Earnings Call)

That is definitely one of the strongest secular growth drivers for the entire cloud computing industry, as small to mid-sized businesses might be forced to speed up their digitization plans to remain competitive in the digital economy we have been facing with the COVID-19 pandemic. Apart from that, most likely existing customers will have to extend their multi-year deals with Amazon, Microsoft, or Google or even sign higher transactional values.

"We've seen a lot of companies extending their contracts with us. The backlog of multi-year deals has gone up quite a bit. It's good from a customer connectedness standpoint. Certainly each industry is going through different dynamics right now."

(Source: Q3 20 Earnings Call)

After the better-than-expected Q3 earnings results, Wall Street analysts have remained bullish about the future performance of the company, emphasizing the future growth potential of its cloud business.

China Renaissance analyst Ella notes that Amazon Web Services offers a "layer of stability" as compares get tough in 2021, adds the analyst. Ji believes the recent selloff in Amazon shares provides an "exceptional entry opportunity."

Barclays analyst Ross Sandler raised the firm's price target on Amazon.com to $3,660 from $3,530 and keeps an Overweight rating on the shares following the company's Q3 results. There is a "heated debate" in the investment community around which companies in e-commerce are likely to sustain their customers and frequency in 2021, but Amazon "should stand out from the pack on that front with the best retention," Sandler tells investors in a research note.

(Source: The Fly)

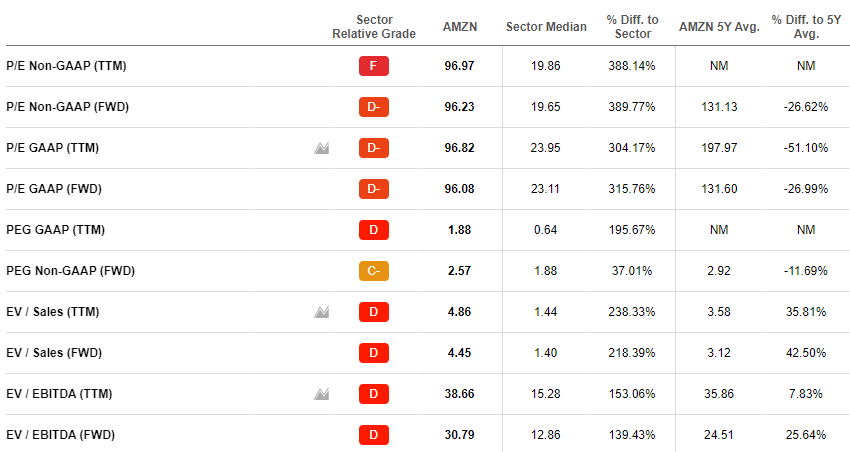

Unfortunately, for investors who are looking for value opportunities, Amazon has been one of the best mega-cap performers so far in 2020, leading to an SA Quant value rating of D-.

(Source: Seeking Alpha)

According to the figure above, both P/E and P/S are trading a couple of times higher than the sector median. We anticipate that the stock price performance of Amazon will also come under pressure due to a potential rotation from growth into value as we have previously described in the case of Microsoft. If true, then trading multiples like P/E should return closer to historical averages of the overall S&P 500 market. Apart from that, a potential driver for a lower P/E trading multiple might be a higher-than-expected increase in the EPS in the future.

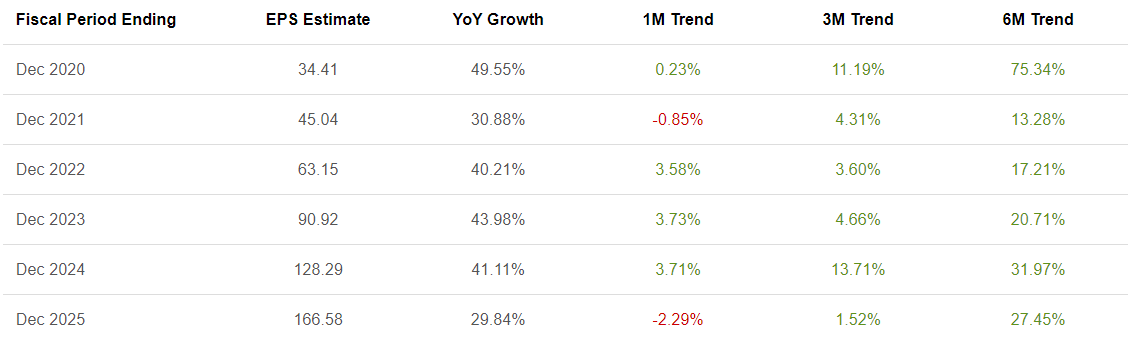

(Source: Seeking Alpha)

According to the figure above, Wall Street analysts estimate a more than 30% y/y growth between 2020 and 2025. Surprisingly, SA quant revisions rating is only C, although analysts have been revising upward their EPS estimates over the last couple of months.

To sum it up, we like to use SA Quant Rating analysis as it reflects both the short-term stock price momentum leading to potential trading opportunities as well as the long-term profitability and value of the underlying company. Therefore, we can conclude that the cloud computing giants like Amazon or Microsoft will most likely face a volatile and turbulent short-term market performance due to the available COVID-19 vaccine on the market. However, the long-term bullish secular trends as we have described in our first chapter combined with the strong Wall Street sell-side consensus outlook of cloud computing business for both companies point out the future value creation for shareholders.

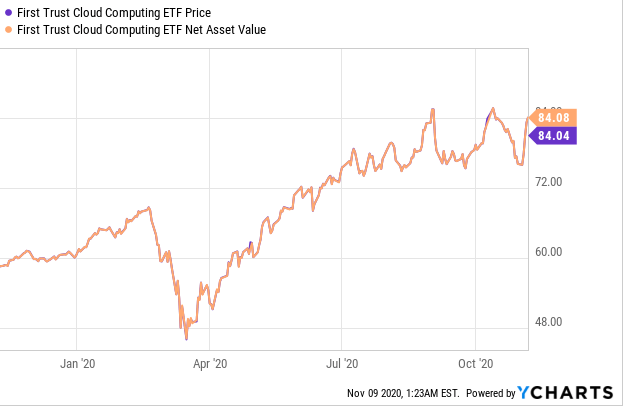

Performance

According to the figure above, both NAV and market prices have declined by approximately 28% between mid-February and mid-March 2020, as the result of the global COVID-19 pandemic. This ETF has managed to begin its recovery a couple of days before the nationwide lockdown orders were put in place around March 15, unlike the other most negatively impacted industries like tourism or travel. This doesn't come as a surprise as cloud computing has become essential for remote working and learning as well as to analyze the vast amount of data our healthcare institutions have been using to fight the COVID-19 pandemic. Over the last couple of weeks, SKYY has reached a new record stock price of $84.52 per share. However, the future bullish trend might become at risk if sooner than expected COVID-19 vaccine becomes available to the mass population and our authorities decide not to ease restrictions anymore.

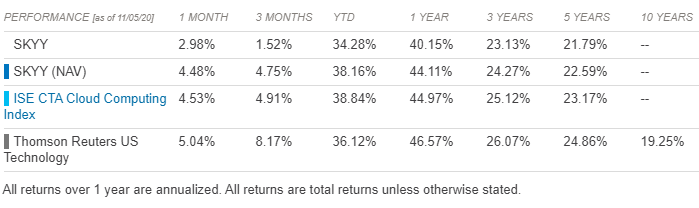

(Source: ETF.com)

According to the figure above, SKYY has generated double-digit returns over the last year, 3 years, and 5 years.

This chart indicates that the fund has significantly outperformed the largest tech-related ETF on the market - the Technology Select Sector SPDR Fund (XLK) by approximately 6.6% year to date. During the same time period, it has outperformed the S&P 500 index (SPY) by a wide margin of approximately 30%, while it has generated a slightly higher return of roughly 0.7% compared to the Nasdaq 100 (QQQ).

If we take a look over a longer time period of the last 5 years, then SKYY has been a great outperformer compared to the broader S&P 500 index and the Nasdaq 100 composite, while XLK has generated a slightly higher return of approximately 3% compared to SKYY. We believe that SKYY should outperform XLK over the next decade, given that our society will most likely face a higher digitization rate in most aspects of our daily lives to fight the long-term consequences of the COVID-19 pandemic.

(Source: Seeking Alpha)

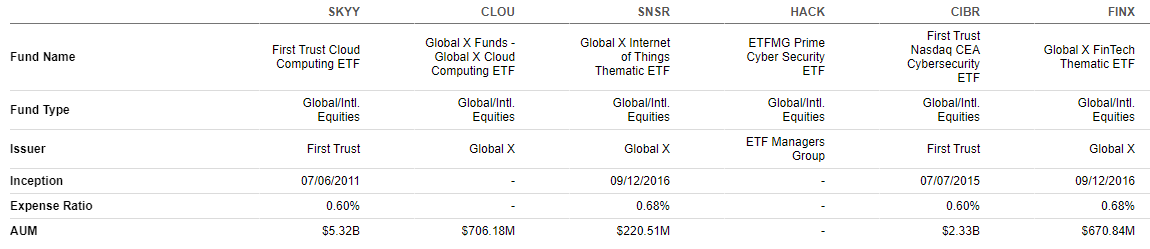

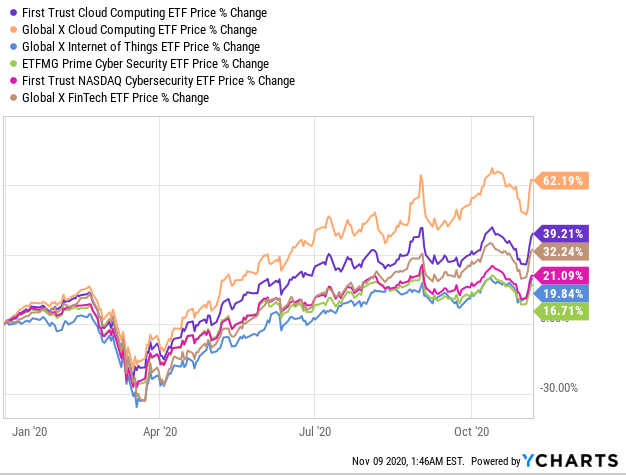

For our peer analysis, we will rely on the recommended peers, Seeking Alpha website recommends us in its Peers tab.

If we expand our historical performance analysis to its recommended peers by the Seeking Alpha website, then SKYY has only underperformed the most direct peer - Global X Cloud Computing ETF (CLOU) by a wide margin of approximately 23% year to date. On the other hand, all of the other peers on the list - including ETFMG Prime Cyber Security ETF (HACK), Global X FinTech Thematic ETF(FINX), Global X Internet of Things(SNSR), and First Trust Nasdaq CBA Cybersecurity ETF(CIBR) - have achieved a significantly lower performance compared to SKYY.

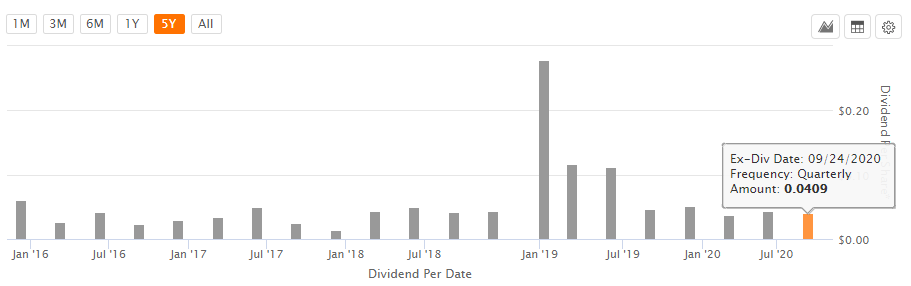

If we take a look over a longer time period of the last 5 years, then FINX has only outperformed SKYY, while all the other ETFs have significantly underperformed SKYY by more than 50%. Our readers should keep in mind that SKYY consists of high-growth tech companies, which have been lately almost in bubble-type market conditions due to the high importance of the cloud computing industry during the COVID-19 pandemic. In general, growth companies prefer to allocate any potential earnings into the future growth of the company compared to returning them to shareholders. Therefore, this ETF is not suitable for investors who are looking for a steady monthly or quarterly income or any high-yield dividend opportunities. Nevertheless, this ETF has been consistent with its minor quarterly dividend payments over the last 5 years.

According to the figure above, shareholders have received a regular quarterly dividend of approximately $0.05 per share over the last year. In fact, this fund has paid an annual dividend of $0.3255 in 2019, which makes up a dividend yield of approximately 0.40% as of 11/06/2020.

Conclusion

We assign a Neutral outlook given that cloud computing stocks will most likely face short-term market price corrections, because of the most recently announced COVID-19 vaccine on the market available for the mass population. However, once trading multiples of major cloud computing companies like Microsoft or Amazon fall closer to historical averages, we see it as a great buy-the-dip opportunity. Likewise, we anticipate that the future growth of the cloud computing industry will be driven by the positive secular trends like improved digitization rate and industrial 4.0 revolution we have mentioned in our articles. Therefore, we believe this ETF is the right choice for our readers, who are looking to allocate part of their portfolio into future high-growth secular trends of the cloud computing industry, which will shape our daily lives and our economy over the next decade. In terms of major risks, investors should consider the following: (1) any faster-than-expected achieved herd immunity with available vaccines on the market over the next 12 months, (2) political risks like an escalation of social unrests following the outcome of presidential elections in the U.S., (3) current high valuations of tech companies might trigger an unexpectedly sharp downturn like was the case with major stock market indexes back in March 2020.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article does not constitute a bid or an invitation to bid for the purchase or sale of the financial instruments in question. Neither is it intended to provide any kind of personal investment advice, therefore, readers should conduct their own due diligence. Investing in financial instruments may always be associated with risk. Please contact your personal financial or investment advisor for any additional questions or materials regarding this article. We shall not be liable for any type of damage or loss arising from the use of the information contained in this article.